Synergies between the two companies

Synergies between the two companies

Synergies between the two companies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

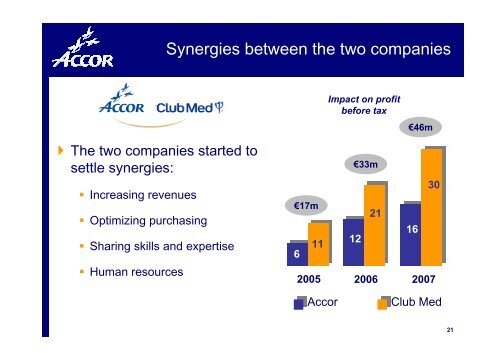

� The <strong>two</strong> <strong>companies</strong> started to<br />

settle synergies:<br />

� Increasing revenues<br />

� Optimizing purchasing<br />

� Sharing skills and expertise<br />

� Human resources<br />

<strong>Synergies</strong> <strong>between</strong> <strong>the</strong> <strong>two</strong> <strong>companies</strong><br />

€17m<br />

6<br />

11<br />

2005<br />

Impact on profit<br />

before tax<br />

€33m<br />

12<br />

21<br />

2006<br />

€46m<br />

16<br />

30<br />

2007<br />

Accor Club Med<br />

21

Club MedColombus -Bahamas<br />

22

Creation of <strong>the</strong> European leader in casinos<br />

� Jointly held by <strong>the</strong> Desseigne-Barrière family (51%), Accor (34%) and<br />

Colony Capital (15%)<br />

� €1 billion in revenues<br />

� 37 casinos<br />

� 13 luxury hotels<br />

� Restaurants<br />

Casino Barrière d'Enghien-les-Bains<br />

� Unique positioning to capitalize on <strong>the</strong> ongoing consolidation of <strong>the</strong><br />

casino industry in Europe: concession won for <strong>the</strong> new Toulouse casino<br />

� Shareholders’ pact for company management and pooling of skills<br />

� Capital gain of €83 million for Accor<br />

23

Casino Nice<br />

24

Casino Deauville<br />

25

Hôtel Normandy<br />

26

Travel agencies<br />

� Acquisition of Maritz Corporate Travel in <strong>the</strong> United<br />

States<br />

� Acquisition of Protravel in France<br />

Carlon Wagonlit Travel streng<strong>the</strong>ns<br />

its its # 2 position worldwide<br />

27

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

Outline<br />

28

�Revenues of €1,676m:<br />

up 5.6% as published<br />

�At constant scope of consolidation<br />

and exchange rates: up 3.8%<br />

� Hotels: up 2.1%<br />

� Services: up 11.8%<br />

� O<strong>the</strong>r businesses: up 6.6%<br />

First-quarter 2005 revenues up 5.6%,<br />

confirming a good overall trend<br />

4.3%<br />

Q1 04<br />

Like-for-like change<br />

6.1%<br />

Q2 04<br />

2.9%<br />

Q3 04<br />

Excl. impact of Easter<br />

vacation calendar and 29<br />

days in February<br />

5.1%<br />

Q4 04<br />

5.4%<br />

3.8%<br />

Q1 05<br />

29

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

� An international strategic investor for<br />

Accor<br />

� A new asset management policy<br />

� Accelerated expansion<br />

Outline<br />

30

invests<br />

via Colony VI et Colyzéo<br />

€ 1 billion<br />

in<br />

31

� International investment fund<br />

specialized in real estate and hotels<br />

Colony Capital<br />

� Since 1991, Colony Capital has invested $12.5 billion<br />

with an average return on investment of 21%<br />

32

Los<br />

Angeles<br />

Hawaii<br />

Head office<br />

Offices<br />

Boston<br />

New York<br />

International presence of Colony<br />

London<br />

Paris<br />

Madrid<br />

Rome<br />

Beirut<br />

Seoul<br />

Shanghai<br />

Hong Kong<br />

Tokyo<br />

Taipei<br />

Current investments : 1/3 Europe, 1/3 North America , 1/3 Asia<br />

33

� Accor Casinos<br />

� Group Lucien Barrière<br />

� Sofitel Demeure et Libertel<br />

� Novotel Paris Tour Eiffel<br />

Accor's traditional partner since 1998<br />

Novotel Paris Tour Eiffel<br />

34

Benefits for Accor<br />

A sizeable investment from an international strategic investor<br />

for Accor :<br />

� Give additional equity resources<br />

� Speed up expansion<br />

� Provide international expertise in hotel expansion<br />

A catalyst for for <strong>the</strong> <strong>the</strong> Accor share price<br />

35

ORAs<br />

(mandatory notes)<br />

� Amount: €500 million<br />

� Maturity: 3 years<br />

� Interest: 4.5%<br />

� Issue price €39<br />

(10% premium on <strong>the</strong> average<br />

share price of <strong>the</strong> past month)<br />

Terms of <strong>the</strong> transaction (1/2)<br />

Convertible notes<br />

� Amount: €500 million<br />

� Maturity: 5 years (put at 3 years)<br />

� Interest: 3.25%<br />

� Conversion price €43<br />

(21% premium on <strong>the</strong> average<br />

share price of <strong>the</strong> past month)<br />

36

� Specific clauses for <strong>the</strong> subscriber<br />

� No conversion before January 1, 2007<br />

� Six-month standstill following conversion<br />

� No short over <strong>the</strong> period<br />

� Corporate governance :<br />

Terms of <strong>the</strong> transaction(2/2)<br />

� Colony joins <strong>the</strong> Supervisory Board and <strong>the</strong> commitments<br />

committee<br />

37

� 2004 Results<br />

� 2005 Q1 sales<br />

� Strategic Vision<br />

� An international strategic investor for<br />

Accor<br />

� A new asset management policy<br />

� Accelerated expansion<br />

Outline<br />

38

Innovative asset management<br />

to support <strong>the</strong> Hotel strategy<br />

An innovative<br />

asset externalization program<br />

designed to:<br />

� Reduce capital intensity in upscale hotels<br />

� Variabilize holding costs in <strong>the</strong> midscale segment<br />

Focus on on operating hotels<br />

and<br />

Reinforce expansion strategy<br />

39

Using <strong>the</strong> right operating structure<br />

for each segment<br />

Hotel segment Preferred operating structure<br />

� Management contracts<br />

with minority stake<br />

� Variable rents, based on<br />

a % of revenues<br />

� Franchises<br />

� Fixed/variable rents<br />

� Franchises<br />

40