Comprehensive Annual Financial Report for FY 2012 - Omnitrans

Comprehensive Annual Financial Report for FY 2012 - Omnitrans

Comprehensive Annual Financial Report for FY 2012 - Omnitrans

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

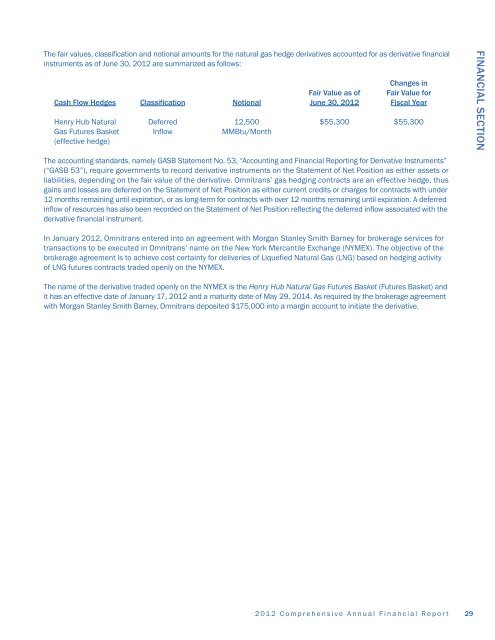

The fair values, classification and notional amounts <strong>for</strong> the natural gas hedge derivatives accounted <strong>for</strong> as derivative financial<br />

instruments as of June 30, <strong>2012</strong> are summarized as follows:<br />

Changes in<br />

Fair Value as of Fair Value <strong>for</strong><br />

Cash Flow Hedges Classification Notional June 30, <strong>2012</strong> Fiscal Year<br />

Henry Hub Natural Deferred 12,500 $55,300 $55,300<br />

Gas Futures Basket Inflow MMBtu/Month<br />

(effective hedge)<br />

FINANCIAL SECTION<br />

The accounting standards, namely GASB Statement No. 53, “Accounting and <strong>Financial</strong> <strong>Report</strong>ing <strong>for</strong> Derivative Instruments”<br />

(“GASB 53”), require governments to record derivative instruments on the Statement of Net Position as either assets or<br />

liabilities, depending on the fair value of the derivative. <strong>Omnitrans</strong>’ gas hedging contracts are an effective hedge, thus<br />

gains and losses are deferred on the Statement of Net Position as either current credits or charges <strong>for</strong> contracts with under<br />

12 months remaining until expiration, or as long-term <strong>for</strong> contracts with over 12 months remaining until expiration. A deferred<br />

inflow of resources has also been recorded on the Statement of Net Position reflecting the deferred inflow associated with the<br />

derivative financial instrument.<br />

In January <strong>2012</strong>, <strong>Omnitrans</strong> entered into an agreement with Morgan Stanley Smith Barney <strong>for</strong> brokerage services <strong>for</strong><br />

transactions to be executed in <strong>Omnitrans</strong>’ name on the New York Mercantile Exchange (NYMEX). The objective of the<br />

brokerage agreement is to achieve cost certainty <strong>for</strong> deliveries of Liquefied Natural Gas (LNG) based on hedging activity<br />

of LNG futures contracts traded openly on the NYMEX.<br />

The name of the derivative traded openly on the NYMEX is the Henry Hub Natural Gas Futures Basket (Futures Basket) and<br />

it has an effective date of January 17, <strong>2012</strong> and a maturity date of May 29, 2014. As required by the brokerage agreement<br />

with Morgan Stanley Smith Barney, <strong>Omnitrans</strong> deposited $175,000 into a margin account to initiate the derivative.<br />

<strong>2012</strong> <strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong><br />

29