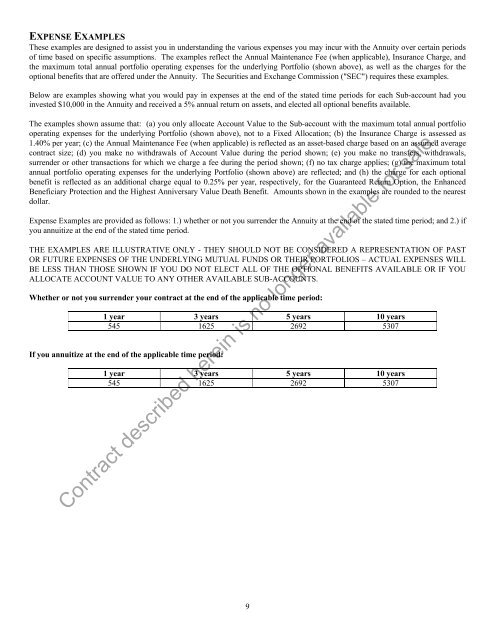

EXPENSE EXAMPLESThese examples are designed to assist you in understanding the various expenses you may incur with the Annuity over certain periodsof time based on specific assumptions. The examples reflect the Annual Maintenance Fee (when applicable), Insurance Charge, andthe maximum total annual portfolio operating expenses for the underlying Portfolio (shown above), as well as the charges for theoptional benefits that are offered under the Annuity. The Securities and Exchange Commission ("SEC") requires these examples.Below are examples showing what you would pay in expenses at the end of the stated time periods for each Sub-account had youinvested $10,000 in the Annuity and received a 5% annual return on assets, and elected all optional benefits available.The examples shown assume that: (a) you only allocate Account Value to the Sub-account with the maximum total annual portfoliooperating expenses for the underlying Portfolio (shown above), not to a Fixed Allocation; (b) the Insurance Charge is assessed as1.40% per year; (c) the Annual Maintenance Fee (when applicable) is reflected as an asset-based charge based on an assumed averagecontract size; (d) you make no withdrawals of Account Value during the period shown; (e) you make no transfers, withdrawals,surrender or other transactions for which we charge a fee during the period shown; (f) no tax charge applies; (g) the maximum totalannual portfolio operating expenses for the underlying Portfolio (shown above) are reflected; and (h) the charge for each optionalbenefit is reflected as an additional charge equal to 0.25% per year, respectively, for the Guaranteed Return Option, the EnhancedBeneficiary Protection and the Highest Anniversary Value Death Benefit. Amounts shown in the examples are rounded to the nearestdollar.Expense Examples are provided as follows: 1.) whether or not you surrender the Annuity at the end of the stated time period; and 2.) ifyou annuitize at the end of the stated time period.THE EXAMPLES ARE ILLUSTRATIVE ONLY - THEY SHOULD NOT BE CONSIDERED A REPRESENTATION OF PASTOR FUTURE EXPENSES OF THE UNDERLYING MUTUAL FUNDS OR THEIR PORTFOLIOS – ACTUAL EXPENSES WILLBE LESS THAN THOSE SHOWN IF YOU DO NOT ELECT ALL OF THE OPTIONAL BENEFITS AVAILABLE OR IF YOUALLOCATE ACCOUNT VALUE TO ANY OTHER AVAILABLE SUB-ACCOUNTS.Whether or not you surrender your contract at the end of the applicable time period:1 year 3 years 5 years 10 years545 1625 2692 5307If you annuitize at the end of the applicable time period:1 year 3 years 5 years 10 years545 1625 2692 5307Contract described herein is no longer available for sale.9

INVESTMENT OPTIONSWHAT ARE THE INVESTMENT OBJECTIVES AND POLICIES OF THE PORTFOLIOS?Each variable investment option is a Sub-account of American Skandia Life Assurance Corporation Variable Account B (see "Whatare Separate Accounts" for more detailed information.) Each Sub-account invests exclusively in one Portfolio. You should carefullyread the prospectus for any Portfolio in which you are interested. The following chart classifies each of the Portfolios based on ourassessment of their investment style (as of the date of this Prospectus). The chart also provides a description of each Portfolio'sinvestment objective (in italics) and a short, summary description of their key policies to assist you in determining which Portfoliosmay be of interest to you. There is no guarantee that any underlying Portfolio will meet its investment objective.The name of the advisor/sub-advisor for each Portfolio appears next to the description. Those Portfolios whose name includes theprefix "AST" are Portfolios of American Skandia Trust. The investment manager for AST is American Skandia Investment Services,Incorporated, an affiliated company of American Skandia. However, a sub-advisor, as noted below, is engaged to conduct day-to-dayinvestment decisions.The Portfolios are not publicly traded mutual funds. They are only available as investment options in variable annuity contracts andvariable life insurance policies issued by insurance companies, or in some cases, to participants in certain qualified retirement plans.However, some of the Portfolios available as Sub-accounts under the Annuity are managed by the same portfolio advisor or subadvisoras a retail mutual fund of the same or similar name that the Portfolio may have been modeled after at its inception. Certainretail mutual funds may also have been modeled after a Portfolio. While the investment objective and policies of the retail mutualfunds and the Portfolios may be substantially similar, the actual investments will differ to varying degrees. Differences in theperformance of the funds can be expected, and in some cases could be substantial. You should not compare the performance of apublicly traded mutual fund with the performance of any similarly named Portfolio offered as a Sub-account. Details about theinvestment objectives, policies, risks, costs and management of the Portfolios are found in the prospectuses for the underlying mutualfunds. The current prospectus and statement of additional information for the underlying Portfolios can be obtained by calling 1-800-766-4530.Effective close of business June 28, 2002, the AST Goldman Sachs Small-Cap Value portfolio is no longer offered as a Subaccountunder the Annuity, except as noted below. Annuity contracts with Account Value allocated to the AST Goldman SachsSmall-Cap Value Sub-account on or before June 28, 2002 may continue to allocate Account Value and make transfers into the ASTGoldman Sachs Small-Cap Value Sub-account, including any bank drafting, dollar cost averaging, asset allocation and rebalancingprograms. Owners of <strong>Annuities</strong> issued after June 28, 2002 will not be allowed to allocate Account Value to the AST Goldman SachsSmall-Cap Value Sub-account.The AST Goldman Sachs Small-Cap Value Sub-account may be offered to new Owners at some future date; however, at the presenttime, American Skandia has no intention to do so.Please refer to Appendix B for certain required financial information related to the historical performance of the Subaccounts.Contract described herein is no longer available for sale.10