Upscale Hotels Asset Management Strategy

Upscale Hotels Asset Management Strategy

Upscale Hotels Asset Management Strategy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

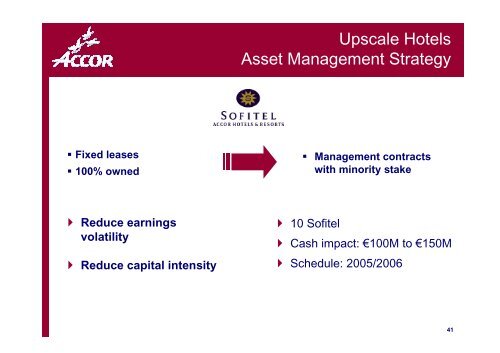

� Fixed leases<br />

� 100% owned<br />

� Reduce earnings<br />

volatility<br />

� Reduce capital intensity<br />

<strong>Upscale</strong> <strong>Hotels</strong><br />

<strong>Asset</strong> <strong>Management</strong> <strong>Strategy</strong><br />

� <strong>Management</strong> contracts<br />

with minority stake<br />

� 10 Sofitel<br />

� Cash impact: €100M to €150M<br />

� Schedule: 2005/2006<br />

41

An initial major transaction in March 2005<br />

with Foncière des Régions<br />

�Long term partnership with a consortium led by "Foncière des<br />

Régions" which includes Assurances du Crédit Mutuel, Generali,<br />

Predica (Groupe Crédit Agricole)<br />

�128 hotels in France (16,714 rooms): Novotel, Mercure and Ibis<br />

�Value: €1,025 million<br />

�Variable rents set at 15.5 % of revenues with no minimum<br />

guaranteed<br />

�Duration: 12 years, renewable 4 times per hotel at Accor’s discretion<br />

42

�Impact on profit before tax: + €10m<br />

�Renovation program financed by the investor: €100m<br />

�Capital gain: €120m<br />

�Cash: €140m<br />

An initial transaction in March 2005<br />

with Foncière des Régions<br />

Good financial conditions<br />

43

� Owned<br />

� Leased<br />

�Optimize ROCE<br />

<strong>Hotels</strong> disposals in non-priority locations<br />

� Franchise<br />

� Sale<br />

� 30 hotels in Europe<br />

� Impact:<br />

€130m to €150m in cash<br />

� Schedule: 2005/2006<br />

44

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

� An international strategic investor for<br />

Accor<br />

� A new asset management policy<br />

� Accelerated expansion<br />

Outline<br />

45

� A more favorable business environment<br />

� New financial leeway<br />

Accor is is stepping up up<br />

its its growth strategy<br />

Growth strategy<br />

46

Economy hotels in Europe:<br />

� Weak penetration of hotel<br />

chains in a growth market<br />

� Competition still limited<br />

(except in UK and France)<br />

� Accor’s expertise in this<br />

segment<br />

� High return<br />

Strengthening leadership positions in<br />

Economy hotels in Europe<br />

Target markets:<br />

� Expansion focused on<br />

major cities in Spain, the<br />

United Kingdom, Central<br />

Europe and Italy<br />

� Opportunistic expansion<br />

in Germany, France and<br />

the Benelux countries<br />

Initial three-year budget: €300m<br />

Stepped up up expansion: an an additional €150m<br />

47

Growth drivers:<br />

� Large populations<br />

� Exponential growth in<br />

demand<br />

� No economy hotels and<br />

fragmented supply in<br />

other segments<br />

Growth drivers in emerging markets<br />

Target markets:<br />

� China, India, Russia,<br />

Latin America, Middle<br />

East<br />

� Using joint ventures/<br />

management contracts /<br />

variable-rent contracts<br />

Initial 3-year budget: €100 million<br />

Faster expansion: + €200 million<br />

48

� Economy hotels:<br />

� 1et Ibis Tianjin opened in 2004<br />

Average occupancy rate: 94%<br />

ROCE: 13% from the first year<br />

� 10 projects already underway<br />

� Objective: 50 Ibis units in 2010<br />

� <strong>Upscale</strong> and midscale hotels:<br />

� Sofitel and Novotel: 50 hotels under<br />

management contract in 2010<br />

The breakthrough in China<br />

Average investment over three years: €100 million<br />

49

Vast VastMarket Market<br />

Basic<br />

Sophisticated<br />

40%<br />

2004<br />

Services growth strategy<br />

Strong Stronggrowing growing market<br />

market<br />

2025<br />

70%<br />

% of the world’s population living in cities<br />

(target population)<br />

50