Aftab Automobiles Limited - Credit Rating Agency of Bangladesh

Aftab Automobiles Limited - Credit Rating Agency of Bangladesh

Aftab Automobiles Limited - Credit Rating Agency of Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

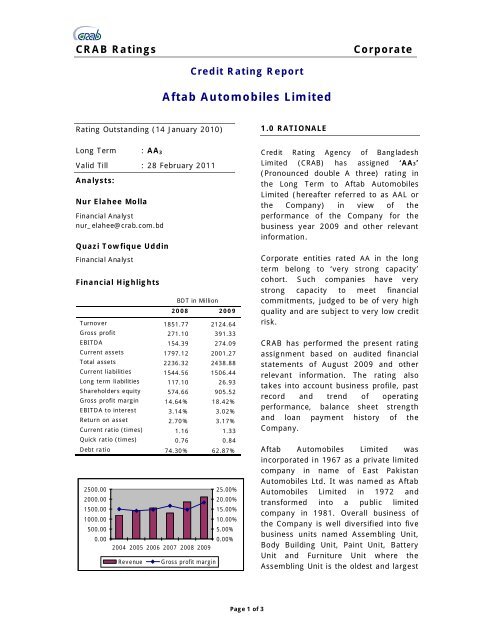

CRAB <strong>Rating</strong>sCorporate<strong>Credit</strong> <strong>Rating</strong> Report<strong>Aftab</strong> <strong>Automobiles</strong> <strong>Limited</strong><strong>Rating</strong> Outstanding (14 January 2010)1.0 RATIONALELong Term : AA 3Valid Till : 28 February 2011Analysts:Nur Elahee MollaFinancial Analystnur_elahee@crab.com.bdQuazi Towfique UddinFinancial AnalystFinancial HighlightsBDT in Million2008 2009Turnover 1851.77 2124.64Gross pr<strong>of</strong>it 271.10 391.33EBITDA 154.39 274.09Current assets 1797.12 2001.27Total assets 2236.32 2438.88Current liabilities 1544.56 1506.44Long term liabilities 117.10 26.93Shareholders equity 574.66 905.52Gross pr<strong>of</strong>it margin 14.64% 18.42%EBITDA to interest 3.14% 3.02%Return on asset 2.70% 3.17%Current ratio (times) 1.16 1.33Quick ratio (times) 0.76 0.84Debt ratio 74.30% 62.87%2500.002000.001500.001000.00500.000.002004 2005 2006 2007 2008 2009RevenueGross pr<strong>of</strong>it margin25.00%20.00%15.00%10.00%5.00%0.00%<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong><strong>Limited</strong> (CRAB) has assigned ‘AA3’(Pronounced double A three) rating inthe Long Term to <strong>Aftab</strong> <strong>Automobiles</strong><strong>Limited</strong> (hereafter referred to as AAL orthe Company) in view <strong>of</strong> theperformance <strong>of</strong> the Company for thebusiness year 2009 and other relevantinformation.Corporate entities rated AA in the longterm belong to ‘very strong capacity’cohort. Such companies have verystrong capacity to meet financialcommitments, judged to be <strong>of</strong> very highquality and are subject to very low creditrisk.CRAB has performed the present ratingassignment based on audited financialstatements <strong>of</strong> August 2009 and otherrelevant information. The rating alsotakes into account business pr<strong>of</strong>ile, pastrecord and trend <strong>of</strong> operatingperformance, balance sheet strengthand loan payment history <strong>of</strong> theCompany.<strong>Aftab</strong> <strong>Automobiles</strong> <strong>Limited</strong> wasincorporated in 1967 as a private limitedcompany in name <strong>of</strong> East Pakistan<strong>Automobiles</strong> Ltd. It was named as <strong>Aftab</strong><strong>Automobiles</strong> <strong>Limited</strong> in 1972 andtransformed into a public limitedcompany in 1981. Overall business <strong>of</strong>the Company is well diversified into fivebusiness units named Assembling Unit,Body Building Unit, Paint Unit, BatteryUnit and Furniture Unit where theAssembling Unit is the oldest and largestPage 1 <strong>of</strong> 3

CRAB <strong>Rating</strong>sCorporateunit <strong>of</strong> the Company contributing on an average 56.23% <strong>of</strong> total revenue over the fiveyearperiod ended 2009. The rating considers the contractual right <strong>of</strong> assembling Hinochassis from Navana Ltd which has dealership <strong>of</strong> Hino chassis from Toyota TsushoCorporation (Japan). The overall sales and marketing along with recovery activities aredone through Navana Ltd which eventually keeps the related risk at low. The overallactivities including operational, selling and collection functions <strong>of</strong> the Body Building Unitare also aligned with the activities <strong>of</strong> the Assembling Unit. Therefore strong brand nameHino and the overall services <strong>of</strong> the Company facilitate continued growth <strong>of</strong> revenue <strong>of</strong>the Company. The brand name <strong>of</strong> ‘Navana’ also facilitates the Company to achieve soundgrowth <strong>of</strong> Battery Unit and Furniture Unit which eventually resulted in sustained revenuegrowth <strong>of</strong> the Company over the years.Total revenue <strong>of</strong> the Company stood at BDT 2,124.64 million in 2009 which was BDT1,851.77 million in 2008 registering a growth <strong>of</strong> 14.74%. The Company reported anaverage sales growth <strong>of</strong> 13.84% over the five-year period ended 2009 where that <strong>of</strong>CGSD was 13.19% during the same period. The rating considers the expected growth inrevenue <strong>of</strong> the Company after implementing the proposed BMRE project <strong>of</strong> expandingthe operation <strong>of</strong> the Assembling Unit and Body Building Unit. However the cost <strong>of</strong> goodssold had a decreasing trend with slight variability which was on an average 84.31% <strong>of</strong>sales. The gross pr<strong>of</strong>it margin <strong>of</strong> the Company was sound at a stable rate over the lastfive years registering an average rate <strong>of</strong> 15.69%. The Company’s earnings were 3.17%<strong>of</strong> its average assets and 10.01% <strong>of</strong> its average equity in 2009 compared to 2.70% and10.13% respectively in the previous year. The overall pr<strong>of</strong>itability <strong>of</strong> the Companyrevealed better position in 2009.The Company maintained current ratio <strong>of</strong> less than 1.5 times over the last five yearsregistering an average rate <strong>of</strong> 1.24 times. Both the current and quick ratio <strong>of</strong> theCompany was reasonably stable over the same period. From the analysis <strong>of</strong> its liquidityratios it is found that the Company had more inventories over year which increased from26.45% <strong>of</strong> assets in 2007 to 30.24% in 2009. The Company’s financials are quitesusceptible to receivable collection as it has large amount <strong>of</strong> account receivable out <strong>of</strong>which 32% remained outstanding for more than six months. Although the cashconversion cycle <strong>of</strong> the Company improved from 265.24 days in 2008 to 251.35 days in2009 it was still high compared to its previous trend.The leverage position considering all liabilities reflects moderate debt based capitalstructure <strong>of</strong> the Company. The debt ratio <strong>of</strong> the Company has a decreasing trend from83.44% in 2005 and in 2009, 62.87% <strong>of</strong> the assets were financed through externalsources considering all liabilities including 120 days deferred payment <strong>of</strong> LC facility owedto Toyota Tsusho Corporation (Japan). The debt ratio considering only long term debt isnegligible (1.10%). The rating also considers present BMRE plan <strong>of</strong> issuing BDT 1,800.0million Preference share which will be converted into Ordinary Shares on 31 May, 2010.However the Company has planned to repay debt <strong>of</strong> BDT 500.0 million and to meet theworking capital requirement arising from the BMRE project with the fund infused throughPreference Share. Therefore the decreasing trend in the debt ratio over the years alongwith the proposed issue <strong>of</strong> fully convertible preference share which will enhance theequity base <strong>of</strong> the Company keeping the credit risk at low, are considered whileassigning the rating.Page 2 <strong>of</strong> 3

CRAB <strong>Rating</strong>sCorporateThe rating also considered the listing <strong>of</strong> the Company in both the bourses <strong>of</strong> the country,composition <strong>of</strong> Board, effectiveness <strong>of</strong> the Board, trend <strong>of</strong> dividend declaration over theyears, sponsors’ involvement with wide range <strong>of</strong> companies. Total shareholder’s equity <strong>of</strong>the Company stood at BDT 905.52 million in 2009 which was BDT 574.66 million in 2008registering a growth <strong>of</strong> 58%. The equity base mainly increased in the form <strong>of</strong> retainedearnings arising from pr<strong>of</strong>it on investment in shares (BDT 242.56 million). However afterconversion <strong>of</strong> the proposed issue <strong>of</strong> fully convertible Preference Share the equity base <strong>of</strong>the Company will be increased largely.The rating also considers the labor retention success, technology used, raw materialprocurement efficiency and quality control system to maintain customer confidence. Thebrand image <strong>of</strong> ‘Hino’ and ‘Navana’ along with well diversified business <strong>of</strong> the Companywill help to keep its success trend. The management <strong>of</strong> the Company is not likely to poseany threat for <strong>Aftab</strong> <strong>Automobiles</strong> Ltd as it is an old and established organization havinggood succession planning. The IT infrastructure and quick flow <strong>of</strong> information regardingproduction, labor, stocks and sales related issues are also considered while assigningrating which eventually help the Head Office to effectively control and monitor theoperation <strong>of</strong> the factory.Page 3 <strong>of</strong> 3