Download the Ngāi Tahu Corporate Profile - Ngai Tahu

Download the Ngāi Tahu Corporate Profile - Ngai Tahu

Download the Ngāi Tahu Corporate Profile - Ngai Tahu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

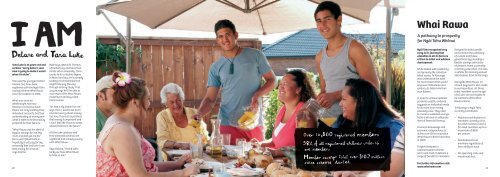

Whai RawaA pathway to prosperityfor <strong>Ngāi</strong> <strong>Tahu</strong> WhānuiTana Luke is 16 years-old andreckons “every dollar I savenow is going to make it easierwhen I’m older”.Tana and his younger bro<strong>the</strong>rDelane (14), have beenregistered with <strong>the</strong> <strong>Ngāi</strong> <strong>Tahu</strong>savings scheme Whai Rawasince its inception in 2006.What was once anafterthought has nowbecome a conscious habitthat is not only building <strong>the</strong>irindividual accounts, but <strong>the</strong>irunderstanding of money andwhat it takes to be financiallyprepared for <strong>the</strong>ir futures.“Whai Rawa was <strong>the</strong> start ofregular savings for me. Mymum and dad got me <strong>the</strong>forms and I filled <strong>the</strong>m in –hopefully it will pay for myuniversity fees and later I cankeep saving for a house,”says Delane.Both boys attend St Thomasof Canterbury and have <strong>the</strong>irminds set on university. Tanawants to do a double degreein Māori and law. He’s alreadylooking at scholarships thatmight help pay his waythrough tertiary study. Thatway he says he’ll be able tosave more of his Whai Rawainvestment and buy a firsthome sooner.“It’s had a big impact on me,”says Tana. I used to let mumand dad worry about money,but now I have an awarenessthat money is important andI don’t feel like I have to stressabout finances in <strong>the</strong> future.”All <strong>the</strong> Luke whānau and<strong>the</strong>ir extended whānau areregistered and actively savingwith Whai Rawa.Says Delane, “I think we’relucky we have Whai Rawato help us out.”<strong>Ngāi</strong> <strong>Tahu</strong> recognised veryearly in its journey thateducation in all its forms iscritical to tribal and whānaudevelopment.While tasked with protectingand growing <strong>the</strong> collectivetribal assets, Te Rūnangaalso understood <strong>the</strong> needfor mechanisms that wouldempower individuals andwhānau to determine <strong>the</strong>irown futures.In order to achieve optimalpersonal wealth, evidencesuggests an individual needsto do more than merelypassively save. They needto create a sustained savingshabit and have an adequatelevel of financial literacy.Financial knowledge andeconomic independence isat <strong>the</strong> core of <strong>the</strong> innovativeWhai Rawa scheme launchedin 2006.A hybrid between asuperannuation schemeand a unit trust, it delivers arange of benefits to members.Designed to build wealthand enhance <strong>the</strong> wellbeingof current and futuregenerations by providing aflexible savings vehicle forretirement, home ownershipor tertiary education. It is alsoa vehicle for receiving annualdistributions from Te Rūnanga.Alongside Whai Rawa, anannual payment is also madeto our kaumātua, all thosetribal members over <strong>the</strong> ageof 65 who are not eligible tobe members of <strong>the</strong> WhaiRawa scheme.Te Rūnanga o <strong>Ngāi</strong> <strong>Tahu</strong>currently contributes:• Matched contributions tomembers currently at 4:1for child members and 1:1for adult members up to amaximum of $200per annum.• Distributions to allmembers regardless of<strong>the</strong>ir ability to save• All operating costs andinvestment fees.For fur<strong>the</strong>r information visit:40www.whairawa.com41