Stagecoach Flex - Prudential Annuities

Stagecoach Flex - Prudential Annuities

Stagecoach Flex - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

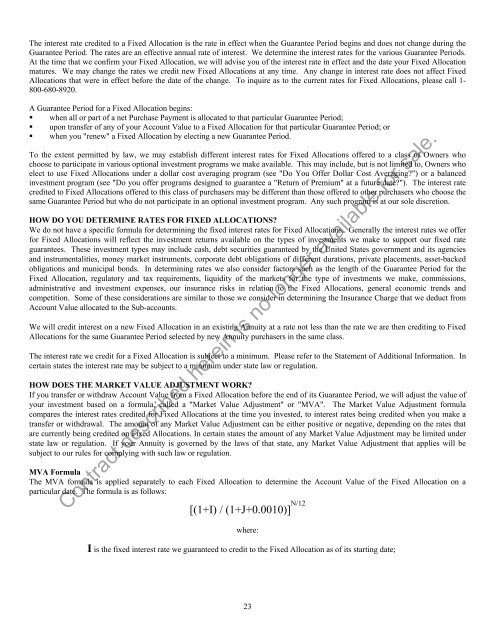

The interest rate credited to a Fixed Allocation is the rate in effect when the Guarantee Period begins and does not change during theGuarantee Period. The rates are an effective annual rate of interest. We determine the interest rates for the various Guarantee Periods.At the time that we confirm your Fixed Allocation, we will advise you of the interest rate in effect and the date your Fixed Allocationmatures. We may change the rates we credit new Fixed Allocations at any time. Any change in interest rate does not affect FixedAllocations that were in effect before the date of the change. To inquire as to the current rates for Fixed Allocations, please call 1-800-680-8920.A Guarantee Period for a Fixed Allocation begins:• when all or part of a net Purchase Payment is allocated to that particular Guarantee Period;• upon transfer of any of your Account Value to a Fixed Allocation for that particular Guarantee Period; or• when you "renew" a Fixed Allocation by electing a new Guarantee Period.To the extent permitted by law, we may establish different interest rates for Fixed Allocations offered to a class of Owners whochoose to participate in various optional investment programs we make available. This may include, but is not limited to, Owners whoelect to use Fixed Allocations under a dollar cost averaging program (see "Do You Offer Dollar Cost Averaging?") or a balancedinvestment program (see "Do you offer programs designed to guarantee a "Return of Premium" at a future date?"). The interest ratecredited to Fixed Allocations offered to this class of purchasers may be different than those offered to other purchasers who choose thesame Guarantee Period but who do not participate in an optional investment program. Any such program is at our sole discretion.HOW DO YOU DETERMINE RATES FOR FIXED ALLOCATIONS?We do not have a specific formula for determining the fixed interest rates for Fixed Allocations. Generally the interest rates we offerfor Fixed Allocations will reflect the investment returns available on the types of investments we make to support our fixed rateguarantees. These investment types may include cash, debt securities guaranteed by the United States government and its agenciesand instrumentalities, money market instruments, corporate debt obligations of different durations, private placements, asset-backedobligations and municipal bonds. In determining rates we also consider factors such as the length of the Guarantee Period for theFixed Allocation, regulatory and tax requirements, liquidity of the markets for the type of investments we make, commissions,administrative and investment expenses, our insurance risks in relation to the Fixed Allocations, general economic trends andcompetition. Some of these considerations are similar to those we consider in determining the Insurance Charge that we deduct fromAccount Value allocated to the Sub-accounts.We will credit interest on a new Fixed Allocation in an existing Annuity at a rate not less than the rate we are then crediting to FixedAllocations for the same Guarantee Period selected by new Annuity purchasers in the same class.The interest rate we credit for a Fixed Allocation is subject to a minimum. Please refer to the Statement of Additional Information. Incertain states the interest rate may be subject to a minimum under state law or regulation.HOW DOES THE MARKET VALUE ADJUSTMENT WORK?If you transfer or withdraw Account Value from a Fixed Allocation before the end of its Guarantee Period, we will adjust the value ofyour investment based on a formula, called a "Market Value Adjustment" or "MVA". The Market Value Adjustment formulacompares the interest rates credited for Fixed Allocations at the time you invested, to interest rates being credited when you make atransfer or withdrawal. The amount of any Market Value Adjustment can be either positive or negative, depending on the rates thatare currently being credited on Fixed Allocations. In certain states the amount of any Market Value Adjustment may be limited understate law or regulation. If your Annuity is governed by the laws of that state, any Market Value Adjustment that applies will besubject to our rules for complying with such law or regulation.MVA FormulaThe MVA formula is applied separately to each Fixed Allocation to determine the Account Value of the Fixed Allocation on aparticular date. The formula is as follows:Contract described herein is no longer available for sale.[(1+I) / (1+J+0.0010)] N/12where:I is the fixed interest rate we guaranteed to credit to the Fixed Allocation as of its starting date;23