CRAB Rating Corporate - Credit Rating Agency of Bangladesh

CRAB Rating Corporate - Credit Rating Agency of Bangladesh

CRAB Rating Corporate - Credit Rating Agency of Bangladesh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

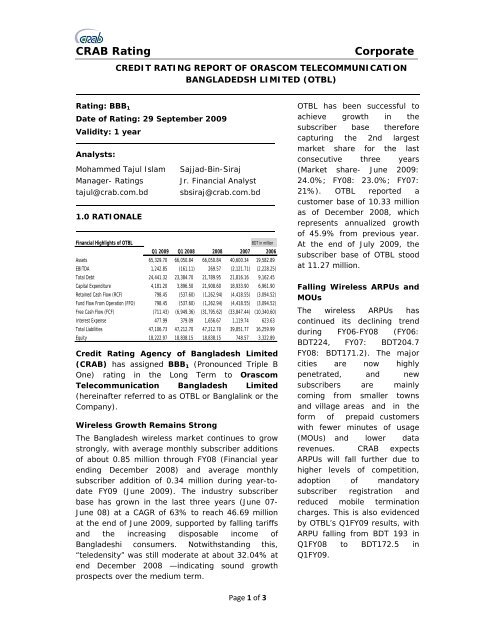

<strong>CRAB</strong> <strong>Rating</strong><strong>Corporate</strong>CREDIT RATING REPORT OF ORASCOM TELECOMMUNICATIONBANGLADEDSH LIMITED (OTBL)<strong>Rating</strong>: BBB 1Date <strong>of</strong> <strong>Rating</strong>: 29 September 2009Validity: 1 yearAnalysts:Mohammed Tajul IslamManager- <strong>Rating</strong>stajul@crab.com.bd1.0 RATIONALESajjad-Bin-SirajJr. Financial Analystsbsiraj@crab.com.bdFinancial Highlights <strong>of</strong> OTBLBDT in millionQ1 2009 Q1 2008 2008 2007 2006Assets 65,329.70 66,050.84 66,050.84 40,600.34 19,582.89EBITDA 1,242.85 (161.11) 269.57 (2,121.71) (2,228.25)Total Debt 24,441.32 23,384.70 21,789.95 21,816.16 9,162.45Capital Expenditure 4,181.20 3,896.50 21,908.60 18,933.90 6,961.90Retained Cash Flow (RCF) 798.45 (537.60) (1,262.94) (4,418.55) (3,094.52)Fund Flow From Operation (FFO) 798.45 (537.60) (1,262.94) (4,418.55) (3,094.52)Free Cash Flow (FCF) (711.43) (6,949.36) (31,795.62) (33,847.44) (10,340.60)Interest Expense 477.99 379.09 1,656.67 1,119.74 623.63Total Liabilities 47,106.73 47,212.70 47,212.70 39,851.77 16,259.99Equity 18,222.97 18,838.15 18,838.15 748.57 3,322.89<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong> Limited(<strong>CRAB</strong>) has assigned BBB 1 (Pronounced Triple BOne) rating in the Long Term to OrascomTelecommunication <strong>Bangladesh</strong> Limited(hereinafter referred to as OTBL or Banglalink or theCompany).Wireless Growth Remains StrongThe <strong>Bangladesh</strong> wireless market continues to growstrongly, with average monthly subscriber additions<strong>of</strong> about 0.85 million through FY08 (Financial yearending December 2008) and average monthlysubscriber addition <strong>of</strong> 0.34 million during year-todateFY09 (June 2009). The industry subscriberbase has grown in the last three years (June 07-June 08) at a CAGR <strong>of</strong> 63% to reach 46.69 millionat the end <strong>of</strong> June 2009, supported by falling tariffsand the increasing disposable income <strong>of</strong><strong>Bangladesh</strong>i consumers. Notwithstanding this,“teledensity” was still moderate at about 32.04% atend December 2008 —indicating sound growthprospects over the medium term.OTBL has been successful toachieve growth in thesubscriber base thereforecapturing the 2nd largestmarket share for the lastconsecutive three years(Market share- June 2009:24.0%; FY08: 23.0%; FY07:21%). OTBL reported acustomer base <strong>of</strong> 10.33 millionas <strong>of</strong> December 2008, whichrepresents annualized growth<strong>of</strong> 45.9% from previous year.At the end <strong>of</strong> July 2009, thesubscriber base <strong>of</strong> OTBL stoodat 11.27 million.Falling Wireless ARPUs andMOUsThe wireless ARPUs hascontinued its declining trendduring FY06-FY08 (FY06:BDT224, FY07: BDT204.7FY08: BDT171.2). The majorcities are now highlypenetrated, and newsubscribers are mainlycoming from smaller townsand village areas and in theform <strong>of</strong> prepaid customerswith fewer minutes <strong>of</strong> usage(MOUs) and lower datarevenues. <strong>CRAB</strong> expectsARPUs will fall further due tohigher levels <strong>of</strong> competition,adoption <strong>of</strong> mandatorysubscriber registration andreduced mobile terminationcharges. This is also evidencedby OTBL’s Q1FY09 results, withARPU falling from BDT 193 inQ1FY08 to BDT172.5 inQ1FY09.Page 1 <strong>of</strong> 3

<strong>CRAB</strong> <strong>Rating</strong>Page 2 <strong>of</strong> 3<strong>Corporate</strong>High Revenue Growth but Low EBITDA and EBITDA MarginsOTBL achieved high revenue growth over the past years. In FY08, the revenue reachedat BDT 19,945.90 million from BDT 13,398.43 million in 2007, registering a growth <strong>of</strong>around 48.87%. In 2009 first quarter, it earned BDT 5770.72 million which was 21.43%higher than first quarter in 2008. OTBL’s financial showed negative EBITDA in the pastyears however in FY08, EBITDA turned to positive. EBITDA Margin as <strong>of</strong> FY08 is 1.35%,which was -15.84% and -34% in FY07 and FY06 respectively. EBITDA margin <strong>of</strong> OTBL isyet to reach a comfortable position to be in line with the level <strong>of</strong> revenue and scale <strong>of</strong>operation and CAPEX plan.Falling ARPUs and increased expenditure on subscriber acquisition and retention costsaffects the EBITDA and its margin. <strong>CRAB</strong> expects EBITDA margins would not increaserapidly in an environment <strong>of</strong> falling wireless ARPUs, higher network expansion costs andregulatory pressures. However, redefining its <strong>of</strong>fering as per market need, adding morevalue added features at competitive price, OTBL is expected be able to achieve positivenet pr<strong>of</strong>it by 2014 as per projection <strong>of</strong> OTBL.High CAPEX, Negative FCF and High Leverage Ratios - 3G & WIMAX an EventRiskCAPEX as a percentage <strong>of</strong> revenue remained high [Q1-2009: 72.46%; FY08:109%;FY07:141.31%; FY06: 106.23%] as significant CAPEX was carried out to increase thenetwork coverage all over the country. Resultantly, FCF <strong>of</strong> OTBL has remained negativedue to higher CAPEX and financing costs. <strong>CRAB</strong> notes that CAPEX in absolute termthough low in Q1 2009 compare to the previous years, it is expected to report stable-toincreasingCAPEX (excluding 3G) in the medium term.If the 3G auction is held in FY10, industry CAPEX can potentially exceed previous levels.The impact on financial leverage is difficult to ascertain at this stage, as actual bid pricesmay be materially higher than the expected and that operators may not bid for spectrumin all circles.Orascom Telecom <strong>Bangladesh</strong> Limited’s (OTBL) ratings factor in its high financialleverage on a net basis. Total debt increased to BDT 24,441.32 million in Q1 2009 fromBDT 21,789.95 million in FY08, resulting in net financialleverage (total adjusted debt net <strong>of</strong> cash/operating EBITDA) <strong>of</strong> 19.25 times.As <strong>of</strong> Q1 2009, OTBL had strong liquidity pressure, with total debt <strong>of</strong> BDT 24441.32million and a cash balance <strong>of</strong> BDT 515.51 million, i.e. reflecting a net debt position.The high CAPEX combined with high working capital requirements kept free cash flow(FCF) negative in Q1 2009: -711.43 million; FY08: -31,795.62 million, FY07: -33,847.44million. OTBL achieved a significant improvement in cash flow and coverage position inQ1 2009. For the first time RCF and FFO as percentages <strong>of</strong> Total Debt became positive3.27%. Coverage ratio which was negative and below 1.0x in the previous years,became 2.64x in Q1 2009. Due to lowering capital expenditure and improvements inEBITDA, EBITDA minus CAPEX as percentages <strong>of</strong> Gross Interest Expenses shows animprovement in Q1 2009, though it is not yet at satisfactory level. In Q1 2009, theoperating EBITDA cover on net fixed charges also improved to -6.15 timesin FY08 against -18.80 times in FY07, as term loan repayments kept the interestexpense lower in FY08.

<strong>CRAB</strong> <strong>Rating</strong><strong>Corporate</strong>The Company has BDT 3832.74 million fund based limits and BDT 2,676.91 million <strong>of</strong>non fund based limits. OTBL’s high working capital requirements with major CAPEX planfor the next few years are likely to keep debt at high level. The sponsor support has alsobeen taken into consideration during the rating exercise especially the recent capitalinjection in OTBL and shareholders loan in supporting the business expansion.Page 3 <strong>of</strong> 3