You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58 | The Year <strong>2001</strong><br />

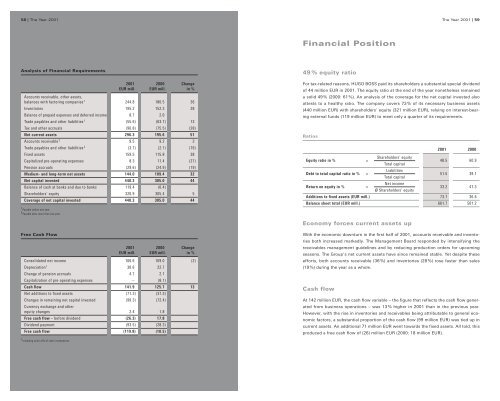

Analysis of Financial Requirements<br />

Free Cash Flow<br />

<strong>2001</strong> 2000 Change<br />

EUR mill. EUR mill. in %<br />

Accounts receivable, other assets,<br />

balances with factoring companies 1 244.8 180.5 36<br />

Inventories 195.2 152.3 28<br />

Balance of prepaid expenses and deferred income 8.7 2.0<br />

Trade payables and other liabilities 1 (55.6) (63.7) 13<br />

Tax and other accruals (96.8) (75.5) (28)<br />

Net current assets 296.3 195.6 51<br />

Accounts receivable 2 9.5 9.2 3<br />

Trade payables and other liabilities 2 (3.7) (2.1) (76)<br />

Fixed assets 159.5 115.8 38<br />

Capitalized pre-operating expenses 8.3 11.4 (27)<br />

Pension accruals (29.6) (24.9) (19)<br />

Medium- and long-term net assets 144.0 109.4 32<br />

Net capital invested 440.3 305.0 44<br />

Balance of cash at banks and due to banks 119.4 (0.4)<br />

Shareholders’ equity 320.9 305.4 5<br />

Coverage of net capital invested 440.3 305.0 44<br />

1 Payable within one year.<br />

2 Payable after more than one year.<br />

<strong>2001</strong> 2000 Change<br />

EUR mill. EUR mill. in %<br />

Consolidated net income 106.6 109.0 (2)<br />

Depreciation 1 30.6 22.7<br />

Change of pension accruals 4.7 2.1<br />

Capitalization of pre-operating expenses – (8.1)<br />

Cash flow 141.9 125.7 13<br />

Net additions to fixed assets (71.3) (37.3)<br />

Changes in remaining net capital invested<br />

Currency exchange and other<br />

(99.3) (72.4)<br />

equity changes 2.4 1.8<br />

Free cash flow – before dividend (26.3) 17.8<br />

Dividend payment (93.5) (28.3)<br />

Free cash flow (119.8) (10.5)<br />

1 Including write-offs of other investments.<br />

Financial Position<br />

49 % equity ratio<br />

For tax-related reasons, <strong>HUGO</strong> <strong>BOSS</strong> paid its shareholders a substantial special dividend<br />

of 44 million EUR in <strong>2001</strong>. The equity ratio at the end of the year nonetheless remained<br />

a solid 49% (2000: 61%). An analysis of the coverage for the net capital invested also<br />

attests to a healthy ratio. The company covers 73% of its necessary business assets<br />

(440 million EUR) with shareholders’ equity (321 million EUR), relying on interest-bearing<br />

external funds (119 million EUR) to meet only a quarter of its requirements.<br />

Ratios<br />

Equity ratio in % =<br />

Debt to total capital ratio in % =<br />

Return on equity in % =<br />

Economy forces current assets up<br />

With the economic downturn in the first half of <strong>2001</strong>, accounts receivable and inventories<br />

both increased markedly. The Management Board responded by intensifying the<br />

receivables management guidelines and by reducing production orders for upcoming<br />

seasons. The Group’s net current assets have since remained stable. Yet despite these<br />

efforts, both accounts receivable (36%) and inventories (28%) rose faster than sales<br />

(19%) during the year as a whole.<br />

Cash flow<br />

Shareholders’ equity<br />

Total capital<br />

Liabilities<br />

Total capital<br />

Net income<br />

ø Shareholders’ equity<br />

The Year <strong>2001</strong> | 59<br />

<strong>2001</strong> 2000<br />

48.5 60.9<br />

51.5 39.1<br />

33.2 41.3<br />

Additions to fixed assets (EUR mill.) 73.7 36.6<br />

Balance sheet total (EUR mill.) 661.7 501.2<br />

At 142 million EUR, the cash flow variable – the figure that reflects the cash flow generated<br />

from business operations – was 13% higher in <strong>2001</strong> than in the previous year.<br />

However, with the rise in inventories and receivables being attributable to general economic<br />

factors, a substantial proportion of the cash flow (99 million EUR) was tied up in<br />

current assets. An additional 71 million EUR went towards the fixed assets. All told, this<br />

produced a free cash flow of (26) million EUR (2000: 18 million EUR).