IDLC Securitization Trust 2007-A - Credit Rating Agency of ...

IDLC Securitization Trust 2007-A - Credit Rating Agency of ...

IDLC Securitization Trust 2007-A - Credit Rating Agency of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

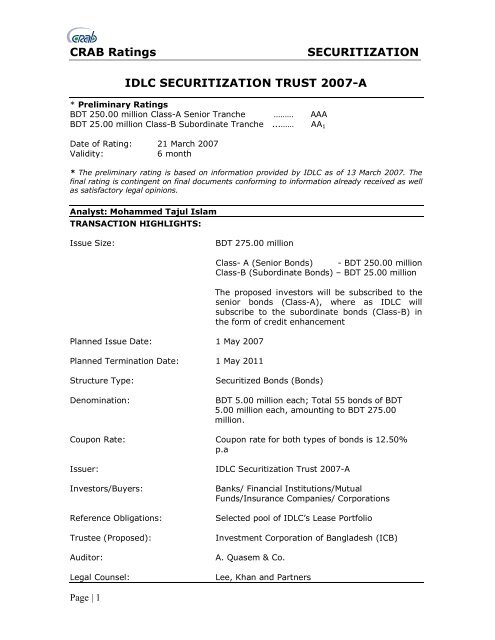

CRAB <strong>Rating</strong>sSECURITIZATION<strong>IDLC</strong> SECURITIZATION TRUST <strong>2007</strong>-A* Preliminary <strong>Rating</strong>sBDT 250.00 million Class-A Senior Tranche ……… AAABDT 25.00 million Class-B Subordinate Tranche ...…… AA 1Date <strong>of</strong> <strong>Rating</strong>: 21 March <strong>2007</strong>Validity:6 month* The preliminary rating is based on information provided by <strong>IDLC</strong> as <strong>of</strong> 13 March <strong>2007</strong>. Thefinal rating is contingent on final documents conforming to information already received as wellas satisfactory legal opinions.Analyst: Mohammed Tajul IslamTRANSACTION HIGHLIGHTS:Issue Size:BDT 275.00 millionPlanned Issue Date: 1 May <strong>2007</strong>Planned Termination Date: 1 May 2011Class- A (Senior Bonds) - BDT 250.00 millionClass-B (Subordinate Bonds) – BDT 25.00 millionThe proposed investors will be subscribed to thesenior bonds (Class-A), where as <strong>IDLC</strong> willsubscribe to the subordinate bonds (Class-B) inthe form <strong>of</strong> credit enhancementStructure Type:Denomination:Securitized Bonds (Bonds)BDT 5.00 million each; Total 55 bonds <strong>of</strong> BDT5.00 million each, amounting to BDT 275.00million.Coupon Rate: Coupon rate for both types <strong>of</strong> bonds is 12.50%p.aIssuer: <strong>IDLC</strong> <strong>Securitization</strong> <strong>Trust</strong> <strong>2007</strong>-AInvestors/Buyers:Reference Obligations:<strong>Trust</strong>ee (Proposed):Auditor:Legal Counsel:Banks/ Financial Institutions/MutualFunds/Insurance Companies/ CorporationsSelected pool <strong>of</strong> <strong>IDLC</strong>’s Lease PortfolioInvestment Corporation <strong>of</strong> Bangladesh (ICB)A. Quasem & Co.Lee, Khan and PartnersPage | 1

CRAB <strong>Rating</strong>sSECURITIZATIONOriginator & Servicer:<strong>IDLC</strong> <strong>of</strong> Bangladesh Limited2.0 TRANSACTION SUMMARY:The Preliminary ratings as indicated above constitute the securitization <strong>of</strong> leasereceivables originated by <strong>IDLC</strong>, a leading non-bank financial institution. The creditlinked securities are backed by the collateral (<strong>IDLC</strong>’s earmarked portfolio) which willbe purchased at closing by <strong>IDLC</strong> <strong>Securitization</strong> <strong>Trust</strong> <strong>2007</strong>-A, with the proceeds fromthe issuance <strong>of</strong> the above mentioned securities. The Issuer is a Special PurposeVehicle (SPV), registered in Bangladesh as <strong>Trust</strong>. The outstanding principal <strong>of</strong> theunderlying pool, repayable in quarterly installments after 12 months <strong>of</strong> issuance <strong>of</strong>security and matures at the end <strong>of</strong> 48 month, whereas the final maturity <strong>of</strong> theunderlying pool is 58 months from the issue date. The investors hold an undividedbeneficial interest in the underlying assets and receivables. The rating <strong>of</strong> thesecurities is directly linked to the rating <strong>of</strong> the underlying pool as well as transactionstructure.3.0 RATIONALE:The preliminary ratings assigned against each class issued by <strong>IDLC</strong> <strong>Securitization</strong><strong>Trust</strong> <strong>2007</strong>-A is based on the following:• The credit quality <strong>of</strong> the reference portfolio <strong>of</strong> <strong>IDLC</strong>, whose credit performancehas a direct impact on the repayment <strong>of</strong> principal and interest to thebondholders.• <strong>Credit</strong> enhancement in the form <strong>of</strong> over-collateralization <strong>of</strong> BDT 29.00 million (initial bond size is BDT 275.00 million whereas total assignment <strong>of</strong> collateral atthe beginning <strong>of</strong> the transaction is BDT 304.00 million which constitutes overcollateralization<strong>of</strong> 10.54% <strong>of</strong> the initial pool size).• Cash Reserve in the trust account at the beginning <strong>of</strong> the transaction to thetune <strong>of</strong> BDT 6.18 million.• Retention provision <strong>of</strong> excess spread as credit enhancement.• Reinvestment provisions <strong>of</strong> trust assets by the trust.• Senior-Subordinated Structure protects the interest <strong>of</strong> senior bondholders andis a form <strong>of</strong> credit enhancement to the senior bondholders.• Substitution/Replacement eligibility criteria to swap delinquent andprepayment loans.• The ability <strong>of</strong> <strong>IDLC</strong> to underwrite and service its lease finance loans.• Strong payment structure <strong>of</strong> the transaction.• Undertaking by the servicer to provide servicer advance in case <strong>of</strong> delay incollection to redeem the bonds at stipulated time.• The undertaking <strong>of</strong> Investment Corporation <strong>of</strong> Bangladesh (ICB) as a <strong>Trust</strong>eeto pay all the expenses <strong>of</strong> the <strong>Trust</strong> other than interest on the securities andthe incorporation <strong>of</strong> appropriated cash collateralization/ substitution triggers.• The bankruptcy remoteness <strong>of</strong> the Issuer.• Trapping <strong>of</strong> prepayment risk through creating Provisional Account from wherepre determined obligation <strong>of</strong> the <strong>Trust</strong> will be met.Page | 2