Stagecoach Flex - Prudential Annuities

Stagecoach Flex - Prudential Annuities

Stagecoach Flex - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

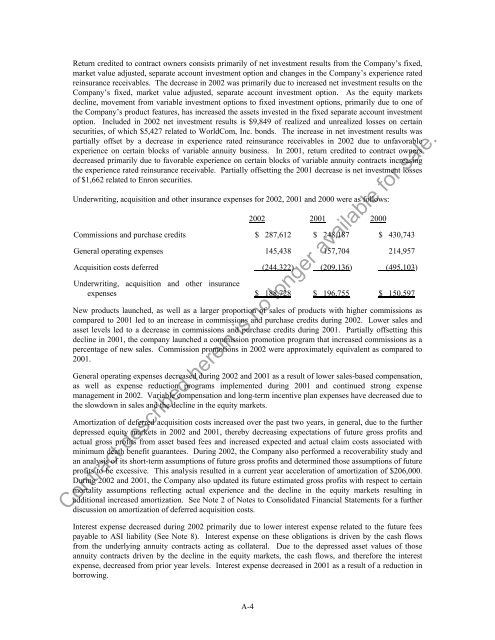

Return credited to contract owners consists primarily of net investment results from the Company’s fixed,market value adjusted, separate account investment option and changes in the Company’s experience ratedreinsurance receivables. The decrease in 2002 was primarily due to increased net investment results on theCompany’s fixed, market value adjusted, separate account investment option. As the equity marketsdecline, movement from variable investment options to fixed investment options, primarily due to one ofthe Company’s product features, has increased the assets invested in the fixed separate account investmentoption. Included in 2002 net investment results is $9,849 of realized and unrealized losses on certainsecurities, of which $5,427 related to WorldCom, Inc. bonds. The increase in net investment results waspartially offset by a decrease in experience rated reinsurance receivables in 2002 due to unfavorableexperience on certain blocks of variable annuity business. In 2001, return credited to contract ownersdecreased primarily due to favorable experience on certain blocks of variable annuity contracts increasingthe experience rated reinsurance receivable. Partially offsetting the 2001 decrease is net investment lossesof $1,662 related to Enron securities.Underwriting, acquisition and other insurance expenses for 2002, 2001 and 2000 were as follows:2002 2001 2000Commissions and purchase credits $ 287,612 $ 248,187 $ 430,743General operating expenses 145,438 157,704 214,957Acquisition costs deferred (244,322) (209,136) (495,103)Underwriting, acquisition and other insuranceexpenses $ 188,728 $ 196,755 $ 150,597New products launched, as well as a larger proportion of sales of products with higher commissions ascompared to 2001 led to an increase in commissions and purchase credits during 2002. Lower sales andasset levels led to a decrease in commissions and purchase credits during 2001. Partially offsetting thisdecline in 2001, the company launched a commission promotion program that increased commissions as apercentage of new sales. Commission promotions in 2002 were approximately equivalent as compared to2001.General operating expenses decreased during 2002 and 2001 as a result of lower sales-based compensation,as well as expense reduction programs implemented during 2001 and continued strong expensemanagement in 2002. Variable compensation and long-term incentive plan expenses have decreased due tothe slowdown in sales and the decline in the equity markets.Amortization of deferred acquisition costs increased over the past two years, in general, due to the furtherdepressed equity markets in 2002 and 2001, thereby decreasing expectations of future gross profits andactual gross profits from asset based fees and increased expected and actual claim costs associated withminimum death benefit guarantees. During 2002, the Company also performed a recoverability study andan analysis of its short-term assumptions of future gross profits and determined those assumptions of futureprofits to be excessive. This analysis resulted in a current year acceleration of amortization of $206,000.During 2002 and 2001, the Company also updated its future estimated gross profits with respect to certainmortality assumptions reflecting actual experience and the decline in the equity markets resulting inadditional increased amortization. See Note 2 of Notes to Consolidated Financial Statements for a furtherdiscussion on amortization of deferred acquisition costs.Contract described herein is no longer available for sale.Interest expense decreased during 2002 primarily due to lower interest expense related to the future feespayable to ASI liability (See Note 8). Interest expense on these obligations is driven by the cash flowsfrom the underlying annuity contracts acting as collateral. Due to the depressed asset values of thoseannuity contracts driven by the decline in the equity markets, the cash flows, and therefore the interestexpense, decreased from prior year levels. Interest expense decreased in 2001 as a result of a reduction inborrowing.A-4