AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

AXS-Alphaliner Newsl..

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ALPHALINER Weekly <strong>Newsl</strong>etter 2009-Week 16<br />

axs-alphaliner.com – the worldwide reference in liner shipping<br />

CORPORATE UPDATES<br />

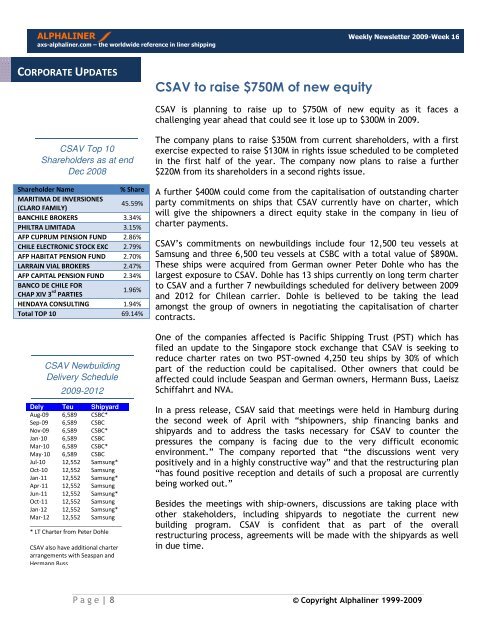

CSAV Top 10<br />

Shareholders as at end<br />

Dec 2008<br />

Shareholder Name % Share<br />

MARITIMA DE INVERSIONES<br />

(CLARO FAMILY)<br />

45.59%<br />

BANCHILE BROKERS 3.34%<br />

PHILTRA LIMITADA 3.15%<br />

AFP CUPRUM PENSION FUND 2.86%<br />

CHILE ELECTRONIC STOCK EXC 2.79%<br />

AFP HABITAT PENSION FUND 2.70%<br />

LARRAIN VIAL BROKERS 2.47%<br />

AFP CAPITAL PENSION FUND 2.34%<br />

BANCO DE CHILE FOR<br />

CHAP XIV 3 rd PARTIES<br />

1.96%<br />

HENDAYA CONSULTING 1.94%<br />

Total TOP 10 69.14%<br />

CSAV Newbuilding<br />

Delivery Schedule<br />

2009-2012<br />

Dely Teu Shipyard<br />

Aug-09 6,589 CSBC*<br />

Sep-09 6,589 CSBC<br />

Nov-09 6,589 CSBC*<br />

Jan-10 6,589 CSBC<br />

Mar-10 6,589 CSBC*<br />

May-10 6,589 CSBC<br />

Jul-10 12,552 Samsung*<br />

Oct-10 12,552 Samsung<br />

Jan-11 12,552 Samsung*<br />

Apr-11 12,552 Samsung<br />

Jun-11 12,552 Samsung*<br />

Oct-11 12,552 Samsung<br />

Jan-12 12,552 Samsung*<br />

Mar-12 12,552 Samsung<br />

_______________________________<br />

* LT Charter from Peter Dohle<br />

CSAV also have additional charter<br />

arrangements with Seaspan and<br />

Hermann Buss<br />

CSAV to raise $750M of new equity<br />

CSAV is planning to raise up to $750M of new equity as it faces a<br />

challenging year ahead that could see it lose up to $300M in 2009.<br />

The company plans to raise $350M from current shareholders, with a first<br />

exercise expected to raise $130M in rights issue scheduled to be completed<br />

in the first half of the year. The company now plans to raise a further<br />

$220M from its shareholders in a second rights issue.<br />

A further $400M could come from the capitalisation of outstanding charter<br />

party commitments on ships that CSAV currently have on charter, which<br />

will give the shipowners a direct equity stake in the company in lieu of<br />

charter payments.<br />

CSAV’s commitments on newbuildings include four 12,500 teu vessels at<br />

Samsung and three 6,500 teu vessels at CSBC with a total value of $890M.<br />

These ships were acquired from German owner Peter Dohle who has the<br />

largest exposure to CSAV. Dohle has 13 ships currently on long term charter<br />

to CSAV and a further 7 newbuildings scheduled for delivery between 2009<br />

and 2012 for Chilean carrier. Dohle is believed to be taking the lead<br />

amongst the group of owners in negotiating the capitalisation of charter<br />

contracts.<br />

One of the companies affected is Pacific Shipping Trust (PST) which has<br />

filed an update to the Singapore stock exchange that CSAV is seeking to<br />

reduce charter rates on two PST-owned 4,250 teu ships by 30% of which<br />

part of the reduction could be capitalised. Other owners that could be<br />

affected could include Seaspan and German owners, Hermann Buss, Laeisz<br />

Schiffahrt and NVA.<br />

In a press release, CSAV said that meetings were held in Hamburg during<br />

the second week of April with “shipowners, ship financing banks and<br />

shipyards and to address the tasks necessary for CSAV to counter the<br />

pressures the company is facing due to the very difficult economic<br />

environment.” The company reported that “the discussions went very<br />

positively and in a highly constructive way” and that the restructuring plan<br />

“has found positive reception and details of such a proposal are currently<br />

being worked out.”<br />

Besides the meetings with ship-owners, discussions are taking place with<br />

other stakeholders, including shipyards to negotiate the current new<br />

building program. CSAV is confident that as part of the overall<br />

restructuring process, agreements will be made with the shipyards as well<br />

in due time.<br />

P a g e | 8 © Copyright <strong>Alphaliner</strong> 1999-2009