Membership Guide - SuperFacts.com

Membership Guide - SuperFacts.com

Membership Guide - SuperFacts.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

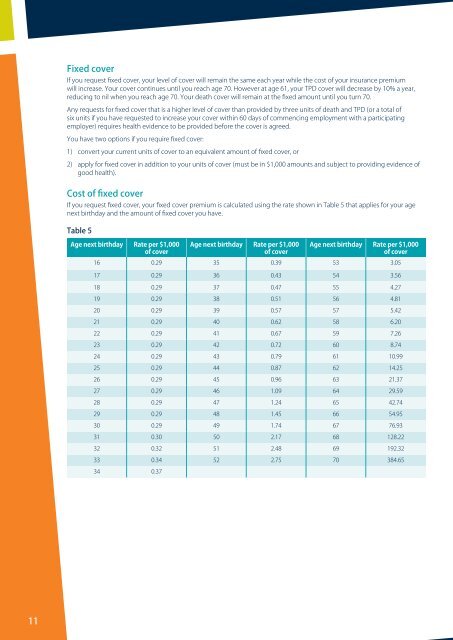

Fixed coverIf you request fixed cover, your level of cover will remain the same each year while the cost of your insurance premiumwill increase. Your cover continues until you reach age 70. However at age 61, your TPD cover will decrease by 10% a year,reducing to nil when you reach age 70. Your death cover will remain at the fixed amount until you turn 70.Any requests for fixed cover that is a higher level of cover than provided by three units of death and TPD (or a total ofsix units if you have requested to increase your cover within 60 days of <strong>com</strong>mencing employment with a participatingemployer) requires health evidence to be provided before the cover is agreed.You have two options if you require fixed cover:1) convert your current units of cover to an equivalent amount of fixed cover, or2) apply for fixed cover in addition to your units of cover (must be in $1,000 amounts and subject to providing evidence ofgood health).Cost of fixed coverIf you request fixed cover, your fixed cover premium is calculated using the rate shown in Table 5 that applies for your agenext birthday and the amount of fixed cover you have.Table 5Age next birthday Rate per $1,000of coverAge next birthday Rate per $1,000of coverAge next birthday Rate per $1,000of cover16 0.29 35 0.39 53 3.0517 0.29 36 0.43 54 3.5618 0.29 37 0.47 55 4.2719 0.29 38 0.51 56 4.8120 0.29 39 0.57 57 5.4221 0.29 40 0.62 58 6.2022 0.29 41 0.67 59 7.2623 0.29 42 0.72 60 8.7424 0.29 43 0.79 61 10.9925 0.29 44 0.87 62 14.2526 0.29 45 0.96 63 21.3727 0.29 46 1.09 64 29.5928 0.29 47 1.24 65 42.7429 0.29 48 1.45 66 54.9530 0.29 49 1.74 67 76.9331 0.30 50 2.17 68 128.2232 0.32 51 2.48 69 192.3233 0.34 52 2.75 70 384.6534 0.3711