Inglewood Business Magazine July-Sept

First Edition Final.pdf

First Edition Final.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

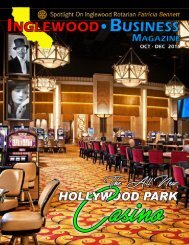

INGLEWOOD<br />

BUSINESS MAGAZINE<br />

After mortgage rates stayed surprisingly low in 2014, who knows how they will<br />

shake out in the new year? Either way, borrowers who want to refinance or buy a<br />

home have the best chance to get the lowest rate by knowing more, not less, about the<br />

mortgage game. These 10 tips can help you navigate the mortgage process in 2015.<br />

1 . Don’t buy a home beyond your<br />

budget. A home should be a source of<br />

investment not a financial heart ache,<br />

especial for first-time buyers.<br />

Borrowing from family members<br />

and living from pay check to pay check<br />

makes for larger mortgage payments<br />

and bigger risks in the future.<br />

2. Always be on the lookout for<br />

competitive rates, points and fees.<br />

Compare different bids.<br />

3. Obtain an immediate<br />

confirmation of your locked in interest<br />

rate terms, point and fees.<br />

4. Never agree to prepayment<br />

penalties. If there is no mention of<br />

prepayment penalties, make sure you<br />

have an addendum attached to the<br />

mortgage that specifically states that<br />

no other penalty fees will be added.<br />

5. Know all that you can about your<br />

loan! Ask thorough questions and<br />

seek advice from professionals that<br />

you trust.<br />

6. Pick the right kind of loan. Rates<br />

are higher on 30 year loans than on<br />

comparable 1 5 year loans. Lenders<br />

hate holding loans at below market<br />

rates. Try considering “hybrid” loans<br />

–those with a fixed rate for the first five<br />

or seven years of their 30 year<br />

duration. If you’re going to be in your<br />

home for a shorter period consider an<br />

adjustable rate mortgage.<br />

7. If you are buying rather than<br />

refinancing, consider getting preapproved<br />

mortgage or contingent loan<br />

approval letter. Pre–approval can<br />

strengthen your negotiating position<br />

with the seller, however it can add<br />

pressure on you to close a deal before<br />

the loan commitment expires. A<br />

contingent approval is a letter from the<br />

lender that states that the largest loan<br />

that you would qualify for. It will also<br />

give you additional negotiating<br />

leverage without binding you to the<br />

lender or the lender binded to you.<br />

8. Save all of your documents!<br />

<strong>Inglewood</strong> <strong>Business</strong> <strong>Magazine</strong> <strong>July</strong> - <strong>Sept</strong>ember 2015<br />

21