AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ALPHALINER<br />

Weekly <strong>Newsl</strong>etter<br />

Web: www.axs-alphaliner.com | E-mail: data@alphaliner.com | Sales: commercial@axsmarine.com<br />

21.04.2009 to 27.04.2009<br />

Volume 2009 Issue 17<br />

<strong>Alphaliner</strong> Weekly <strong>Newsl</strong>etter is the premier liner shipping news summary, compiled and distributed every Monday.<br />

The newsletter is available upon subscription. Information is given in good faith but without guarantee. Please send<br />

your feedback, comments and questions to data@alphaliner.com<br />

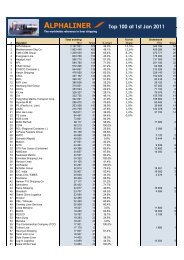

Top 5 Container Ports<br />

Mar 2009 Performance<br />

% Change vs Feb 09 vs Mar 08<br />

Singapore 18.5% -14.6%<br />

Shanghai 47.3% -8.8%<br />

Hong Kong 24.5% -18.9%<br />

Shenzhen 33.5% -21.8%<br />

LA/LB 23.0% -16.8%<br />

M teu<br />

I N S I D E T H I S I S S U E<br />

1 Chart of the Week<br />

Weak first quarter volumes<br />

Idle fleet stays high at 10.6%<br />

Chinese ports 1Q liftings drop 12.8%<br />

4 Service Updates<br />

CKYH rearranges Asia Euope servce<br />

CSCL reinstates ME-FE-US pendulum<br />

Maersk adds Halifax on TA-3/TP-7<br />

Zim slots on GA FE-Med service<br />

CSCL takes slots on PNX from Zim<br />

CMA CGM adds Med-Japan link<br />

Maersk swaps AE European ports<br />

MOL boosts JSS 1 on intra-Asia<br />

K Line launch Shanghai-Japan loop<br />

SCI/MSC team up on ISES<br />

Hamburg Sud drop Europe-ECSA loop<br />

Other service updates<br />

9 Corporate Updates<br />

MSC continues fixtures spree<br />

China Navigation gains control of TOL<br />

COSCO 2008 liner profits slump<br />

CSCL 1Q loss hits $177M<br />

CSAV facing $400M loss for 1H09<br />

Horizon Lines books $10M loss for 1Q<br />

APL rates and volume continues to slip<br />

16 Delivery Updates<br />

New April deliveries<br />

Chart of the Week<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Top 5 Container Ports - Monthly Throughput<br />

Jan 2008-Mar 2009<br />

Jan-08<br />

Feb-08<br />

Mar-08<br />

Apr-08<br />

May-08<br />

Jun-08<br />

Jul-08<br />

Aug-08<br />

Sep-08<br />

Oct-08<br />

Nov-08<br />

Dec-08<br />

Jan-09<br />

Feb-09<br />

Mar-09<br />

Weak first quarter volumes but March offers hope<br />

Container trade volumes recovered in March following the weak February<br />

figures but it is still too early to call a bottom to volume declines that<br />

ports have seen since September 2008.<br />

<strong>Alphaliner</strong>’s survey of the top 5 container ports showed a 29% month-on-<br />

month increase in the combined liftings for March at the ports of<br />

Singapore, Shanghai, Hong Kong, Shenzhen and Los Angeles/Long Beach.<br />

Shanghai in particular recovered strongly, handling 2.18 Mteu, 47% more<br />

than the previous month. It is closing the gap with Singapore, which<br />

remained the top ranked port with handling volumes of 2.19 Mteu.<br />

A large part of the volume recovery in March was due to the resumption in<br />

shipments after the Lunar New Year holidays in many parts of Asia. The<br />

application of rate increases on a number of trades that took effect from 1<br />

April, particularly in the Asia-Europe sector, had also led to some pre-GRI<br />

bookings surge at the end of March.<br />

P a g e | 1 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

Singapore<br />

Shanghai<br />

Hong Kong<br />

Shenzhen<br />

LA/LB

No. of Vessels<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Carriers’ losses could<br />

reach $4Bn in 1Q<br />

Carriers with 1Q09 profit<br />

guidance/announcements<br />

CSAV -$265M<br />

NOL -$240M<br />

CSCL -$177M<br />

Idle Fleet Breakdown by Size Range<br />

as at 27 Apr 2009<br />

10<br />

55<br />

89<br />

114<br />

140<br />

Size Range in teu<br />

98<br />

Note, the count for the 500-1,000 teu<br />

range includes only ships which are<br />

usually deployed on container services<br />

and excludes the spot multipurpose units<br />

usually deployed on breakbulk, project<br />

cargo or tramp trades as they rarely<br />

interfere on container trades.<br />

The March volumes at the top 5 ports are however 16% lower than the<br />

corresponding period in 2008, reflecting the challenging conditions that the<br />

industry is facing. Overall first quarter volumes fell 19% against the<br />

previous year.<br />

Apart from the top 5 ports, all main ports are affected by the volume<br />

slowdown. In Europe, Rotterdam had reported a 16% decline in container<br />

volumes to 2.3 Mteu for the first quarter and the port forecasts an overall<br />

decline in throughput of 6%-10% for 2009. It says problems in container<br />

shipping continue to dominate for the time being and the recovery will<br />

begin “a little later than anticipated”. Antwerp also reported a 16% fall in<br />

first quarter volumes to 1.7 Mteu. Over in the US East Coast, the port of<br />

New York/New Jersey saw first quarter volumes drop 17% to 0.82 Mteu.<br />

Although there were some successes on the part of carriers in finally<br />

recovering some of the volumes and rate declines over the March-April<br />

period, the battle to regain profitability remains gruelling. Within the last<br />

two weeks, a number of carriers have issued profit warnings, cautioning<br />

that the first quarter earnings would be negative. Collectively, the Top 20<br />

carriers may be facing total losses that could exceed $4 Bn for the first<br />

quarter alone – the largest ever quarterly loss in the industry’s history.<br />

Idle fleet stays high at 10.6%<br />

The idle containership fleet increased marginally over the last fortnight,<br />

according to <strong>Alphaliner</strong> figures. As at 27 April, a total of 506 ships for 1.34<br />

Mteu was idle against 486 ships for 1.31 Mteu two weeks ago. The idle fleet<br />

now represents 10.6% of the cellular fleet against 10.4% a fortnight ago.<br />

The non-operating owners' share of the idle fleet continues to increase as<br />

carriers continue to redeliver ships at expiry of charters. The fleet idle for<br />

non-operating owners account has reached 274 units representing 425,000<br />

teu (31.8% of the total idle fleet).<br />

TEU Millions<br />

Idle fleet evolution Dec 2008-Apr 2009<br />

1.60<br />

1.40<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

0.00<br />

Non Operating Owner TEU<br />

Carrier TEU<br />

©<strong>Alphaliner</strong><br />

P a g e | 2 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

3.4%<br />

As % of<br />

total fleet<br />

7.2%

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

China<br />

Top 10 Container Ports<br />

Volumes Handled<br />

Jan-Mar 2009<br />

Chinese ports 1Q liftings down by 12.8%<br />

The newly released China ports statistics saw first quarter container<br />

handling volume in the country drop by 12.8% to 25.5 Mteu compared to a<br />

year ago.<br />

Amongst the main ports, only Yingkou, Qingdao and Tianjin saw an increase<br />

in volumes. The largest drops were seen in the Pearl River Delta (PRD)<br />

region of South China, with the Shenzhen ports dropping 21% while the<br />

emerging Guangzhou port (primarily Nansha) saw volumes drop by 24%.<br />

South China bore the brunt of the decline as it is most heavily exposed to<br />

the slump in the US and Europe, with export-oriented industries mainly<br />

concentrated in the area. Together with neighbouring Hong Kong port, the<br />

3 main ports in the PRD saw total volumes drop by 22% to 10.6 Mteu.<br />

Rank Port<br />

Mar 2009<br />

Mteu<br />

y-o-y<br />

change %<br />

Jan-Mar<br />

2009 Mteu<br />

y-o-y<br />

change %<br />

1 Shanghai 2.18 -8.8% 5.61 -15.1%<br />

2 Shenzhen 1.34 -21.8% 3.88 -21.2%<br />

3 Qingdao 0.86 2.6% 2.50 2.3%<br />

4 Ningbo-Zhoushan 0.84 -3.7% 2.26 -10.2%<br />

5 Guangzhou 0.85 -12.9% 2.15 -24.3%<br />

6 Tianjin 0.73 5.5% 1.93 1.4%<br />

7 Xiamen 0.36 -7.2% 1.03 -8.4%<br />

8 Dalian 0.34 -4.5% 0.99 -2.0%<br />

9 Lianyungang 0.22 -4.3% 0.57 -9.8%<br />

10 Yingkou 0.20 14.7% 0.51 9.0%<br />

Total Top 10 Ports 7.91 -8.2% 21.43 -12.4%<br />

Coastal ports 8.90 -6.6% 23.78 -12.3%<br />

River ports 0.59 -19.2% 1.70 -19.4%<br />

Total All Ports excl Hkg 9.50 -7.5% 25.48 -12.8%<br />

For Comparison<br />

Singapore 2.19 -14.6% 6.02 -17.9%<br />

Hong Kong 1.63 -18.9% 4.55 -20.9%<br />

The only bright spot has been increased cross-Taiwan Strait container<br />

volumes which has increased by 4.6 times in Kaohsiung since the launch of<br />

direct shipping links between Taiwan and China last December. The volume<br />

of cross-strait containers handled by the port increased from 16,000 teu in<br />

December to 74,000 teu in March. Cross-strait voyages that included a stop<br />

at Kaohsiung rose from 38 in December 2008, to 118 in March.<br />

Although the direct cross-strait shipping links have cut transportation costs<br />

by 15% to 30%, it has not lead to a significant increase in volumes as ships<br />

which had to take detours through third country ports in the past can now<br />

trade directly. Most of these used to transit at Hong Kong but can now<br />

bypass the port.<br />

P a g e | 3 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

SERVICE UPDATES<br />

CNEU / AEX replaced by<br />

new AEN / AES<br />

CKYH re-arranges Asia-Europe service<br />

The CKYH Alliance (COSCON, K Line, Yang Ming, Hanjin Shipping) is to<br />

replace its Asia-Europe CNEU and AEX loops with two loops (AEN/AES).<br />

The CNEU loop resulted from the merger in December of the former AEN<br />

and AES service, which the alliance stated would last only for the<br />

traditional slack season from early December 2008 to end of March 2009.<br />

The new AEN/AES loops will be run with nine and eight ships respectively,<br />

with vessels of 8,400-10,000 teu, all provided by COSCO (some of which<br />

had spent 3 or 4 months at anchor in Chinese waters).<br />

Four of the 16 COSCO ships used will be however marketed under Hanjin<br />

names:<br />

> HANJIN FUZHOU ex COSCO ASIA,<br />

> HANJIN ALEXANDRIA ex COSCO AMERICA,<br />

> HANJIN CASABLANCA ex COSCO AFRICA<br />

> HANJIN BILBAO ex COSCO PACIFIC<br />

Meanwhile CKYH partners are to add a direct call at Ashdod in Israel on<br />

their Asia-Med Express service (AMS).<br />

CSCL reinstates ME-FE-US pendulum<br />

CSCL is revive its Middle East-Far East-USWC pendulum by grafting the<br />

transpacific AAS service to the FE-ME AMA service, thus reconstructing the<br />

pendulum pattern abandoned 18 months ago.<br />

The reconstructed AMA-AAS pendulum will be slightly different from its<br />

forerunner on its western end as it follows the rotation of the AMA, with a<br />

call at Dammam while it skips Mumbai-Nhava Sheva.<br />

IRIS Lines and CMA CGM, which used to slot on the AMA, will continue with<br />

their slot allocations on the FE-ME string of the pendulum.<br />

Maersk adds direct Halifax call on TA-3/TP-7<br />

Maersk Line is to add Halifax to its transpacific/transatlantic pendulum<br />

(TA-3 / TP-7). Halifax is added on the westbound leg of the pendulum and<br />

will be the first North America call out of Europe. The ECNA westbound<br />

range will thus cover successively Halifax, New York, Savannah and Miami<br />

before continuing to Balboa, the USWC and Asia.<br />

The move is possibly in answer to the inclusion of Halifax to the revised<br />

CKYH FE-USEC 'AWE 4' loop and the launch by CMA CGM of a new relay<br />

service connecting Halifax to its Kingston hub ('Black Pearl' service)<br />

P a g e | 4 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Zim / GA slot arrangement<br />

expands to FE-Med<br />

Of note, Halifax is already served by two transpacific/transatlantic<br />

pendulums in both directions: on Zim's ZCS and the Grand Alliance PAX.<br />

The Grand Alliance Asia-Med-USEC AEX service also calls at Halifax.<br />

Niche carriers calling at Halifax, include ACL (transatlantic Conro service),<br />

Melfi Marine (Med-Canada-Cuba service), Hamburg Süd (Med-Canada-<br />

Mexico-Cuba service and Nirint Shipping (Europe-Canada-Cuba service).<br />

Zim slots on Grand Alliance FE-Med service<br />

Zim has opted to take slots on the Grand Alliance / New World Alliance<br />

Far East-Med loop (EU M), replacing slots on COSCO's Asia-Med Express<br />

(EUM - part of CKYH), thus ending two years of presence on this service.<br />

These two rival services share three West Med calls: Genoa, Barcelona and<br />

Valencia.<br />

The Zim move to the EU M loop follows the slot agreement reached a few<br />

weeks ago with GA partners, involving the Zim's East Med Express service<br />

(EMX) and the GA's FE-North Europe EU 3 and EU 4 loops.<br />

Meanwhile, Zim is to resume Piraeus calls on its Med-US-FE ZCS pendulum,<br />

effective May. The new Med rotation will be as follows: Tarragona,<br />

Piraeus, Haifa, Livorno, Genoa, Tarragona.<br />

CSCL takes slots on PNX from Zim<br />

CSCL offers a Pearl River-Vancouver service (branded ANW 2) through slots<br />

on the relevant leg of the Grand Alliance/Zim PNX service, in continuation<br />

of the slot allocation it had on the Zim's Asia-Pacific Express service (APX)<br />

that was closed last month as Zim teamed up with Grand Alliance on this<br />

run. The PNX is currently run with six 8,000 teu ships from OOCL. Zim is<br />

expected to bring VLCS newbuildings of between 8,000-10,000 teu on this<br />

service in July.<br />

CMA CGM adds Med-Japan direct service<br />

CMA CGM is to add Japan direct calls to its Asia-Med MEX loop, with the<br />

extension of the loop to Nagoya, Yokohama and Kobe. It will make<br />

redundant its dedicated Busan-Japan feeder service. CMA CGM will<br />

therefore cover Japanese ports directly again, with an Asia-Europe loop,<br />

almost ten years after having dropped them from a previous service.<br />

Japan calls were included for the first time in December 1998 with the<br />

launch of the Med-North China-Japan service, extended in March 1999 to<br />

North Europe and integrated in May 1999 within the NCJ/TPX pendulum,<br />

according to <strong>Alphaliner</strong> archives. The Japan calls were dropped in<br />

December 1999 as the Asian market was severely affected by the Asian<br />

Crisis, and Japan was covered with a feeder service instead.<br />

P a g e | 5 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

The duration of the rotation of the MEX loop will remain 10 weeks as the<br />

Lianyungang and Qingdao calls are to be removed and covered with the<br />

Maersk Line / CMA CGM joint Asia-Med loop (AE-11), within the frame of<br />

the recently announced VSA with Maersk Line on the Asia-Med route.<br />

Besides, the Jeddah call is removed from the MEX and a Beirut call is<br />

added (Beirut is removed from the PHEX/LEVEX).<br />

Maersk Line swaps European ports on AE loops<br />

Maersk Line is to bring a few alterations to the European range covered by<br />

its Asia-Europe AE-1 loop, effective May 2009. Felixstowe will replace<br />

Southampton while Le Havre will be moved to the AE-10 loop, where it<br />

becomes the first import call (Le Havre is already served by the AE-1 as an<br />

export call). These two loops will continue to be served by a common set<br />

of 19 ships of 8,500 teu alternating on both loops.<br />

MOL to boost its intra-Asia JSS 1 loop<br />

MOL is to inject 4,600-,5,000 teu ships on its core intra-Asia Japan-Straits<br />

'Super Express' 1 service (JSS 1 / CHS-1), thus increasing its capacity by<br />

around 20% (from 4,000 teu to 4,800 teu). MOL is to assign to the JSS 1 the<br />

5,087 teu MOL EMERALD (newbuilding) and the 4,646 teu MOL ENCORE<br />

(transferred from the trimmed-down FE-Australia service run by NYK /<br />

MOL and K Line - 7256 and the 4,646 teu MOL EXPEDITOR (ex APL<br />

EXPEDITOR returned to MOL). They will replace the 4,180 teu MOL ELBE<br />

and MOL INGENUITY, and the 3,733 teu MOL THAMES.<br />

The previous JSS 1 capacity upgrade dates back to November 2007, when<br />

it was boosted from 2,790 teu to 3,840 teu. This service is also used by<br />

various slot buyers including Interasia Lines, Wan Hai and MISC.<br />

K Line launches Shanghai–Japan loop<br />

K Line is to launch its own Shanghai-Tokyo-Yokohama service, using the<br />

1,133 teu CHIANGMAI BRIDGE, with Shanghai Hai Hua (Hasco) taking slots.<br />

The Shanghai-Osaka-Kobe service launched last December is replaced by a<br />

slot allocation on the relevant Hasco loop.<br />

SCI/MSC team up on ISES – K Line/YML drop out<br />

S.C. India is to team up with MSC on a new Indian Subcontinent Europe<br />

Service (ISES), to be run with ships of 4,000-4,500 teu. For S.C. India, it<br />

will replace the current ISES service, operated in partnership with K Line<br />

and Yang Ming. This latter service was originally run with seven ships but<br />

was cut to only four ships after the departure of MISC Bhd and Zim. S.C.<br />

India had lately added a fifth ship, the recently chartered 3,359 teu E.R.<br />

SYDNEY, joining the two ships of 4,400 teu already deployed by the Indian<br />

carrier, and the two 2,878 teu / 3,266 teu ships provided by K Line and<br />

Yang Ming. These two latter carriers are probably to continue service the<br />

P a g e | 6 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Indian subcontinent-Europe trade on the relevant CKYH Far East-Europe<br />

services with transhipment at Colombo.<br />

As for MSC, the new ISES will add a second two way loop on the Indian<br />

subcontinent-Europe sector. MSC already operates a two-way loop on the<br />

India-Europe run, the IPAK service, the capacity of which has just been<br />

doubled from approximately 2,500-3,000 weekly teu to some 6,000 weekly<br />

teu, a westbound only Colombo-Med-North Europe service as part of its<br />

wider Europe-Indian Ocean-Australia-Asia pendulum, and an eastbound<br />

only Med-Colombo service as part of its wider Med-Asia 'Phoenix' service,<br />

according to <strong>Alphaliner</strong> records.<br />

Hamburg Süd to drop Europe-ECSA loop<br />

In its annual report published last week, Hamburg Süd announced that it is<br />

to abandon its second North Europe-ECSA service (Brazil Express),<br />

operated jointly with Hapag-Lloyd with 2,500 teu ships. Hamburg Süd will<br />

then focus on its main loop (River Plate Express), using 5,500 teu ships<br />

with plans to upgrade to 5,900 teu ships shortly. Hapag-Lloyd, Maersk Line<br />

and CSAV have slot allocations on the latter loop.<br />

However, CSAV is expected to cease buying slots on the 'River Plate<br />

Express' next month to focus on its own Europe-ECSA service<br />

(EUROATLAN). The EUROATLAN is currently being upgraded from the 2,500<br />

teu size to the 4,000 teu scale, allowing CSAV to have a better use of its<br />

4,000+ teu fleet, especially as it is awaiting the delivery of newbuildings<br />

of this size in the coming weeks. One of them, the CSAV LONCOMILLA, is<br />

already scheduled in June on the EUROATLAN after a positioning trip on<br />

the Asia-ECSA (ASAX) run. The loss of the CSAV allocation on the main loop<br />

could be a factor behind Hamburg Süd's decision to drop the second<br />

service.<br />

Another reason for dropping the second loop is the launch by Maersk Line<br />

of a Med-ECSA relay service hubbing at Algeciras and Tangier, freeing up<br />

space on its L-class service, as well as on the Hamburg Süd service on<br />

which Maersk slots.<br />

This rationalisation follows the streamlining of the Med-ECSA services in<br />

March and the Far East-WCSA services in February. Hamburg Süd currently<br />

has six ships of 2,500 to 5,900 teu lying idle, according to <strong>Alphaliner</strong><br />

records. Hamburg Süd is also expected to receive the first ship of its 7,100<br />

teu newbuilding program by the end of the year.<br />

As for Hapag-Lloyd, which operates three of the five ships deployed on the<br />

'Brazil Express' loop, it has not yet announced if it will continue to operate<br />

the service on a stand-alone basis.<br />

P a g e | 7 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

MSC launches Amazon<br />

relay service<br />

Oslo Fjord service<br />

launched<br />

Indian coastal service<br />

launched<br />

Other service updates<br />

As anticipated, MSC has launched a dedicated relay service covering the<br />

Amazon, connecting its Freeport hub (Bahamas) with Manaus and Vila do<br />

Conde. It also encompasses an existing feeder loop connecting Freeport to<br />

San Juan de Puerto Rico and Port of Spain. It turns in three weeks using<br />

three ships, the MSC PROSPECT (1,354 teu), MSC ACAPULCO (1,162 teu)<br />

and PAUL RICKMERS (1,162 teu).<br />

+++<br />

Samskip Multimodal Container Logistics (Samskip), DFDS-Lys Line and<br />

Unifeeder are to team up on the Rotterdam-Oslo Fjord route<br />

This service has been ensured by DFDS-Lys Line and Samskip since January<br />

2006. Unifeeder will bring the recently chartered 803 teu JORK RULER<br />

alongside the LYS POINT. The JORK RULER replaces the 390 teu<br />

VANGUARD.<br />

The new joint service will include all present ports in the Oslo Fjord (Oslo,<br />

Moss, Brevik, Larvik, Kristiansand) and adds a call at Fredrikstad.<br />

+++<br />

Caravel Lines, the NVOCC division of Chennai-based Caravel Logistics, is to<br />

launch its own Indian coastal service to connect Mundra, Cochin and<br />

Tuticorin. The service is to be ensured with the chartered 558 teu<br />

REGGEBORG, recently lying spot at Singapore. Of note, the REGGEBORG<br />

flies the Dutch flag and thus contravenes Indian regulations stipulating<br />

that cabotage services are reserved to Indian flag ships. However, this rule<br />

could be waived in case an adequate ship is not available under the Indian<br />

flag.<br />

Caravel adds to the half-dozen of carriers offering cabotage container<br />

services between Indian ports, including S.C. India, Shreyas Shipping,<br />

Seaways Shipping, Transport Corp. of India (TCI), Gati Ltd and Seabridge<br />

Maritime. Caravel Logistics was created in 1994.<br />

P a g e | 8 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

CORPORATE UPDATES<br />

Recent MSC Fixtures<br />

NRS 8,411 Series<br />

Vessel Expected Dely<br />

NORTHERN JAVELIN Jul-09<br />

NORTHERN JASPER<br />

NORTHERN JUBILEE Aug-09<br />

NORTHERN JAGUAR Sep-09<br />

NORTHERN JUVENILLE Dec-09<br />

NORTHERN JUPITER Jan-10<br />

NORTHERN JUSTICE Feb-10<br />

NORTHERN JAMBOREE Jun-10<br />

NRS 8,411 Series<br />

Vessel Expected Dely<br />

NORTHERN JAVELIN Jul-09<br />

NORTHERN JASPER<br />

NORTHERN JUBILEE Aug-09<br />

NORTHERN JAGUAR Sep-09<br />

NORTHERN JUVENILLE Dec-09<br />

NORTHERN JUPITER Jan-10<br />

NORTHERN JUSTICE Feb-10<br />

NORTHERN JAMBOREE Jun-10<br />

MSC continues fixture spree<br />

MSC has recently fixed several large containerships at bargain rates,<br />

including a series of eight 8,411 teu newbuildings and five existing units of<br />

5,000 teu.<br />

The eight 8,411 teu newbuildings are chartered from German shipowner<br />

Norddeutsche Reederei Schuldt (NRS) for the duration of one year, with an<br />

option for a further year, at a reported USD 10,000 (USD 12,000 for the<br />

optional year).<br />

The ships were ordered speculatively at DSME in two stages in May / August<br />

2007. The first of them, NORTHERN JAVELIN, presently lies alongside at the<br />

yard, almost completed, while the second one, NORTHERN JASPER, is also<br />

close to completion. The ships delivery is however expected to take place<br />

in July-August.<br />

They were to become the first VLCS delivered without commitment to any<br />

carrier. MSC thus emerges as the White Knight for these ships which<br />

otherwise would have lied at anchor as soon as delivered.<br />

One question which springs to mind is to which route MSC will assign these<br />

ships. One would think immediately of the Far East-North Europe or<br />

transpacific routes, but actually, MSC has a sufficient number of VLCS and<br />

ULCS, including those to be delivered in the next 12 months, to fulfil its<br />

needs on these routes. The additional ships would fit well on the Indian<br />

subcontinent-Europe route or on the Europe-South America route. Other<br />

remote possibilities include the enhancement of MSC’s Far East-Middle East<br />

service (Falcon) and the organisation of a direct India-Med-US service.<br />

MSC has recently strongly boosted its Indian subcontinent-Europe service,<br />

having replaced 2,500-3,000 teu ships by 5,000-6,700 teu ones, and is still<br />

to push the capacity one step up with the new service that it is to launch<br />

in co-operation with S.C. India (see page 6). Thus, the injection of 8,000<br />

teu ships on this route is only a matter of time.<br />

On the Europe-ECSA route, MSC is currently operating four loops employing<br />

23 ships offering a total weekly capacity of 19,000 teu (of which 10,400 teu<br />

dedicated to the Med-ECSA route, including volumes relayed to/from Asia<br />

and Africa). 14 of the 23 ships employed fall in the 5,500-6,000 teu range.<br />

The largest ships employed do not exceed 6,000 teu for the moment, but<br />

there is scope to inject 8,000 teu ships on this route, including the NRS<br />

ones, which are fitted with 700 reefer plugs.<br />

It has also to be borne in mind that MSC is to lose four 8,400 teu ships that<br />

it had on temporary charter from CMA CGM and CSCL (as sublets)<br />

P a g e | 9 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

> MSC XIAN – alias CMA CGM DON PASCUALE (24-30 m – Redelivered to CMA<br />

CGM around 05 April)<br />

> MSC BENGAL – alias CMA CGM FAUST (24-30 m – Redelivered to CMA CGM<br />

around 25 April)<br />

> MSC BALTIC – alias CSCL AMERICA (24 m – Expiring this summer)<br />

> MSC BELGIUM – alias CSCL OCEANIA (24 m – Expiring this summer)<br />

As for the reported $10,000 daily rate negotiated with MSC for the 8,400<br />

teu NRS ships, the owners will be taking a big hit as breakeven rates would<br />

need to be in excess of $35,000/day. As a comparison, similar ships<br />

ordered by Seaspan at HHI in May 2007 at a cost of $132.5 M per vessel<br />

were fixed on 12-year charters to COSCO at $42,900/day.<br />

Assuming that NRS can operate the ships on a running cost of $7,000 per<br />

day, the reported $10,000 rate leaves a differential of $3,000 to repay<br />

capital and financial costs. It is not much as these latter costs can be<br />

estimated at around $27,000-28,000 for these ships, but it is still a better<br />

option than sending them into lay-up, explaining perhaps why NRS<br />

accepted such a deal.<br />

So, MSC saves some $25,000 per day on total daily costs, had it ordered<br />

these ships itself. MSC profits of a 12-24 months opportunity window for<br />

these ships, and should it redeliver them at expiry of the charter, it will<br />

have benefitted during that time of ship costs 70% lower than the best<br />

costs its competitors could normally obtain (assuming the contract is a<br />

straight time charter contract with no other conditions attached).<br />

During the 12 months firm period, MSC will benefit of a daily cost of around<br />

$1.2 per teu slot instead of the $4 per teu slot expected for such ships<br />

(excluding fuel expenses, port dues, canal tolls and other voyage related<br />

expenses).<br />

Separately, MSC has also fixed five ships of 5,000 teu :<br />

>NYK PROCYON – 48 mths - delivered last week as MSC SOCOTRA<br />

>BELLAVIA – 12 mths – delivery early May<br />

>OCTAVIA – 12 mths – delivery early May<br />

>HS LIVINGSTON – 12 mths – delivery Q3 2009 (date unclear)<br />

>HS HUMBOLDT – 12 mths – delivery Q3 2009 (date unclear)<br />

MSC continues to build up market share while the entire industry is<br />

grappling with an overcapacity challenge. It has defied the trend and<br />

continues to add capacity at a time when most other carriers are trying to<br />

P a g e | 10 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

dispose of excess tonnage. Its fleet has passed in March the 1.5 Mteu mark,<br />

a 0.3 Mteu increase in 15 months. Its market share has grown from 10.4% at<br />

the start of 2008 to 11.5% as at 1 April 2009, according to <strong>Alphaliner</strong><br />

figures (See our last issue).<br />

China Navigation gains full control of TOL<br />

Hong Kong based multi-purpose (mpp) liner operator China Navigation Co.<br />

(CNCo) has taken whole control of Tasman Orient Line (TOL) in acquiring<br />

the 33% stake of the Ahrenkiel Group, effective from 1st April 2009. CNCo<br />

is the deep sea shipping arm of the Swire Group.<br />

Following the acquisition, TOL’s container and breakbulk services<br />

connecting East Asia to New Zealand are expected to be combined with<br />

those of Swire Shipping.The Hamburg/Berne based Ahrenkiel Group will<br />

retain its partnership in Quadrant Pacific, which is one of New Zealand’s<br />

largest ship agency companies with eight branches in the country.<br />

TOL and Quadrant Pacific were established in July 1999 with the merger of<br />

Tasman Asia Line (TAL) and New Zealand Orient Line (NZOL). The resulting<br />

company was owned by Fletcher Challenge Paper (57%), Christian<br />

Ahrenkiel and CNCo. Following the acquisition of Fletcher Challenge by<br />

Norske Skog (a paper manufacturing company) in July 2000, the majority<br />

holding in TOL was disposed by the latter in January 2001, with CNCo<br />

taking two-thirds of the company and Ahrenkiel taking the remaining onethird<br />

share.<br />

Historically, the Tasman Asia Line was the direct successor of the 'Tasman<br />

Jebsen Line', set up in 1985 by Norwegian owner Kristian Gerhard Jebsen<br />

in partnership with the Tasman Pulp and Paper Company. Ahrenkiel had<br />

acquired NZOL in 1992 prior to the merger with TAL. With the disposal, it<br />

marks Ahrenkiel’s departure from direct liner operations. It retains its<br />

shipmanagement and logistics business as well as the ship finance business<br />

under Fondshaus Hamburg, which is suffering from the recent drop in asset<br />

values.<br />

Last week, Fondshaus was forced to close one of its KG ship funds, KG<br />

Fund No 38, after one of its three ships failed to find a charterer and was<br />

unable to fulfil its dividend payments to investors of the fund. The 3,388<br />

teu JOHANNESBURG, built in 2006, has not been able to find employment<br />

since it ended its 24-month-charter with MOL late last year. Ahrenkiel will<br />

take over ownership of the vessel from the fund and the €4 M of equity in<br />

the fund will be returned to its shareholders.<br />

COSCO 2008 liner profits slump<br />

China COSCO Holdings, the parent company of COSCON reported a 40.4%<br />

reduction in net profits in 2008 to RMB 11.6 Bn ($1.7 Bn) despite a 16.6%<br />

increase in total revenues to RMB 130.9 Bn.<br />

P a g e | 11 © Copyright <strong>Alphaliner</strong> 1999-2009

Liftings in M teu<br />

% Increase<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

5.793 5.709<br />

1%<br />

COSCON<br />

Volume Growth<br />

2006-2008<br />

12%<br />

5.111<br />

13%<br />

2008 2007 2006<br />

Dely Teu Shipyard<br />

Jan-09 10,020 Nantong (NACKS)<br />

Jun-09 5,100 Jiangnan Changxing<br />

Jun-09 5,100 Jiangnan Changxing<br />

Sep-09 5,100 Jiangnan Changxing<br />

Sep-09 5,100 Jiangnan Changxing<br />

Jan-10 1,800 Dalian Shipyard<br />

Jan-10 1,800 Dalian Shipyard<br />

Jan-10 1,800 Dalian Shipyard<br />

Jan-10 1,800 Dalian Shipyard<br />

Feb-10 5,100 Jiangnan Changxing<br />

Feb-10 5,100 Jiangnan Changxing<br />

Jun-10 5,100 Jiangnan Changxing<br />

Jun-10 5,100 Jiangnan Changxing<br />

Sep-10 5,100 Jiangnan Changxing<br />

Sep-10 5,100 Jiangnan Changxing<br />

Dec-10 5,100 Jiangnan Changxing<br />

Dec-10 5,100 Jiangnan Changxing<br />

Jul-11 4,250 Jiangsu New YZJ<br />

Aug-11 4,250 Jiangsu New YZJ<br />

Sep-11 4,250 Jiangsu New YZJ<br />

Oct-11 4,250 Jiangsu New YZJ<br />

Nov-11 4,250 Jiangsu New YZJ<br />

Dec-11 4,250 Jiangsu New YZJ<br />

Jan-12 4,250 Jiangsu New YZJ<br />

Jan-12 4,250 Jiangsu New YZJ<br />

Feb-12 4,250 Jiangsu New YZJ<br />

Mar-12 4,250 Jiangsu New YZJ<br />

Apr-12 4,250 Jiangsu New YZJ<br />

May-12 4,250 Jiangsu New YZJ<br />

Jun-12 4,250 Jiangsu New YZJ<br />

Jul-12 4,250 Jiangsu New YZJ<br />

Jul-12 4,250 Jiangsu New YZJ<br />

Aug-12 4,250 Jiangsu New YZJ<br />

Sep-12 4,250 Jiangsu New YZJ<br />

Oct-12 4,250 Jiangsu New YZJ<br />

Nov-12 4,250 Jiangsu New YZJ<br />

Dec-12 4,250 Jiangsu New YZJ<br />

2012 13,350 Nantong (NACKS)<br />

2012 13,350 Nantong (NACKS)<br />

2012 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

Operating profit for COSCO’s liner shipping business under COSCON<br />

dropped by 82.4% to RMB 292 M ($43 M) in 2008 compared to RMB 1,656 M<br />

($242 M) in 2007. Total liftings grew by only 1.5% to 5.79 Mteu despite a<br />

significant increase in vessel capacity which grew from 435,138 teu at the<br />

end of 2007 to 496,317 teu, an increase of 14%. Utilisation levels dropped<br />

across all the trade segments, with load factors on its three key<br />

international segments of Transpacific, Asia-Europe and Intra-Asia falling<br />

by 5% on the headhaul legs. Average rates were down by 6.4% overall with<br />

the Asia-Europe trade suffering the worst drop of 14.9% in 2008.<br />

The container shipping operations by COSCON contribute 33% of the<br />

group’s revenue and 2% of its operating profits. The liner shipping segment<br />

suffered the greatest slump of all of COSCO’s business units which also<br />

includes dry bulk shipping, logistics, terminals and container leasing.<br />

COSCO has a large orderbook of 59 container vessels due for delivery<br />

between 2009 and 2013. These ships have a total capacity of 445,000 teu.<br />

Deliveries this year would include nine new vessels, thereof four owned<br />

5,100 teu ships and one owned 10,020 teu vessel and furthermore one<br />

4,506 teu and three 8,495 teu chartered-in vessels.<br />

The company said that due to poor market conditions it “is negotiating<br />

with shipowners to postpone the delivery in 2010 of the three 8,495 teu<br />

vessels planned for 2009.” They are part of a series of eight 8,495 teu<br />

ships fixed for 12 years from Seaspan, which ordered them in 2007.<br />

Seaspan also has eight more ships of 13,092 teu fixed to COSCO for<br />

delivery between 2010 and 2011.The bulk of COSCO’s newbuildings are on<br />

its own account, with 37 ships due to be delivered by 2013. These include<br />

eight 13,350 ships ordered at Nantong Shipyard (NACKS) for delivery in<br />

2012-2013.<br />

The company said that it was able to “increase its market presence<br />

without sacrificing its service quality” by integrating routes and slot sales<br />

to cope with the slowdown in demand. It has also established a “CKYH<br />

Task Force to fully utilise the resources of the consortium for optimizing<br />

the allocation of shipping capacity for each route and reducing the<br />

operational risks through various measures, including early termination of<br />

charters, vessel repairs, service suspensions during off-seasons, and route<br />

capacity reduction.”<br />

The carrier has embarked on a cost savings program that had included<br />

slow steaming of vessels on 17 routes last year. It has also negotiated<br />

lower rates with its suppliers and reduced its stock of containers and<br />

chassis units, which it will continue to implement in 2009.<br />

The company offered some hope for a recovery “with the economic<br />

stimulus policies launched by various countries and the decrease in<br />

inventories of retail stores, the container shipping market will revive when<br />

the US and European economies and trades recover.” Despite this, COSCO<br />

estimates that its full year liftings will drop by 9.6% to 5.235 Mteu.<br />

P a g e | 12 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

CSAV 1Q loss to hit<br />

$265M<br />

CSCL 1Q loss hits $177M<br />

China Shipping Container Lines (CSCL) has announced a RMB 1.21 Bn<br />

($177M) loss for the first quarter of 2009, a drastic reversal from the RMB<br />

488 M ($71 M) profit recorded a year before.<br />

The company had earlier issued a profit warning to the Hong Kong stock<br />

exchange on 22 April which cautioned that “transportation volume and<br />

freight rates of the Company have suffered a sharp decrease, which<br />

resulted in an expected loss for the Company for the first quarter of<br />

2009.”<br />

The loss was attributed to “the the impact of global economy and a<br />

substantial decrease in revenue from loaded container volume and freight<br />

rate per teu as compared with the corresponding period of last year.”<br />

CSCL added that, since the second half of 2008, “the major economies of<br />

the world were extensively and rapidly adversely affected by the outbreak<br />

of the financial crisis which also manifested the tendency of further<br />

deterioration. Along with the decline of both the import and export data<br />

of China, the depressed performances of various international trade lanes<br />

directly resulted in the Company’s losses.”<br />

CSAV facing $400M loss in 1H09<br />

CSAV had disclosed at the extraordinary general meeting of shareholders<br />

on 21 April that it could be facing a loss of almost $400 M for the first six<br />

months of 2009, compared to a profit of $18 M in the same period last<br />

year.<br />

First quarter losses are expected to reach $265 M, a part of which is due<br />

to bunker hedging losses. Second quarter losses are expected to lessen to<br />

about $133 M.<br />

The company informed its shareholders that it is in discussions with banks<br />

and shipowners over a restructuring program that could see it raise $400<br />

M from shipowners through the capitalisation of future charter<br />

commitments on ships chartered by CSAV. However, the company said<br />

that the formula for such a capitalisation exercise has not yet been<br />

finalised.<br />

The company intends to raise $130M in a rights issue at a price of CL$250<br />

per share, a 30% discount to the market price.<br />

A second rights issue is planned to raise a further $220 M later in the year<br />

but no price has been fixed.<br />

Meanwhile the company confirmed that it has laid off about 660 staff<br />

worldwide including 60 in Chile.<br />

P a g e | 13 © Copyright <strong>Alphaliner</strong> 1999-2009

Liftings in M teu<br />

% Increase<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

0.276<br />

Horizon Lines<br />

Volume Growth<br />

2006-2008<br />

-3%<br />

0.286<br />

0.297<br />

-4% -4%<br />

2008 2007 2006<br />

Carrier to suspend<br />

financial guidance due to<br />

“unprecedented<br />

uncertainties”<br />

APL<br />

Monthly Operating<br />

Performance<br />

2003-2009<br />

$/TEU & $/ton<br />

Horizon Lines books $10M loss for 1Q<br />

US Jones Act domestic liner operator, Horizon Lines has announced a first<br />

quarter net loss of $10 M compared with a $0.7 M net profit last year. The<br />

loss included a $4.4 M charge related to US Department of Justice antitrust<br />

investigations and a $0.8 M restructuring charge related to staff<br />

redundancies.<br />

The company provides container shipping and logistics services within the<br />

continental US, Puerto Rico, Alaska, Hawaii and Guam. Last year, it<br />

reported profits of $3.06 M compared to $28.86 M in 2007, due largely to<br />

asset impairment and restructuring charges. Horizon Lines has seen its<br />

volumes dropping in recent years since its IPO in 2005.<br />

Despite the first quarter loss, the company said that its financial<br />

performance was “slightly above” expectations. However, it will stop<br />

providing financial forecasts as it believes that “too many unprecedented<br />

uncertainties remain in 2009 to resume our practice of providing specific<br />

annual financial guidance.” It also added that “while our first-quarter<br />

financial performance was somewhat ahead of our expectations, there can<br />

be no assurances that this can be sustained throughout the year.”<br />

APL rates and volumes continues to slip<br />

In its newly released first quarter operating performance announcement,<br />

APL’s parent company, Neptune Orient Lines reported a drastic 27% drop<br />

in liftings to 963,200 teu for the 14 week period from 27 December 2008<br />

to 3 April 2009. This represents the most drastic quarterly drop in volumes<br />

for the carrier since the merger of the NOL and APL fleet in 1997.<br />

The carrier also disclosed that average rates dropped by 16% to $1237/teu<br />

for the period compared to the same period last year. It attributed the<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

6 week reporting periods normalized for comparison<br />

TEU/month $/TEU 180cst bunker price<br />

P a g e | 14 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

500,000<br />

450,000<br />

400,000<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

TEU/month

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

poor performance to “the decline in demand on all major trade lanes in<br />

view of the current global economic downturn. Lower average revenue<br />

was due to lower core freight rates and lower bunker recovery.”NOL will<br />

announce its first quarter financial results on 12 May but had earlier issued<br />

a profit warning that quarterly losses could reach $240 M.<br />

P a g e | 15 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

DELIVERY UPDATES<br />

Recent Deliveries<br />

April 2009<br />

Name Teu Operator<br />

BELUGA NATION 474 N/A<br />

CCL NINGBO 698 Centrans<br />

O.M. UNDARUM 704 N/A<br />

CSCL YOKOHAMA 907 CSCL<br />

ALASKABORG 964 N/A<br />

MARE 974 Contaz<br />

VEGA AQUILA 997 N/A<br />

EMPIRE 1,440 N/A<br />

WARNOW MASTER 1,496 N/A<br />

MAERSK WINDHOEK 1,708 Maersk<br />

CSCL CALLAO 2,544 CSCL<br />

CITY OF SHANGHAI 2,564 HMM<br />

FESCO DIOMID 3,108 MSC<br />

ZIM DALIAN 4,253 Zim<br />

CPO PHILADELPHIA 4,255 H. Sud<br />

RUDOLF SCHEPERS 4,256 K Line<br />

COSCO FUKUYAMA 4,506 COSCO<br />

ZIM ONTARIO 4,872 Zim<br />

NYK REMUS 4,922 NYK<br />

MOL EMERALD 5,087 MOL<br />

APL WASHINGTON 6,966 APL<br />

XIN DA YANG ZHOU 8,530 CSCL<br />

HAMMERSMITH BR. 9,040 K Line<br />

CMA CGM HYDRA 10,960 CMA CGM<br />

The MOL EMERALD (5,087 teu) is delivered<br />

Seaspan Corporation is to receive the 5,087 teu MOL EMERALD, first of four<br />

units ordered at Hyundai H.I. in August 2006 with a 12 year commitment<br />

with Japanese carrier MOL.<br />

The MOL EMERALD will start her career on the MOL's intra Asia Japan-<br />

Straits 'Super Express' 1 service (JSS 1 / CHS-1), on which she will become<br />

the largest ship (this service is to be enhanced with a new set of larger<br />

ships - See related news above).<br />

CONTI ONTARIO (4,872 teu) joins Zim<br />

German owner Conti Reederei has received the 4,872 teu CONTI ONTARIO<br />

from Korean shipyard DSME (Daewoo - Okpo). She is managed by<br />

Niederelbe Schiffahrt Buxtehude and is on long term charter to Zim as ZIM<br />

ONTARIO. She will join the Zim’s ZCS pendulum in a couple of weeks. The<br />

CONTI ONTARIO is the 12th unit of its type and the second of the series to<br />

trade for Zim. The first ten vessels all trade for MSC. Some of these ships<br />

were built in South Korea, whereas others originate from DMHI, DSME’s<br />

Romanian yard at Mangalia. The CONTI ONTARIO follows the CONTI SAN<br />

FRANCISCO, delivered in February. She will be followed by two more sister<br />

ships built at DMHI for Singapore-based Seacastle, the APL OMAN and APL<br />

QATAR.<br />

CPO PHILADELPHIA (4,255teu) joins Hamburg Süd<br />

German owner Reederei Claus Peter Offen (CPO) has received the CPO<br />

PHILADELPHIA, third of ten 4,255 teu ships ordered at Hyundai H.I. by this<br />

owner in April 2007. Six of them have been chartered by Hamburg Süd and<br />

four by UASC. The CPO PHILADELPHIA is one of the Hamburg Süd units and<br />

will sail as CAP HARRIETT. She is to perform a Far East-ECSA trip to join<br />

the Med-ECSA service operated by Hamburg Süd, CMA CGM, CSAV, Maruba,<br />

Zim and Niver Lines. The ship follows the CPO NEW YORK, delivered<br />

earlier in January.<br />

CITY OF SHANGHAI (2,564 teu) joins HMM<br />

German owner Manfred Lauterjung has received the CITY OF SHANGHAI,<br />

third of five ships of 2,564 teu ordered in September 2004 at the Xiamen<br />

shipyard ('Xiamen 2500' series). The CITY OF SHANGHAI has joined her<br />

charterer Hyundai M.M. for employment on the NYK / HMM service (New<br />

Horizon Express – NHX).<br />

The CITY OF SHANGHAI follows the CITY OF GUANGZHOU, delivered in<br />

July. Nine ships of this design have been ordered so far : five by Manfred<br />

P a g e | 16 © Copyright <strong>Alphaliner</strong> 1999-2009

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

Lauterjung, two by Zodiac Maritime and two by UK-based investing<br />

company Marine Capital Ltd (which acquired them from Zodiac).<br />

CSCL YOKOHAMA (907 teu) delivered<br />

CSCL is to take in charge the chartered 907 teu CSCL YOKOHAMA, last of a<br />

series of four feeders built at Nanjing by the Wujiazhui Shipyard for the<br />

account of Great Horse Shipping. She is assigned to a CSCL weekly shuttle<br />

connecting Ningbo and Shanghai to Osaka and Kobe. She follows the CSCL<br />

NAGOYA, delivered in October 2008.<br />

P a g e | 17 © Copyright <strong>Alphaliner</strong> 1999-2009