AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ALPHALINER<br />

Weekly <strong>Newsl</strong>etter<br />

Web: www.axs-alphaliner.com | E-mail: data@alphaliner.com | Sales: commercial@axsmarine.com<br />

13.04.2009 to 20.04.2009<br />

Volume 2009 Issue 16<br />

<strong>Alphaliner</strong> Weekly <strong>Newsl</strong>etter is the premier liner shipping news summary, compiled and distributed every Monday.<br />

The newsletter is available upon subscription. Information is given in good faith but without guarantee. Please send<br />

your feedback, comments and questions to data@alphaliner.com<br />

Market Share Evolution<br />

Top 3 Carriers<br />

2000-2009<br />

Maersk<br />

MSC<br />

CMA CGM<br />

Maersk %<br />

MSC %<br />

CMA CGM %<br />

I N S I D E T H I S I S S U E<br />

1 Chart of the Week<br />

The rise and rise of MSC<br />

3 42 ships over 6,000 teu idle<br />

4 Service Updates<br />

Grand Alliance drops Amsterdam<br />

KL and TSK team up in Asia<br />

Asia-Australia loop merged<br />

MSC launch WCSA services<br />

MCC develops in Eastern Russia<br />

CMA CGM & Maersk on Asia-Med<br />

MACS streamlines Eur-SA service<br />

Temas boosts Indonesian presence<br />

8 Corporate Updates<br />

CSAV to raise $750M<br />

NOL 1Q loss may soar to -$240M<br />

OOCL 1Q revenue tumbles 31%<br />

Hamburg Sud reports higher revenue<br />

Textainer increases it container fleet<br />

13 Delivery Updates<br />

New April deliveries<br />

14 Terminal Updates<br />

Hamburg receives its largest boxship<br />

Eurogate unveils strong 2008 results<br />

COSCO Pacific reports 2008 results<br />

SIPG defers Zeebrugge investment<br />

Busan to acquire 3 New Port berths<br />

TEU Millions<br />

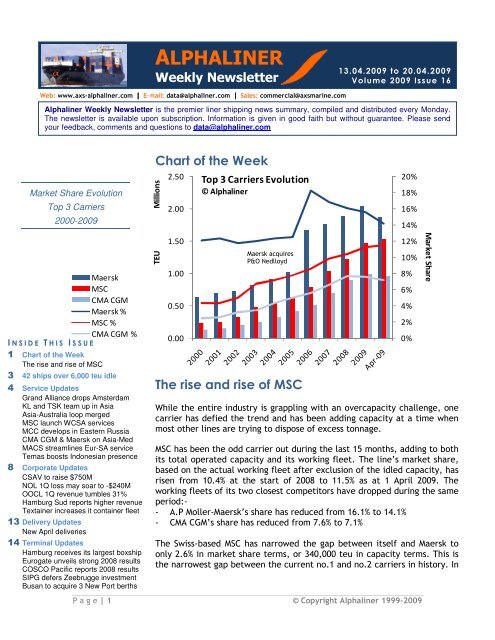

Chart of the Week<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

Top 3 Carriers Evolution<br />

© <strong>Alphaliner</strong><br />

Maersk acquires<br />

P&O Nedlloyd<br />

The rise and rise of MSC<br />

P a g e | 1 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

While the entire industry is grappling with an overcapacity challenge, one<br />

carrier has defied the trend and has been adding capacity at a time when<br />

most other lines are trying to dispose of excess tonnage.<br />

MSC has been the odd carrier out during the last 15 months, adding to both<br />

its total operated capacity and its working fleet. The line’s market share,<br />

based on the actual working fleet after exclusion of the idled capacity, has<br />

risen from 10.4% at the start of 2008 to 11.5% as at 1 April 2009. The<br />

working fleets of its two closest competitors have dropped during the same<br />

period:-<br />

- A.P Moller-Maersk’s share has reduced from 16.1% to 14.1%<br />

- CMA CGM’s share has reduced from 7.6% to 7.1%<br />

The Swiss-based MSC has narrowed the gap between itself and Maersk to<br />

only 2.6% in market share terms, or 340,000 teu in capacity terms. This is<br />

the narrowest gap between the current no.1 and no.2 carriers in history. In<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Market Share

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

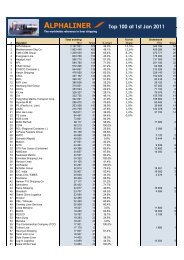

Top 3 Carriers<br />

Volume Growth<br />

MSC operating costs<br />

lower than its<br />

competitors?<br />

Carrier CAGR 2005-2008<br />

Maersk 1.9%<br />

MSC 17.3%<br />

CMA CGM 23.8%<br />

MSC Newbuilding<br />

Delivery Schedule<br />

2009-2011<br />

Delivery TEU Shipyard<br />

Feb-09 11,660 Hyundai<br />

Mar-09 13,798 Samsung<br />

Mar-09 14,000 Daewoo<br />

May-09 14,000 Daewoo<br />

May-09 13,798 Samsung<br />

May-09 4,254 Zhejiang<br />

Jun-09 13,798 Samsung<br />

Jun-09 4,254 Zhejiang<br />

Jul-09 4,254 Zhejiang<br />

Aug-09 13,798 Samsung<br />

Oct-09 13,798 Samsung<br />

Dec-09 13,798 Samsung<br />

Jan-10 14,000 Daewoo<br />

Jan-10 13,798 Samsung<br />

Feb-10 14,000 Daewoo<br />

Mar-10 14,000 Daewoo<br />

May-10 14,000 Daewoo<br />

Jul-10 14,000 Daewoo<br />

Nov-10 14,000 Daewoo<br />

Feb-11 14,000 Daewoo<br />

TEU Millions<br />

14.00<br />

12.00<br />

10.00<br />

8.00<br />

6.00<br />

4.00<br />

2.00<br />

0.00<br />

Top 3 Carriers - Liftings 2005-2008<br />

2008 TEU 2007 TEU 2006 TEU 2005 TEU<br />

Maersk Line<br />

2008, MSC liftings increased by 5% to reach 10.5 Mteu, closing in on<br />

Maersk’s 13.8 Mteu.<br />

Most other carriers are actively laying up idle capacity. Notably, carriers<br />

such as APL have 21 ships of 3,300-6,400 teu idled, representing 22% of its<br />

operated capacity at today’s count. In the case of these lines the cost of<br />

keeping ships inactive is apparently lower than operating them on<br />

unprofitable routes at the moment.<br />

MSC on the other hand has only 2 ships currently believed in idle status.<br />

The line has in fact been adding capacity by chartering ships at bargain<br />

rates. While most carriers ceased to charter ships and to the contrary<br />

redeliver excess tonnage, MSC is on its side breathing life into the charter<br />

market for large ships. During the past six months, it has chartered a dozen<br />

ships of the 2,500-6,000 teu range for periods of 12 to 24 months, plus ten<br />

other ships for shorter periods. Recent fixtures include the 24-monthscharter<br />

of ER FRANCE (5,762 teu) at a reported $8,000/day, SANTA CELINA<br />

(3,430 teu) at $7,250/day for 12 months and CALA PANCALDO and CALA<br />

PIGAFETTA (2,785 teu) at $6,000/day for 12 months.<br />

MSC’s fleet has also been boosted by the addition of three ULCS of 14,000<br />

teu (MSC DANIELA and DANIT classes) and four VLCS of 11,660 teu (MSC<br />

SOLA class), all assigned to its Far East-Europe 'Silk' service. The carrier<br />

seems unaffected by the downturn and is for the moment receiving its<br />

large newbuildings on schedule. MSC’s orderbook includes a further 41<br />

units over 12,500 teu.<br />

Below this size, the carrier’s orderbook is surprisingly low, with six units of<br />

5,550 teu and three ones of 4,250 teu. This explains why MSC has been<br />

active in chartering ships of this size during the past 12 months, including a<br />

series of five 5,500-5,700 teu ships taken en bloc from Hyundai M.M. last<br />

summer for delivery in January-April 2009.<br />

In the meantime, MSC has been active in the scrap market, sending two<br />

dozen (15 owned, 9 chartered) of its aging ships to the breakers, removing<br />

43,000 teu from its fleet since September. All of these ships have been<br />

P a g e | 2 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

MSC<br />

CMA CGM

Note :<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

To avoid any misinterpretation, <strong>Alphaliner</strong><br />

uses the word ‘IDLE’ instead of ‘LAID UP’.<br />

Idle ships include:<br />

- Carrier-controlled ships left without<br />

service assignment<br />

- Chartered ships redelivered to owners<br />

with no further employment<br />

- Ships in long term lay-up<br />

- Ships damaged or under long time repairs<br />

following damage (or under conversion)<br />

- Ships arrested for financial/legal reasons<br />

Following categories are NOT included as<br />

idle:<br />

- Ships awaiting their sailing slot as they<br />

change service (if waiting period is less<br />

than a week)<br />

- Ships in routine GR/dry-dock<br />

- Ships waiting to a berth at the roads /<br />

anchorages due to strike, missed slot or<br />

port congestion<br />

Idle ships by operators<br />

> 6,000 teu<br />

Operator No of Idle ships<br />

Maersk Line 14<br />

APL 8<br />

CSAV 5<br />

CSCL 3<br />

OOCL 2<br />

MISC Bhd 2<br />

IRISL 2*<br />

MOL 1<br />

MSC 1<br />

Evergreen 1<br />

HMM 1<br />

COSCO 1<br />

UASC 1<br />

* Note: IRISL ships are lying at yard<br />

and have not been handed over<br />

to owner<br />

more than 28 years old, including the 40 years old MSC STEFANIA and six<br />

other ships built in 1970. MSC still has 42 ships (22 owned and 20<br />

chartered) built before 1980 currently in its fleet, totalling 64,000 teu.<br />

42 ships of over 6,000 teu idle<br />

1. Tracking idle container ships is a challenge as most owners and operators<br />

do not disclose the ships they put at anchor. <strong>Alphaliner</strong> has implemented<br />

procedures that allow the identification of idle vessels with a high degree<br />

of reliability. Other methods such as those relying only on tracking inactive<br />

ships using AIS (Automatic Identification System) data or other automated<br />

reporting are prone to error.<br />

2. Furthermore, these automated methods of tracking idle ships suffer from<br />

several disadvantages, notably the inability to track ships that are outside<br />

of the coverage range. Such methods also incorrectly treat empty ships<br />

which are moving from one anchorage to another as ‘active’ while actually<br />

they are not actively working and thus continue to be considered ‘idle’ by<br />

<strong>Alphaliner</strong>. Conversely, certain ships in routine dry-dock are erroneously<br />

considered as idle while they should not be, as dry-docking is a routine<br />

part of ship operations.<br />

3. The AIS-based or other automated analysis are also based on a certain<br />

number of inactive days before declaring ships as inactive, thereby missing<br />

out early data as it takes between 7 to 21 days before these inactive ships<br />

are actually classified as idle. Observation also shows that these methods<br />

have erroneously classified as idle some ships routed via the Cape of Good<br />

Hope, as AIS often fails to capture ships in such remote waters.<br />

<strong>Alphaliner</strong>’s tracking method provides a more comprehensive and up-todate<br />

snapshot of the idle fleet with a satisfying degree of reliability. Ships<br />

are classified as inactive as soon as they leave an active assignment. This<br />

data is updated on a daily basis, thereby providing a reliable and up-todate<br />

account of the current inactive fleet.<br />

As at 20 April, a total of 42 ships of more than 6,000 teu capacity tracked<br />

by <strong>Alphaliner</strong> are now classed as idle. Maersk Line currently has the largest<br />

number of large ships idle with 14 such ships followed by APL which has 8<br />

ships of above 6,000 teu that are inactive.<br />

Detailed idle containership statistics are available exclusively from<br />

<strong>Alphaliner</strong>. They include vessel and operator particulars. The report<br />

provides a unique insight into the current operating environment for both<br />

owners and operators. For subscription details, please contact us at<br />

commercial@axsmarine.com<br />

P a g e | 3 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

SERVICE UPDATES<br />

Amsterdam left with sole<br />

mainline service<br />

following departure of<br />

EU 2<br />

Current crisis prompts<br />

further service<br />

consolidation in<br />

Intra-Asia<br />

Grand Alliance drops Amsterdam on EU 2<br />

The Grand Alliance (Hapag-Lloyd + NYK + OOCL + MISC Bhd) is to alter the<br />

European range rotation of its Asia-Europe Loop 2 (EU 2) service.<br />

The main change concerns the inclusion of Rotterdam at the expense of<br />

Amsterdam. The EU2 used to call at the Ceres Terminal in Amsterdam,<br />

which used to be controlled by alliance member NYK. Since December<br />

2008, the terminal has been under the control of Hutchison Port Holdings<br />

(HPH) which obtained a majority stake in a share-swap agreement with<br />

NYK. Under the terms of the agreement, NYK was granted by HPH a<br />

minority stake in Rotterdam’s Europe Container Terminals (ECT).<br />

With the EU 2 dropping Amsterdam, the Ceres Terminal is now left with<br />

only a single deep sea loop calling, the Grand Alliance’s Asia-Europe Loop<br />

1 (EU 1).<br />

On its side, Rotterdam is reported to consider a reduction in port dues in<br />

order to attract additional traffic. The port of Rotterdam had earlier<br />

reported a 16% decline in container volumes to 2.3M TEU for the first<br />

quarter of 2009. The port forecasts a decline in throughput of 6%-10% for<br />

2009. It says problems in container shipping continue to dominate the<br />

situaltion and that recovery will begin “a little later than anticipated”.<br />

K Line and TSK team up on intra Asia services<br />

K Line and TSK (Tokyo Senpaku Kaisha - the intra-Asia arm of NYK) have<br />

reached an agreement to launch a joint service between Japan, the<br />

Philippines and the Straits / Jakarta sector from mid-May 2009.<br />

In response to the ongoing financial crisis that has drastically reduced<br />

cargo volume for this sector, the two carriers will merge two existing,<br />

independent services, the TSK's 'Pegasus' service (PGS) and the K Line's<br />

'Pineapple Express' into one service, unifying fleet deployment to their<br />

maximum size, thereby improving efficiency and schedule integrity.<br />

Four vessels of about 1,700 teu will be deployed on a 28-day round voyage<br />

to provide a weekly service (two provided by K Line and two by TSK). It<br />

will cover Osaka, Shimizu, Tokyo, Yokohama, Nagoya, Kobe, Keelung,<br />

Manila, Singapore, Port Kelang, Jakarta, Singapore, Manila, Osaka.<br />

In addition to this newly-established joint service, both carriers also agree<br />

to widen their cooperation by exchanging slots with each other on their<br />

existing services, to maximize efficiency and provide a wider range of<br />

services to their customers.<br />

P a g e | 4 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Consolidation also in<br />

Asia-Australian trades<br />

2 new services in WCSA<br />

launched<br />

upgraded Western and<br />

Central Med coverage<br />

Asia-Australia loops merged temporarily<br />

Two Asia-Australia loops connecting Japan and China to Melbourne, Sydney<br />

and Brisbane are to be temporarily merged into a single loop. The services<br />

concerned are the ANL / CSCL / OOCL North Asia-China-Australia (NACA)<br />

loop and the NYK / MOL / K Line Asia-SE Australia (AUS 2) service.<br />

The two services are merged into a temporary joint service, run with six<br />

ships of around 4,000 teu (instead of a total of ten ships for the two<br />

original loops). A seventh carrier, COSCO, is also involved through a slot<br />

allocation on the NYK-MOL-K Line loop.<br />

ANL, market leader on this run, explains that the decision is motivated by<br />

''the continued downward trend of world trade in the current economic<br />

conditions caused by the financial crisis and the continued depressed<br />

freight rate levels''. The original pattern is to be re-instated when the<br />

market recovers.<br />

MSC launches American Pacific coast services<br />

MSC has announced the introduction of two new services linking the US<br />

West Coast, Mexico and Central America to the West Coast of South<br />

America.<br />

The 'Puma' service will link ports in USA, Mexico, Guatemala, El Salvador,<br />

Costa Rica and Panama, offering a weekly service between Balboa, Long<br />

Beach, Oakland, Manzanillo, and Puerto Caldera. In addition, fortnightly<br />

calls will also be offered at Salina Cruz, Mazatlan, Puerto Quetzal and<br />

Acajutla. The first sailing will occur from Balboa on 29 April with the MSC<br />

PERU to be followed by two other ships of between 1,600-2,100 teu.<br />

The 'Condor' service will link ports in Peru, Ecuador, Colombia and Panama<br />

by offering a weekly service between Balboa, Callao, Paita, Guayaquil, and<br />

Buenaventura. Three ships of about 1,200 teu will be deployed with the<br />

first sailing to start from Balboa on 17 April with the MSC PAOLA.<br />

The two new services will hub at Balboa, located at the Pacific side of the<br />

Panama Canal - this port has not been used by MSC so far.<br />

CMA CGM and Maersk team up on Asia-Med<br />

CMA CGM today announced the following improvements on its Asia-<br />

Mediterranean services, starting from mid-May :<br />

CMA CGM will offer an upgraded coverage of Western and Central<br />

Mediterranean from Asia, including direct calls at Lianyungang and<br />

Qingdao, within a new Vessel Sharing Agreement with Maersk on a service<br />

based on the current Maersk's AE-11 loop. It will rotate as follows :<br />

Lianyungang, Qingdao, Shanghai, Fuzhou, Hong Kong, Chiwan, Yantian,<br />

P a g e | 5 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Tanjung Pelepas, Jeddah, Port Said, Gioia Tauro, Genoa, Fos, Gioia Tauro,<br />

Damietta, Port Said, Salalah, Port Kelang, Singapore, Lianyungang. The<br />

service will be operated with nine vessels of about 8,500 teu, eight of<br />

which provided by Maersk and one by CMA CGM (The newbuilding CMA CGM<br />

CENDRILLON).<br />

CMA CGM will revamp its Asia-Adriatic PHEX/LEVEX within a new<br />

partnership with Maersk Line through a Vessel Sharing Agreement, with<br />

each company providing four vessels of 6,500 teu. The new service ''will<br />

offer faster transit times to Trieste, Koper and Rijeka''. It will rotate as<br />

follows : Shanghai, Busan, Hong Kong, Chiwan, Tanjung Pelepas, Port<br />

Kelang, Port Said, Damietta, Trieste, Koper, Rijeka (by feeder), Damietta,<br />

Port Said, Jeddah, Port Kelang, Singapore, Shanghai<br />

MCC develops own Eastern Russia feeder<br />

MCC Transport, the APM-Maersk intra Asia arm, has launched its own<br />

Busan-Eastern Russia feeder services, covering Vladivostok and Vostochny,<br />

using the chartered 698 teu OSG BEAUTEC and OSG BOSSTEC (the latter<br />

sub-chartered from Chinese carrier Onto Shipping).<br />

On this run, MCC Transport / Maersk used to either buy slots or to deploy<br />

ships on an ad hoc basis from time to time. The two new services connect<br />

at Busan with long haul services of Maersk and MCC. Maersk-MCC is also<br />

offering direct Shanghai-Russia services through slot buying on the FESCO.<br />

In December 2004, APM-Maersk had acquired SCF Oriental Lines from<br />

Sovcomflot Logistics, a carrier which offered Korea-Russia services using<br />

the Vostochny gateway for oncarriage of boxes on the Trans-Siberian<br />

Railway.<br />

As for Onto Shipping, it is to replace the OSG BOSSTEC by the 672 teu JIN<br />

MAN YANG on its Lianyungang-Qingdao-Japan service.<br />

MACS streamline Europe – S Africa service<br />

MACS Maritime Carrier has removed two ships from its Europe-South Africa<br />

multipurpose and breakbulk service. The two ships are the 26,000 tdw/850<br />

teu conbulkers STELLENBOSCH and ALGOA BAY. The service is now run with<br />

five multipurpose units, two of which are fitted with ramps.<br />

STELLENBOSCH and ALGOA BAY, both 31 years old, are actually sent on the<br />

Southern Africa-Mexico-USA 'Gulf Africa Line' (GAL - a joint service of MACS<br />

and Dannebrog) on which they replace two 38-year-old conbulkers of<br />

30,000 tdw / 1,100 teu, earmarked for scrap: the BLUE MASTER and<br />

SILVERFJORD.<br />

These two pairs of ships are veterans of the South Africa trade, carrying<br />

containers and machinery as well as granite blocks exported from South<br />

Africa. MACS is awaiting a series of 37,000 tdw / 2,000 teu newbuildings<br />

P a g e | 6 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

ordered in China. The first of them is planned for delivery at the end of the<br />

year.<br />

Temas boosts Indonesian presence<br />

Indonesian carrier PT Pelayaran Tempuran Emas (Temas Line) is enhancing<br />

its fleet with both newbuildings from China and second hand purchases. It<br />

has recently received the 537 teu ESTUARI MAS from the Ningbo Boda<br />

Shipyard and two 296 teu units, the LAGUN MAS and GUHI MAS, from the<br />

Yuenshan Shipyard. It has also purchased two second hand ships : the 1,002<br />

teu KAWA MAS (built 1985 - ex X-PRESS MANASLU purchased from<br />

Singapore-based owners linked to Sea Consortium) and the brand new 538<br />

teu LAGOA MAS, purchased from a Chinese owner which took her in charge<br />

only a few weeks ago.<br />

Last year, Temas also added the SUNGAI MAS (500 teu - built 1980 - ex<br />

X-PRESS PUMORI). With these newcomers, Temas Line operates today a<br />

fleet of 32 ships representing 15,760 teu, all owned, deployed on three<br />

sets of routes out of Jakarta and out of Surabaya, covering a dozen of<br />

Indonesian ports.<br />

P a g e | 7 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

CORPORATE UPDATES<br />

CSAV Top 10<br />

Shareholders as at end<br />

Dec 2008<br />

Shareholder Name % Share<br />

MARITIMA DE INVERSIONES<br />

(CLARO FAMILY)<br />

45.59%<br />

BANCHILE BROKERS 3.34%<br />

PHILTRA LIMITADA 3.15%<br />

AFP CUPRUM PENSION FUND 2.86%<br />

CHILE ELECTRONIC STOCK EXC 2.79%<br />

AFP HABITAT PENSION FUND 2.70%<br />

LARRAIN VIAL BROKERS 2.47%<br />

AFP CAPITAL PENSION FUND 2.34%<br />

BANCO DE CHILE FOR<br />

CHAP XIV 3 rd PARTIES<br />

1.96%<br />

HENDAYA CONSULTING 1.94%<br />

Total TOP 10 69.14%<br />

CSAV Newbuilding<br />

Delivery Schedule<br />

2009-2012<br />

Dely Teu Shipyard<br />

Aug-09 6,589 CSBC*<br />

Sep-09 6,589 CSBC<br />

Nov-09 6,589 CSBC*<br />

Jan-10 6,589 CSBC<br />

Mar-10 6,589 CSBC*<br />

May-10 6,589 CSBC<br />

Jul-10 12,552 Samsung*<br />

Oct-10 12,552 Samsung<br />

Jan-11 12,552 Samsung*<br />

Apr-11 12,552 Samsung<br />

Jun-11 12,552 Samsung*<br />

Oct-11 12,552 Samsung<br />

Jan-12 12,552 Samsung*<br />

Mar-12 12,552 Samsung<br />

_______________________________<br />

* LT Charter from Peter Dohle<br />

CSAV also have additional charter<br />

arrangements with Seaspan and<br />

Hermann Buss<br />

CSAV to raise $750M of new equity<br />

CSAV is planning to raise up to $750M of new equity as it faces a<br />

challenging year ahead that could see it lose up to $300M in 2009.<br />

The company plans to raise $350M from current shareholders, with a first<br />

exercise expected to raise $130M in rights issue scheduled to be completed<br />

in the first half of the year. The company now plans to raise a further<br />

$220M from its shareholders in a second rights issue.<br />

A further $400M could come from the capitalisation of outstanding charter<br />

party commitments on ships that CSAV currently have on charter, which<br />

will give the shipowners a direct equity stake in the company in lieu of<br />

charter payments.<br />

CSAV’s commitments on newbuildings include four 12,500 teu vessels at<br />

Samsung and three 6,500 teu vessels at CSBC with a total value of $890M.<br />

These ships were acquired from German owner Peter Dohle who has the<br />

largest exposure to CSAV. Dohle has 13 ships currently on long term charter<br />

to CSAV and a further 7 newbuildings scheduled for delivery between 2009<br />

and 2012 for Chilean carrier. Dohle is believed to be taking the lead<br />

amongst the group of owners in negotiating the capitalisation of charter<br />

contracts.<br />

One of the companies affected is Pacific Shipping Trust (PST) which has<br />

filed an update to the Singapore stock exchange that CSAV is seeking to<br />

reduce charter rates on two PST-owned 4,250 teu ships by 30% of which<br />

part of the reduction could be capitalised. Other owners that could be<br />

affected could include Seaspan and German owners, Hermann Buss, Laeisz<br />

Schiffahrt and NVA.<br />

In a press release, CSAV said that meetings were held in Hamburg during<br />

the second week of April with “shipowners, ship financing banks and<br />

shipyards and to address the tasks necessary for CSAV to counter the<br />

pressures the company is facing due to the very difficult economic<br />

environment.” The company reported that “the discussions went very<br />

positively and in a highly constructive way” and that the restructuring plan<br />

“has found positive reception and details of such a proposal are currently<br />

being worked out.”<br />

Besides the meetings with ship-owners, discussions are taking place with<br />

other stakeholders, including shipyards to negotiate the current new<br />

building program. CSAV is confident that as part of the overall<br />

restructuring process, agreements will be made with the shipyards as well<br />

in due time.<br />

P a g e | 8 © Copyright <strong>Alphaliner</strong> 1999-2009

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

-50<br />

-100<br />

-150<br />

-200<br />

-250<br />

-300<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

NOL Group<br />

Quarterly Profit/Loss<br />

1Q07 to 1Q09 (forecast)<br />

US$M<br />

1Q<br />

07<br />

2Q<br />

07<br />

3Q<br />

07<br />

4Q<br />

07<br />

1Q<br />

08<br />

2Q<br />

08<br />

3Q<br />

08<br />

APL Newbuilding<br />

Delivery Schedule<br />

2009-2012<br />

Dely Teu Shipyard<br />

2012 10,700 Daewoo<br />

2012 10,700 Daewoo<br />

2012 10,700 Daewoo<br />

2012 10,700 Daewoo<br />

2012 10,070 Hyundai<br />

2012 10,070 Hyundai<br />

2012 10,070 Hyundai<br />

2012 10,070 Hyundai<br />

APL also has 20 ships on LT<br />

charter arrangements due in<br />

2009-2012<br />

4Q<br />

08<br />

1Q<br />

09<br />

(F)<br />

NOL first quarter loss could soar to -$240M<br />

Neptune Orient Lines Limited, the parent company of APL, has issued a<br />

profit warning to the Singapore stock exchange, announcing that it<br />

anticipates its first quarter 2009 results to show an estimated net loss of<br />

US$240M, which is in excess of the net loss of US$149 million which the<br />

Group reported for 4Q 2008.<br />

The first quarter results for the Singapore based carrier will be reported on<br />

12 May 2009. In its release, NOL blamed the seasonally slower first quarter<br />

period for the slump in profits. However, the company added that “this<br />

deterioration in performance is also due to a worsening of business<br />

operating conditions in the first quarter. On the expectation of adverse<br />

business operating conditions continuing, NOL expects its full year loss to<br />

be significantly worse”.<br />

Following the announcement, some analysts have downgraded earnings<br />

estimates for NOL. BNP Paribas revised its full year net loss estimate to<br />

$486M, which is significantly more than the consensus estimate that<br />

currently stands at $230M.<br />

Earlier, NOL had announced plans for an additional $250M-$300M in cost<br />

savings, bringing the annual total for 2009 to $500M-$550M. The company<br />

says that the expected loss for the year is notwithstanding the ongoing cost<br />

savings and mitigation efforts undertaken by the company.<br />

NOL president and chief executive Ron Widdows has taken a “voluntary”<br />

20% reduction in remuneration from March, while the company’s chairman<br />

will be taking a 40% reduction in director’s pay. In November, the company<br />

had already announced a reduction of its global workforce by 1,000<br />

positions, mainly in North America. Further job losses and salary<br />

adjustments could still follow.<br />

NOL had earlier denied speculation that it is considering a rights issue to<br />

raise its capital base to cope with the difficult period. Given the latest<br />

announcement on the potentially significant losses expected this year, the<br />

company may still need to undertake measures to shore up its capital<br />

structure. The company has $467M of short term borrowings that is due to<br />

be repaid in 2009.<br />

Apart from its commitments on eight ships of 10,000 teu on order for<br />

delivery in 2012, the company has 20 additional ships on long term charter<br />

contracts due for delivery between 2009 and 2012. It has already<br />

negotiated with shipyards and owners for later delivery of its new vessels<br />

and currently has 21 ships (22% of its capacity) idle, making it one of the<br />

worst casualties of the current over-capacity environment.<br />

P a g e | 9 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

OOCL revenue tumbles 31% in first quarter<br />

Hong Kong based OOCL has released its first quarter operational update<br />

with total revenues dropping by 31.2% to $954M from $1.4M a year ago.<br />

Liftings were 15.6% down from the same period last year.<br />

The overall load factor dropped by 11% compared with last year despite a<br />

1.2% decrease in capacity. Overall average revenue per teu decreased by<br />

18.5% compared with the same period last year.<br />

OOCL Operating Highlights 1Q 2009 breakdown by trade<br />

Liftings (teu) Revenue ($'000) $/teu<br />

Trade 1Q2009 1Q2008 Change 1Q2009 1Q2008 Change 1Q2009 1Q2008 Change<br />

Trans-Pacific 279,377 329,496 -15.2% 409,980 496,598 -17.4% 1467 1507.144 -2.6%<br />

Asia/Europe 164,300 191,904 -14.4% 149,819 343,521 -56.4% 9121.8624 1790.067 -49.1%<br />

Trans-Atlantic 85,378 99,713 -14.4% 131,153 168,955 -22.4% 1536.145 1694.413 -9.3%<br />

Intra-Asia/Australasia 449,107 538,036 -16.5% 263,215 378,232 -30.4% 586.0853 702.9864 -16.6%<br />

TOTAL 978,162 1,159,149 -15.6% 954,167 1,387,306 -31.2% 975.4693 1196.831 -18.5%<br />

All trades suffered<br />

reductions in both<br />

volume and rates<br />

The carrier saw the largest revenue slide on the Asia-Europe trades, with<br />

revenue more than halved from $344M to $150M. Liftings fell by 14% but<br />

more significantly, rates on the trade dropped by 49% which contributed to<br />

the drastic slide in profitability.<br />

Surprisingly, the intra-Asia and Australasian trades also took a severe<br />

hammering, with revenue falling by 30% to $263M. Both volumes and rates<br />

in the trade dropped by about 16.5%. This trade represents OOCL’s largest<br />

tradelane, accounting for 46% of its total liftings.<br />

All tradelanes suffered a drop in both rates and volumes. While the Trans-<br />

Pacific trade saw the lowest drop in revenue per teu, the impact of the<br />

rate slump will likely be felt from May onwards when the new Trans-Pacific<br />

contracts are in place.<br />

The carrier said it plans to slash capacity and admits that the outlook<br />

remains “poor” with rates falling below profitable levels. The first-quarter<br />

operating results were released a month after the parent company Orient<br />

Overseas (International) Ltd (OOIL) announced a drop in underlying net<br />

profit for 2008 which halved to $272.3M as a result of higher costs and a<br />

challenging environment for OOCL.<br />

Responding to the crash in volumes, the company plans to cut capacity by<br />

20% in 2009 by redelivering chartered-in tonnage and suspending services.<br />

OOCL currently has 14% of its capacity idled.<br />

P a g e | 10 © Copyright <strong>Alphaliner</strong> 1999-2009

Liftings in M teu<br />

% Increase<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

2.669<br />

Hamburg Sud<br />

Volume Growth<br />

2006-2008<br />

25%<br />

2.143<br />

16%<br />

1.840<br />

21%<br />

2008 2007 2006<br />

Hamburg Sud Newbuilding<br />

Delivery Schedule<br />

2009-2012<br />

Dely Teu Shipyard<br />

Mar-09 5,560 Daewoo (DMHI)<br />

May-09 5,905 Daewoo (DMHI)<br />

Aug-09 5,905 Daewoo (DMHI)<br />

Oct-09 7,100 Daewoo (DMHI)<br />

Dec-09 7,100 Daewoo (DMHI)<br />

Dec-09 5,905 Daewoo (DMHI)<br />

Feb-10 7,100 Daewoo (DMHI)<br />

Apr-10 7,100 Daewoo (DMHI)<br />

May-10 4,600 Daewoo (DSME)<br />

Jun-10 7,100 Daewoo (DMHI)<br />

Jul-10 4,600 Daewoo (DSME)<br />

Aug-10 7,100 Daewoo (DMHI)<br />

Hamburg Süd reports higher revenue & volume<br />

The Hamburg Süd Group presented what it called a “satisfactory result” for<br />

2008 but warns that 2009 will be a challenging year for the liner services.<br />

The carrier’s total turnover in 2008 rose by 32.8% to $6.5Bn of which liner<br />

revenue accounted for $5.5Bn or 84% of the total revenue. In addition to<br />

the liner operations, the group also operates 60 tramp ships on the bulk<br />

trades which includes the tramp operations of Rudolf A. Oetker and<br />

Furness Withy Chartering. The group, which is part of the German Oetker<br />

Group does not disclose actual profit figures.<br />

Hamburg Süd’s container volume grew by an impressive 25% to reach 2.67<br />

Mteu. Part of the increase was due to the acquisition of Costa Container<br />

Lines (CCL) which was taken over in November 2007. It eventually dropped<br />

the Costa brand name at the end of 2008 and currently only operates<br />

alongside its Brazillian sister company Alianca. Over the last decade, the<br />

company’s liftings have averaged an annual increase of 21%, due partly to<br />

the acquisitions that were made during that period which had included<br />

Ellerman Line, Kien Hung, Ybarra and the cross-trade operations of FESCO.<br />

The carrier had earlier said that “for the first time in many years, 2008 saw<br />

a structural overcapacity in container ships and this will continue to rise<br />

substantially in the months ahead. Even if world trade were to experience<br />

a recovery in 2010 - a situation not yet foreseeable today - it would still<br />

take quite some time for supply and demand in container shipping to<br />

achieve equilibrium.”<br />

The present downturn hit the Hamburg Süd liner operations in the final<br />

quarter of 2008 when vessel utilisation fell to 72%. The Line said that its<br />

core trades from Asia, Europe and North America to South America East<br />

Coast were worst hit and South American imports had collapsed by 40% and<br />

exports were down 20% in January.<br />

Like all major carriers, Hamburg Süd has embarked on a cost-saving<br />

program that will attempt to streamline its liner network and make cuts in<br />

its cost structure, with target savings of up to €300M in 2009. The cost<br />

cutting measures will reach from a freeze in hiring to re-negotiations of<br />

terminal charges and vessel charter rates. Hamburg Süd currently has<br />

about 8% of its capacity idle.<br />

The carrier also has a significant orderbook with a series of 12 ships due for<br />

delivery over 2009 to 2010. This includes six ships of 7,100 teu from a<br />

series of ten units initially ordered by CP Offen that will be deployed on its<br />

ECSA trades. They will be fitted with up to 1,500 reefer plugs, which will<br />

make them the world's largest reefer ships.<br />

P a g e | 11 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Textainer to acquire<br />

Amficon fleet from 1 May<br />

Main Container Leasing<br />

Companies<br />

Total Dry Container Fleet<br />

as at Jan 2009<br />

Textainer increases its container fleet<br />

Leading container lessor, Textainer announced on 16 April that it has<br />

acquired the management rights to 150,000 teu of containers from<br />

Amphibious Container Leasing Limited (Amficon). The acquisition takes<br />

effect from 1 May. Arising from this purchase, Textainer will operate a<br />

fleet of approximately 2.2 million TEU of mainly dry containers.<br />

With the acquisition, Textainer would control approximately 19% of the<br />

global leasing market for dry containers, further extending its current lead<br />

at the top of the leasing fleet table. The acquisition of Amficon’s<br />

significant number of flat rack and open top containers will also double<br />

Textainer’s fleet of specialized containers, a market segment that it is<br />

planning to strategically increase.<br />

This is the latest in a series of consolidations in the container leasing<br />

sector as it grapples with a challenging operating environment with<br />

difficult funding conditions and carrier returning surplus container units to<br />

lessors. Textainer has earlier acquired the management of the fleet of<br />

Gateway in 2006 and Capital Lease in 2007.<br />

Textainer<br />

Florens<br />

Triton<br />

TAL<br />

GE Seaco<br />

CAI<br />

Seacastle<br />

Gold<br />

UES/GVC<br />

Cronos<br />

Dong Fang<br />

Capital<br />

Amficon<br />

Beacon<br />

Top 15 Container Leasing Company Fleet as at Jan 2009<br />

(Dry containers only excl Reefers)<br />

CARU<br />

Textainer and Amficon<br />

fleet to be combined<br />

from 1 May 2009<br />

0.00 0.50 1.00 1.50 2.00 2.50<br />

TEU Millions<br />

P a g e | 12 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

DELIVERY UPDATES<br />

Recent Deliveries<br />

April 2009<br />

Name Teu Operator<br />

BELUGA NATION 474 N/A<br />

CCL NINGBO 698 Centrans<br />

O.M. UNDARUM 704 N/A<br />

ALASKABORG 964 N/A<br />

MARE 974 Contaz<br />

VEGA AQUILA 997 N/A<br />

EMPIRE 1,440 N/A<br />

WARNOW MASTER 1,496 N/A<br />

MAERSK WINDHOEK 1,708 Maersk<br />

CSCL CALLAO 2,544 CSCL<br />

FESCO DIOMID 3,108 MSC<br />

ZIM DALIAN 4,253 Zim<br />

RUDOLF SCHEPERS 4,256 K Line<br />

COSCO FUKUYAMA 4,506 COSCO<br />

NYK REMUS 4,922 NYK<br />

APL WASHINGTON 6,966 APL<br />

XIN DA YANG ZHOU 8,530 CSCL<br />

HAMMERSMITH BR. 9,040 K Line<br />

CMA CGM HYDRA 10,960 CMA CGM<br />

XIN DA YANG ZHOU (8,530 teu) is delivered<br />

CSCL is to receive the 8,530 teu XIN DA YANG ZHOU, last of five sister<br />

ships ordered by CSCL at the Hudong-Zhonghua Shipbuilding (Group) Co<br />

Ltd (aka Hudong Shipyard) in October 2004. Her completion was delayed<br />

by the crash of a gantry crane at the yard last July. Her employment is<br />

currently unknown. The XIN DA YANG ZHOU follows the XIN FEI ZHOU,<br />

delivered in December.<br />

NYK REMUS (4,922 teu) is delivered<br />

NYK has received the NYK REMUS, ninth unit in a series of twelve 4,922<br />

teu panamaxes ordered at Hyundai H.I. in two steps in November 2004 and<br />

November 2006. The NYK REMUS was initially expected to join the Grand<br />

Alliance-Zim new FE-USEC joint service (SCE), but this plan was altered<br />

and the ship is believed to join at a later date. She follows the NYK<br />

DENEB, delivered one year earlier.<br />

RUDOLF SCHEPERS (4,256 teu) joins K Line<br />

German shipowner Rudolf Schepers has taken delivery of the 4,256 teu<br />

RUDOLF SCHEPERS, first unit in the ‘Jiangsu 4250’ series produced by the<br />

Jiangsu Yangzijiang shipyard.<br />

The RUDOLF SCHEPERS joins her charterer K Line, which has assigned her<br />

to the Far East-ECSA SEAS service run by CMA CGM, Maruba, CSCL and K<br />

Line. This service was organized in March 2009 through the merger of the<br />

SEAS 1 and SEAS 2 loops.<br />

COSCO FUKUYAMA (4,506 teu) is delivered<br />

COSCO Container Lines has taken in charge the COSCO FUKUYAMA, fourth<br />

of a series of 4,506 teu panamaxes ordered at Samsung by Japanese<br />

financing house Itochu Corp. with the backing of a COSCO long term<br />

charter. The COSCO FUKUYAMA is assigned to the CKYH FE-USEC 'AWE 2'<br />

loop. She follows the COSCO OSAKA, delivered in September<br />

CSCL CALLAO (2,544 teu) is delivered<br />

Seaspan Corporation has received the 2,544 teu CSCL CALLAO, seventh of<br />

eight ships of the 'Jiangsu 2500' design ordered by this owner to the<br />

Jiangsu Yangzijiang Shipbuilding Co.<br />

The CSCL CALLAO is chartered to CSCL for a period of 12 years. She will<br />

start her career on the Far East-Africa service offered by Hapag-Lloyd,<br />

CSCL and Maruba (WAX/WSX). She is the 20th unit built in the 'Jiangsu<br />

2500' series and follows the CSCL SAN JOSE, delivered in December.<br />

P a g e | 13 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

TERMINAL UPDATES<br />

VLCS presents<br />

challenges to current<br />

Hamburg draft conditions<br />

Hamburg receives its largest containership<br />

The port of Hamburg has welcomed its largest-ever containership, the<br />

11,356 teu CMA CGM ANDROMEDA, completed two months ago by Hyundai<br />

H.I. and assigned to the French Line’s FAL-1 loop. The call came less than<br />

two weeks after Antwerp’s first ULCS call, which was performed by MSC<br />

BEATRICE (13,798 teu)<br />

The 363 m vessel is another milestone for Hamburg. Calls like those of CMA<br />

CGM ANDROMEDA and the recent visit of MARIT MAERSK (10,000 teu) on her<br />

delivery voyage, prove that Hamburg is ready to handle vessels of more<br />

than 360 metres in length as regular callers.<br />

Currently, most of the large mainline container ships at Hamburg stand in<br />

the 8,000 to 10,000 teu range. Typically, such vessels have a length of 335<br />

to 350 m, while the new breed of 11,300 to 14,000 teu ships will measure<br />

about 365 metres in length. The step from VLCS to ULCS might seem small,<br />

but Hamburg – just as Antwerp – is a river port, where vessels have to<br />

travel some four hours upriver from the open sea and negotiate a busy and<br />

winding fairway. In order to ensure that such river ports remain<br />

competitive in the long term is it essential that they can handle the coming<br />

generation of containerships.<br />

However, neither Antwerp nor Hamburg nor any comparable river port can<br />

presently accept very large and ultra-large vessels at full draft. In such<br />

ports, the ships have to sail in with the flood tide on a slightly reduced<br />

draft. These drawbacks are compensated by Hamburg’s and Antwerp’s<br />

proximity to the consumer markets, the final destination of the ships’<br />

cargo. In order to further improve nautical conditions for large (container)<br />

vessels, dredging schemes are in the pipeline for both Hamburg’s river Elbe<br />

and Antwerp’s river Scheldt.<br />

At Hamburg, the CMA CGM ANDROMEDA is handled at HHLA’s Burchardkai<br />

(CTB). CTB is presently undergoing a reconstruction scheme that will add<br />

multiple ULCS-ready berths and double the facility's capacity to 5.2 Mteu<br />

per year. The CMA CGM ANDROMEDA is presently the largest ship in CMA<br />

CGM’s fleet. She is the first of a series of 12 units. CMA CGM is due to<br />

receive its first of a series of eight 13,300 teu ship in July.<br />

P a g e | 14 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Cost management to<br />

cope with downturn<br />

Eurogate unveils strong 2008 results<br />

The Eurogate Group, a German stevedore and terminal operator created in<br />

1999 through the merger of Hamburg’s Eurokai and the Bremen-based BLG,<br />

has presented its figures for the year 2008. Despite the slow market,<br />

Eurogate closed fiscal 2008 with the best operating result in the company’s<br />

10-year history.<br />

Like for many terminal operators, 2008 was a peculiar year for Eurogate.<br />

An extraordinarily strong first half of 2008 boosted the company’s<br />

performance to such a degree that it has offset the low end year<br />

volumes.The group increased its revenue by 8.4% to €715M and posted a<br />

profit of €116.5M, 3.5% above the previous year’s level. It handled a total<br />

of 14.2 Mteu.<br />

Eurogate’s outlook for the ongoing year is determined by the current<br />

financial and economic crisis with declining container volumes in the first<br />

quarter of 2009 (minus 17,7% in its main ports of Bremerhaven and<br />

Hamburg). Eurogate said it has adapted its human resources and<br />

investment planning to cope with the downturn. The group held talks with<br />

its employee representatives in order to negotiate more flexible working<br />

hours and payment schemes, in order to be able to respond promptly to<br />

developments in container handling. The company is planning to introduce<br />

short-time work in Bremerhaven, where volumes suffered the most, but<br />

does not plan any enforced layoffs.<br />

Of the €470M planned for 2008 investments, only €238.4M were actually<br />

spent. Most non-essential investments have been postponed and will most<br />

likely be delayed beyond 2009. Nevertheless, Eurogate said it will adhere<br />

to its large-scale investment projects such as the westward expansion of its<br />

Hamburg terminal. The company is thus continuing to push for the<br />

deepening of the shipping channels in the rivers Weser and Elbe and other<br />

port-related infrastructure projects.<br />

Outside of Germany, the company operates terminals in Italy, Portugal and<br />

Morocco. The new Eurogate container terminal at the Moroccan port of<br />

Tangier Med, which started operations in September 2008 and became fully<br />

operational earlier this year handled 64,178 teu in its first quarter. The<br />

facility lately acquired a new customer : the Japanese shipping line MOL,<br />

which is to use Tangier for a new Asia-West Africa service by transhipment<br />

between the New World Alliance Asia-Europe JEX loop and its new Tangier-<br />

West Africa feeder service. Meanwhile, the Eurogate facility at Cagliari,<br />

Sardinia, received a dramatic boost last year, when the Grand Alliance<br />

moved its Mediterranean hub to the port. In terms of group-wide cargo<br />

handling figures though, the move was a zero-sum-game for Eurogate. Most<br />

of the new business was acquired at the expense of Gioia Tauro, another<br />

Eurogate terminal.<br />

P a g e | 15 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Top 5 Global Terminal<br />

Operators<br />

Liftings<br />

2008 vs 2007<br />

Mixed fortunes as<br />

COSCO Pacific sees<br />

dramatic declines in<br />

Jan-Mar 2009 volumes<br />

COSCO Pacific Terminals reports 2008 results<br />

COSCO Pacific’s total container terminal throughput increased by 18% to<br />

reach 45.8 Mteu in 2008, from the 38.9 Mteu recorded in 2007. Profit from<br />

the container terminal business was flat $128M, the same level as recorded<br />

in 2007.<br />

Cosco Pacific has stakes in container terminals in mainland China, Hong<br />

Kong, Singapore, Belgium, Egypt and Greece. It is currently the fifth<br />

largest global port operator based on unadjusted throughput.<br />

Liftings in M teu<br />

Before equity adjustments<br />

67.6<br />

66.3<br />

63.5 63.2<br />

58.8<br />

HPH APMT<br />

(Est)<br />

2008 2007<br />

46.8 45.8<br />

The company said that it is cutting capital expenditures and will stop new<br />

port investments as it seeks to conserve cash during the current industry<br />

slump. The company’s vice chairman had confirmed that COSCO Pacific's<br />

capital expenditure will fall to $570M in 2009 from $890M in 2008. The<br />

company believes new port investments are too risky in the current<br />

operating environment. Hence it will focus on improving and developing<br />

ports in which it holds a controlling stake.<br />

The company plans to slow the progress of committed new port projects to<br />

meet the forecast decrease in demand this year. The company chairman<br />

also added that he expects “the situation in 2009 to be even worse than in<br />

the fourth quarter of last year.”<br />

For the first quarter of 2009, COSCO Pacific’s terminals dropped by 8%,<br />

with the most dramatic falls seen in Singapore (-52%), Antwerp (-46%),<br />

Hong Kong (-27%) and Nansha (-25%). Total liftings at its terminals over the<br />

January to March period dropped to 9.6 Mteu from 10.4 Mteu a year<br />

earlier.<br />

P a g e | 16 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

58.9<br />

43.3<br />

38.9<br />

PSA DPW COSCO<br />

Pacific

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

SIPG defers Zeebrugge investment<br />

SHANGHAI International Port Group (SIPG) has decided to postpone its 40%<br />

investment in APM Terminals Zeebrugge. APM Terminals and SIPG had<br />

announced a “framework agreement” in September 2006 that would lead<br />

to the acquisition of a ‘substantial minority interest’ in the Belgian facility<br />

by SIPG. It would have marked the first overseas foray for the Shanghai<br />

port operator. However, the current downturn in container volumes have<br />

prompted the Chinese operator to temporarily abandon its international<br />

expansion plans and will instead focus on its home market which is also<br />

facing a significant slowing in handling volumes. Despite the recent<br />

slowdown in trade, SIPG still expects business at its stronghold – the port of<br />

Shanghai – to grow by 3.9% this year to reach 29 Mteu. The group’s 2008<br />

net profit increased by more than a quarter year-on-year and reached USD<br />

676 M.<br />

AP Moeller-Maersk’s annual report reveals that the terminal remains<br />

wholly-owned by AMPT ever since its launch in 2006. APMT currently<br />

partners SIPG at the Shanghai East Container Terminal, which was<br />

established in 2002.<br />

Busan Port to acquire three berths from New Port<br />

South Korea’s Busan Port Authority (BPA) has announced that it would<br />

acquire three berths at the North Terminal of Pusan New Port from Pusan<br />

New Port Co before the end of the month.<br />

The three berths with a total capacity of 1.5 Mteu are currently nearing<br />

completion. No purchase price was disclosed but it was reported that BPA<br />

will put the berths out to open tender by the end of this month.<br />

PSA International was reported to have approached the Korean government<br />

expressing interest in buying the three berths in 2008, and is known to<br />

have been in touch with the authorities again this year. It is the frontrunner<br />

in the bid to acquire the three new berths under an open tender<br />

process, with little interest shown by other operators.<br />

Pusan New Port Co, which is majority-owned by DP World, has struggled to<br />

attract cargo at the six berths it operates since it opened in late 2006,<br />

which remains severely under-utilised.<br />

Additional capacity is expected to be added by 2011, when Busan New<br />

Container Terminal (BNCT), also known as Busan Phase 2-3, begins<br />

operations. This terminal is a joint venture partnership that includes<br />

Macquarie, CMA CGM, BPA, KMTC and other local partners.<br />

P a g e | 17 © Copyright <strong>Alphaliner</strong> 1999-2009