AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

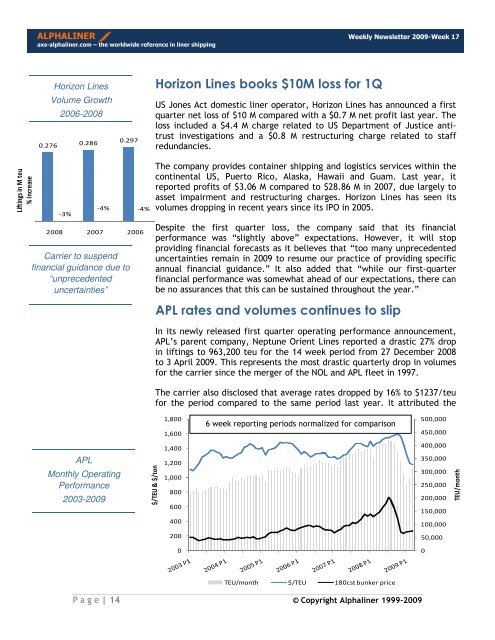

Liftings in M teu<br />

% Increase<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

0.276<br />

Horizon Lines<br />

Volume Growth<br />

2006-2008<br />

-3%<br />

0.286<br />

0.297<br />

-4% -4%<br />

2008 2007 2006<br />

Carrier to suspend<br />

financial guidance due to<br />

“unprecedented<br />

uncertainties”<br />

APL<br />

Monthly Operating<br />

Performance<br />

2003-2009<br />

$/TEU & $/ton<br />

Horizon Lines books $10M loss for 1Q<br />

US Jones Act domestic liner operator, Horizon Lines has announced a first<br />

quarter net loss of $10 M compared with a $0.7 M net profit last year. The<br />

loss included a $4.4 M charge related to US Department of Justice antitrust<br />

investigations and a $0.8 M restructuring charge related to staff<br />

redundancies.<br />

The company provides container shipping and logistics services within the<br />

continental US, Puerto Rico, Alaska, Hawaii and Guam. Last year, it<br />

reported profits of $3.06 M compared to $28.86 M in 2007, due largely to<br />

asset impairment and restructuring charges. Horizon Lines has seen its<br />

volumes dropping in recent years since its IPO in 2005.<br />

Despite the first quarter loss, the company said that its financial<br />

performance was “slightly above” expectations. However, it will stop<br />

providing financial forecasts as it believes that “too many unprecedented<br />

uncertainties remain in 2009 to resume our practice of providing specific<br />

annual financial guidance.” It also added that “while our first-quarter<br />

financial performance was somewhat ahead of our expectations, there can<br />

be no assurances that this can be sustained throughout the year.”<br />

APL rates and volumes continues to slip<br />

In its newly released first quarter operating performance announcement,<br />

APL’s parent company, Neptune Orient Lines reported a drastic 27% drop<br />

in liftings to 963,200 teu for the 14 week period from 27 December 2008<br />

to 3 April 2009. This represents the most drastic quarterly drop in volumes<br />

for the carrier since the merger of the NOL and APL fleet in 1997.<br />

The carrier also disclosed that average rates dropped by 16% to $1237/teu<br />

for the period compared to the same period last year. It attributed the<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

6 week reporting periods normalized for comparison<br />

TEU/month $/TEU 180cst bunker price<br />

P a g e | 14 © Copyright <strong>Alphaliner</strong> 1999-2009<br />

500,000<br />

450,000<br />

400,000<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

TEU/month