Summary of the Ombudsman´s Report 2011

In 2012 we celebrate the 20th Anniversary of the German private commercial banks´ Ombudsman Scheme. When it launched its Ombudsman Scheme in 1992, making it the first leading German financial-sector association to do so.

In 2012 we celebrate the 20th Anniversary of the German private commercial banks´ Ombudsman Scheme. When it launched its Ombudsman Scheme in 1992, making it the first leading German financial-sector association to do so.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ankenverband 111<br />

Securities business<br />

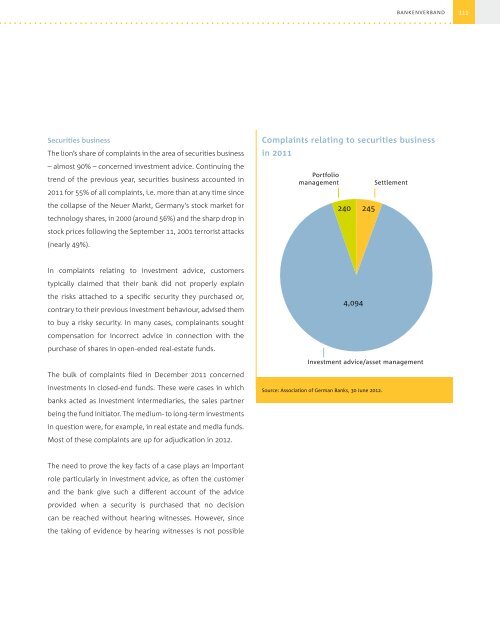

The lion’s share <strong>of</strong> complaints in <strong>the</strong> area <strong>of</strong> securities business<br />

– almost 90% – concerned investment advice. Continuing <strong>the</strong><br />

trend <strong>of</strong> <strong>the</strong> previous year, securities business accounted in<br />

<strong>2011</strong> for 55% <strong>of</strong> all complaints, i.e. more than at any time since<br />

<strong>the</strong> collapse <strong>of</strong> <strong>the</strong> Neuer Markt, Germany’s stock market for<br />

technology shares, in 2000 (around 56%) and <strong>the</strong> sharp drop in<br />

stock prices following <strong>the</strong> September 11, 2001 terrorist attacks<br />

(nearly 49%).<br />

Complaints relating to securities business<br />

in <strong>2011</strong><br />

Portfolio<br />

management<br />

240 245<br />

Settlement<br />

In complaints relating to investment advice, customers<br />

typically claimed that <strong>the</strong>ir bank did not properly explain<br />

<strong>the</strong> risks attached to a specific security <strong>the</strong>y purchased or,<br />

contrary to <strong>the</strong>ir previous investment behaviour, advised <strong>the</strong>m<br />

to buy a risky security. In many cases, complainants sought<br />

compensation for incorrect advice in connection with <strong>the</strong><br />

purchase <strong>of</strong> shares in open-ended real-estate funds.<br />

4,094<br />

Investment advice/asset management<br />

The bulk <strong>of</strong> complaints filed in December <strong>2011</strong> concerned<br />

investments in closed-end funds. These were cases in which<br />

banks acted as investment intermediaries, <strong>the</strong> sales partner<br />

being <strong>the</strong> fund initiator. The medium- to long-term investments<br />

in question were, for example, in real estate and media funds.<br />

Most <strong>of</strong> <strong>the</strong>se complaints are up for adjudication in 2012.<br />

Source: Association <strong>of</strong> German Banks, 30 June 2012.<br />

The need to prove <strong>the</strong> key facts <strong>of</strong> a case plays an important<br />

role particularly in investment advice, as <strong>of</strong>ten <strong>the</strong> customer<br />

and <strong>the</strong> bank give such a different account <strong>of</strong> <strong>the</strong> advice<br />

provided when a security is purchased that no decision<br />

can be reached without hearing witnesses. However, since<br />

<strong>the</strong> taking <strong>of</strong> evidence by hearing witnesses is not possible