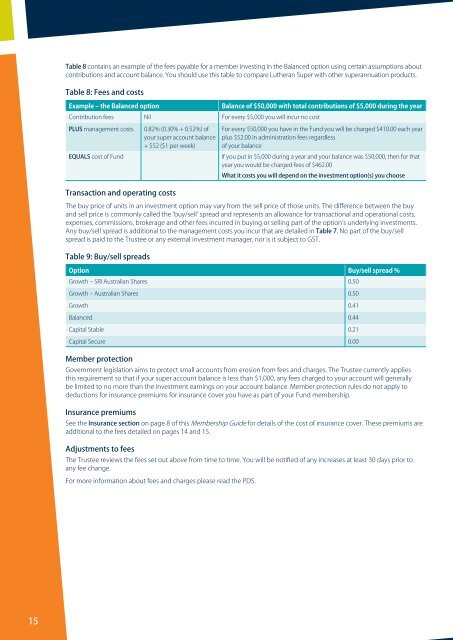

Table 8 contains an example of the fees payable for a member investing in the Balanced option using certain assumptions aboutcontributions and account balance. You should use this table to <strong>com</strong>pare Lutheran Super with other superannuation products.Table 8: Fees and costsExample – the Balanced optionContribution fees Nil For every $5,000 you will incur no costBalance of $50,000 with total contributions of $5,000 during the yearPLUS management costsEQUALS cost of Fund0.82% (0.30% + 0.52%) ofyour super account balance+ $52 ($1 per week)For every $50,000 you have in the Fund you will be charged $410.00 each yearplus $52.00 in administration fees regardlessof your balanceIf you put in $5,000 during a year and your balance was $50,000, then for thatyear you would be charged fees of $462.00What it costs you will depend on the investment option(s) you chooseTransaction and operating costsThe buy price of units in an investment option may vary from the sell price of those units. The difference between the buyand sell price is <strong>com</strong>monly called the ‘buy/sell’ spread and represents an allowance for transactional and operational costs,expenses, <strong>com</strong>missions, brokerage and other fees incurred in buying or selling part of the option’s underlying investments.Any buy/sell spread is additional to the management costs you incur that are detailed in Table 7. No part of the buy/sellspread is paid to the Trustee or any external investment manager, nor is it subject to GST.Table 9: Buy/sell spreadsOption Buy/sell spread %Growth – SRI Australian Shares 0.50Growth – Australian Shares 0.50Growth 0.41Balanced 0.44Capital Stable 0.21Capital Secure 0.00Member protectionGovernment legislation aims to protect small accounts from erosion from fees and charges. The Trustee currently appliesthis requirement so that if your super account balance is less than $1,000, any fees charged to your account will generallybe limited to no more than the investment earnings on your account balance. Member protection rules do not apply todeductions for insurance premiums for insurance cover you have as part of your Fund membership.Insurance premiumsSee the Insurance section on page 8 of this <strong>Membership</strong> <strong>Guide</strong> for details of the cost of insurance cover. These premiums areadditional to the fees detailed on pages 14 and 15.Adjustments to feesThe Trustee reviews the fees set out above from time to time. You will be notified of any increases at least 30 days prior toany fee change.For more information about fees and charges please read the PDS.15

Section 8 – Tax andyour superAlthough super is one of the most tax effective vehicles inwhich to save for your retirement, different levels of tax mayapply to certain contributions.Generally, tax is paid:• when contributions are paid into the Fund• on investment earnings• on benefits to which the tax-free limit doesn’t apply,which are paid to you when you are under age 60Tax is <strong>com</strong>plicated, so you may wish to seek assistance froma tax adviser for advice on how superannuation taxes affectyou personally.For more information about tax and super, please readthe PDS.In line with the Superannuation industry (Supervision) Act1993, the Trustee of Lutheran Super is authorised to ask foryour tax file number. The Trustee will only use your tax filenumber for lawful purposes. These purposes may change inthe future if there are changes to legislation.The Trustee may pass your tax file number to any othersuper fund or account to which your super is transferred inthe future unless you request in writing that this notbe done.By providing your tax file number:• the Trustee will be able to accept all types ofcontributions made by or for you (some limitsmay apply)• you can avoid paying tax at a higher rate than wouldotherwise apply on your contributions• you can avoid paying tax at a higher rate than wouldotherwise apply on your benefit, and• it will be easier for you to find your super in the futureand ensure that you receive all of your super benefitswhen you retire.Choosing not to provide your tax file number is not anoffence. However, if you don’t provide your tax file numbernow or in the future:• the Trustee will only be able to accept contributionsmade for you by your employer. No other contributions,for example, after-tax contributions, can be accepted• you may pay more tax on contributions made for you byyour employer. In some circumstances you may be ableto claim back this additional tax, however time limits,fees and other rules may apply• you may pay more tax on your super benefit than youwould otherwise (although you can claim this backwhen you lodge your tax return).Super factDon’t pay extra tax! Providing yourtax file number is importantProviding your TFN to the Fund is important. If the Funddoes not have your TFN, you will pay additional tax onyour contributions and the Fund cannot accept any extracontributions you may make. Additionally, you may pay highertax than necessary on your super payout. Please ensure thatyou fill in Step 5 of the Application for membership form.Section 9 – Otherimportant informationEnquiries and <strong>com</strong>plaintsMost enquiries can be sorted out over the phone,but if we are unable to help you immediately, youmay be asked to put your enquiry in writing. You canwrite to:Enquiries and Complaints OfficerLutheran SuperC/- GPO Box 4303Melbourne VIC 3001The matter will be investigated by the Complaints Officerand, where necessary, the Complaints Committee on behalfof the Trustee. You will be advised of the Trustee’s decisionas soon as possible and within 90 days or within 30 days ofthe Trustee’s decision, whichever is earlier.If you have a <strong>com</strong>plaint and you are not satisfied with theresponse or the matter can’t be resolved, you may be able torefer the matter to the Superannuation Complaints Tribunal(SCT). The SCT is an independent government body whichis set up to help resolve disputes between super funds andtheir members. Any <strong>com</strong>plaints must be lodged with theTribunal within certain time limits.For more information you can contact the SCT on1300 884 114 or write to:Superannuation Complaints TribunalLocked Bag 3060GPO Melbourne Victoria 3001For other important information, including Family Lawand your super and protecting your privacy, please readthe PDS.16