Responsibility Report - Peabody Energy

Responsibility Report - Peabody Energy

Responsibility Report - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

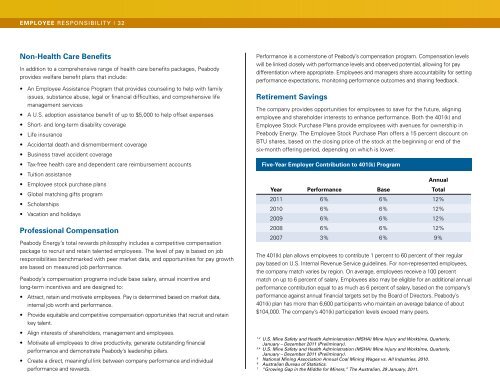

employee responsibility | 32Non-Health Care BenefitsIn addition to a comprehensive range of health care benefits packages, <strong>Peabody</strong>provides welfare benefit plans that include:• An Employee Assistance Program that provides counseling to help with familyissues, substance abuse, legal or financial difficulties, and comprehensive lifemanagement services• A U.S. adoption assistance benefit of up to $5,000 to help offset expenses• Short- and long-term disability coverage• Life insurance• Accidental death and dismemberment coverage• Business travel accident coverage• Tax-free health care and dependent care reimbursement accounts• Tuition assistance• Employee stock purchase plans• Global matching gifts program• Scholarships• Vacation and holidaysProfessional Compensation<strong>Peabody</strong> <strong>Energy</strong>’s total rewards philosophy includes a competitive compensationpackage to recruit and retain talented employees. The level of pay is based on jobresponsibilities benchmarked with peer market data, and opportunities for pay growthare based on measured job performance.<strong>Peabody</strong>’s compensation programs include base salary, annual incentive andlong-term incentives and are designed to:• Attract, retain and motivate employees. Pay is determined based on market data,internal job worth and performance.• Provide equitable and competitive compensation opportunities that recruit and retainkey talent.• Align interests of shareholders, management and employees.• Motivate all employees to drive productivity, generate outstanding financialperformance and demonstrate <strong>Peabody</strong>’s leadership pillars.• Create a direct, meaningful link between company performance and individualperformance and rewards.Performance is a cornerstone of <strong>Peabody</strong>’s compensation program. Compensation levelswill be linked closely with performance levels and observed potential, allowing for paydifferentiation where appropriate. Employees and managers share accountability for settingperformance expectations, monitoring performance outcomes and sharing feedback.Retirement SavingsThe company provides opportunities for employees to save for the future, aligningemployee and shareholder interests to enhance performance. Both the 401(k) andEmployee Stock Purchase Plans provide employees with avenues for ownership in<strong>Peabody</strong> <strong>Energy</strong>. The Employee Stock Purchase Plan offers a 15 percent discount onBTU shares, based on the closing price of the stock at the beginning or end of thesix-month offering period, depending on which is lower.Five-Year Employer Contribution to 401(k) ProgramAnnualYear Performance Base Total2011 6% 6% 12%2010 6% 6% 12%2009 6% 6% 12%2008 6% 6% 12%2007 3% 6% 9%The 401(k) plan allows employees to contribute 1 percent to 60 percent of their regularpay based on U.S. Internal Revenue Service guidelines. For non-represented employees,the company match varies by region. On average, employees receive a 100 percentmatch on up to 6 percent of salary. Employees also may be eligible for an additional annualperformance contribution equal to as much as 6 percent of salary, based on the company’sperformance against annual financial targets set by the Board of Directors. <strong>Peabody</strong>’s401(k) plan has more than 6,600 participants who maintain an average balance of about$104,000. The company’s 401(k) participation levels exceed many peers.1,2U.S. Mine Safety and Health Administration (MSHA) Mine Injury and Worktime, Quarterly,January – December 2011 (Preliminary).3,4U.S. Mine Safety and Health Administration (MSHA) Mine Injury and Worktime, Quarterly,January – December 2011 (Preliminary).5National Mining Association Annual Coal Mining Wages vs. All Industries, 2010.6Australian Bureau of Statistics.7“Growing Gap in the Middle for Miners,” The Australian, 29 January, 2011.