Notes to the financial statements - Plasmon

Notes to the financial statements - Plasmon

Notes to the financial statements - Plasmon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>financial</strong> <strong>statements</strong> continued<br />

for <strong>the</strong> year ended 31 March 2003<br />

1,469,500 share options were granted during <strong>the</strong> year under <strong>the</strong> 1998 Employee Share Option Scheme (<strong>the</strong> "1998 Scheme"). The 1998<br />

Scheme allows for <strong>the</strong> granting of share options up <strong>to</strong> 15% of <strong>the</strong> issued ordinary share capital, normally within 42 days following <strong>the</strong><br />

preliminary announcement of <strong>the</strong> final or interim results of <strong>the</strong> Company. No payment is required for <strong>the</strong> grant of <strong>the</strong> share options and<br />

subscription price per share is set at prevailing market rates. These options, as with those issued during <strong>the</strong> previous year, require <strong>the</strong> launch of<br />

UDO drives and media before <strong>the</strong> options can be exercised.<br />

The share options granted in <strong>the</strong> four years ended 31 March 2001 (at subscription prices per share of £0.465, £0.77, £1.37, £2.74 and £1.14)<br />

also have performance criteria attached <strong>to</strong> <strong>the</strong>m. Exercise of <strong>the</strong>se share options is conditional on earnings per share for <strong>the</strong> Group over any<br />

three consecutive years following grant having grown by an average of at least 6 percentage points above inflation. The earnings per share<br />

criteria will be adjusted <strong>to</strong> remove <strong>the</strong> impact of <strong>the</strong> UDO programme. In addition group profits for any <strong>financial</strong> year have <strong>to</strong> exceed <strong>the</strong> levels<br />

shown in <strong>the</strong> table below:<br />

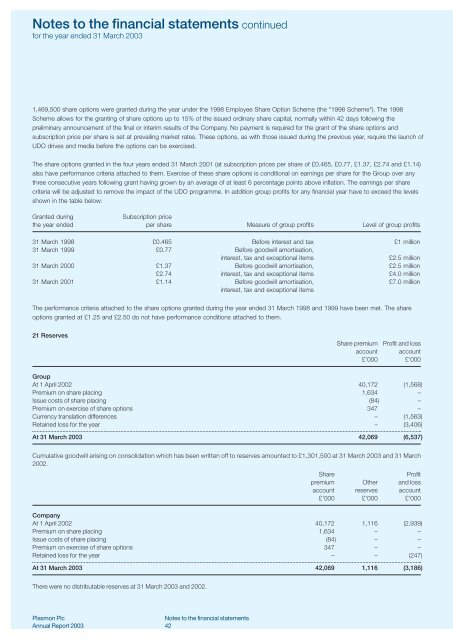

Granted during Subscription price<br />

<strong>the</strong> year ended per share Measure of group profits Level of group profits<br />

31 March 1998 £0.465 Before interest and tax £1 million<br />

31 March 1999 £0.77 Before goodwill amortisation,<br />

interest, tax and exceptional items £2.5 million<br />

31 March 2000 £1.37 Before goodwill amortisation, £2.5 million<br />

£2.74 interest, tax and exceptional items £4.0 million<br />

31 March 2001 £1.14 Before goodwill amortisation, £7.0 million<br />

interest, tax and exceptional items<br />

The performance criteria attached <strong>to</strong> <strong>the</strong> share options granted during <strong>the</strong> year ended 31 March 1998 and 1999 have been met. The share<br />

options granted at £1.25 and £2.50 do not have performance conditions attached <strong>to</strong> <strong>the</strong>m.<br />

21 Reserves<br />

Share premium Profit and loss<br />

account account<br />

£’000 £’000<br />

Group<br />

At 1 April 2002 40,172 (1,568)<br />

Premium on share placing 1,634 –<br />

Issue costs of share placing (84) –<br />

Premium on exercise of share options 347 –<br />

Currency translation differences – (1,563)<br />

Retained loss for <strong>the</strong> year – (3,406)<br />

At 31 March 2003 42,069 (6,537)<br />

Cumulative goodwill arising on consolidation which has been written off <strong>to</strong> reserves amounted <strong>to</strong> £1,301,500 at 31 March 2003 and 31 March<br />

2002.<br />

Share Profit<br />

premium O<strong>the</strong>r and loss<br />

account reserves account<br />

£’000 £’000 £’000<br />

Company<br />

At 1 April 2002 40,172 1,116 (2,939)<br />

Premium on share placing 1,634 – –<br />

Issue costs of share placing (84) – –<br />

Premium on exercise of share options 347 – –<br />

Retained loss for <strong>the</strong> year – – (247)<br />

At 31 March 2003 42,069 1,116 (3,186)<br />

There were no distributable reserves at 31 March 2003 and 2002.<br />

<strong>Plasmon</strong> Plc<br />

Annual Report 2003<br />

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>financial</strong> <strong>statements</strong><br />

42