The future of IFRSs in Europe

Since the adoption of the IAS Regulation in 2002, the International Financial Reporting Standards (IFRSs) have served as the authoritative accounting rules for publicly traded companies in the European Union.

Since the adoption of the IAS Regulation in 2002, the International Financial Reporting Standards (IFRSs) have served as the authoritative accounting rules for publicly traded companies in the European Union.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ankenverband<br />

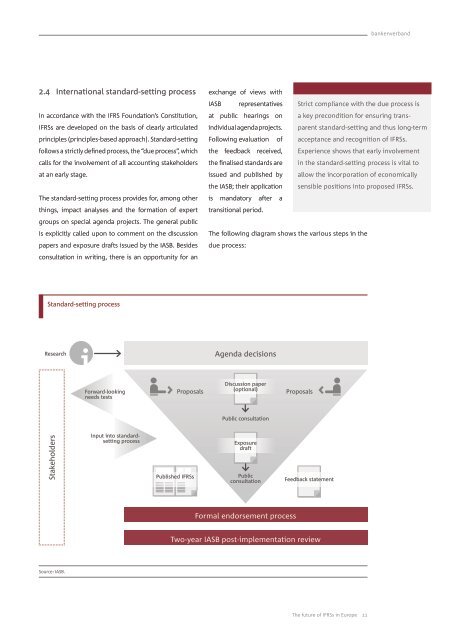

2.4 International standard-sett<strong>in</strong>g process<br />

In accordance with the IFRS Foundation’s Constitution,<br />

<strong>IFRSs</strong> are developed on the basis <strong>of</strong> clearly articulated<br />

pr<strong>in</strong>ciples (pr<strong>in</strong>ciples-based approach). Standard-sett<strong>in</strong>g<br />

follows a strictly def<strong>in</strong>ed process, the “due process”, which<br />

calls for the <strong>in</strong>volvement <strong>of</strong> all account<strong>in</strong>g stakeholders<br />

at an early stage.<br />

<strong>The</strong> standard-sett<strong>in</strong>g process provides for, among other<br />

th<strong>in</strong>gs, impact analyses and the formation <strong>of</strong> expert<br />

groups on special agenda projects. <strong>The</strong> general public<br />

is explicitly called upon to comment on the discussion<br />

papers and exposure drafts issued by the IASB. Besides<br />

consultation <strong>in</strong> writ<strong>in</strong>g, there is an opportunity for an<br />

exchange <strong>of</strong> views with<br />

IASB representatives Strict compliance with the due process is<br />

at public hear<strong>in</strong>gs on<br />

<strong>in</strong>dividual agenda projects.<br />

a key precondition for ensur<strong>in</strong>g transparent<br />

standard-sett<strong>in</strong>g and thus long-term<br />

Follow<strong>in</strong>g evaluation <strong>of</strong> acceptance and recognition <strong>of</strong> <strong>IFRSs</strong>.<br />

the feedback received,<br />

the f<strong>in</strong>alised standards are<br />

issued and published by<br />

the IASB; their application<br />

Ex perience shows that early <strong>in</strong>volvement<br />

<strong>in</strong> the standard-sett<strong>in</strong>g process is vital to<br />

allow the <strong>in</strong>corporation <strong>of</strong> economically<br />

sensible positions <strong>in</strong>to proposed <strong>IFRSs</strong>.<br />

is mandatory after a<br />

transitional period.<br />

<strong>The</strong> follow<strong>in</strong>g diagram shows the various steps <strong>in</strong> the<br />

due process:<br />

Standard-sett<strong>in</strong>g process<br />

Research<br />

Agenda decisions<br />

Forward-look<strong>in</strong>g<br />

needs tests<br />

Proposals<br />

Discussion paper<br />

(optional)<br />

Proposals<br />

Public consultation<br />

Stakeholders<br />

Input <strong>in</strong>to standardsett<strong>in</strong>g<br />

process<br />

Published <strong>IFRSs</strong><br />

Exposure<br />

draft<br />

Public<br />

consultation<br />

Feedback statement<br />

Formal endorsement process<br />

Two-year IASB post-implementation review<br />

Source: IASB.<br />

<strong>The</strong> <strong>future</strong> <strong>of</strong> <strong>IFRSs</strong> <strong>in</strong> <strong>Europe</strong> 11