AXS-Alphaliner - AXSMarine

AXS-Alphaliner - AXSMarine

AXS-Alphaliner - AXSMarine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE MARKET SHARE EVOLUTION DURING 2000-2008<br />

Between January 2000 and January 2008, the teu capacity deployed<br />

on liner trades has more than doubled. It has risen from 5,150,000<br />

teu to 11,696,000 teu, i.e. a 127% increase, according to <strong>AXS</strong>-<br />

<strong>Alphaliner</strong> data. This means that in order to simply keep their market<br />

shares stable during that period, carriers had to increase their<br />

fleet capacities by 127%. Those who failed to invest, or charter,<br />

enough to keep pace have lost market share.<br />

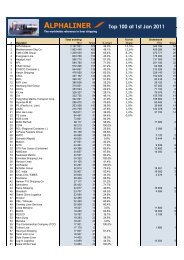

The graph next page illustrates the performances of a selection of<br />

carriers among the TOP 30 lines. It is based on the ratio between<br />

market shares at 1 st January 2000 and 1 st January 2008. For example,<br />

CSCL’s market share rose from 1.67% to 3.69%, i.e. an increase<br />

of 120.1%, as its fleet grew by 400% during the past 8 years<br />

(i.e. an average annual growth of 22.3%).<br />

Market shares are deducted from the existing on board teu capacities<br />

of carriers, compared to the total capacity effectively deployed<br />

on liner trades (these figures take into account cellular ships, multipurpose<br />

ships and roro ships which are effectively employed on<br />

regular liner services, and they DO NOT include ships which are<br />

operated OUTSIDE liner trades, even if these ships are teu-fitted).<br />

<strong>Alphaliner</strong> computes total market capacity and the carriers’ individual<br />

market shares on a daily basis. These figures are published online<br />

in our <strong>AXS</strong>-<strong>Alphaliner</strong> TOP 100 page, which is free to access.<br />

As clearly illustrated by our figures and the below graph, the three<br />

rising stars of this decade so far are CMA CGM, MSC and CSCL.<br />

This trio even deserves a particular mention as these lines grew<br />

mostly organically, although CMA CGM bought a few niche carriers.<br />

Fourth in the ranking comes Hapag-Lloyd. The carrier substantially<br />

raised its market share thanks to the 2005 purchase of CP Ships by<br />

its parent company TUI AG, for merging within the Hapag-Lloyd<br />

business.<br />

Liner Market Shares Page 6 of 9 © <strong>Alphaliner</strong> 2008<br />

Web: www.axs-alphaliner.com | E-mail: data@alphaliner.com<br />

MSN: support@axsmarine.com