Membership Guide - SuperFacts.com

Membership Guide - SuperFacts.com

Membership Guide - SuperFacts.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

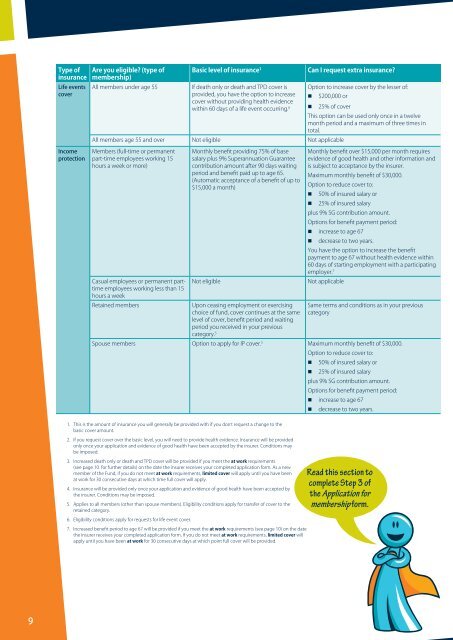

Type ofinsuranceLife eventscoverAre you eligible? (type ofmembership)All members under age 55Basic level of insurance 1If death only or death and TPD cover isprovided, you have the option to increasecover without providing health evidencewithin 60 days of a life event occurring. 6All members age 55 and over Not eligible Not applicableCan I request extra insurance?Option to increase cover by the lesser of:• $200,000 or• 25% of coverThis option can be used only once in a twelvemonth period and a maximum of three times intotal.In<strong>com</strong>eprotectionMembers (full-time or permanentpart-time employees working 15hours a week or more)Casual employees or permanent parttimeemployees working less than 15hours a weekRetained membersMonthly benefit providing 75% of basesalary plus 9% Superannuation Guaranteecontribution amount after 90 days waitingperiod and benefit paid up to age 65.(Automatic acceptance of a benefit of up to$15,000 a month)Not eligibleMonthly benefit over $15,000 per month requiresevidence of good health and other information andis subject to acceptance by the insurer.Maximum monthly benefit of $30,000.Option to reduce cover to:• 50% of insured salary or• 25% of insured salaryplus 9% SG contribution amount.Options for benefit payment period:• increase to age 67• decrease to two years.You have the option to increase the benefitpayment to age 67 without health evidence within60 days of starting employment with a participatingemployer. 7Not applicableUpon ceasing employment or exercisingchoice of fund, cover continues at the sameSame terms and conditions as in your previouscategorylevel of cover, benefit period and waitingperiod you received in your previouscategory. 5Spouse members Option to apply for IP cover. 5 Maximum monthly benefit of $30,000.Option to reduce cover to:• 50% of insured salary or• 25% of insured salaryplus 9% SG contribution amount.Options for benefit payment period:• increase to age 67• decrease to two years.1. This is the amount of insurance you will generally be provided with if you don’t request a change to thebasic cover amount.2. If you request cover over the basic level, you will need to provide health evidence. Insurance will be providedonly once your application and evidence of good health have been accepted by the insurer. Conditions maybe imposed.3. Increased death only or death and TPD cover will be provided if you meet the at work requirements(see page 10 for further details) on the date the insurer receives your <strong>com</strong>pleted application form. As a newmember of the Fund, if you do not meet at work requirements, limited cover will apply until you have beenat work for 30 consecutive days at which time full cover will apply.4. Insurance will be provided only once your application and evidence of good health have been accepted bythe insurer. Conditions may be imposed.5. Applies to all members (other than spouse members). Eligibility conditions apply for transfer of cover to theretained category.6. Eligibility conditions apply for requests for life event cover.7. Increased benefit period to age 67 will be provided if you meet the at work requirements (see page 10) on the datethe insurer receives your <strong>com</strong>pleted application form. If you do not meet at work requirements, limited cover willapply until you have been at work for 30 consecutive days at which point full cover will be provided.Read this section to<strong>com</strong>plete Step 3 ofthe Application formembership form.9