Alphaliner Newsletter no 19 - 2013 full

Alphaliner Newsletter no 19 - 2013 full

Alphaliner Newsletter no 19 - 2013 full

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Readers are reminded that unauthorized<br />

redistribuon of the newsleer is prohibited<br />

and are requested to quote<br />

‘<strong>Alphaliner</strong>’ as source for all data derived<br />

from the newsleer. Please refer to our<br />

<strong>full</strong> user terms and copyrights at<br />

www.alphaliner.com/terms_of_use.php<br />

Containership scrapping is<br />

expected to reach a record<br />

high this year, with an increasing<br />

number of younger<br />

containerships of less than 20<br />

years old being sent for demolition.<br />

Trading prospects are expected<br />

to remain poor with<br />

the panamax sector the weakest<br />

amongst all size segments.<br />

The over-supply in<br />

this sector is worsening as<br />

demand for such ships falls<br />

due to owners’ preference for<br />

larger over-panamax tonnage.<br />

Despite the record number of<br />

ships scrapped, the total<br />

capacity removed due to<br />

vessel deletions still trails<br />

new vessel deliveries by a<br />

ratio of 1 to 3.<br />

INSIDE THIS ISSUE:<br />

Scrapping still insufficient 1<br />

MAERSK MALACCA - A check- 3<br />

ered history<br />

New Order/Resale updates 4<br />

CSCL selects HHI for its 18,400<br />

teu newbuildings<br />

Growing interest for 9,000 teu<br />

wide-beam ships<br />

Simatech acquires two 3,300<br />

teu ships<br />

Service Updates<br />

6<br />

G6 inaugurates new FE-USEC<br />

CEC & AZX services<br />

Evergreen/YM/PIL/Si<strong>no</strong>trans<br />

launch new FE-Aus loop<br />

Zim add Norfolk on FE-USEC<br />

loop<br />

First 8,000 teu ship introduced<br />

on ESA<br />

HMM merges FE-Chennai and<br />

Korea-Russia loops<br />

Maersk and Sfamarine revise<br />

six WAF relay loops<br />

Maersk enhances Tunisia coverage,<br />

adds Cashew calls to<br />

FEW 1, adds Libya connections<br />

UFS and Metz enhance Greece<br />

feeder coverage<br />

COSCO, Yang Ming & Hanjin<br />

team up on Baltic feeder<br />

WEC Lines adds North Europe-<br />

Iberia service<br />

King Ocean rearranges Caribbean<br />

loops<br />

PIL & MOL team up on Asia-<br />

Indian Ocean islands trade &<br />

Mozambique service streamlined<br />

Delivery Updates<br />

April/May deliveries<br />

13<br />

TEU<br />

ALPHALINER<br />

Volume <strong>2013</strong> Issue <strong>19</strong><br />

Weekly <strong>Newsletter</strong> 30.04.<strong>2013</strong> to 06.05.<strong>2013</strong><br />

Web: www.alphaliner.com | E-mail: editor@alphaliner.com | Sales: commercial@alphaliner.com<br />

<strong>Alphaliner</strong> Weekly <strong>Newsletter</strong> is distributed every Monday. The newsletter is available upon subscription. Information is<br />

given in good faith but without guarantee. Please send your feedback, comments and questions to editor@alphaliner.com<br />

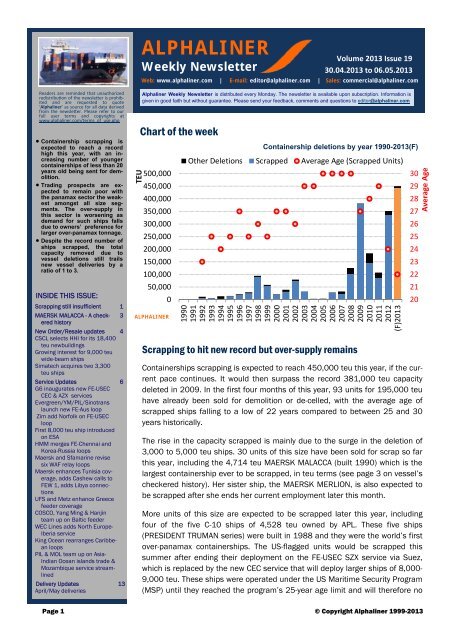

Chart of the week<br />

500,000<br />

450,000<br />

400,000<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

ALPHALINER<br />

Containership deletions by year <strong>19</strong>90-<strong>2013</strong>(F)<br />

Other Deletions Scrapped Average Age (Scrapped Units)<br />

<strong>19</strong>90<br />

<strong>19</strong>91<br />

<strong>19</strong>92<br />

<strong>19</strong>93<br />

<strong>19</strong>94<br />

<strong>19</strong>95<br />

<strong>19</strong>96<br />

<strong>19</strong>97<br />

<strong>19</strong>98<br />

<strong>19</strong>99<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

(F)<strong>2013</strong><br />

Scrapping to hit new record but over-supply remains<br />

Containerships scrapping is expected to reach 450,000 teu this year, if the current<br />

pace continues. It would then surpass the record 381,000 teu capacity<br />

deleted in 2009. In the first four months of this year, 93 units for <strong>19</strong>5,000 teu<br />

have already been sold for demolition or de-celled, with the average age of<br />

scrapped ships falling to a low of 22 years compared to between 25 and 30<br />

years historically.<br />

The rise in the capacity scrapped is mainly due to the surge in the deletion of<br />

3,000 to 5,000 teu ships. 30 units of this size have been sold for scrap so far<br />

this year, including the 4,714 teu MAERSK MALACCA (built <strong>19</strong>90) which is the<br />

largest containership ever to be scrapped, in teu terms (see page 3 on vessel’s<br />

checkered history). Her sister ship, the MAERSK MERLION, is also expected to<br />

be scrapped after she ends her current employment later this month.<br />

More units of this size are expected to be scrapped later this year, including<br />

four of the five C-10 ships of 4,528 teu owned by APL. These five ships<br />

(PRESIDENT TRUMAN series) were built in <strong>19</strong>88 and they were the world’s first<br />

over-panamax containerships. The US-flagged units would be scrapped this<br />

summer after ending their deployment on the FE-USEC SZX service via Suez,<br />

which is replaced by the new CEC service that will deploy larger ships of 8,000-<br />

9,000 teu. These ships were operated under the US Maritime Security Program<br />

(MSP) until they reached the program’s 25-year age limit and will therefore <strong>no</strong><br />

Page 1 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong><br />

30<br />

29<br />

28<br />

27<br />

26<br />

25<br />

24<br />

23<br />

22<br />

21<br />

20<br />

Average Age

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Unit Scrapped<br />

The five C-10 units delivered to<br />

APL in <strong>19</strong>88 were the largest<br />

containerships at that time.<br />

These vessels have a beam of<br />

39.4 m, which were too wide to<br />

transit the Panama Canal which<br />

has a width limit of 32.3 m.<br />

The average age of scrapped<br />

units has fallen dramatically<br />

since the second half of 2012 and<br />

is <strong>no</strong>w down to 22 years.<br />

An increasing number of vessels<br />

below 20 years are being<br />

scrapped, a previously unseen<br />

phe<strong>no</strong>me<strong>no</strong>n. Many cash<br />

strapped owners do <strong>no</strong>t find buyers<br />

for further trading, leading<br />

them to accept scrap offers.<br />

This also reflects the poor trading<br />

prospects with charter rates<br />

for ships of 3,000-5,000 teu expected<br />

to remain weak in the<br />

near term. The smaller ships fare<br />

better. Modern ships of 1,100 teu<br />

obtain currently higher rates than<br />

some panamaxes of 5,000 teu<br />

aged only of 10 years.<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Jan-08<br />

Units Scrapped ≤ 20 years<br />

Units Scrapped > 20 years<br />

Average Age of scrapped units<br />

40<br />

38<br />

36<br />

34<br />

32<br />

30<br />

28<br />

26<br />

24<br />

22<br />

20<br />

18<br />

Jan-09<br />

Jan-10<br />

Jan-11<br />

Jan-12<br />

Jan-13<br />

Average Age<br />

longer receive an operating stipend to subsidize the higher costs of<br />

maintaining them under the US registry. The fifth C-10 unit, the Singapore<br />

flagged APL KENNEDY, will be retained for the time being.<br />

The ongoing exodus of both panamax and early over-panamax ships<br />

reflects the poor short term trading prospects for these vessels. Charter<br />

rates for modern 4,200 teu panamax units stand currently at<br />

about $9,200/day, which is well below the long term average rate of<br />

$24,000/day. Older panamaxes obtain even lower rates, down to<br />

$6,000 in extreme cases.<br />

$/day<br />

Charter rate for 4,000 teu Panamax containerships : 2000-<strong>2013</strong><br />

50,000<br />

Despite the record scrapping levels, deletions still trail behind the<br />

delivery of new vessels. Based on <strong>Alphaliner</strong>’s records, new containership<br />

deliveries in the first four months of <strong>2013</strong> have reached<br />

496,000 teu, outpacing the capacity scrapped by a ratio of 3-to-1.<br />

Total deliveries in <strong>2013</strong> could rival the previous record of 1.57 Mteu<br />

delivered in 2008, even after allowance for deferrals and slippage.<br />

Capacity in TEU<br />

45,000<br />

40,000<br />

35,000<br />

30,000<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

-50,000<br />

0<br />

Containership deliveries vs deletions and net capacity increase<br />

by month : 2008-<strong>2013</strong><br />

2008 Jan<br />

ALPHALINER<br />

Page 2 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong><br />

Jul<br />

TEU Scrapped<br />

TEU delivered<br />

Net Increase<br />

2009 Jan<br />

12 year average = $24,000/day<br />

Jul<br />

2010 Jan<br />

Jul<br />

2011 Jan<br />

Jul<br />

2012 Jan<br />

ALPHALINER<br />

Jul<br />

<strong>2013</strong> Jan

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Diana Containerships, the USlisted<br />

owners of the MAERSK<br />

MALACCA and MAERSK MER-<br />

LION, is expected to book a loss<br />

of over $13M each for the early<br />

disposal of the two vessels for<br />

demolition.<br />

The two ships were acquired in<br />

June 2011 for $24M each, and<br />

were chartered back to Maersk<br />

for two years at a daily gross rate<br />

of $21,450. They had a carrying<br />

value of $23.9M at the end of<br />

2012 on Diana’s books.<br />

Older panamax ships are increasingly<br />

being displaced by larger<br />

ships of 7,000-9,000 teu on their<br />

traditional trades, including the<br />

FE-US East Coast routes where<br />

they are being replaced by larger<br />

ships that have switched to using<br />

the Suez Canal.<br />

Demand is expected to drop further<br />

in 2015 when the third set of<br />

locks in the Panama Canal is<br />

opened, which will allow ships of<br />

up to 13,000 teu to transit the<br />

canal.<br />

Age Profile of Panamax ships<br />

3,000‐5,100 teu<br />

≤ 5 years<br />

6-10 years<br />

11-15 years<br />

16-20 years<br />

21-25 years<br />

> 25 years<br />

0 100 200 300<br />

Units<br />

MAERSK MALACCA - A checkered history<br />

(data extracted from <strong>Alphaliner</strong> archives)<br />

MAERSK MALACCA, together with its sistership the MAERSK MERLION, was<br />

built in <strong>19</strong>90 for the Denmark-based East Asiatic Company (EAC). Both<br />

ships are maxi-panamaxes built in Japan by Mitsui, based on EAC specifications.<br />

They were delivered to EAC in July and November <strong>19</strong>90 as AROSIA<br />

and ALSIA, with an original advertised capacity of 4,026 teu and fitted with<br />

486 reefer plugs. The high reefer capacity was partly aimed at the Australian<br />

reefer exports, as EAC also maintained at the time a Singapore-Australia<br />

feeder service with two high reefer capacity 'Strider' class 328 teu ships<br />

fitted with 158 reefer plugs.<br />

The AROSIA and ALSIA joined the Maersk Line fleet in <strong>19</strong>93 after EAC’s Europe-Far<br />

East activities were acquired by A.P. Møller (APM), parent company<br />

of the Maersk Line, in April <strong>19</strong>93. At the time, EAC was a leading carrier on<br />

the Europe-Far East route, with a wholly-owned service run with nine ships<br />

of 3,000-4,000 teu. Created in Copenhagen in 1897 to serve the Scandinavia-Far<br />

East trades, with historical roots in Thailand, EAC used to serve the<br />

trade with tweendeckers. It launched its first Europe-FE <strong>full</strong> container service<br />

in <strong>19</strong>72 as a partner in the newly formed ScanDutch consortium, set up<br />

together with Wilh. Wilhelmsen (Norway), Broströms (Sweden) and Nedlloyd<br />

(Netherlands). ScanDutch started operations with a <strong>full</strong> set of 2,500-3,000<br />

teu ships, which corresponded to the intake of the maxi-panamaxes at the<br />

time (maxi-panamaxes are defined by the maximum length allowed to transit<br />

the Panama locks). All these pioneering ships were scrapped by 2002.<br />

The Europe-Far East 'ScanDutch' service ran initially in the eastbound direction<br />

only, via the Cape of Good Hope and Panama. The group only started to<br />

use the Suez route in both directions when the Suez Canal re-opened in<br />

<strong>19</strong>75 (the Canal was closed in <strong>19</strong>67 during the Six Day War).<br />

After the dissolution of ScanDutch in <strong>19</strong>91, EAC teamed up with Ben Line<br />

(a Scottish carrier who was a member of the Trio consortium with Hapag-<br />

Lloyd, MOL, NYK and OCL) and in early <strong>19</strong>93, EAC bought the Europe-Far<br />

East trade interests of Ben Line, Wilh. Wilhelmsen and Broströms, all finally<br />

coming under Maersk’s control.<br />

The AROSIA and ALSIA became then the MAERSK MARSTAL and MAERSK<br />

MUNKEBO following APM's purchase of EAC, with a revised <strong>no</strong>minal capacity<br />

advertised as 4,281 teu (through a boosted deck cargo count). They remained<br />

initially on the Europe-Far East route but were soon dislodged by<br />

larger ships, including the first 7,400 teu ships in <strong>19</strong>96 (MAERSK REGINA<br />

class). Then, they plied various routes and were also transferred in September<br />

2003 to the Singapore branch of A.P. Møller under the new names of<br />

MAERSK MERLION and MAERSK MALACCA under the Singapore flag. Of<br />

<strong>no</strong>te, the MAERSK MERLION was sublet to MISC Bhd as MISC MERLION<br />

from February 2007 to March 2009 while the MAERSK MALACCA was sublet<br />

to MSC as MSC MALACCA from July 2008 to May 2009.<br />

Both ships were sold in April 2011 by A.P. Møller Singapore to Diana Containerships<br />

Inc., the US-based listed vehicle of Greek owner Diana Shipping,<br />

with a charter back of two years to Maersk Line without changing name.<br />

Their <strong>no</strong>minal capacity was then revised to 4,714 teu due to a remeasurement<br />

of deck cargo (without any change in the capacity of 3,046<br />

teu at 14 tons).<br />

The MAERSK MALACCA has ended her employment in early May on the<br />

Maersk-CMA CGM Med-USEC joint service (West Med/Amerigo), which is to<br />

be closed and replaced by new alternatives. She has been sold for demolition<br />

for $10.3 M, with delivery due in early June. The MAERSK MERLION is<br />

also expected to be scrapped after ending her current employment this<br />

week on Maersk's FE-US East Coast TP-7 service via Panama, which is to be<br />

closed and replaced by a new TP-7 service using the Suez route.<br />

Page 3 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

NEWBUILDING UPDATES<br />

CSCL’s 18,400 teu ships are<br />

aimed at the Far East Europe<br />

trade. UASC, which co-operates<br />

with CSCL on several trades, is<br />

also mulling a similar order. The<br />

two carriers could then mount a<br />

joint Asia-Europe loop run with<br />

ten ships of 18,000 teu.<br />

CSCL and UASC currently offer a<br />

joint FE-Europe service involving<br />

also CMA CGM as ship provider.<br />

CSCL provides six 14,074 teu<br />

ships while UASC provides three<br />

ships of 13,100 teu. CMA CGM<br />

provides the tenth ship. The three<br />

carriers also jointly operate the<br />

FE-Middle East AMA/AGX 1/<br />

CIMEX 1 service which deploys<br />

seven ships of 12,500-14,000 teu.<br />

CSCL 18400 class<br />

2014<br />

'Triple E' Class<br />

<strong>2013</strong><br />

CMA CGM MARCO POLO<br />

2012<br />

EMMA MAERSK<br />

2006<br />

GUDRUN MAERSK<br />

2005<br />

SOVEREIGN MAERSK<br />

<strong>19</strong>97<br />

REGINA MAERSK<br />

<strong>19</strong>96<br />

NYK ALTAIR<br />

<strong>19</strong>94<br />

PRESIDENT TRUMAN<br />

<strong>19</strong>88<br />

CSCL selects HHI for its 18,400 teu newbuildings<br />

Hyundai Heady Industries (HHI) has secured the order for five 18,400<br />

teu ships from CSCL. HHI confirmed in a statement today that it had<br />

won the order worth a total of $700 M. The contract price works out<br />

to $140 M per vessel, which is $50 M lower than what Maersk<br />

agreed to pay in 2011 for their 20 ‘EEE’ units of 18,200 teu at Daewoo<br />

Shipbuilding & Marine Engineering (DSME).<br />

CSCL has opted for a single engine design for these ships, in contrast<br />

to Maersk which chose a costlier but safer twin-engine design. The<br />

CSCL ships, measuring 400 m in length, 58.6 m in width and 30.5 m<br />

in depth will start to be delivered from the second half of 2014. They<br />

will be the largest containerships ever built, with a <strong>no</strong>minal capacity<br />

that is marginally higher than Maersk’s ‘EEE’ units whose deliveries<br />

are due to start from this summer.<br />

Evolution of the largest containerships : <strong>19</strong>88-2014<br />

TEU LOA Breath Draft<br />

tdw m m m<br />

18,400 TEU<br />

~ 205,000<br />

18,270 TEU<br />

~ 200,000<br />

16,020 TEU<br />

Page 4 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong><br />

187,600<br />

15,550 TEU<br />

175,000<br />

9,500 TEU<br />

115,700<br />

8,200 TEU<br />

105,000<br />

7,403 TEU<br />

90,500<br />

4,953 TEU<br />

63,000<br />

4,538 TEU<br />

55,500<br />

0 100 200 300 400 500<br />

Length Overall (LOA) in meters<br />

400 58.6 16.0<br />

400 59.0 16.0<br />

395 53.6 16.0<br />

397 56.4 16.0<br />

367 42.8 15.0<br />

347 42.8 14.5<br />

318 42.8 14.5<br />

300 37.1 13.0<br />

275 39.4 12.5<br />

© <strong>Alphaliner</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

NEWBUILDING/RESALE UPDATES<br />

Pending Deliveries :-<br />

Wide-beam units of 8,000-9,999<br />

teu with <strong>19</strong> rows on deck due in<br />

May and June<br />

(from <strong>Alphaliner</strong> records) :<br />

Name Teu Operator<br />

CAP SAN NICOLAS 9,814 Hamburg<br />

Süd<br />

built by Hyundai H.I.<br />

MSC ANTALYA<br />

(JUDITH SCHULTE)<br />

built by Jiangnan Changxing<br />

8,948 MSC<br />

MSC ABIDJAN 8,827 MSC<br />

built by Sungdong<br />

VALOR 8,827 Evergreen<br />

built by Sungdong<br />

VALUE 8,827 Evergreen<br />

built by Sungdong<br />

CSAV TOCONAO 8,600 CSAV<br />

built by DMHI (Daewoo-Mangalia)<br />

The current depressed ship prices<br />

offer good opportunities for<br />

regional carriers with spare cash<br />

to build their own fleet at low<br />

cost, a strategy which should<br />

prove rewarding when the charter<br />

market picks up as they will<br />

be sheltered from potentially<br />

high charter rates.<br />

Growing interest for 9,000 teu wide-beam ships<br />

The Hyundai group has received last week two orders for its new<br />

9,000 teu wide beam design (Hyundai 9000 W). Hyundai Samho will<br />

build two units for interests linked to International Maritime Enterprises<br />

SAM for delivery in May and June 2014, with two options attached.<br />

The two ships are ordered speculatively with <strong>no</strong> charters<br />

fixed.<br />

Other orders are on the rails, including six 'Hyundai 9000 W' units for<br />

Greek owner Oceanbulk and US private equity firm Oaktree Capital,<br />

which have concluded in March an LOI with Hyundai H.I. Six units of<br />

this design have already been delivered this winter to the Schulte<br />

Group and for XT Shipping, rated at 8,762 teu, which ordered them<br />

jointly in February 2011 with the backing of a seven year charter by<br />

MSC. These ships offer an Lbp to B ratio of only 5.9, which allows to<br />

limit their length to 300 m and their draft to 14.5 m, making them<br />

highly versatile as they are able to serve ports with restrictions, particularly<br />

in Latin America and India.<br />

This also makes them 'Black Sea-max' ships (or 'Bosporus-max') as<br />

the Turkish authorities place Bosporus transit restrictions for ships<br />

exceeding 300 m in length, although the transit for longer ships can<br />

be authorized on a case-by-case basis, depending on ships and circumstances.<br />

This explains Maersk’s decision to employ the seven<br />

wide beam units of 8,000 teu that it chartered from CSAV, which<br />

have a length of 299.9 m and a breadth of 45.6 m, on its Far East-<br />

Black sea service. This service is operated jointly with CMA CGM,<br />

which does <strong>no</strong>t operate such wide beam ships for the moment and<br />

therefore deploys 6,550 teu units of 299.97 m with a breadth of 40<br />

m alongside the Maersk 8,004 teu units.<br />

Simatech acquires two 3,300 teu ships<br />

Singapore interests linked to Dubai-based Simatech have purchased<br />

two ships of 3,359 teu, aged 15 years, from German <strong>no</strong>n operating<br />

owner E.R. Schiffahrt, the E.R. SYDNEY and E.R. MELBOURNE.<br />

Both ships were owned by KGs initially set up by Nordcapital, the<br />

fund raising company of E.R. Schiffahrt, and were traded by Blue Star<br />

Holding, formed in July 2012 by E.R. Capital Holding and Komrowski<br />

Holding. Simatech has renamed them respectively UNI GLOBE and<br />

UNI GALAXY for employment on its intra-Gulf services and Gulf-India<br />

services. They are Simatech’s largest owned ships. They add to eight<br />

other owned ships of 1,200 to 1,700 teu.<br />

Simatech's current operated fleet stands at 40,000 teu, of which<br />

70% is chartered. Its largest chartered ship is a 4,600 teu unit.<br />

Page 5 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

SERVICE UPDATES<br />

G6 : CEC Service Details<br />

China‐US East Coast (CEC) Service<br />

Vessels Deployed:<br />

11 x 8,000‐8,600 teu<br />

Port Rotaon<br />

Hong Kong, Shekou, Yanan, Sin‐<br />

gapore, (Suez), New York, Savan‐<br />

nah, Charleston, Norfolk, ( Suez),<br />

Jeddah, Singapore, Cai Mep, Hong<br />

Kong<br />

G6 : AZX Service Details<br />

China‐US East Coast (CEC) Service<br />

Vessels Deployed:<br />

10 x 5,000‐7,500 teu<br />

Port Rotaon<br />

Hong Kong, Shekou, Yanan, Sin‐<br />

gapore, (Suez), New York, Savan‐<br />

nah, Charleston, Norfolk, ( Suez),<br />

Jeddah, Singapore, Cai Mep, Hong<br />

Kong<br />

The two new strings will replace<br />

the existing New World Alliance<br />

SZX and Grand Alliance AEX<br />

services, with the addition of<br />

about 3,300 teu as a result of the<br />

vessel upgrades on the CEC service.<br />

The SZX which was operated by<br />

nine US-flagged ships from APL<br />

will be <strong>no</strong>minally replaced by the<br />

AZX. It will retain five US-flagged<br />

ships from APL which will provide<br />

alternate week sailings on<br />

the US-flag ships that are required<br />

for APL to carry certain<br />

US government and military cargo.<br />

The four other US-flagged ships<br />

on the SZX are APL C-10 class<br />

ships of 4,528 teu which will be<br />

scrapped.<br />

G6 inaugurates new FE-USEC CEC & AZX services<br />

As planned, the G6 carriers (APL, Hapag-Lloyd, HMM, MOL, NYK and<br />

OOCL) will launch in mid-May their two new FE-USEC services routed<br />

via the Suez Canal, the CEC and AZX. Zim will also take slots on both<br />

services.<br />

The CEC service will be inaugurated on 17 May with the sailing of the<br />

8,598 teu SEATTLE EXPRESS from Hong Kong. The CEC service will<br />

call at Hong Kong, Shekou, Yantian, Singapore, (Suez), New York,<br />

Savannah, Charleston, Norfolk, (Suez), Jeddah, Singapore, Cai Mep<br />

and Hong Kong, under a slightly revised rotation from the one initially<br />

an<strong>no</strong>unced in March with the addition of a Savannah call.<br />

It will deploy 11 ships of between 8,000 and 8,600 teu, with an average<br />

weekly capacity of 8,367 teu:-<br />

► SEATTLE EXPRESS (8,598 teu) - currently idle<br />

► HOUSTON EXPRESS (8,411 teu) - shifted from FE-USWC NWX<br />

► OOCL SOUTHAMPTON (8,063 teu) - shifted from FE-ME MEX<br />

► MOL COSMOS (8,110 teu) - shifted from FE-Eur Loop 1<br />

► SAVANNAH EXPRESS (8,411 teu) - shifted from FE-USWC NWX<br />

► MOL COMMITMENT (8,600 teu) - newbuilding<br />

► APL ZEEBRUGGE (8,540 teu) - shifted from FE-USWC SAX<br />

► APL ANTWERP (8,100 teu) - newbuilding shifted from FE-ME WAX<br />

► APL POLAND (8,540 teu) - shifted from FE-ME WAX<br />

► OOCL SEOUL (8,063 teu) - shifted from FE-EU Loop 5<br />

► VANCOUVER EXPRESS (8,598 teu) - shifted from FE-USWC NWX<br />

The AZX service will be inaugurated on 20 May with the sailing of the<br />

5,888 teu OOCL OAKLAND from Laem Chabang. The service will call<br />

at Laem Chabang, Singapore Colombo, (Suez), Damietta, Cagliari,<br />

Halifax, New York, Savannah, Norfolk, Cagliari, Damietta, (Suez), Jebel<br />

Ali, Singapore, Laem Chabang. It will deploy ten ships of 5,000 to<br />

7,500 teu with a weekly average of 5,987 teu:-<br />

► OOCL OAKLAND (5,888 teu) - shifted from AEX<br />

► APL CYPRINE * (5,016 teu) - shifted from SZX<br />

► OOCL DUBAI (5,888 teu) - shifted from AEX<br />

► APL AGATE * (5,016 teu) - shifted from SZX<br />

► BERLIN EXPRESS (7,506 teu) - shifted from FE-USWC PNX<br />

► APL PEARL * (5,016 teu) - shifted from SZX<br />

► YANTIAN EXPRESS (7,506 teu) - shifted from AEX<br />

► APL BELGIUM * (5,514 teu) - shifted from FE-USWC TP-1<br />

► DALIAN EXPRESS (7,506 teu) - shifted from AEX<br />

► APL CORAL * (5,016 teu) - shifted from SZX<br />

* US-Flag units operated by APL for US government cargo<br />

(APL JAPAN will be removed from U.S.-flag service & replaced with the APL BELGIUM)<br />

Page 6 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Evergreen/Yang Ming/PIL/<br />

Si<strong>no</strong>trans : CAT Service Details<br />

China‐Australia‐Taiwan Service<br />

(New from June)<br />

Vessels Deployed:<br />

6 x 4,200 teu<br />

Port Rotaon<br />

Ningbo, Shanghai, Shekou,<br />

Kaohsiung, Sydney, Melbourne,<br />

Brisbane, Kaohsiung, Ningbo<br />

Zim : ZCP Service Details<br />

Zim Container Service ‐ Pacific<br />

(ZCP)<br />

Vessels Deployed:<br />

10 x 5,000 teu<br />

Port Rotaon<br />

Ningbo, Shanghai, Busan, Balboa,<br />

Kingston, Savannah, Norfolk<br />

(added June), New York, Halifax,<br />

Kingston, Los Angeles, Oakland,<br />

Vostochny (bunkering), Ningbo<br />

Evergreen/YM/PIL/Si<strong>no</strong>trans launch new FE-Aus loop<br />

Evergreen, Yang Ming, PIL and Si<strong>no</strong>trans are to launch an additional<br />

Far East-Australia service in June, complementing their existing services.<br />

The new China-Australia-Taiwan (CAT) service will connect<br />

Ningbo, Shanghai, Shekou, Kaohsiung, Sydney, Melbourne, Brisbane,<br />

Kaohsiung, Ningbo. It will turn in six weeks with six ships of the<br />

4,200 teu-class fitted with 400 to 600 reefer plugs.<br />

The first sailing is planned from Ningbo on 8 June with the YM OAK-<br />

LAND, followed by the ITAL MATTINA, KOTA LANGSAR, YM BUSAN,<br />

SNL COLOMBO and one further ship.<br />

The CAT service is expected to add 12% to the weekly capacity on the<br />

China-Australia trade.<br />

Boomerang<br />

AAS<br />

AANA 2<br />

AANA 1<br />

CKA<br />

AEA 1<br />

CAS<br />

CAT<br />

China-Australia Services : Weekly Capacity by Loop<br />

Ave. TEU per week<br />

0 1,000 2,000 3,000 4,000 5,000<br />

Maersk / MSC<br />

Hapag‐Lloyd / Hamburg Süd / HMM / APL<br />

NYK / MOL / K Line / OOCL / Evergreen<br />

ANL / CSCL / OOCL<br />

Hanjin / STX P.O. / Yang Ming / Si<strong>no</strong>trans / TS Lines<br />

CSCL / OOCL<br />

COSCO / PIL<br />

Evergreen / Yang Ming / PIL / Si<strong>no</strong>trans (New from June)<br />

Note : Only ship providers are listed. Slot takers are <strong>no</strong>t shown (see website for slot takers).<br />

Zim to add Norfolk on FE-USEC loop<br />

Zim is to add Norfolk to its Far East-USEC 'ZCP' service, with the first<br />

sailing covering Norfolk offered on 15 May from Ningbo, for a Norfolk<br />

call planned on 15 June. Of <strong>no</strong>te, Norfolk is home to Zim's USA head<br />

office.<br />

The ZCP will therefore call at Ningbo, Shanghai, Busan, Balboa, Kingston,<br />

Savannah, Norfolk (added June), New York, Halifax, Kingston,<br />

Los Angeles, Oakland, Vostochny (bunkering), Ningbo. It will continue<br />

to turn in ten weeks with ten ships of around 5,000 teu with CSCL<br />

taking slots on the service.<br />

Page 7 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Evergreen/COSCO/Zim :<br />

ESAService Details<br />

Asia‐East Coast South America<br />

ESA Service (Upgraded from May)<br />

Vessels Deployed:<br />

11 x 3,400‐4,200 teu<br />

TBR 11 x 8,000‐8,800teu<br />

Port Rotaon<br />

Shanghai, Ningbo, Yanan, Hong<br />

Kong, Singapore, Santos, Parana‐<br />

gua, Montevideo, Bue<strong>no</strong>s Aires,<br />

Rio Grande, Itapoa, Santos, Singa‐<br />

pore, Hong Kong, Shanghai<br />

HMM : ACS-KR 2 Service Details<br />

ACS‐KR 2 (Revamped from May)<br />

Vessels Deployed:<br />

6 x 2,200 teu<br />

Port Rotaon<br />

Busan, Vostochny, Busan, Ulsan,<br />

Shanghai, Yanan, Singapore,<br />

Port Kelang, Chennai, Port Kelang,<br />

Singapore, Busan<br />

First 8,000 teu ship introduced this week on ESA<br />

COSCO will assign from this week the 8,063 teu OOCL QINGDAO on<br />

the Far East-ECSA (ESA) service which it jointly operates with Ever-<br />

green, with Zim to join this month. The vessel is one of two 8,063 teu<br />

OOCL's 'S-Class' ships that COSCO has chartered from OOCL for this<br />

run in an exchange involving ships chartered out by OOCL from<br />

COSCO for the FE-ME run.<br />

The OOCL QINGDAO is the first 8,000 teu ship introduced on the ESA<br />

service run so far with 11 ships of 3,400 of 4,200 teu provided by<br />

Evergreen and COSCO. Further 8,000 teu-class ships are to follow in<br />

the coming weeks, including two ships from Zim which joins this service<br />

as a vessel provider. The other ships will be the ITAL CONTESSA<br />

(8,073 teu - Evergreen), OOCL NINGBO (8,063 teu - COSCO), VALOR<br />

(8,827 teu - Evergreen), ZIM NINGBO (8,440 teu - Zim), LT CORTESIA<br />

(8,073 teu - Evergreen), VALUE (8,827 teu - Evergreen), ZIM SAN DIE-<br />

GO (8,440 teu - Zim) and VALIANT (8,827 teu - Evergreen).<br />

Two other carriers, Maersk Line and Hamburg Süd, are already using<br />

8,000 teu-class ships on the FE-ECSA route (ASAS 1/NGX).<br />

The ESA upsize follows the launch of the ’Ipanema’ service by MSC in<br />

April. The two services will add about 9,000 teu every week to the FE<br />

–South America East Coast.<br />

FE-ECSA services breakdown by weekly capacity<br />

HMM merges FE-Chennai and Korea-Russia loops<br />

Hyundai M.M. is to merge its Korea-China-SE Asia-Chennai service<br />

(ACS) with its Busan-Vostochny service (KR 2). The ACS-KR 2 will then<br />

be run in six weeks using six ships of 2,174 teu, the sixth ship being<br />

the HYUNDAI VLADIVOSTOK, which used to run the KR 2 service. The<br />

ACS-KR 2 offers a butterfly rotation centered on Busan, calling at<br />

Busan, Vostochny, Busan, Ulsan, Shanghai, Yantian, Singapore, Port<br />

Kelang, Chennai, Port Kelang, Singapore, Busan.<br />

The six 2,174 teu ships plying the service were originally built for<br />

Page 8 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Maersk’s six WAF loops serving<br />

the Central West Africa and Angola<br />

involve a total of 33 ships<br />

of 1,700 to 2,500 teu, all <strong>full</strong>y<br />

geared to serve ports <strong>no</strong>t<br />

equipped, or insufficiently<br />

equipped, to handle containers.<br />

HMM in <strong>19</strong>97-98 and were sold in July 2007 to Danaos Corp., each<br />

with a ten-year charter back to HMM.<br />

Bengal Tiger Line, which co-loads on the ACS, is involved on the<br />

whole rotation while CMA CGM, FESCO and Pan Continental, which<br />

took slots on the KR 2, will continue to take slots on the Busan-<br />

Vostochny string of the new service.<br />

Apart from offering direct Russia-SE Asia-Chennai connections, the<br />

inclusion of Vostochny in the ACS also allows all the ACS ships to<br />

benefit from the cheaper bunker fuel available at the Russian port,<br />

which has motivated several carriers to add this port to their rotation<br />

since early 2012, sometimes with the sole purpose of bunkering.<br />

Maersk and Sfamarine revise six WAF relay loops<br />

Maersk Line and Safmarine are to revamp their relay services covering<br />

the Central West Africa and South West Africa ranges, spanning<br />

Ivory Coast to Angola. Six loops hubbing at Algeciras and at Tangier<br />

are concerned, of which four cover Central West Africa and two are<br />

dedicated to Angola. The North West Africa range is <strong>no</strong>t affected by<br />

the changes and continues to be covered with four loops.<br />

The port coverage remains the same but several ports are swapped<br />

between loops to adapt to changing regional patterns. The revised<br />

loops stand as follows :<br />

Central West Arica range :<br />

► WAF 1 : Tangier, Algeciras, Tema, Pointe Noire, Libreville, Tangier<br />

- 6 x 1,700-2,500 teu weekly<br />

► WAF 2 : Tangier, Algeciras, Abidjan, Coto<strong>no</strong>u, Lome, Tangier - 5 x<br />

2,500 teu weekly<br />

► WAF 3 : Tangier, Algeciras, Lagos-Apapa, Lagos-Tincan, Onne, Takoradi<br />

(1/2), Tangier - 6 x 2,500 teu weekly<br />

► WAF 6 - Tangier, Algeciras, Lagos-Apapa, Douala, Abidjan, Tangier<br />

- 5 x 2,500 teu weekly<br />

Angola :<br />

► WAF 5 : Algeciras, Vigo, Leixoes, Lisbon, Algeciras, Luanda, Walvis<br />

Bay, Abidjan, Algeciras - 8 x 1,400-1,700 teu weekly<br />

► WAF 5 plus : Tangier, Algeciras, Luanda, Lobito, Namibe, Tangier -<br />

3 x 1,700 teu fortnightly<br />

In addition to this, the Maersk Algeciras-South Africa relay service will<br />

omit its <strong>no</strong>rthbound call at Luanda and will <strong>no</strong>w focus exclusively on<br />

the Med-South Africa sector, connecting Durban, Ngqura and Cape<br />

Town to Algeciras. The service deploys seven ships of 1,300-1,700<br />

teu.<br />

Page 9 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Maersk : Tunis feeder<br />

Service Details<br />

Tunis feeder<br />

Vessels Deployed:<br />

3 x 800‐900 teu<br />

Port Rotaon<br />

Valencia, Tunis, Marsaxlokk, Tu‐<br />

nis, Valencia<br />

Maersk : FEW 1 Service Details<br />

FEW 1<br />

Vessels Deployed:<br />

10 x 2,500 teu geared<br />

Port Rotaon<br />

Port Kelang, Tanjung Pelepas,<br />

Lome, Onne, Douala, Bissau<br />

(seasonal), Cochin (seasonal),<br />

Walvis Bay, Port Kelang.<br />

Maersk : Libya Service Details<br />

Libya Feeder service<br />

Vessels Deployed:<br />

Slots on Bahari ‐ twice weekly<br />

Port Rotaon<br />

Port Said (West + SCCT) to Ben‐<br />

ghazi, Misurata, Tripoli, Al Khoms,<br />

Tobruk<br />

UFS/Metz: Malta-Greece Service<br />

Malta‐Greece Feeder<br />

Vessels Deployed:<br />

1 x 500 teu<br />

Port Rotaon<br />

Marsaxlokk, Piraeus, Thessaloniki,<br />

Marsaxlokk<br />

Maersk enhances Tunisia coverage<br />

Maersk Line is to organize a butterfly service centered on Tunisia,<br />

connecting Valencia, Tunis, Marsaxlokk, Tunis, Valencia. The service<br />

will turn in three weeks with three ships of 800-900 teu. The first<br />

sailing is planned from Valencia on 8 May with the 907 teu MARGUE-<br />

RITE and followed by the 862 teu MAERSK FUNCHAL<br />

The service will complement Maersk's Tunis coverage. Maersk also<br />

provides an Algeciras weekly feeder service ensured though slots on<br />

X-Press Feeders' 'Tunisia X-Press' service (TTX).<br />

Maersk adds Cashew calls to FEW 1<br />

Maersk Line has added seasonal calls at Bissau (Guinea) and Cochin<br />

(South India) on the backhaul leg of its Asia-West Africa 'FEW 1' loop.<br />

These extra calls are motivated by seasonal cashew volumes. Raw<br />

cashew nuts is a main export of Guinea-Bissau and the state of Kerala<br />

is a main importer, with large cashew processing plants located<br />

there. It makes this state one of Bissau main trading partners, with<br />

Cochin a main gateway for raw cashew imports. As the two cashew<br />

calls impliy an extra distance and extra port stays, extra ships will be<br />

added to the service, which is usually run with ten geared ships of<br />

2,500 teu.<br />

Maersk adds Libya connections through slots<br />

Maersk Line is to take slots on the Port Said-Libya feeder services<br />

maintained by Malta-based Bahari Shipping. Bahari launched this<br />

service in December 2012 with the chartered 1,042 teu MEKONG<br />

SPIRIT and has since progressively enhanced it with three more chartered<br />

units, the 1,561 teu THERMAIKOS (January), the 500 teu LADY<br />

HALUOM (March) and the 1,373 teu TARRAGONA (April).<br />

UFS and Metz enhance Greece feeder coverage<br />

United Feeder Services (UFS) and Metz Container Line (MCL) are to<br />

launch this week a Malta-Greece feeder shuttle, using the 508 teu<br />

BF CARTAGENA. This new weekly common feeder shuttle will complement<br />

the existing Malta-Greece service that UFS and MCL provide<br />

through slots on the Malta-Greece and Greece-Malta legs of CMA<br />

CGM's North Europe Med Express service (FEMEX). Besides, UFS and<br />

MCL also cover Greece with a<strong>no</strong>ther common feeder service hubbing<br />

at Damietta and Port Said.<br />

Maersk Line and Seago Line (APM-Maersk intra Europe arm) are to<br />

use the new Marsaxlokk-based shuttle at the expense of the Damietta-based<br />

shuttle.<br />

Page 10 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

COSCO/Yang Ming/Hanjin : Baltic<br />

Feeder Service Details<br />

Russia‐Finland Feeder service<br />

Vessels Deployed:<br />

3 x 1,000‐1,500 teu<br />

Port Rotaon<br />

Hamburg (HHLA + Eurogate), St<br />

Petersburg (Petrolesport + FCT),<br />

Kotka, Hamburg, St Petersburg,<br />

Kotka, Hamburg<br />

WEC : North Europe-Iberia<br />

Service Details<br />

North Europe Iberia Service 2<br />

Vessels Deployed:<br />

2 x 860 teu<br />

Port Rotaon<br />

Roerdam, Tilbury, Antwerp, Vi‐<br />

go, Leixoes, Sines, Lisbon, Roer‐<br />

dam<br />

King Ocean Service : Western<br />

loop Service Details<br />

ECCA & NCSA svc (Western loop)<br />

Vessels Deployed:<br />

3 x 950 teu<br />

Port Rotaon<br />

Port Everglades, Puerto Limon,<br />

Manzanillo (Pan), Barranquilla,<br />

Cartagena (Col), Oranjestad, Wil‐<br />

lemstad (~Curaçao), Maracaibo,<br />

Barranquilla, Cartagena (Col),<br />

Puerto Limon, Port Everglades<br />

COSCO, Yang Ming & Hanjin team up on Baltic feeder<br />

COSCO Container Lines and Yang Ming are to team up with Hanjin<br />

Shipping on its planned dedicated 'Russia Finland feeder service'<br />

(RFS). The service will offer a butterfly pattern spanning three<br />

weeks (Hanjin intended initially to launch it with a single ship plying<br />

an 11 day rotation).<br />

There will be two successive loops per three-week cycle, each one<br />

connecting Hamburg to St Petersburg and Kotka. At Hamburg, the<br />

ships will call at both the HHLA and Eurogate terminals. At St Petersburg,<br />

they will call at both Petrolesport and First Container Terminal.<br />

The RFS will employ three ships, one from each carrier. It will take off<br />

from Hamburg on <strong>19</strong> May. It will replace slots on common feeder services.<br />

The three RFS partners involved are member of the CKYH alliance. K<br />

Line, the fourth partner, did <strong>no</strong>t say if it will participate. Hamburg is a<br />

key hub for the CKYH partners. Eight weekly Asia-North Europe services<br />

involving Hanjin call at Hamburg, of which four are CKYH loops<br />

and four other loops on which some of them co-load or slot.<br />

WEC Lines adds North Europe-Iberia service<br />

WEC Lines is to launch a new weekly North Europe-Iberia service<br />

connecting Rotterdam, Tilbury, Antwerp, Vigo, Leixoes, Sines, Lisbon,<br />

Rotterdam. It will turn in two weeks with two chartered ships of 868<br />

teu, the BJORG and ROBERT (who have been spot in Germany).<br />

WEC Lines has been already offering a weekly North Europe-Iberia<br />

service connecting Felixstowe, Moerdijk and Rotterdam to Vigo, Leixoes,<br />

Lisbon and Setubal, using two ships of 1,008 teu. These services<br />

are also used by MSC, which controls WEC Lines, which acts as<br />

a regional Europe carrier. Besides, MSC also operates a service connecting<br />

Antwerp to Iberia (Accordion) that is also used by WEC.<br />

King Ocean rearranges Caribbean loops<br />

King Ocean has streamlined its Central America and NCSA coverage.<br />

It has merged its Colombia-Netherland Antillas service and its Florida<br />

-NCSA service connecting Florida to Cartagena, Barranquilla, Aruba<br />

and La Guaira in its main Florida-Centram-NCSA service, dubbed<br />

'Western loop' .<br />

Willemstad and Maracaibo, which used to be covered through transhipment<br />

at Cartagena on the Colombia-Netherland Antillas service,<br />

have been inserted into the Florida-Centram-NCSA service (Western<br />

loop). The new rotation stands as follows : Port Everglades, Puerto<br />

Page 11 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

King Ocean has also shifted its<br />

Grenada call (St George's) from<br />

its Lower Caribbean loop to its<br />

upper Caribbean loop and has<br />

added a second Trinidad call to<br />

the Lower Caribbean loop, <strong>no</strong>w<br />

serving Point Lisas on top of Port<br />

of Spain.<br />

The two latter services were purchased<br />

from Bernuth Lines in<br />

September 2012.<br />

PIL/MOL : IOI/IOX<br />

Service Details<br />

Indian Ocean Island Service<br />

Vessels Deployed:<br />

4 x 1,500 teu<br />

Port Rotaon<br />

Singapore, Port Louis, Toamasina,<br />

Reunion, Singapore<br />

PIL : MZS Service Details<br />

Asia‐Mozambique Service (MZS)<br />

Vessels Deployed:<br />

7 x 1,700‐1,800 teu<br />

Port Rotaon<br />

Singapore, Maputo, Beira, Nacala,<br />

Singapore<br />

Limon, Manzanillo (Pan), Barranquilla, Cartagena, Oranjestad, Willemstad,<br />

Maracaibo, Barranquilla, Cartagena, Puerto Limon, Port Everglades.<br />

A third week and third 960 teu ship has been added to the rotation<br />

to cater for the extra calls (SPYROS, shifted from the closed Florida-<br />

NCSA service and adding to the HOHERIFF and VEGA POLLUX). The<br />

'Northern loop' remains unchanged and continues to connect Port<br />

Everglades to Puerto Cortes and Santo Tomas de Castilla on a weekly<br />

basis with a single 966 teu ship (VEGA SAGITTARIUS). La Guaira. also<br />

served with the Colombia-Netherland Antillas service, continues to be<br />

served with the 'Eastern Loop'.<br />

PIL & MOL team up on Asia-Indian Ocean islands trade<br />

Pacific International Lines (PIL) and Mitsui O.S.K. Lines (MOL) will<br />

jointly launch a new Singapore-Indian Ocean Island service (IOI/IOX).<br />

The service will connect Singapore to Port Louis, Toamasina and Reunion.<br />

It will turn in four weeks with four ships of 1,300-1,500 teu,<br />

two of which provided by PIL and two by MOL. Connections will be<br />

offered at Singapore to East Asia and Oceania on the respective networks<br />

of PIL and MOL. The first sailing is planned on 7 June from Singapore.<br />

The new service is based on the Singapore-Indian Ocean legs of the<br />

MOL's IOX and PIL's IOI, which are both superseded by the new service.<br />

PIL streamlines Mozambique service - MOL slots<br />

Further to the launch by PIL and MOL of a joint Singapore-Indian<br />

Ocean Island service (IOI/IOX), PIL is to streamline its Singapore-<br />

Mozambique relay service in removing the Indian Ocean Island calls<br />

from its IOI/IOM service, transforming it into the new MZS service. A<br />

direct call at Nacala is added on top of existing Maputo and Beira<br />

calls.<br />

On its side, MOL is to close its own fortnightly Singapore-Mozambique<br />

service (MZX/IOX) and will continue to serve Mozambique through<br />

slots on PIL's revised Singapore-Mozambique MZS relay service as<br />

part of a slot swap involving MOL space on the IOX service.<br />

The MZS will connect Singapore to Maputo, Beira and Nacala. It will<br />

turn in seven weeks with seven ships of around 1,800 teu, all provided<br />

by PIL. Connections will be offered at Singapore to East Asia and<br />

Oceania on the respective networks of PIL and MOL. The first sailing<br />

of the new MZS is planned on 7 June from Singapore.<br />

Page 12 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

DELIVERY UPDATES<br />

Cellular Containerships Deliveries<br />

April <strong>2013</strong><br />

Name Teu Operator<br />

CMA CGM ALENXAN-<br />

DER VON HUMBOLDT<br />

16,020 CMA CGM<br />

MOL QUEST 14,000 MOL<br />

NYK HERCULES 13,208 NYK<br />

HANJIN GOLD 13,102 Hanjin<br />

HANJIN GREEN EARTH 13,102 Hanjin<br />

APL NEW YORK 9,200 APL<br />

YM UNICORN 8,626 Yang Ming<br />

EVER LOGIC 8,452 Evergreen<br />

KRISTINA 6,620 Maersk<br />

HYUNDAI PARAMOUNT 5,023 HMM<br />

XIN WEN ZHOU 4,738 CSCL<br />

XIN XU ZHOU 4,538 CSCL<br />

WAN HAI 516 4,680 Wan Hai<br />

HANJIN INDIGO 4,600 Hanjin<br />

COSCO SAO PAULO 4,253 COSCO<br />

KOTA LEMBAH 4,250 PIL<br />

HANJIN ARGENTINA 3,560 Hanjin<br />

BALAO 2,546 H-L<br />

VNL RUBY 1,794 Evergreen<br />

SUNNY LOTUS 1.043 KMTC<br />

CHANG RONG 5 798<br />

CHANG RONG 8 656<br />

Quanzhou<br />

Ansheng<br />

Quanzhou<br />

Ansheng<br />

The CMA CGM JULES VERNE (16,020 teu) is delivered<br />

CMA CGM has received the CMA CGM JULES VERNE, last of a trio of<br />

16,020 teu ships originally ordered at Daewoo (DSME) as 13,830<br />

teu ships in July 2007 within an eight ship program (CMA CGM<br />

CHRISTOPHE COLOMB series). The last three units were deferred by<br />

two years due to the financial crisis and boosted to 16,020 teu in<br />

early 2011, based on a enhanced design with two more bays and<br />

one more row than the original series.<br />

The trio are currently the largest ever containerships afloat in <strong>no</strong>minal<br />

capacity terms (until the delivery of the first of the Maersk Line's<br />

‘EEE’ ships of 18,270 teu in late June this year).<br />

The first unit, CMA CGM MARCO POLO, was delivered in November<br />

2012 and the second unit, CMA CGM ALEXANDER VON HUMBOLDT,<br />

was delivered in April. The first two ships fly the British flag, while<br />

CMA CGM JULES VERNE will sail under the French flag. The CMA<br />

CGM JULES VERNE will join its two sisters on the CMA CGM Far East-<br />

Europe FAL1 service.<br />

The HANJIN BLUE OCEAN (13,102 teu) is delivered<br />

Hanjin has received the HANJIN BLUE OCEAN, last of a series of nine<br />

13,100 teu-class ships initially contracted by Münchmeyer Petersen<br />

& Co (MPC) at Hyundai Heavy Industries in February 2008 with the<br />

backing of Hanjin as long term charterer. Eventually, MPC stepped<br />

down due to difficulties in arranging financial in the aftermaths of the<br />

Lehmann Bros failure in September 2008. Five of the contracts were<br />

taken over by Hanjin and four others were granted to third-party investors<br />

through Gansey Bay Ltd, an Isle of Man-registered entity. The<br />

deliveries of the nine ships were also deferred by around one year.<br />

The HANJIN BLUE OCEAN is to join the CKYH 'NE 6' service. She follows<br />

the HANJIN GOLD and HANJIN GREEN EARTH, delivered earlier<br />

in April.<br />

The KATHERINE (6,673 teu) is delivered, joins Maersk<br />

Greek owner Tech<strong>no</strong>mar Shipping has received the KATHERINE, last<br />

of four wide-beam 6,673 teu ships that it ordered at Hyundai Samho<br />

in two steps in May and September 2011. The quartet was subsequently<br />

chartered by Maersk Line for three years. Maersk Line also<br />

chartered simultaneously three sister ships from International Maritime<br />

Enterprises SAM for five years.<br />

The KATHERINE follows the KRISTINA, delivered in April. These ships<br />

were initially earmarked to start their careers on the Asia-Europe<br />

route but most of them are finally expected to join Maersk's new FE-<br />

Page 13 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Cellular Containerships Deliveries<br />

May <strong>2013</strong><br />

Name Teu Operator<br />

CMA CGM JULES<br />

VERNE<br />

16,020 CMA CGM<br />

HANJIN BLUE OCEAN 13,102 Hanjin Shg<br />

EVER LIVEN 8,452 Evergreen<br />

KATHERINE 6,673 Maersk<br />

RHL CONSTANTIA 4,620 MOL<br />

HANJIN MARINE 4,532 Hanjin Shg<br />

COSCO VALENCIA 4,253 COSCO<br />

HANJIN MEXICO 3,560 Hanjin Shg<br />

NILEDUTCH HIPPO 3,421 NileDutch<br />

RENJIAN JINTANG 1,744 Quanzhou<br />

An Sheng<br />

US East Coast TP-7 service via Suez which was inaugurated on 16<br />

April with the sailing of the KRISTINA from Ningbo and was followed<br />

by the KRISTINA a week later.<br />

RHL CONSTANTIA (4,620 teu) joins MOL<br />

Reederei Hamburger Lloyd (RHL) is to receive the RHL CONSTANTIA,<br />

third of four overpanamax containerships of 4,620 teu ordered in<br />

2008 in China at the Shanghai Shipyard (two ships) and at the<br />

Jiangnan Changxing shipyard (two ships). They are based on the<br />

'SDARI 4600' wide-beam design of the Shanghai Merchant Ship Design<br />

and Research Institute (SDARI), with a Lbp to B ratio of 6.7 and<br />

are capable of a 23 k<strong>no</strong>ts speed, powered by a <strong>full</strong>y electronicallycontrolled<br />

slow speed engine of 36,240 kW assembled in China under<br />

license from MAN-B&W.<br />

She follows the RHL CONCORDIA delivered in August 2012. The last<br />

ship, RHL CALLIDITAS, is currently under fitting out and is planned for<br />

delivery in June.<br />

The RHL CONSTANTIA has been chartered by MOL, which will assign<br />

her from 13 April on the Japan-USWC 'JAS' service, offered jointly with<br />

K Line, which brands it PSW-3. She will replace the 4,646 teu panamax<br />

MOL EXCELLENCE, which was acquired by Seaspan together<br />

with three sister ships as part of a deal concluded in January. The<br />

MOL EXCELLENCE will continue to be operated by MOL under a two-<br />

year charter back arrangement and is expected to be deployed on<br />

the FE-US-Europe APX pendulum. The Seaspan deal involved the construction<br />

of four new 10,000 teu containerships in China, which will<br />

be chartered by MOL.<br />

The HANJIN MARINE (4,532 teu) is delivered<br />

Hanjin is to take in charge the HANJIN MARINE, second of three widebeam<br />

units of 4,532 teu ordered in June 2011 at Hyundai Samho by<br />

HI Investment & Securities with the backing of a seven-year charter<br />

by Hanjin. These six ships are part of a program of six wide-beam<br />

ships, with the other three units ordered at Samsung H.I. by Hanjin<br />

itself.<br />

The HANJIN MARINE will start her career on the China-Korea-<br />

Australia service operated by Hanjin, STX Pan Ocean, Yang Ming and<br />

Si<strong>no</strong>trans. The third ship in the series, HANJIN MAR, will join the<br />

same service in early June. Both ships are overpanamaxes and are to<br />

replace two Hanjin's panamax units, the HANJIN MILANO and HANJIN<br />

DÜSSELDORF, who are scheduled to join the new CKYH Far East-<br />

USEC service via Panama that was launched on 20 April by Hanjin<br />

and COSCO with Yang Ming and K Line taking slots (AWE-7).<br />

Page 14 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

* May<br />

Apr<br />

Mar<br />

Feb<br />

<strong>2013</strong> Jan<br />

Dec<br />

Nov<br />

Oct<br />

Sep<br />

Aug<br />

Jul<br />

Jun<br />

May<br />

Apr<br />

Mar<br />

Feb<br />

2012 Jan<br />

Dec<br />

Nov<br />

Oct<br />

Sep<br />

Aug<br />

Jul<br />

Jun<br />

May<br />

Apr<br />

Mar<br />

Feb<br />

2011 Jan<br />

Dec<br />

Nov<br />

Oct<br />

Sep<br />

Aug<br />

Jul<br />

Jun<br />

May<br />

Apr<br />

Mar<br />

Feb<br />

2010 Jan<br />

Dec<br />

Nov<br />

Oct<br />

Sep<br />

Aug<br />

Jul<br />

Jun<br />

May<br />

Apr<br />

Mar<br />

Feb<br />

2009 Jan<br />

Deliveries by Month<br />

2009-<strong>2013</strong><br />

2<br />

6<br />

14<br />

10<br />

12<br />

10<br />

<strong>19</strong><br />

15<br />

12 13<br />

20<br />

16<br />

14 20<br />

11 18<br />

9 15<br />

10 16<br />

10<br />

16<br />

16<br />

22<br />

24<br />

18<br />

24<br />

20<br />

23<br />

17<br />

21<br />

23<br />

28<br />

26<br />

15<br />

24<br />

23<br />

28<br />

20<br />

20<br />

21<br />

23<br />

29<br />

33<br />

26<br />

27<br />

13<br />

29<br />

<strong>19</strong><br />

TEU delivered<br />

Units delivered<br />

20<br />

28<br />

34<br />

* Deliveries recorded month-to-date<br />

33<br />

The COSCO VALENCIA (4,253 teu) is delivered<br />

COSCO has received the COSCO VALENCIA, 14th unit of its 4,253 teu<br />

'Jiangsu New Yangzijiang' newbuilding program, comprising 20 ships<br />

delivered in 2012 and <strong>2013</strong>. Of <strong>no</strong>te, the deliveries of the last ten<br />

ships were deferred by 9-12 months.<br />

The COSCO VALENCIA is to join the Far East-USEC 'AWE 2' loop operated<br />

by COSCO within the frame of the CKYH partnership, on which<br />

replacing the 4,530 teu COSCO KAWASAKI. She follows the COSCO<br />

SAO PAULO delivered in April.<br />

The HANJIN MEXICO (3,560 teu) is delivered<br />

Hanjin is to take in charge this week the HANJIN MEXICO, last of four<br />

wide-beam 3,560 teu ships ordered in June 2011 at Hyundai Mipo<br />

by PIL-related interests (Singapore) with the backing of a long term<br />

charter by the Korean carrier. The HANJIN MEXICO, will start her career<br />

on Hanjin's transpacific CAX loop, on which her three sister ships<br />

are <strong>no</strong>w deployed. She follows the HANJIN ARGENTINA, delivered in<br />

April.<br />

The HEDDA SCHULTE (3,421 teu) joins NileDutch<br />

Reederei Thomas Schulte has received the HEDDA SCHULTE, second<br />

of four 3,421 teu ships ordered in August 2008 originally by Nordic<br />

Hamburg Shipping in China at the Rongcheng Shenfei shipyard for<br />

delivery in 2011. The first of the four units was delivered to Nordic<br />

Hamburg in November 2011. The construction of the three remaining<br />

units faced delays and two of them were finally refused by Nordic<br />

Hamburg. These hulls, the former NORDIC LÜNEBURG and NORDIC<br />

STETTIN, were put up for sale by the yard, with Thomas Schulte buying<br />

them, renaming them respectively HEDDA SCHULTE and LUCIA<br />

SCHULTE.<br />

The HEDDA SCHULTE has joined her charterer NileDutch for assignment<br />

to its Far East-West Africa service under the name NILEDUTCH<br />

HIPPO.<br />

The units, dubbed 'Maxbox' by their designer, Flensburg-based Ingo<br />

Schluter, are <strong>full</strong>y geared and are fitted with 539 reefer plugs. A<strong>no</strong>ther<br />

'Maxbox' was already delivered to Hansa Shipping in April 2012 as<br />

HS ROSSINI. Hansa Shipping had ordered two of them. The contract<br />

for the second ship (due to be named HS RAVEL) was cancelled and<br />

the hull remains currently for sale by the shipyard.<br />

Page 15 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>

ALPHALINER Weekly <strong>2013</strong> Issue <strong>19</strong><br />

Why some Chinese container<br />

ships do <strong>no</strong>t have IMOs.<br />

Numerous ships listed in the <strong>Alphaliner</strong><br />

database do <strong>no</strong>t have<br />

IMO numbers associated to them,<br />

in particular Chinese ships plying<br />

domestic services. The reason is<br />

that IMOs are <strong>no</strong>rmally <strong>no</strong>t assigned<br />

to ships confined to operations<br />

in domestic waters. Unlike<br />

ships used for international trading,<br />

IMO numbers are <strong>no</strong>t mandatory<br />

for ships used solely on domestic<br />

services.<br />

Such ships are afforded only an<br />

international MMSI number and a<br />

call sign by the ITU for safety and<br />

communication purposes and a<br />

national identification number in<br />

the national registries.<br />

Therefore, these ships are usually<br />

<strong>no</strong>t listed in conventional databases<br />

maintained by most of other<br />

vessel database providers that<br />

rely on the IMO numbers assigned<br />

by the same common UK source.<br />

RENJIAN JINTANG (1,744 teu) is delivered<br />

Quanzhou An Sheng Shipping Co, a Chinese domestic operator set<br />

up in Quanzhou in 2002, is to receive the REN JIAN JINTANG, fifth of<br />

eight 1,744 teu ships ordered at the Weihai Shipyard and Shenfei<br />

Shipyard. These ships have been designed by the Shanghai Merchant<br />

Ship Design and Research Institute (SDARI). The REN JIAN JIN-<br />

TANG will ply the company's China domestic services, ensured with<br />

ten ships of 1,500-3,000 teu as well as by some 15 other ships of<br />

100 to 800 teu.<br />

The REN JIAN JINTANG has been built by the Weihai shipyard. She<br />

follows the REN JIAN YINGKOU, delivered in February by the Weihai<br />

shipyard.<br />

KMTC receives the SUNNY LOTUS (1,043 teu)<br />

KMTC has received the SUNNY LOTUS, a 1,043 teu ship ordered at<br />

the Dae Sun shipyard in September 2011. The SUNNY LOTUS will<br />

join KMTC's Korea-Japan network.<br />

The CHANG RONG 5 (798 teu) and CHANG RONG<br />

8 (656 teu) are delivered<br />

Quanzhou An Sheng Shipping Co has received in end April two chartered<br />

Chinese-owned containerships aimed at its China domestic<br />

services, the 798 teu CHANG RONG 5 and the 656 teu CHANG RONG<br />

8. The CHANG RONG 5 was built by the Fujian Changxin shipyard<br />

while the CHANG RONG 8 is a product from the Zhejiang Yuhuan<br />

Haihang shipyard.<br />

The BAHRI HOFUF (26,000 tdw roro) is delivered<br />

The National Shipping Company of Saudi Arabia (NSCSA - <strong>no</strong>w branded<br />

as Bahri) has received the BAHRI HOFUF, second of a six 26,000<br />

tdw roro vessels newbuilding program. These ships, with a container<br />

carrying capacity of 364 teu were ordered at Hyundai Mipo in March<br />

2011 and were designed by the Danish firm Knud E Hansen.<br />

The BAHRI HOFUF is bound for India where she will join the NSCSA's<br />

long established India-Middle East-USEC service. The BAHRI HOFUF<br />

follows the BAHRI ABHA, delivered in February. These ships replace<br />

four elderly roro units which are earmarked for scrap.<br />

Page 16 © Copyright <strong>Alphaliner</strong> <strong>19</strong>99-<strong>2013</strong>