AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

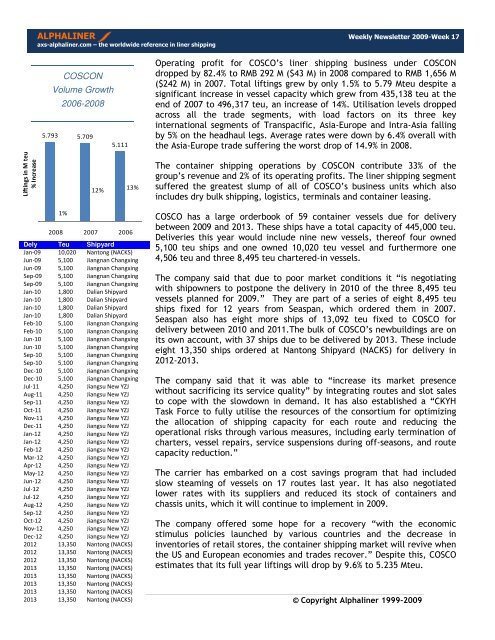

Liftings in M teu<br />

% Increase<br />

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 17<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

5.793 5.709<br />

1%<br />

COSCON<br />

Volume Growth<br />

2006-2008<br />

12%<br />

5.111<br />

13%<br />

2008 2007 2006<br />

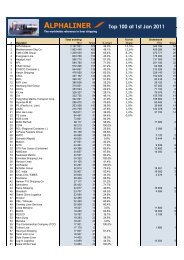

Dely Teu Shipyard<br />

Jan-09 10,020 Nantong (NACKS)<br />

Jun-09 5,100 Jiangnan Changxing<br />

Jun-09 5,100 Jiangnan Changxing<br />

Sep-09 5,100 Jiangnan Changxing<br />

Sep-09 5,100 Jiangnan Changxing<br />

Jan-10 1,800 Dalian Shipyard<br />

Jan-10 1,800 Dalian Shipyard<br />

Jan-10 1,800 Dalian Shipyard<br />

Jan-10 1,800 Dalian Shipyard<br />

Feb-10 5,100 Jiangnan Changxing<br />

Feb-10 5,100 Jiangnan Changxing<br />

Jun-10 5,100 Jiangnan Changxing<br />

Jun-10 5,100 Jiangnan Changxing<br />

Sep-10 5,100 Jiangnan Changxing<br />

Sep-10 5,100 Jiangnan Changxing<br />

Dec-10 5,100 Jiangnan Changxing<br />

Dec-10 5,100 Jiangnan Changxing<br />

Jul-11 4,250 Jiangsu New YZJ<br />

Aug-11 4,250 Jiangsu New YZJ<br />

Sep-11 4,250 Jiangsu New YZJ<br />

Oct-11 4,250 Jiangsu New YZJ<br />

Nov-11 4,250 Jiangsu New YZJ<br />

Dec-11 4,250 Jiangsu New YZJ<br />

Jan-12 4,250 Jiangsu New YZJ<br />

Jan-12 4,250 Jiangsu New YZJ<br />

Feb-12 4,250 Jiangsu New YZJ<br />

Mar-12 4,250 Jiangsu New YZJ<br />

Apr-12 4,250 Jiangsu New YZJ<br />

May-12 4,250 Jiangsu New YZJ<br />

Jun-12 4,250 Jiangsu New YZJ<br />

Jul-12 4,250 Jiangsu New YZJ<br />

Jul-12 4,250 Jiangsu New YZJ<br />

Aug-12 4,250 Jiangsu New YZJ<br />

Sep-12 4,250 Jiangsu New YZJ<br />

Oct-12 4,250 Jiangsu New YZJ<br />

Nov-12 4,250 Jiangsu New YZJ<br />

Dec-12 4,250 Jiangsu New YZJ<br />

2012 13,350 Nantong (NACKS)<br />

2012 13,350 Nantong (NACKS)<br />

2012 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

2013 13,350 Nantong (NACKS)<br />

Operating profit for COSCO’s liner shipping business under COSCON<br />

dropped by 82.4% to RMB 292 M ($43 M) in 2008 compared to RMB 1,656 M<br />

($242 M) in 2007. Total liftings grew by only 1.5% to 5.79 Mteu despite a<br />

significant increase in vessel capacity which grew from 435,138 teu at the<br />

end of 2007 to 496,317 teu, an increase of 14%. Utilisation levels dropped<br />

across all the trade segments, with load factors on its three key<br />

international segments of Transpacific, Asia-Europe and Intra-Asia falling<br />

by 5% on the headhaul legs. Average rates were down by 6.4% overall with<br />

the Asia-Europe trade suffering the worst drop of 14.9% in 2008.<br />

The container shipping operations by COSCON contribute 33% of the<br />

group’s revenue and 2% of its operating profits. The liner shipping segment<br />

suffered the greatest slump of all of COSCO’s business units which also<br />

includes dry bulk shipping, logistics, terminals and container leasing.<br />

COSCO has a large orderbook of 59 container vessels due for delivery<br />

between 2009 and 2013. These ships have a total capacity of 445,000 teu.<br />

Deliveries this year would include nine new vessels, thereof four owned<br />

5,100 teu ships and one owned 10,020 teu vessel and furthermore one<br />

4,506 teu and three 8,495 teu chartered-in vessels.<br />

The company said that due to poor market conditions it “is negotiating<br />

with shipowners to postpone the delivery in 2010 of the three 8,495 teu<br />

vessels planned for 2009.” They are part of a series of eight 8,495 teu<br />

ships fixed for 12 years from Seaspan, which ordered them in 2007.<br />

Seaspan also has eight more ships of 13,092 teu fixed to COSCO for<br />

delivery between 2010 and 2011.The bulk of COSCO’s newbuildings are on<br />

its own account, with 37 ships due to be delivered by 2013. These include<br />

eight 13,350 ships ordered at Nantong Shipyard (NACKS) for delivery in<br />

2012-2013.<br />

The company said that it was able to “increase its market presence<br />

without sacrificing its service quality” by integrating routes and slot sales<br />

to cope with the slowdown in demand. It has also established a “CKYH<br />

Task Force to fully utilise the resources of the consortium for optimizing<br />

the allocation of shipping capacity for each route and reducing the<br />

operational risks through various measures, including early termination of<br />

charters, vessel repairs, service suspensions during off-seasons, and route<br />

capacity reduction.”<br />

The carrier has embarked on a cost savings program that had included<br />

slow steaming of vessels on 17 routes last year. It has also negotiated<br />

lower rates with its suppliers and reduced its stock of containers and<br />

chassis units, which it will continue to implement in 2009.<br />

The company offered some hope for a recovery “with the economic<br />

stimulus policies launched by various countries and the decrease in<br />

inventories of retail stores, the container shipping market will revive when<br />

the US and European economies and trades recover.” Despite this, COSCO<br />

estimates that its full year liftings will drop by 9.6% to 5.235 Mteu.<br />

P a g e | 12 © Copyright <strong>Alphaliner</strong> 1999-2009