Download PDF - DLF

Download PDF - DLF

Download PDF - DLF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ContentsCompany Information ----------------------------------------------------------------------------------------- 3Message from the Chairman -------------------------------------------------------------------------------- 4Board of Directors --------------------------------------------------------------------------------------------- 6Notice of the Annual General Meeting -------------------------------------------------------------------- 7Directors’ Report --------------------------------------------------------------------------------------------- 12Management Discussion & Analysis Report ---------------------------------------------------------- 22Corporate Governance Report --------------------------------------------------------------------------- 32Financial Statements ---------------------------------------------------------------------------------------- 54Auditors’ Report ---------------------------------------------------------------------------------------------- 55Balance Sheet ------------------------------------------------------------------------------------------------ 60Statement of Pro t & Loss --------------------------------------------------------------------------------- 61Cash Flow Statement --------------------------------------------------------------------------------------- 62Notes ------------------------------------------------------------------------------------------------------------ 64Consolidated Financial Statements -------------------------------------------------------------------- 114Details of Subsidiary Companies -----------------------------------------------------------------------186

Company InformationBoard of DirectorsExecutive DirectorsDr. K.P. SinghChairmanMr. Rajiv SinghVice ChairmanMr. T.C. GoyalManaging DirectorMs. Pia SinghWhole-time DirectorMr. Kameshwar SwarupGroup Executive Director - Legal(upto 31/12/2011)Non-Executive DirectorsMr. G.S. TalwarDr. D.V. KapurMr. K.N. MemaniMr. M.M. SabharwalMr. Ravinder Narain(upto 04/08/2011)Mr. B. BhushanBrig. (Retd.) N.P. SinghReference InformationRegistered OfceShopping Mall, 3 rd Floor, Arjun MargPhase-I, <strong>DLF</strong> City, Gurgaon-122 002(Haryana)Corporate Ofce<strong>DLF</strong> Centre, Sansad MargNew Delhi-110 001Statutory AuditorsM/s. Walker, Chandiok & CoRegistrar & Share Transfer AgentKarvy Computershare Private Ltd.Listed atBombay Stock ExchangeNational Stock ExchangeCompany SecretaryMr. Subhash Setia3

Message from the ChairmanDr. K.P. Singh, ChairmanDear Shareholders,At a time when the Indian economy is experiencing a slowdown due to global and domestic turbulence andpolicy formulations aimed at curbing inationary pressures having a depressing impact on productivity andgrowth the real estate sector too is faced with formidable challenges.As indicated in my Message to you last year, your Company had foreseen the possibility of a moderation ofthe growth momentum and had put into place prudent corporate strategies to mitigate risks by off-loadingcertain non-core assets and focusing on key strengths while at the same time ensuring the success ofproduct launches.During the year gone by, higher input and interest costs resulting from continuing high in ation had anadverse impact on prots, but I am glad to report that your Company has been able to sustain operationalstability, thanks to our strong market position, geographic spread of scale and low-cost but high qualityland banks in prime locations pan India.Uninterrupted access to affordable nance is vital for the health of the urban infrastructure and housingsector. In my view, care should be taken in formulating monetary policies to ensure that tightening of creditaimed at combating ination does not have the unintended side-effect of stunting the growth of the realestate development industry.4

It is my rm belief that the housing and construction sector is poised to become the next big driver ofgrowth in India. The Economic Survey for 2011-12 credits the housing sector for contributing about5 percent to India’s GDP. With linkages to more than 250 ancillary industries, the housing and urban infrastructuresector has a major multiplier effect on the entire economy, providing jobs across the spectrum,right from highly qualied engineers and architects to unskilled labourers, thereby promoting the cause ofinclusive growth.Your Company continues to take signicant strides in carrying out its social outreach commitments. Amonga wide range of targeted programmes undertaken by the <strong>DLF</strong> Foundation, ongoing rural healthcare andeducation schemes have been pro-actively pursued by setting up well-equipped primary health centres andproviding special medical and schooling facilities for children of construction workers at sites. Two agshipprogrammes -- “<strong>DLF</strong> Life” (for imparting job oriented skills) and “Raghvendra Scholars” (for meritoriousstudents among the underprivileged) -- were successfully implemented during the year. An ambitiousGurgaon Renewal Mission was launched to involve all stakeholders in holistic efforts towards urban revivaland environmental enrichment.Your Company remains committed to the underlying values of providing exemplary customer service,achieving business objectives with social responsibility and enhancing stakeholder value.I look forward to your continued support in the year ahead and wish you the very best.With best wishes,Sincerely,New Delhi(Dr. K.P. Singh)6 th August, 2012 Chairman5

Board of Directors(Sitting L-R) : Ms. Pia Singh, Mr. Rajiv Singh, Dr. K.P. Singh, Mr. T.C. Goyal, Mr. M.M. Sabharwal(Standing L-R) : Mr. G.S. Talwar, Mr. K.N. Memani, Dr. D.V. Kapur, Brig. (Retd.) N.P. Singh, Mr. B. Bhushan6

NoticeNotice is hereby given that the Forty-seventhAnnual General Meeting of <strong>DLF</strong> Limited will beheld on Friday, the 7 th September, 2012 at 10:30A.M. at Epicentre, Apparel House, Sector-44,Gurgaon – 122 003 (Haryana) to transact thefollowing business:Ordinary Business1. To receive, consider and adopt the AuditedBalance Sheet as at 31 st March, 2012, theStatement of Prot & Loss for the year endedon that date together with the Reports ofDirectors and Auditors thereon.2. To declare dividend.3. To appoint a Director in place of Dr. D.V. Kapur,who retires by rotation and being eligible,offers himself for re-appointment.4. To appoint a Director in place of Mr. RajivSingh, who retires by rotation and beingeligible, offers himself for re-appointment.5. To consider and if thought t, to pass with orwithout modication(s), the following resolutionas an Ordinary Resolution:“RESOLVED THAT Mr. M.M. Sabharwal, aDirector who retires by rotation at the AnnualGeneral Meeting has expressed his desirenot to offer himself for re-appointment as aDirector and the resulting vacancy be not lledup at the meeting.”6. To appoint Auditors of the Company to holdofce from the conclusion of this meetinguntil the conclusion of the next AnnualGeneral Meeting and to x their remuneration.M/s. Walker, Chandiok & Co, the retiringAuditors are eligible for re-appointment.Special Business7. To consider and if thought t, to pass with orwithout modi cation(s), the following resolutionas a Special Resolution:“RESOLVED THAT pursuant to the provisionsof Section 314(1) and other applicableprovisions, if any, of the Companies Act, 1956(including any statutory modi cation or reenactmentthereof, for the time being in force),consent of the Company, be and is herebyaccorded to the elevation of Mr. Rahul Talwaras General Manager (Marketing), <strong>DLF</strong> IndiaLimited (DIL), a subsidiary Company w.e.f.1 st April, 2012 at a remuneration and on theterms & conditions as set out in the ExplanatoryStatement annexed to the Notice.RESOLVED FURTHER THAT the Board ofDirectors of the Company including any dulyconstituted committee thereof (hereinafterreferred to as “the Board”) be and is herebyauthorised to take all such steps as may benecessary, proper or expedient to give effectto this resolution.”By Order of the Boardfor <strong>DLF</strong> LIMITEDNew DelhiSubhash Setia6 th August, 2012 Company Secretary7

Notes:1. A Member entitled to attend and vote at themeeting is entitled to appoint a proxy toattend and vote on a poll instead of himselfand the proxy need not be a Member of theCompany. The instrument of proxy in orderto be effective should be deposited at theRegistered Ofce of the Company not laterthan 48 hours before the commencement ofthe meeting. Blank proxy Form is attached.2. The Explanatory Statement pursuant toSection 173(2) of the Companies Act, 1956 inrespect of business under Item Nos. 5 and 7set out above to be transacted at the meeting isannexed hereto and forms part of this Notice.3. The details of Directors seeking reappointment,in terms of Clause 49 of theListing Agreement, are annexed hereto andform part of this Notice.4. Karvy Computershare Private Limited (Karvy),Plot No. 17–24, Vittalrao Nagar, Madhapur,Hyderabad-500 081, Phone No. 040-44655000Fax No. 040-23420814; E-mail: einward.ris@karvy.com; Website: www.karvy.com, is theRegistrar and Share Transfer Agent (RTA) forPhysical Shares. Karvy is also the depositoryinterface of the Company with both NationalSecurities Depository Limited (NSDL) andCentral Depository Services (India) Limited(CDSL). However, keeping in view theconvenience of the shareholders, documentsrelating to shares will continue to be acceptedby Karvy Computershare Private Limited, at(i) 105-108, 1 st Floor, Arunachal Building, 19,Barakhamba Road, Connaught Place, NewDelhi – 110 001, Ph.: 011-43509200; (ii) atthe Registered Ofce of the Company; andalso (iii) at Corporate Affairs Department,1-E, Jhandewalan Extension, Naaz CinemaComplex, New Delhi – 110 055.5. Corporate Members intending to send theirauthorised representatives to attend themeeting are requested to send a certiedcopy of Board Resolution authorising theirrepresentatives to attend and vote on theirbehalf at the meeting.6. The Register of Members and Share TransferBooks of the Company will remain closedfrom Tuesday, 28 th August, 2012 to Friday,7 th September, 2012 (both days inclusive) fordetermining eligibility for payment of dividend,if declared at the meeting.7. The dividend, if declared at the meeting, willbe paid on or before Saturday, 6 th October,2012 to those Members or their mandates: (a)whose names appear as Bene cial Ownersat the end of the business hours on Monday,the 27 th August, 2012 in the list of Bene cialOwners to be furnished by the Depositories(NSDL and CDSL) in respect of the sharesheld in electronic form; and (b) whose namesappear as Members on the Company’sRegister of Members after giving effect tovalid transfer requests in physical form lodgedwith the Company or its Registrar & ShareTransfer Agent (RTA) on or before Monday,27 th August, 2012.8. Relevant documents referred to in theaccompanying Notice and ExplanatoryStatement are open for inspection by theMembers at the Registered Of ce of theCompany on all working days, between14:00 -16:00 hrs. up to the date of the meeting.The requisite statutory registers shall also beopen for inspection during the meeting.9. The Auditors’ Certi cate required under Clause14 of the SEBI (Employees Stock OptionsScheme and Employees Stock PurchaseScheme) Guidelines, 1999 shall be placed atthe Annual General Meeting.10. Members holding shares in dematerialisedform are requested to intimate all changespertaining to their bank details, NationalElectronic Clearing Service (NECS),Electronic Clearing Service (ECS), mandates,nominations, power of attorney, change ofaddress, change of name and e-mail addressetc., to their respective Depository Participants.Changes intimated to the DepositoryParticipants will be automatically re ectedin the Company’s record which will help theCompany and Karvy to provide ef cient and8

etter services. Members holding shares inphysical form are also requested to intimatesuch changes to Karvy under the signaturesof rst/joint holder(s).11. Reserve Bank of India has initiated NECS forcredit of dividend directly to the bank accountsof the Members. Members are requestedto register their bank account details (CoreBanking Solutions enabled account number,9 digit MICR and 11 digit IFS Code), inrespect of shares held in dematerialised formwith their respective Depository Participantsand in respect of shares held in physical formwith Karvy.12. Members desirous of obtaining anyinformation/ clarication(s)/ intending to raiseany query concerning the annual accounts andoperations of the Company, are requested toforward the same at least 7 days prior to thedate of meeting to the Company Secretary atthe Registered Ofce of the Company, so thatthe same may be attended appropriately.13. Pursuant to provisions of Section 205A(5) and205C of the Companies Act, 1956 the Companyhas transferred unpaid/unclaimed dividendup to nancial year 2003-04 to the InvestorEducation and Protection Fund (the ‘Fund’)of the Central Government. The unpaid/unclaimed dividends for the nancial year2004-05 and thereafter, which remainsunpaid or unclaimed for a period of 7 yearsfrom the date it became due for paymentwill be transferred by the Company to theFund. Members who have not encasheddividend warrants may approach to theRTA for obtaining payment thereof.The details of unpaid / unclaimed dividends fornancial year 2004-05 onwards can be viewedon Company’s website i.e. www.dlf.in, whichwas uploaded in compliance to the provisionsof the Investor Education and Protection Fund(Uploading of information regarding unpaidand unclaimed amount lying with Companies)Rules, 2012.Please note that no claim shall lie in respectof unpaid or unclaimed dividend after itstransfer to the Fund.14. The Ministry of Corporate Affairs (MCA)has introduced ‘Green Initiative’ wherebythe documents are permitted to be servedon the Members through electronic modei.e., e-mail. This initiative is a step towardsprotection of environment and enabling fastercommunication with the Members.Accordingly, the Company proposed to serveall the documents to e-mail addresses ofthe Members. Members are requested toprovide / update their e-mail addresses withtheir respective Depository Participants (DPs)or send an e-mail at dlf.cs@karvy.com toget the Annual Report and other documentson such e-mail address. Members holdingshares in physical form are also requested tointimate their e-mail address to Karvy eitherby e-mail at dlf.cs@karvy.com or by sendinga communication at the address mentioned atNote 4 above.15. Members are requested:(a) To bring Attendance Slip duly completedand signed at the meeting and not tocarry briefcase or bag inside the meetingvenue for security reasons;(b) To quote their Folio No./DP Id - Client Idin all correspondence; and(c) To please note that no gift or gift couponswill be distributed at the meeting.9

EXPLANATORY STATEMENT[Pursuant to Section 173(2) of the Companies Act, 1956]Item No. 5Since Mr. M.M. Sabharwal, Director retiring byrotation has not offered himself for re-appointmentand it is decided not to ll the vacancy at themeeting, the above resolution in terms of Section256 of the Companies Act, 1956 read with Clause105 of the Articles of Association of the Company,is proposed.None of the Directors of the Company, exceptMr. M.M. Sabharwal is interested or concerned inpassing of the said Ordinary Resolution.The Board of Directors of your Companycommends the resolution for approval.Item No. 7Mr. Rahul Talwar, Senior Management Trainee,<strong>DLF</strong> India Ltd. (DIL) has been elevated to GeneralManager (Marketing) with effect from 1 st April, 2012.The Board of Directors on the recommendation ofthe Remuneration Committee, in its meeting heldon 30 th May, 2012, subject to your approval, hasapproved his elevation on the following terms andconditions:Particulars(`/month)Basic Salary 30,000House Rent Allowance70% of Basic SalaryPersonal Allowance 20,000Conveyance Allowance 50,000SAF Allowance15% of Basic SalaryHard Furnishing 4,167Contribution to ProvidentFund and GratuityAnnual PerformanceAwardAs per rules of DILRanging between Rs.3.00lacs (minimum guaranteed)and Rs.6.50 lacs (maximumachievable) as per the policy ofDIL.Mr. Rahul Talwar shall be entitled to like any otheremployee annual increment/ increase as per thepolicy of DIL.Mr. Rahul Talwar, being related to Dr. K.P. Singhand Mr. G.S. Talwar, approval of the Membersis being sought by way of Special Resolution forthe above elevation pursuant to the provisions ofSection 314(1) of the Companies Act, 1956.None of the Directors of the Company, exceptDr. K.P. Singh and Mr. G.S. Talwar, being hisrelatives, are interested or concerned in thepassing of the said resolution.The Board of Directors of your Companycommends the resolution for approval.Registered Ofce: By Order of the BoardShopping Mall, 3 rd Floorfor <strong>DLF</strong> LIMITEDArjun Marg, Phase-I, <strong>DLF</strong> City,Gurgaon (Haryana) – 122 002New DelhiSubhash Setia6 th August, 2012 Company SecretaryPursuant to circular no. 2/2011 dated 8 th February, 2011 of the Ministry of Corporate Affairs, Government of India, the BalanceSheet, Statement of Prot & Loss and other documents of the subsidiary companies are not required to be attached with theBalance Sheet of the Company. The annual accounts of the subsidiary companies and the related detailed information willbe made available upon request by the Members of the Company. These documents will be available for inspection by anyMember at the Registered / Corporate Ofce / Corporate Affairs department of the Company and also at the Registered Ofcesof the subsidiary companies concerned.10

Details of Directors seeking Re-appointment at the Annual General Meeting(In pursuance of Clause 49 of the Listing Agreement)Name of Director Dr. D.V. Kapur Mr. Rajiv SinghDate of Birth/ Age 09.09.1928/ 83 years 08.05.1959/ 53 yearsDate of Appointment 21.04.2006 16.11.1988Qualications Electrical Engineeing (Hons.), D.Sc. Graduate from the MassachusettsInstitute of Technology, U.S.A. and holds aDegree in Mechanical EngineeringExpertise in specic functionalareasDirectorship held in other publiccompanies (excluding foreigncompanies)Committee Positions held in <strong>DLF</strong>Limited*Committee Positions in otherPublic Companies*Relationships between Directorsinter-seDr. Kapur had an illustrious career in theGovernment sector with a successful trackrecord of building vibrant organisations andsuccessful project implementation. He servedBharat Heavy Electricals Limited (BHEL) invarious positions with distinction. One of themost remarkable achievements of his careerwas the establishment of a fast growing systemsoriented National Thermal Power Corporation(NTPC) of which he was the founder Chairmancum-ManagingDirector.Dr. Kapur served as Secretary to the Governmentof India in the Ministries of Power, Heavy Industryand Chemicals & Petrochemicals during 1980-86. He was also associated with a number ofnational institutions as Member, Atomic EnergyCommission; Member, Advisory Committeeof the Cabinet for Science and Technology;Chairman, Board of Governors, IIT Bombay;Member, Board of Governors, IIM Lucknow andChairman, National Productivity Council.Reliance Industries LimitedHonda Siel Power Products LimitedZenith Birla (India) LimitedDrivetech Accessories LimitedGKN Driveline (India) LimitedAudit Committee-MemberShareholders’/Investors’ Grievance Committee-ChairmanAudit CommitteeHonda Siel Power Products Limited-ChairmanGKN Driveline (India) Limited-ChairmanZenith Birla (India) Limited-MemberShareholders’/Investors’ GrievanceCommitteeHonda Siel Power Products Limited-ChairmanN.A.Presently holding the position of ViceChairman of the Company. Has over 30years of enriched and diverse managementexperience.<strong>DLF</strong> Home Developers Limited<strong>DLF</strong> India LimitedNilNilDr. K.P. Singh, Ms. Pia Singh and Mr. G.S.TalwarNumber of Shares held 10,000 1,64,56,320* Committee positions of only Audit and Shareholders’/Investors’ Grievance Committee included.11

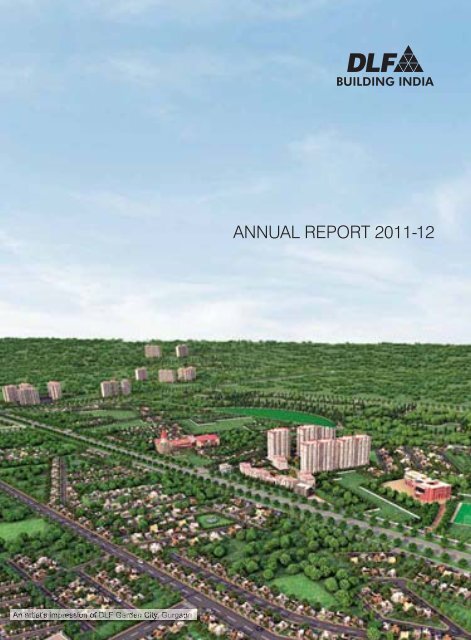

Directors’ ReportThe Primus*, Sector 82A, Gurgaon*This is an artist’s impression

Directors’ ReportYour Directors have pleasure in presenting their47 th Report on the business and operations of theCompany together with the audited results for the nancial year ended 31 st March, 2012.Consolidated Financial Results(` in Crores)2011-12 2010-11Gross Operating Pro t 4,498.79 4,336.54Less: Finance Charges 2,246.48 1,705.62Less: Depreciation 688.83 630.72Pro t before Tax 1,563.48 2,000.20Less: Provision for Tax 369.35 459.41Pro t before minority interest 1,178.15 1,540.79Share of Pro t/(loss) in associates (1.50) 8.83Minority interest 33.64 (7.24)Pro t after exceptional items, tax,minority interest and before priorperiod items1,210.29 1,542.38Prior period items (9.47) 97.23Net Prot 1,200.82 1,639.61Your Company recorded consolidated revenues of` 10,224 Crores in FY’12 as compared to ` 10,144Crores in FY’11, an increase of 1%. The grossoperating profit, on consolidated basis, improvedto ` 4,498.79 Crores from ` 4,336.54 Crores,an increase of 4%. The profit after tax, minorityinterest and prior period items was ` 1,200.82Crores as compared to ` 1,639.61 Crores for theprevious year, a decline of 27%.Your Company’s pro ts were adversely impacted dueto higher input cost with higher constructions costsdue to continuing high in ation.Review of OperationsYour Company booked gross sales of approximately13.5 msf of residential and commercial of ces/complexes valued at ` 5,278 Crores. The averagerealisation declined to ` 3,900 psf on account ofplotted launches with lower unit sales value inLucknow and Hyderabad.The Company’s launches in the residential segmentcomprised a well balanced product mix of premiumhomes and plotted development and received a verygood response.In the rental business, your Company contractedadditional leasing of 1.41 msf of property duringthe year, taking the total leased out space toapproximately 22.66 msf across commercial ofcesand retail malls.Your Company unlocked ` 1,774 Crores duringthe year by divesting certain non-core assets. YourCompany met all stakeholders commitments intime during the year, including those to the lendinginstitutions despite tight liquidity conditions.The performance of the Company on a standalonebasis for the year ended 31 st March, 2012 is asunder:Standalone Financial Results(` in Crores)2011-12 2010-11Turnover 4,582.67 4,158.76Gross Operating Prot 3,201.33 2,971.68Less: Finance Charges 1,553.78 1,286.70Less: Depreciation 139.84 129.77Pro t before Tax 1,507.71 1,555.21Less: Provision for Tax 458.77 309.05Pro t after Tax 1,048.94 1,246.16Prior period items (7.15) 23.42Net Prot 1,041.79 1,269.58Future OutlookYour Company expects the current economic andbusiness environment to stay challenging over thenext few quarters. The Company shall continueto focus on plotted development, luxury/premiumhousing, to improve the cash cycle, timely executionand delivery of its projects, divestment of non-coreassets and cash conservation.The development side of the business is expectedto have planned launches and sales of 10-12 msf.The rental business will target leasing of 2 msf in thecurrent scal.13

Your Company has targeted divestment of non-coreassets to the extent of ` 5,000 – ` 6,000 Crores andachieve reduction in net debt by a similar amount inthe current scal.DividendYour Directors are pleased to recommend a dividendof ` 2 per equity share (100%) (previous year - ` 2per equity share) for the FY’12 amounting to ` 339.67Crores (previous year - ` 339.51 Crores) for approvalof the Members.Corporate SustainabilityYour Company’s social sustainability initiativesencompassing skill development, education andhealth are targeted at the weaker sections of societywith your Company making contributions to inclusivegrowth. In addition, your Company right from thedesign and through construction stages, strives forthe most environment friendly technologies.Credit RatingDuring the year under review-CARE had assigned a short-term rating to <strong>DLF</strong> witha symbol PR1+ for an amount of ` 1,500 Crores. Asthere were no short-term instruments outstanding,the Company requested CARE to withdraw the ratingvide its letter dated 11.02.2012 and the same waswithdrawn by CARE vide its letter dated 31.3.2012.ICRA has assigned long-term rating of “[ICRA]A”(pronounced ICRA A) to the ` 4,000 Crores NCDsprogramme, and ` 12,832 Crores Line of Credit(` 11,056 Crores fund based facilities and ` 1,776Crores non-fund based facilities) vide letter dated20 th and 22 nd March, 2012 respectively.CRISIL has downgraded its ratings on the debtprogrammes and bank facilities to ‘CRISIL A/Negative (long-term) and CRISIL A2+ (short-term)’vide its letter dated 28 th December, 2011 from theearlier rating of ‘CRISIL A+/Stable and CRISIL A1’for the Company’s ` 5,000 Crores non-convertibledebentures and ` 3,000 Crores Short Term DebtProgramme ` 12,000 Crores term loans/overdraftfacilities, ` 3,670 Crores Short Term Loan, BankGuarantee and Letter of Credit Bank facilities.Fixed DepositsThe Company has not accepted/renewed any publicdeposits during the year under review.Subsidiary Companies and ConsolidatedFinancial StatementsThe Consolidated Financial Statements of theCompany and its subsidiaries, prepared inaccordance with applicable accounting standardsissued by the Institute of Chartered Accountants ofIndia, form part of the Annual Report. In terms of theCircular No.2/ 2011 dated 8 th February, 2011 issuedby the Ministry of Corporate Affairs, Government ofIndia, the Board of Directors has, at its meeting heldon 30 th May, 2012 passed a resolution giving consentfor not attaching the Balance Sheet, Statement ofPro t and Loss and other documents of the subsidirycompanies. The required information on subsidiarycompanies is given in this Annual Report. The saiddocuments/details shall be made available, uponrequest, to any Member of the Company and will alsobe made available for inspection by any Member ofthe Company at the registered of ce of the Companyduring working hours on business days.The Company has appointed Independent Directorsin its material non-listed subsidiaries in compliancewith the provisions of Listing Agreement with stockexchanges.Conservation of Energy, TechnologyAbsorption and Foreign Exchange Earnings/Outgo etc.The particulars required to be disclosed underSection 217(1)(e) of the Companies Act, 1956 readwith the Companies (Disclosures of Particulars in theReport of Board of Directors) Rules, 1988 are givenat Annexure-A hereto and form part of this Report.Particulars of EmployeesIn terms of the provisions of Section 217(2A) of theCompanies Act, 1956 read with the Companies(Particulars of Employees) Rules, 1975, as amended,the names and other particulars of the employeesare set out in the annexure to the Directors’ Report.However, as per the provisions of Section 219(1)(b)(iv)of the said Act, the Directors’ Report and the Accountsare being sent to all the Members of the Companyand others entitled thereto excluding the statement ofparticulars of employees. Any member interested inobtaining such particulars may write to the CompanySecretary at the Registered Ofce of the Company.Employees Stock Option Scheme (ESOS)During the year under review, your Company hasallotted 8,13,925 equity shares of ` 2 each fully14

paid upon exercise of stock options by the eligibleemployees under the Employees Stock OptionsScheme, 2006 thereby increasing the paid-up sharecapital by ` 16,27,850.Information in terms of Clause 12 of the SEBI(Employees’ Stock Option Scheme and Employees’Stock Purchase Scheme) Guidelines, 1999 isprovided at Annexure-B.The certicate, as required under Clause 14 of the saidGuidelines, and as obtained from the Statutory Auditorswith respect to the implementation of the Company’sEmployees Stock Option Scheme, 2006 shall beplaced at the forthcoming Annual General Meeting.Listing at Stock ExchangesThe equity shares of your Company are listed on NSEand BSE. The non-convertible debentures issuedby your Company are also listed on the WholesaleDebt Market (WDM) segment of NSE. The listingand custodial fee for the nancial year 2012-13 havebeen paid to the stock exchanges, NSDL / CDSL,respectively.Pursuant to Clause 5A of the Listing Agreement,the Company has opened demat suspenseaccounts for shares issued in dematerialisedand physical form, which remain unclaimed. As on31 st March, 2012, 5,330 equity shares in dematerialisedform and 4,58,093 equity shares in physical formwere lying unclaimed.Management Discussion & Analysis ReportThe Management Discussion and Analysis Reportas required under Clause 49 of the listing agreementwith the stock exchanges forms part of this Report.Corporate Governance ReportThe Corporate Governance Report, as stipulatedunder Clause 49 of the listing agreement with stockexchanges, forms part of this Report.The requisite certi cate from the Statutory Auditorsof the Company, M/s. Walker, Chandiok & Co,Chartered Accountants, con rming compliance withthe conditions of corporate governance as stipulatedunder the aforesaid Clause 49, is attached toCorporate Governance Report.Directors’ Responsibility StatementAs required under Section 217(2AA) of the CompaniesAct, 1956 your Directors con rm having:a) followed, in the preparation of the AnnualAccounts, the applicable accounting standardsand there are no material departures;b) selected such accounting policies and appliedthem consistently and made judgments andestimates that are reasonable and prudent so asto give a true and fair view of the state of affairs ofyour Company at the end of the nancial year andof the prots of your Company for the period;c) taken proper and sufcient care for themaintenance of adequate accounting records inaccordance with the provisions of the CompaniesAct, 1956 for safeguarding the assets of yourCompany and for preventing and detecting fraudand other irregularities; andd) prepared the Annual Accounts on a goingconcern basis.AuditorsThe Auditors, M/s. Walker, Chandiok & Co, CharteredAccountants, hold ofce until the conclusion of theforthcoming Annual General Meeting and are eligiblefor re-appointment. Certicate from the Auditors hasbeen received to the effect that their re-appointment,if made, would be within the limits prescribed underSection 224(1B) of the Companies Act, 1956 andthey are not disqualied for re-appointment within themeaning of Section 226 of the said Act.Auditors’ Report(i) The observation given in point no. 4 of theAuditors’ Report on Standalone Financials readwith Note No. 49 is self-explanatory and do notcall for any further comments.(ii) The observation given in point nos. 4 and 5 of theAuditors’ Report on Consolidated Financials readwith Note Nos. 38 and 39 are self-explanatoryand do not call for any further comments.Cost AuditorsThe Company has appointed Cost Auditors – M/s.Vandana Bansal & Associates, Cost Accountants incompliance with Cost Accounting Records (ElectricityIndustry) Rules, 2011 for its Wind Power Generationdivision. The Cost Audit Report shall be led by theCost Auditors in due course for the FY 2011-12.15

DirectorsPursuant to Section 256 of the Companies Act, 1956read with the Clause 102 of the Articles of Associationof the Company, Dr. D. V. Kapur and Mr. Rajiv SinghDirectors retire by rotation at the ensuing AnnualGeneral Meeting and being eligible, have offeredthemselves for re-appointment.Mr. M. M. Sabharwal, a Director of the Company whoretires by rotation at the ensuing Annual GeneralMeeting has conveyed his desire not to offer himselffor re-appointment.Mr. K. Swarup, Group Executive Director (Legal)superannuated on 31 st December, 2011 andsimultaneously demitted the of ce of Director.The Directors place on record their appreciation forthe contribution made by Mr. Sabharwal andMr. Swarup during their tenure as Directors of theCompany.Brief resume of the Directors proposed to be reappointedand other details as stipulated underClause 49 of the Listing Agreement, are providedin the Notice for convening the Annual GeneralMeeting.Corporate Social ResponsibilityThe Company has made signi cant investmentsin community welfare initiatives including to theunderprivileged sections of society through education,training, health, environment, capacity building andrural-centric interventions as detailed at Annexure-C.The employees of the Company also participated inmany of such initiatives.AcknowledgementsYour Directors wish to place on record theirsincere appreciation to all the employees for theirdedication and commitment. The hard work andunstinting efforts of the employees have enabledthe Company to sustain and further consolidate itsposition in the industry.Your Company continues to occupy a place ofrespect among stakeholders, most of all ourvaluable customers. Your Directors would like toexpress their sincere appreciation for assistanceand co-operation received from the vendorsand stakeholders including nancial institutions,banks, Central and State Government authorities,customers and other business associates, whohave extended their valuable sustained support andencouragement during the year under review. It willbe the Company’s endeavour to build and nurturethese strong links with its stakeholders.For and on behalf of the Board of DirectorsNew Delhi(Dr. K.P. Singh)6 th August, 2012 Chairman16

ANNEXURE - ‘A’Disclosure of Particulars under Section 217(1)(e) of the Companies Act, 1956 read with theCompanies (Disclosure of Particulars in the Report of Board of Directors) Rules, 1988A. CONSERVATION OF ENERGYa) Energy Conservation measures taken Installed 161 MW of Green wind based power turbines at Gujarat& Karnataka.b) Additional Investment and proposals, if any, beingimplemented for reduction of consumption of energyc) Impact of the measures at (a) and (b) above for reductionof energy consumption and consequent impact in the costof production of goodsd) Total energy consumption and energy consumption perunit of production as per Form-A of Annexure to the Rulesin respect of industries speci ed in the schedule thereto.NilThe wind power generation reduces about 2.9 lacs tonnes of Co 2emissions annually and thus generates approximately 2.9 lacsCarbon credits (CER).25,511 CERs have been issued by UNFCCC for wind powergeneration upto 31.12.2010 in the state of Karnataka.6,02,491 CERs have been issued by UNFCCC for wind powergeneration upto 31.08.2011 in the state of Gujarat.Further monitoring and issuances upto 31.03.2012 are in advancedstages at UNFCCC.As per Form A annexed.B. TECHNOLOGY ABSORPTIONe) Efforts made in technology absorption As per Form B annexed.C. FOREIGN EXCHANGE EARNINGS AND OUTGOf) i) Activities relating to exports The Company is engaged in developing/ constructing residentialand commercial properties in India and selling the immovableproperties to customers in India and abroad.ii) Initiatives taken to increase exportsiii) Development of new export markets for products andservicesiv) Export PlansThe Company does not have any export activities.The Company receives remittances of sale consideration forimmovable properties located in India, purchased by the customersabroad.The Company has ongoing initiatives to increase the sale ofimmovable properties to the customers abroad. These includeholding meetings with customers at different locations overseas,attending exhibitions, fairs etc. with a view to develop personalcontacts with overseas customers. While designing its products, theCompany bears in mind international trends and NRIs preferencesin housing.g) Total Foreign Exchange earned and used (` in Crores)2011-12 2010-11a) Foreign Exchange earned 53.38 92.16b) Foreign Exchange used 124.14 120.5217

Form for Disclosure of Particulars with respect to Conservation of EnergyA. Power and fuel consumptionFORM – A1. Electricitya) Purchased 2011-12 2010-11Unit 82,14,320 68,39,850Total Amount (in `) 5,22,65,942 4,01,62,979Rate per Unit 6.40 5.90b) Own Generationi) Through diesel generationUnit 65,57,550 21,73,164Unit per litre of diesel oil 3.50 3.40Cost/Unit (in `) 10.50 11.10ii) Through gas turbine/generator - -Unit - -Unit per litre of fuel oil / gas - -Cost/Unit (in `) - -2. Coal (Specify quantity and where used)Quantity (tonnes) NA NATotal Cost (in `) NA NAAverage Rate NA NA3. Furnace OilQuantity (K. Litres) NA NATotal Amount (in `) NA NAAverage Rate NA NA4. Others/internal generation through wind energyQuantity (Units) 32,25,96,677 27,14,58,669Total Cost (in `) 20,22,10,660 20,70,44,006Rate/Unit (in `) 0.63 0.76B. Consumption per unit of productionStandards (if any) 2011-12 2010-11Products (with details) unit - NA NAElectricity - NA NAFurnace Oil - NA NACoal (specify quality) - NA NAOthers (specify) - NA NAResearch and Development (R&D)Form for Disclosure of Particulars with respect to Absorption1. Speci c areas in which R & D carried out by the Company Nil2. Bene ts derived as a result of the above R & D -3. Future plan of action -4. Expenditure on R & D Nila. Capitalb. Recurringc. TotalNil5. Total R&D expenditure as a percentage of total turnover NilTechnology Absorption, Adaptation and InnovationFORM – B1. Efforts, in brief, made towards technology absorption, adaptation and innovation Company has wind based power generationin the states of Gujarat & Karnataka.18

Corporate Social ResponsibilityGeneralDuring the year, <strong>DLF</strong> has made considerableprogress in meeting its social commitments forthe betterment of society. A number of charitableprojects have been undertaken for the poor andunderprivileged in education, training, healthcare,community development and environment. Thisyear has also been remarkable with the successachieved by the three major agship programmes i.e.Employability-linked Skill Development Programme,the <strong>DLF</strong> Raghvendra Scholarship Programme for theunderprivileged and the Gurgaon Renewal Missionunder the aegis of <strong>DLF</strong> Foundation.Flagship InitiativesSkill Development. <strong>DLF</strong> Foundation launched itsprogramme in skills training under the banner of <strong>DLF</strong>LIFE (Learning Initiative for Employment). Underthis programme the Foundation will establish 250vocational skill training centres across the country.Aiming to skill and train 1 million underserved anddeserving youth across the country over the next 10years and assuring them employment in sectors likeIT, construction, electronics, retail, customer servicesand hospitality. A major highlight of the programme isthat the youth undergoing training in our centres willget assured employment through market linkages.Nurturing Talent through Scholarships for theunderprivileged. Launched in 2011 in the memoryof the founder of <strong>DLF</strong> Ltd., the Ch. RaghvendraScholarship Programme, supports meritoriousstudents hailing from underprivileged families. Underthe programme, the Foundation has supported 65most meritorious students of government schoolsat the primary school level, by enrolling them inprivate schools and undertaking all their educationalexpenses. During the academic year ended 2012,school children from 26 villages in Gurgaon districtwere supported.At undergraduate and postgraduate levels also, <strong>DLF</strong>Foundation has partnered with over 19 colleges anduniversities in Haryana, Uttar Pradesh and Delhi. Asmany as 57 scholarships have been awarded duringthe academic session 2011-12 in disciplines such asEngineering, IT, MBBS, Fine Arts, MSW and MBA.<strong>DLF</strong> Raghvendra Scholars are given scholarship ofRs. 40,000 per student per year for undergraduatestudies and Rs. 50,000 per scholar per annumtowards postgraduate studies to cover their coursefee, books and hostel expenses. The programmewould be expanded from the next academic year.Gurgaon Renewal Mission. Gurgaon has grownas a world class city over a period of time and nowoccupies a place of pride among the emergingcities of the country. However, it is also faced withinfrastructural and environmental challenges. Toaddress these challenges, Gurgaon Renewal Mission(GRM), was launched in November, 2011 drivenby a coalition of partners comprising civil society,business and government. The movement aims toprovide a platform for all stakeholders to spur actionto resuscitate Gurgaon and initiate Gurgaon centricdevelopment. During the year, <strong>DLF</strong> Foundation hassupported the movement by providing the muchneeded infrastructure and secretarial support, apartfrom launching an integrated urban developmentprogramme. Various interactive sessions wereorganized in the form of seminars/workshops wheresenior government ofcials interacted with citizens,corporates and NGOs to formulate a proper roadmap.A pilot project led by the <strong>DLF</strong> City Administration andRWAs was implemented successfully.Educational ProgrammesANNEXURE - ‘C’Rural Schools. <strong>DLF</strong> Foundation has contributed tothe establishment of 30 rural schools in Haryana,UP and Punjab with Bharti Foundation. Situated inremote areas, these rural schools educate 13,000children every year with a focus on the girl child.These schools aim to signicantly change the wayeducation is imparted with the help of trained facultyand information technology.<strong>DLF</strong> Rural Learning Excellence Centres. TheCentres train students in 22 Government schools inthe rural areas of Gurgaon to improve their academiceducation in advanced English, Mathematics andHindi, build life-skills and develop their overallpersonalities. The mobile library programme hasbeen particularly received very well. The programmenow covers over 5,000 children every year.<strong>DLF</strong> Swapan Sarthak and Slum Schools. Four<strong>DLF</strong> schools spread over major villages of Gurgaoncatering to the slum dweller’s children provide free20

education. The students achieved excellent academicresults. The infrastructure in the schools saw signicantupgradation and has resulted in an increased numberof students applying for admissions this year. <strong>DLF</strong>is bearing all educational expenses including fees,uniforms, books and mid-day meals of these students.Of the 3,000 students receiving education at theseschools, the meritorious students have now also beenprovided scholarships for enhancing their education.Urban Schools. The SBM Senior Secondary Schoolin Delhi has 780 students coming from low incomefamilies. The school obtained excellent results thisyear with a 100 percent result in Class 12 with over30 percent students securing an aggregate of over75 percent marks.Healthcare Programmes<strong>DLF</strong> Rural Primary Health Centres. <strong>DLF</strong> Foundationis running a rural health care programme under which ve Rural Primary Health Centres have been setup inHaryana and Punjab. Equipped with diagnostic labs,these Centres provide free medical treatment, freediagnostics and medicines to over one and a halflakh rural community. Specialists are available atthe Centres and partnerships have been establishedwith leading hospitals for evacuation and treatmentof patients for secondary and tertiary care.Eye Care camps. A large number of eye care campscontinue to be organized in rural areas aroundGurgaon in association with Arunodya Eye Centre.In these camps diagnostics and surgical care isprovided. This programme has received a veryencouraging response and is well appreciated.CGS Hospital for Animal Care. India’s rst State-ofthe-artprivate veterinary hospital in Gurgaon providesultra modern facilities like laser surgery, ultrasonictesting and modern lab facilities for animal care. Inaddition this facility will also cater to the animals inthe rural areas through regular mobile veterinaryhealth teams visiting the villages.Labour WelfareMobile Medicare. <strong>DLF</strong> has been the rst to startthe Mobile Medicare Programme for all constructionworkers working in Gurgaon. Equipped with the latestequipment and highly trained doctors and specialists,the Mobile Medical Vans provide free examinationand treatment to over 16,000 construction workersemployed across <strong>DLF</strong> projects in Gurgaon.Primary Education Centres and Crèches.Primary Education Centres and Crèches have beenestablished at all <strong>DLF</strong> construction sites in Gurgaon.These Centres provide primary education to childrenof construction workers. With emphasis on life skillsalong with academics, these centres aim to impartquality education to these young bright children atthese sites.Food SecurityDistribution of Free Food. <strong>DLF</strong> foundation providesfree meals every day to over 300 differently-abledpersons at the India Gate Lawns in New Delhi asa part of the Aapki Rasoi programme as part of theDelhi Government’s ‘Hunger Free Delhi’ campaign.Over 1.7 lakh meals have been distributed so farunder this programme. In another major initiative,<strong>DLF</strong> Foundation has donated 11 vehicles to ISKCONfor distributing mid day meals in 200 governmentschools of Gurgaon.Environment<strong>DLF</strong> Foundation has paid special attention toenvironmental improvements. A total of over 4 lakhtrees have been planted in Gurgaon till date. HUDAhas, over the last eight years, awarded <strong>DLF</strong> with“Excellence in Horticulture Preservation” award.21

Management Discussion& Analysis ReportNew Town Heights*, Kolkata*This is an artist’s impression

Management Discussion & Analysis ReportIIITHE INDIAN ECONOMY2011-12 was a very challenging year for theIndian economy. The year witnessed turmoilas the GDP growth rate came down to 6.5%,the lowest in the last 5 years. This was a resultof the various macro-economic factors, globaleconomy being at the brink of a recession,nancial turmoil in the Euro zone and slowdownin the economic decisions by the Governmentand the 13 consecutive rate hikes announcedby the Reserve Bank of India.The year was characterized by sustained risein ination, as a result of a sharp increase inthe prices of commodities. This was furtherexacerbated by the supply side constraintsand increased borrowing costs. The ReserveBank of India took a cautious monetary stance,sacricing growth over controlling ination. Withdemand and affordability getting impacted, theeconomic growth engine witnessed signs of asignicant slowdown.Over the near term, there is no sign of reversalof this trend, unless the Government initiates aseries of reforms and bold economic measures.THE INDIAN REAL ESTATE SECTORAmidst a slowdown in economic growth, theIndian real estate sector continued to facea challenging environment. With an overalldecline in volumes, pricing was a key issuein some geographies marked by over-supplyand lack of sustained economic activity. Keymarkets were also impacted by policy inertia,leading to signicant reduction in volumes onaccount of lack of fresh approvals.The Ofce Leasing business was marked byoversupply in key geographies and slowing ofdemand on account of lack of fresh investmentby international businesses and lack ofdomestic triggers. This resulted in decline inaverage rentals in certain geographies.The Retail Leasing segment was slightlybetter, as oversupply in the segment gotabsorbed with a marginal increase in retailpenetration and ill-located malls being put toalternate uses. Some geographies, especiallyDelhi, saw marginal improvement in rentals.In case of retail leases with revenue sharing,the share of revenues was matching closelyto minimum guarantees, implying that asdomestic retail picks up, it shall provide boostto retail rentals.The Government has proposed LandAcquisition Bill and Real Estate Regulationand Development Bill. These Bills are yet toachieve consensus and enactment.Residential SegmentThe overall demand in the residential sectorwitnessed muted growth. However someareas in North India, showed increasingvolumes accompanied with price recovery.Mumbai market witnessed a negative growth,as it went through a time correction, due tolack of fresh launches and prices remainingstable. After a long period of regulatory inertia,new Development Control Rules (DCR) normswere introduced in Mumbai market. Bengaluruemerged as the strongest region in terms ofabsorption with an increase of 20% YoY. Thehigh absorption was attributable to a largenumber of affordable launches.The capital value trends however depict that thesector managed to sustain or marginally increasethe capital values. High mortgage rates played adampener while increasing ination aggravatedthe problems of the sector by adversely affectingthe affordability of the consumers.As the interest rate cycle is anticipated tohave peaked, the reduction in mortgage ratesshall help improve affordability and boostsentiments.Cushman & Wakeeld estimates that thecumulative demand in the residential sectorduring the period 2011-15 would reach approx.3.94 million units growing at a CAGR of 11%.23

Housing Units (in thousand)Residential Demand - Supply Projection(Top seven cities)70060050040030020010002011 2012 2013 2014 2015YearSupply Demand Gap (%)Source: Cushman & Wake eld Research62%60%58%56%54%52%50%Commercial SegmentThe commercial ofces segment underwent asetback as a result of deferment of expansionand investment plans because of the adversemacro-economic conditions both nationallyand globally. The second half witnessed asubstantial dropdown in the absorption rate inthe commercial segment.The share of the IT/ITES in ofce leasing droppeddown from 47% in FY’11 to 35% in FY’12, however,the overall demand levels were sustained due toincrease in demand from various other sectorsincluding manufacturing, consulting and telecom.The demand from these sectors rose to 26% thisyear from 16% in FY’11.Cushman & Wakeeld Research estimatesthat the cumulative demand of ofces duringthe period 2011-15 would reach 267 msf.Over 47 % of this total demand is attributed toBengaluru, Mumbai and NCR regions.Million sq.ft.6050403020100Ofce Demand - Supply Projection(Top seven cities)Gap (%)0%-5%-10%-15%-20%-25%-30%-35%2011 2012 2013 2014 2015-40%YearSupply Demand Gap (%)Source: Cushman & Wake eld ResearchRetail SegmentThe retail segment witnessed a substantialboost both in terms of leasing activity as wellGap (%)IIIas the completion of the malls. The organizedretail market grew over the previous year asmany international ‘single brand’ retailers haveforayed in the key markets.Though the segment received a slight llip withGovernment allowing 100% FDI in single brandretail, the sector will not see a signicant recoverytill the government is able to work on a politicalconsensus for allowing FDI in multi-brand retail.Cushman & Wake eld Research estimatesthat the cumulative demand for retail duringthe period 2011-15 would be approximately57 msf witnessing a CAGR of 37%. Over 43%of the total demand is attributed to Bengaluru,Mumbai and NCR regions. Majority of theoperational stock is present in NCR; howeverthe incremental supply came into other cities,primarily Mumbai and Bengaluru.Million sq.ft.121086420Retail Demand - Supply Projection(Top seven cities)2011 2012 2013 2014 2015YearSupply Demand Gap (%)Source: Cushman & Wakeeld Research80%60%40%20%0%-20%-40%-80%-100%-120%Gap (%)BUSINESS AND FINANCIAL PERFORMANCE& OUTLOOK1. STRATEGYThe Company continues to focus onconsolidation of its operations, rationalizationof businesses – “back to the core”, costcontrols and better execution.The Company intends to focus itself on creating“preferred destinations” and create value fromdevelopment in addition to value creation fromexecution or holding land. The Company isoutsourcing construction to “best-in-class”contractors like L&T, Shapoorji Pallonji andalso some regional players. The Company isalso outsourcing project management. The24

Company shall continue to make its projectsaspirational and matching global standardsin certain cases. In light of the inationaryenvironment, the Company will continue on itspath of a cautious mix of plotted colonies andluxury developments.On the rental business, the Company shallcontinue underlying objective of achievinginvestment payback within a targetedtimeframe. The Company shall continue toinvest into infrastructure to ensure quality ofits annuity assets. The prime examples of thisis to connect <strong>DLF</strong> Cybercity, Gurgaon to Delhi-Gurgaon metro network and building a 16-lanesignal free road across <strong>DLF</strong> Cybercity whileconnecting it to residential developments.<strong>DLF</strong>’s rental assets ensure energy and waterconservation. This segment shall endeavourto stay ahead of the curve as it is committedto the business through innovations andimproving quality of its buildingsThe Company’s strategy is to make theorganization far more nimble and responsiveand be able to seize opportunities when theIndian economy shows recovery.In order to derisk the Company from inationaryrisks, the Company has introduced anescalation clause in some of its developmentprojects. The escalation clause shall mitigatethe increases in construction costs in a fair,efcient and transparent manner based onpublished benchmarks.The Company believes that current economicand business environment shall continue tostay challenging for the next few quarters andhence, Company shall continue to focus onfewer but high protability projects like plotteddevelopment, luxury/premium housing toimprove its cash cycle, timely execution anddelivery of its projects.The Company continues to focus onconsolidating its balance sheet with anobjective to bring down the debt gearing toa much lower level. It shall continue to divestnon- core assets, focus on improving operatingcash ows, being very judicious in spendingnew Capex and focus on cash conservation.i) Land BankThe Company’s development potentialreduced from 367 msf in March,2011 to 348 msf in March, 2012 as aresult of deliveries made during theyear, product mix shift and land bankrationalization. A signicant portion ofthe land bank continues in the highlyurbanized and developed areas.Land Bank Development Potential by location as on31 st March, 201213%24%7%56%Super Metro Metro Tier I Tier IISuper Metros – Delhi Metropolitan Region & Mumbai;Metros – Chennai, Bengaluru, Kolkata & Hyderabad;Tier I – Chandigarh, Goa, Pune, Nagpur, Cochin, Coimbatore& Bhubaneswar;Tier II – Gandhinagar, Ludhiana, Amritsar, Jalandhar, Shimla,Sonepat, Panipat, Lucknow & Indore.ii)Debt ProleAs in the past, the Company met allits debt commitments on schedule inthe last nancial year. The Companyhad scheduled debt repayments of` 3,600 Crores, which were repaid ontime. Owing to successive hikes in thebank rate by the Reserve Bank of Indiaand liquidity crunch within the bankingsector, the average cost of debtwitnessed a rise from 11.2% in March,2011 to 13% in March, 2012. The netdebt equity ratio as on 31 st March,2012 stood at 0.83 as compared to0.81 as on 31 st March, 2011.iii) Capital ExpenditureGiven the economic environment, theleasing momentum of commercialof ces was lackadaisical during the25

nancial year. With a majority of theplanned spend having already beenincurred, the Company continuesto moderate its capital expenditurein the ofce spaces and limit it tonishing aspect of the building wherethe pre-leasing has happened.Over the past few years, oversupplyin retail space has largely beenabsorbed. The Company anticipatespick up in the retail leasing activityand has been allocating resourcesfor select retail projects in NCR.The Company bought certain landparcels in New Gurgaon and NewChandigarh areas, with a primaryobjective of ensuring contiguity ofexisting land parcels and in line withits focus on plotted colonies.iv) Divestments of non-core assetsThe Company continued its focus ondivestment of non-core assets with anobjective of reducing the gearing. Theassets divested during the currentscal included land parcels in selectcities, certain hotel land parcels, NoidaIT Park and Pune IT Park. Havingunlocked ` 1,774 Crores from noncoreassets/businesses in FY 2011-12, the total amount cummulativelyunlocked through divestment of noncoreassets increased to about ` 4,841Crores as of March, 2012.The Company has set a divestmenttarget of ` 5,000 to ` 6,000 Croresfor FY 2012-13.the product value chain from land buying,consolidation, approvals, launch, sales to nal delivery to the consumer.Residential SegmentThe Company’s launches in the residentialsegment comprised a well balancedproduct mix of premium/luxury homes andplotted ‘gated’ colonies. The Companystuck to its strategy of changed productmix and consciously slowed down thelaunches of mid-income homes. On theother hand, the Company launched moreof plotted developments which offeredshorter cash cycle and was minimallyaffected by commodity in ation.All the launches received a very goodresponse and a comfortable averagelaunch to sales ratio. The Companysold ~ 13.5 msf in the developmentbusiness in FY’12 and commenceddelivery of 10.24 msf. The average salesprice witnessed a decline during the yearon account of lower-value plotted salesat Lucknow and Hyderabad.(msf)1512.5107.552.50FY’12 Sales (in msf) & ASP (` psf)10.246517390013.5FY '11 FY '1285007500650055004500350025001500( ` psf)2. REVIEW OF OPERATIONS(a) Development Business26The Development Business of theCompany is involved in the sale ofresidential spaces, select commercialofces and commercial complexes. Thebusiness is split into 3 SBU’s i.e. Gurgaon,Super Metros and Rest of India and eachof these are independently responsibleand accountable for all activities across86420Q1 – Q4 FY’12 Sales (msf)Area Sold (msf)6.753.32.21.28Q1FY’12Q2FY’12Q3FY’12Q4FY’12

Prominent Launches in FY’12Sector 91/92, <strong>DLF</strong> Garden City, NewGurgaon – The project is a plotteddevelopment launched in New Gurgaonand spread across an area of 164 acresin two phases. The project comprises ofplots sized between 300-500 sq. yards.The response was overwhelming.Regal Gardens, Sector 90, NewGurgaon – A Group Housing of an areaapproximately 1 msf, most of which hasbeen sold out.The Primus, Sector 82-A, NewGurgaon – A Group Housing of an areaapproximately 1.2 msf, most of which hasbeen sold out.Maiden Heights, Rajapura, Bengaluru– A Group Housing of an areaapproximately 0.7 msf, which offers anexcellent connectivity to BannerghattaRoad, Hosur Road and Electronic City.Garden City, Lucknow – The plotteddevelopment comprising of plots sizedfrom 250 sq. yards to 500 sq. yardsreceived an excellent response to thelaunch of this development.The table below provides a synopsis of the sales volumes and average prices for theHomes segment in FY’12.Region/HeadsCityArea Sold( msf )Sales Value( ` Cr )Gurgaon Gurgaon & New Gurgaon 4.88 3022Rest of India Mullanpur, Lucknow, Hyderabad, Chennai, Kochi & Bengaluru 7.60 1706Super Metro Indore, GK-Delhi & Kolkata 1.07 550Total 13.55 5278OutlookWith the real GDP having grown over8% during last couple of years andresultant wealth creation, increasingdisposable income and distribution ofwealth amongst a larger segment of thepopulation, the outlook for residentialdevelopments continues to be good.The year is also expected to witnesssome decline in interest rates.The Company plans to launch selectpremium and luxury group-housingprojects in the current nancial year.A signicant project for the year wouldbe the luxury housing, which would beanother Golf Community in <strong>DLF</strong> PhaseV, Gurgaon, Besides this, the Companyplans to launch plotted developments invarious locations.(b) Rental BusinessThe Rental Business of the Companyprimarily operates with the objective ofenlarging the Company’s rental portfolioof assets and comprises leasing ofspaces in commercial of ces, I.T.Parks,I.T.SEZs and retail malls. The businessis also responsible for the utilities andfacilities management business that lendthemselves to an annuity model andfurther complements the growing rentalbusiness of the Company.The total leased portfolio of the Companystood at 22.66 msf, yielding an annualizedincome of approximately ` 1,600 Crores.(i) Ofces SegmentThe Company maintained its statusof being a pioneer in the supplier27

of premium Grade-A of ce space.Well designed of ce spaces, largeef cient oor plates, energy ef cientbuildings, all modern amenities andthe best in class maintenance andservice standards with respect tosafety and security have becomesynonymous with a <strong>DLF</strong> ofceproperty. The segment appointedDuPont, world leaders in safetysystems and processes, to achieveworld class safety in all its buildings.DuPont would act as reviewer, trainer,facilitator and catalyst to achieveintegrated safety organization.The Company launched its ownre station at Cyber City, Gurgaon,becoming the rst private developerin the country to do so, with lateststate-of–the-art re tenders/rescueequipment. With this, <strong>DLF</strong> getsthe distinction of owning hydraulicplatform of 90M height, the highestavailable in the country.The Company witnessed a leasingof 1.41 msf of of ce space, afteraccounting for certain unforeseencancellations. The rentals remainedat given the oversupply in certainkey micro markets. Approximately2.88 msf of ofce buildings werecompleted during the year. TheCompany’s ofces business earnedannualized rental income of ` 1,350Crores in FY’12.OutlookEven with a moderate GDP growthexpectation for FY’13, the Indianeconomy would be amongst the fastestgrowing nations of the world. If the globaleconomic environment and domesticeconomy shows signs of consolidationand industry starts looking at freshinvestments, the of ce leasing marketis expected to pick pace. However,the Company has kept a moderate netleasing target of 2 msf for the current nancial year. The objective would be toensure increase in the rental yields.(ii) Retail SegmentThe Company has 1.38 msf of leasedretail space across the country,earning annualised rental income of` 250 Crores.The overall vacancy rate in the mallswas less than 5% in March, 2012 ascompared to 7% in March, 2011.OutlookThe future for the retail sector looksattractive as the penetration of organizedretail is still quite low as compared to otherdeveloping nations and constitutes a veryminor portion of the existing retail sector.The industry would gain further momentumas and when the government relaxes FDIinto multi-brand retail. There has beenabsorption of oversupply of retail spaceon account of alternate use of alreadydeveloped malls and lack of fresh capitalbeing committed for development of malls.The Company is committing capital fordevelopment of approximately 1.8 msfmall at Noida, which is expected to beoperational in second half by Q3 FY’14.(c) Company’s Project Execution Statusand Development PotentialThe Company completed 13 msf ofcommercial and residential projectsin FY’12 while adding 12 msf to newconstruction. As a result, the total areaunder construction reduced from 54msf as on 31 st March, 2011 to 50 msfas on 31 st March, 2012. Deliveries of 13msf were commenced across the citiescomprising plots, commercial complexesand commercial of ces.The development business comprisingprimarily the homes segment, followed bycommercial complexes has a combinedarea of 40.6 msf under construction asof 31 st March, 2012. As of 31 st March,2012, the area available for potentialdevelopment in the Dev Co (including areaunder construction) stood at 272 msf.The Rental business has approximately9 msf of area under construction as of28

31 st March, 2012. As of 31 st March,2012, the area available for potentialdevelopment in the Rent Co (includingarea under construction) stood at 68 msf.AREA UNDER EXECUTION (msf)4140393820151050Development BusinessArea Under Construction (msf)39FY’11Rental Business40.6FY’12Area Under Construction (msf)14.5FY’11(d) Other Businesses9.2FY’12HotelsThe Company owns and operates theluxurious Aman Resorts across theworld. The Aman Resorts witnessedan improved operating and nancialperformance during the year endingDecember, 2011. The Company,however, has planned to divest equity inthe same to a strategic investor as partof divestment of non-core assets andhas mandated international investmentbanks for the same.Life Insurance<strong>DLF</strong> Pramerica Life Insurance CompanyLtd. (DPLI), a 74:26 JV between <strong>DLF</strong>Limited and Prudential InternationalInsurance Holdings (PIIH) completed itsfourth year of operations as on 31 st March,2012. The number of policies issued bythe Company stood at 69,925 in FY’12 asagainst 36,891 during the previous year.The Company has a total of 40 branchesas of 31 st March, 2012. Its performancewas much above industry averages.3. OUTLOOK ON RISKS & CONCERNSThe real estate sector is impacted by, interalia,regulatory and monetary policies andinvestment outlook. The Company’s operationsand its ability for future development has tobe viewed in light of the above and resultantfactors such as the availability of real estate nancing, uncertainty on monetary and scal policy actions, changes in governmentregulations, foreign direct investments,approval processes, environment laws andactions of government land authorities. Otherbusiness risks could be nancial stability ofcommercial and retail tenants, replenishmentof land reserves, inability to competeeffectively in regional markets, lack of ability inidentifying consumer requirements in a timelymanner, over-dependence in a particularmarket/region, input price increases, interestrate hikes in the economy, liquidity/availabilityof credit and various other risks that may beattributable to real estate4. FINANCIAL REVIEWRevenue & ProtabilityIn FY’12, <strong>DLF</strong> reported consolidated revenuesof ` 10,224 Crores, a marginal increase of1% over ` 10,144 Crores in FY’11. EBIDTAstood at ` 4,499 Crores, an increase of 4% ascompared to ` 4,336 Crores in the previousyear. Net pro t after tax, minority interestand prior period items was at ` 1,201 Crores,a decline of 27% from ` 1,640 Crores. TheEPS for FY’12 stood at ` 7.07 as comparedto ` 9.66 for FY’11.The revenue and pro t gures of the Companyduring the year were after adjusting forlosses contributed by non-core businessesof ` 229.50 Crores. The life insurance29

usiness continues in its gestation phase andis expected to contribute positively once itreaches a signicant size and scale.The cost of revenues including cost of lands,plots, constructed properties and developmentrights decreased to ` 3,967 Crores as against` 4,300 Crores in FY’11. The decrease wasprimarily due to faster execution and the launchof plotted developments in which the land costwas a large portion of the overall constructioncosts. Staff costs increased to ` 586Crores versus ` 572 Crores. Depreciation,amortization and impairment charges were at` 689 Crores versus ` 631 Crores in FY’11.Finance costs increased to ` 2,246 Croresfrom ` 1,706 Crores in FY’11. The overall debtwitnessed a marginal increase and the cost ofborrowing impacted the nance costs.120001000080006000400020000Revenue & Profitability10224 101444499 43361201 1640Revenue EBIDTA PATFY’12 FY’11Balance SheetThe Company’s Balance Sheet as on 31 stMarch, 2012 reected a healthy position witha net worth of ` 27,236 Crores and net debtto equity ratio of 0.83 times. The net worth ofthe Company witnessed an increase of ` 904Crores from FY’11, on account of retainedprots during the year.Gross debt increased to ` 25,066 Crores from` 23,990 Crores. Net Debt (net of Cash andequivalents) was ` 22,725 Crores as comparedto ` 21,424 Crores as of 31 st March, 2011. FixedAssets, including Capital Work-in-Progressstood at ` 27,707 Crores as compared to` 28,106 Crores in the previous year.The nancials for FY’12 have been preparedin accordance with revised Schedule VIrequirements as notied by the Ministry ofCorporate Affairs under the Companies Act,1956. The previous year gures have beenregrouped wherever required. However, thenumbers may not be comparable with thequarterly disclosures made during the last nancial year as the same were conforming toearlier Schedule VI requirements.IV. CORPORATE FUNCTIONS(a) Information TechnologyThe function focused on automatingcertain manual processes on theCompany’s ERP platform, which hasalready been implemented and deployingthird party tools and integrating them withERP. Amongst major initiatives were:• Integrating project BOQ and projectbudget on the ERP platform. This is undertesting and implementation.• Automation of internal approvalprocesses in critical areas likeprocurement and lease deeds.• Automation of record keeping andtracking of scheduled preventivemaintenance of all equipments in the<strong>DLF</strong> buildings.• Upgradation of the surveillance systemsin <strong>DLF</strong>’s commercial premises.In addition, as a continuous process,steps are taken to reduce IT costswithout compromising the quality andsupport levels by constant evaluationof the existing contracts aligning thesewith organizational structure and processchanges.(b) Finance and ControlThe Company’s nance departmentis committed to deliver its primaryobjective of effective risk management,accurate reporting metrics and complete nancial propriety. The department andits compliance monitoring systems arenot only geared to report any deviationsfrom required statutory obligations butalso prompt actions to rectify those ina timely manner. The function is basedon a structure whereby the individual nance teams at the business unit levelswork within well de ned parameters thatprovide adequate exibility and controland at the same time allow for smoother30

information ow across the organizationfor faster and effective decision makingfor the group.Regular presentations of audit reportsincluding signicant audit ndings andcompliance assurance along with theimplementation status and resolutiontimelines is made to the Audit Committeeof the Board by the Internal Auditors.(c) Human ResourcesThe Company believes that the humancapital is the key engine for its growthand competitiveness. It continues tofocus on HR practices, systems andpeople development initiatives thatencourage continuous learning on the joband meritocracy and which enhance theorganisation’s capability. The Companyemploys a professionally qualied talentpool of 3,700 employees across thecountry as on 31 st March, 2012.The Company’s objective going forwardwould be to nurture and harnesscore management teams and exploreoutsourcing which will enable us toenhance management bandwidth andfocus. In this direction we have alreadysuccessfully outsourced our constructionactivities to “best-in-class” contractors forall our current and upcoming projects.The changing business scenarionecessitates continuous developmentof employees in terms of skills andcompetencies in line with the Company’srequirements. The Company conducts/sponsors in-house and externaltraining encompassing behavioral andmanagement areas to enhance thequality of employee performance. Thereare several e-learning initiatives forknowledge sharing with employees thatwe undertake on an ongoing basis.(d) LegalThe Legal Department is fully alignedwith the various Business functions toprovide timely legal support on variousoperations of the Company.In order to optimize the ef ciency, suitablelegal controls have been strengthenedfor effective guidance of respectiveteams supporting various functions of theBusinesses.The legal teams manage their mandatesstrictly in compliance with the variousstatutory provisions and render relevantsupport to the business in handlingmatters concerning the compliancemanagement related to their operations.The Company aims at continuousimprovement of the processes whichinter-alia include, reporting methodologyof the legal matters, and standardizationof the procedures in line with the statutoryrequirements and for effectively carryingout various assignments.Cautionary StatementThe above Management Discussion and Analysiscontains certain forward looking statementswithin the meaning of applicable security lawsand regulations. These pertain to the Company’sfuture business prospects and businesspro tability, which are subject to a number of risksand uncertainties and the actual results couldmaterially differ from those in such forward lookingstatements. The risks and uncertainties relatingto these statements include, but are not limitedto, risks and uncertainties, regarding uctuationsin earnings, our ability to manage growth,competition, economic growth in India, ability toattract and retain highly skilled professionals,time and cost over runs on contracts, governmentpolicies and actions with respect to investments, scal de cits, regulation etc. In accordance withthe Code of Corporate Governance approvedby the Securities and Exchange Board of India,shareholders and readers are cautioned thatin the case of data and information external tothe Company, no representation is made onits accuracy or comprehensiveness thoughthe same are based on sources thought to bereliable. The Company does not undertake tomake any announcement in case any of theseforward looking statements become materiallyincorrect in future or update any forward lookingstatements made from time to time on behalf ofthe Company.31

Corporate Governance ReportCommander’s Court*, Chennai*This is an artist’s impression

Corporate Governance ReportYour Directors present the Company’s Report onCorporate Governance in compliance with Clause49 of the Listing Agreement executed with theStock Exchanges.Company’s PhilosophySound Corporate Governance Practices are prerequisitesfor building successful enterprises.The Company’s visionary founder had laid thefoundation for good governance and madeit an integral part of the business. This hasresulted in corporate governance practicesembedded in the culture and mindset of theorganization. These practices manifest in highstandards of accountability, transparency, socialresponsiveness, operational ef ciencies, bestethical practices and result in maximizing theshareholders’ value, protect the interest of allstakeholders besides fully complying with theregulatory requirements.The Company is committed to taking businessdecisions that are ethical and in compliancewith the applicable laws. By combining ethicalprinciples with business acumen, the Companyaims to maintain its leadership position.Board of DirectorsCompositionThe Board represents a healthy blend of knowledgeand experience. The composition of the Board isas under:CategoryNo. of DirectorsExecutive Directors 4Non-executive Directors- Independent Directors 5- Non-independent Director 1Total 10The rich and vast professional expertise ofIndependent Directors gives immense benetsto the Company. The composition of the Boardis in conformity with Clause 49 of the ListingAgreement.Executive Directors are appointed by theshareholders for a maximum period of 5 years at atime or such shorter duration as recommended bythe Board and are eligible for re-appointment uponcompletion of their term.Non-executive Directors/Independent Directors donot have any speci c term, but retire by rotation inaccordance with the provisions of the CompaniesAct, 1956.Prole of DirectorsDr. K. P. Singh (Kushal Pal Singh), the Chairmanof the Company, graduated in Science from MeerutUniversity and pursued Aeronautical Engineeringin England. He was selected to the Indian Army bythe British Of cers Services Selection Board UK,underwent training as a cadet at IMA Dehradunand served in The Deccan Horse cavalry regiment.In 1960, he joined American Universal ElectricCompany and took over as the Managing Directorafter its merger with <strong>DLF</strong> Universal Limited (now<strong>DLF</strong> Limited).As Chairman of <strong>DLF</strong>, he is widely credited withspearheading a transformation of the real estatesector in India and is best known for developingthe Gurgaon satellite city project in Haryana andhis catalytic role in making India the global hub forBusiness Process Outsourcing.In 2010, he was conferred the Padma Bhushannational award by the President of India in hisrecognition of exceptional and distinguishedservices to the Nation.He is also the recipient of numerous other awardsand honours, including the Samman Patra bythe Government of India for being one of the toptax payers of Delhi region in 2000, and the DelhiRatna Award by the Government of Delhi for hiscontribution towards urban development. He hasbeen conferred with an Honorary Doctorate by33