Aman Feed Limited (AFL) - Credit Rating Agency of Bangladesh

Aman Feed Limited (AFL) - Credit Rating Agency of Bangladesh

Aman Feed Limited (AFL) - Credit Rating Agency of Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

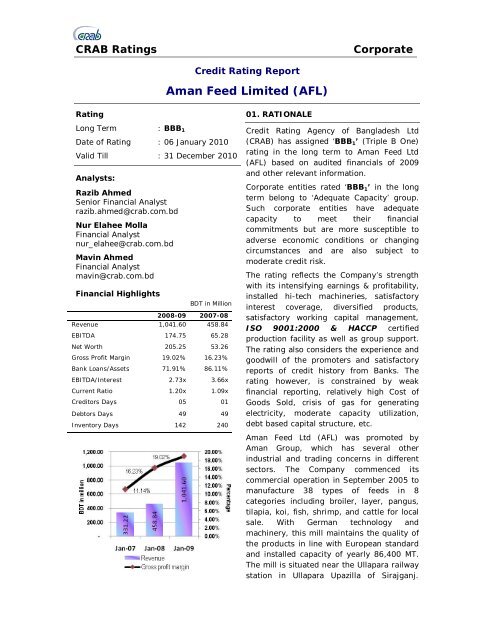

CRAB <strong>Rating</strong>sCorporate<strong>Credit</strong> <strong>Rating</strong> Report<strong>Aman</strong> <strong>Feed</strong> <strong>Limited</strong> (<strong>AFL</strong>)<strong>Rating</strong>Long Term : BBB 1Date <strong>of</strong> <strong>Rating</strong> : 06 January 2010Valid Till : 31 December 2010Analysts:Razib AhmedSenior Financial Analystrazib.ahmed@crab.com.bdNur Elahee MollaFinancial Analystnur_elahee@crab.com.bdMavin AhmedFinancial Analystmavin@crab.com.bdFinancial HighlightsBDT in Million2008-09 2007-08Revenue 1,041.60 458.84EBITDA 174.75 65.28Net Worth 205.25 53.26Gross Pr<strong>of</strong>it Margin 19.02% 16.23%Bank Loans/Assets 71.91% 86.11%EBITDA/Interest 2.73x 3.66xCurrent Ratio 1.20x 1.09x<strong>Credit</strong>ors Days 05 01Debtors Days 49 49Inventory Days 142 24001. RATIONALE<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong> Ltd(CRAB) has assigned ‘BBB 1 ’ (Triple B One)rating in the long term to <strong>Aman</strong> <strong>Feed</strong> Ltd(<strong>AFL</strong>) based on audited financials <strong>of</strong> 2009and other relevant information.Corporate entities rated ‘BBB 1 ’ in the longterm belong to ‘Adequate Capacity’ group.Such corporate entities have adequatecapacity to meet their financialcommitments but are more susceptible toadverse economic conditions or changingcircumstances and are also subject tomoderate credit risk.The rating reflects the Company’s strengthwith its intensifying earnings & pr<strong>of</strong>itability,installed hi-tech machineries, satisfactoryinterest coverage, diversified products,satisfactory working capital management,ISO 9001:2000 & HACCP certifiedproduction facility as well as group support.The rating also considers the experience andgoodwill <strong>of</strong> the promoters and satisfactoryreports <strong>of</strong> credit history from Banks. Therating however, is constrained by weakfinancial reporting, relatively high Cost <strong>of</strong>Goods Sold, crisis <strong>of</strong> gas for generatingelectricity, moderate capacity utilization,debt based capital structure, etc.<strong>Aman</strong> <strong>Feed</strong> Ltd (<strong>AFL</strong>) was promoted by<strong>Aman</strong> Group, which has several otherindustrial and trading concerns in differentsectors. The Company commenced itscommercial operation in September 2005 tomanufacture 38 types <strong>of</strong> feeds in 8categories including broiler, layer, pangus,tilapia, koi, fish, shrimp, and cattle for localsale. With German technology andmachinery, this mill maintains the quality <strong>of</strong>the products in line with European standardand installed capacity <strong>of</strong> yearly 86,400 MT.The mill is situated near the Ullapara railwaystation in Ullapara Upazilla <strong>of</strong> Sirajganj.

CRAB <strong>Rating</strong>sCorporate<strong>AFL</strong>’s revenue from sales experienced sharp growth in FY 2008-09. The revenue sourcesare 100% local sales <strong>of</strong> different types <strong>of</strong> poultry feed and fish meal through listed 67dealers. During FY 2008-09, <strong>AFL</strong> produced 42.16 million kg feed/meal, which was 21.27Million kg in FY 2007-08. Total sales <strong>of</strong> the Company increased to BDT 1,041.60 millionin FY 2008-09 by 127% from BDT 458.84 million.<strong>AFL</strong>’s Gross Pr<strong>of</strong>it Margin (19.02%) as well as Operating Pr<strong>of</strong>it Margin (16.01%)experienced in upward trend in FY 2008-09 due to decreasing CoGS. However, firm’sCoGS were relatively higher than other industry, showing almost 85% <strong>of</strong> total revenuefor last few years <strong>of</strong> operation. Net Pr<strong>of</strong>it Margin <strong>of</strong> the Company also shows upwardtrend but slowly because <strong>of</strong> increasing financial expenditure. Last year, Both ROA & ROE<strong>of</strong> the Company shows positive growth.The rating considers the debt based capital structure <strong>of</strong> <strong>AFL</strong>. Company’s debt to equityratio in FY 2008-09 was 2.86 times, which was 9.65 times in FY 2007-08, indicating thatthe firm recently increases its equity cushion to its creditors/lenders. Debt to asset ratio<strong>of</strong> the Company was 73.60% in FY 2008-09, which was 86.62% in FY 2007-08.<strong>AFL</strong> has satisfactory interest coverage ratio over the last few years <strong>of</strong> operation.However, the concern area is the ratios are in diminishing trends due to increasingfinancial expenses. Company’s Fund from Operation was 2.73 times <strong>of</strong> interest expensesin FY 2008-09, which was 3.66 times <strong>of</strong> interest expenses in FY 2007-08.Liquidity position <strong>of</strong> <strong>AFL</strong> was found to be tight in FY 2006-07 and FY 2007-08, but quiteimproved in recent year. Cash and Bank balance <strong>of</strong> the Company was very low at initialstage <strong>of</strong> the firm and now comes at stable position. Current ratio <strong>of</strong> the Company was atjustified level; current assets are on an average 1.12 times the current liabilities.However, the Company shows efficiency in working capital management.Working capital intensity <strong>of</strong> <strong>AFL</strong> is in decreasing trend because <strong>of</strong> decreasing inventorydays and debtor days, with increasing Days payable in FY 2008-09. The Company showssome improvement through decline in debtor days from 230 to 49 days as the Companyimproved its collection period and inventory days from 240 to 142 days signifying goodinventory management. Increasing trade creditor from BDT 2.05 million to BDT 13.50million in FY 2008-09 indicates that the Company now takes more time to settle itspayment to the creditor.<strong>AFL</strong> has been banking with two commercial banks, i.e., AB Bank <strong>Limited</strong> (KakrailBranch), and EXIM Bank Ltd (RAJUK Branch). <strong>AFL</strong> has been banking with above banksfor more than 3 years. Since the inception <strong>of</strong> business relationship with the subject,overall performance <strong>of</strong> <strong>AFL</strong> is reported to be satisfactory. According to reports fromthese two banks, repayment <strong>of</strong> interest/pr<strong>of</strong>it and principal form <strong>AFL</strong> has been timely.There is no record <strong>of</strong> any default by <strong>AFL</strong> or its sister companies. As per bank recordsduring last one year, financial relationship with <strong>AFL</strong>’s suppliers and customers was foundto be good with no records <strong>of</strong> dishonoring <strong>of</strong> cheques due to insufficient fund.The rating also considers the support from the group (<strong>Aman</strong> Group) regarding financialissues, strong controlling and monitoring system, management support andinfrastructural facilities. The labor retention success, technology used, soundmanagement information system but weak financial reporting and the nature <strong>of</strong> businessare also considered while assigning the rating.Page 2 <strong>of</strong> 2