AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

No. of Vessels<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

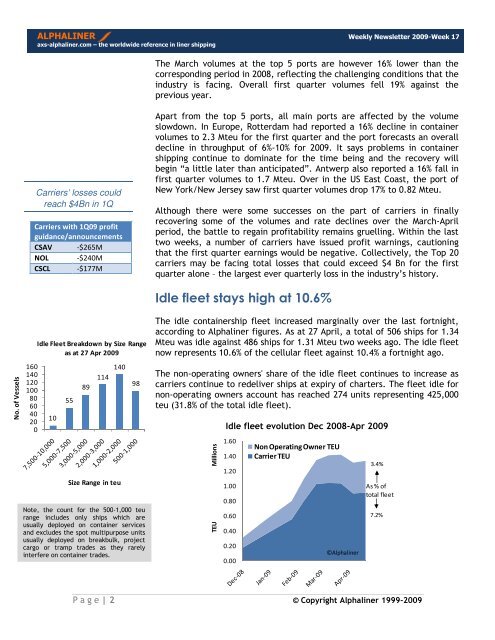

Carriers’ losses could<br />

reach $4Bn in 1Q<br />

Carriers with 1Q09 profit<br />

guidance/announcements<br />

CSAV -$265M<br />

NOL -$240M<br />

CSCL -$177M<br />

Idle Fleet Breakdown by Size Range<br />

as at 27 Apr 2009<br />

10<br />

55<br />

89<br />

114<br />

140<br />

Size Range in teu<br />

98<br />

Note, the count for the 500-1,000 teu<br />

range includes only ships which are<br />

usually deployed on container services<br />

and excludes the spot multipurpose units<br />

usually deployed on breakbulk, project<br />

cargo or tramp trades as they rarely<br />

interfere on container trades.<br />

The March volumes at the top 5 ports are however 16% lower than the<br />

corresponding period in 2008, reflecting the challenging conditions that the<br />

industry is facing. Overall first quarter volumes fell 19% against the<br />

previous year.<br />

Apart from the top 5 ports, all main ports are affected by the volume<br />

slowdown. In Europe, Rotterdam had reported a 16% decline in container<br />

volumes to 2.3 Mteu for the first quarter and the port forecasts an overall<br />

decline in throughput of 6%-10% for 2009. It says problems in container<br />

shipping continue to dominate for the time being and the recovery will<br />

begin “a little later than anticipated”. Antwerp also reported a 16% fall in<br />

first quarter volumes to 1.7 Mteu. Over in the US East Coast, the port of<br />

New York/New Jersey saw first quarter volumes drop 17% to 0.82 Mteu.<br />

Although there were some successes on the part of carriers in finally<br />

recovering some of the volumes and rate declines over the March-April<br />

period, the battle to regain profitability remains gruelling. Within the last<br />

two weeks, a number of carriers have issued profit warnings, cautioning<br />

that the first quarter earnings would be negative. Collectively, the Top 20<br />

carriers may be facing total losses that could exceed $4 Bn for the first<br />

quarter alone – the largest ever quarterly loss in the industry’s history.<br />

Idle fleet stays high at 10.6%<br />

The idle containership fleet increased marginally over the last fortnight,<br />

according to <strong>Alphaliner</strong> figures. As at 27 April, a total of 506 ships for 1.34<br />

Mteu was idle against 486 ships for 1.31 Mteu two weeks ago. The idle fleet<br />

now represents 10.6% of the cellular fleet against 10.4% a fortnight ago.<br />

The non-operating owners' share of the idle fleet continues to increase as<br />

carriers continue to redeliver ships at expiry of charters. The fleet idle for<br />

non-operating owners account has reached 274 units representing 425,000<br />

teu (31.8% of the total idle fleet).<br />

TEU Millions<br />

Idle fleet evolution Dec 2008-Apr 2009<br />

1.60<br />

1.40<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

0.00<br />

Non Operating Owner TEU<br />

Carrier TEU<br />

©<strong>Alphaliner</strong><br />

P a g e | 2 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

3.4%<br />

As % of<br />

total fleet<br />

7.2%