Stagecoach Flex - Prudential Annuities

Stagecoach Flex - Prudential Annuities

Stagecoach Flex - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

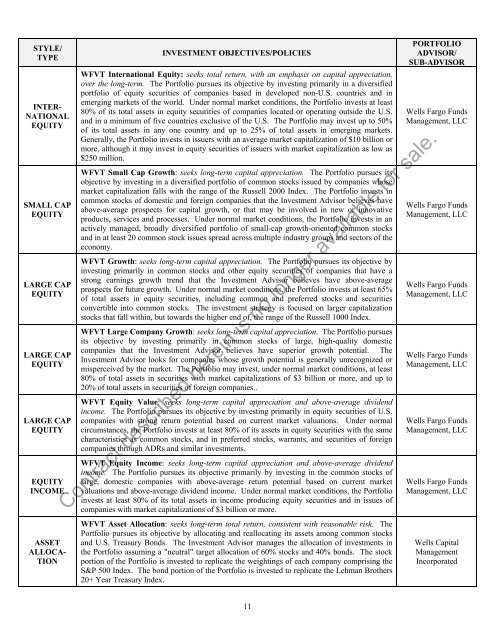

STYLE/TYPEINTER-NATIONALEQUITYSMALL CAPEQUITYLARGE CAPEQUITYLARGE CAPEQUITYLARGE CAPEQUITYEQUITYINCOMEASSETALLOCA-TIONINVESTMENT OBJECTIVES/POLICIESWFVT International Equity: seeks total return, with an emphasis on capital appreciation,over the long-term. The Portfolio pursues its objective by investing primarily in a diversifiedportfolio of equity securities of companies based in developed non-U.S. countries and inemerging markets of the world. Under normal market conditions, the Portfolio invests at least80% of its total assets in equity securities of companies located or operating outside the U.S.and in a minimum of five countries exclusive of the U.S. The Portfolio may invest up to 50%of its total assets in any one country and up to 25% of total assets in emerging markets.Generally, the Portfolio invests in issuers with an average market capitalization of $10 billion ormore, although it may invest in equity securities of issuers with market capitalization as low as$250 million.WFVT Small Cap Growth: seeks long-term capital appreciation. The Portfolio pursues itsobjective by investing in a diversified portfolio of common stocks issued by companies whosemarket capitalization falls with the range of the Russell 2000 Index. The Portfolio invests incommon stocks of domestic and foreign companies that the Investment Advisor believes haveabove-average prospects for capital growth, or that may be involved in new or innovativeproducts, services and processes. Under normal market conditions, the Portfolio invests in anactively managed, broadly diversified portfolio of small-cap growth-oriented common stocksand in at least 20 common stock issues spread across multiple industry groups and sectors of theeconomy.WFVT Growth: seeks long-term capital appreciation. The Portfolio pursues its objective byinvesting primarily in common stocks and other equity securities of companies that have astrong earnings growth trend that the Investment Advisor believes have above-averageprospects for future growth. Under normal market conditions, the Portfolio invests at least 65%of total assets in equity securities, including common and preferred stocks and securitiesconvertible into common stocks. The investment strategy is focused on larger capitalizationstocks that fall within, but towards the higher end of, the range of the Russell 1000 Index.WFVT Large Company Growth: seeks long-term capital appreciation. The Portfolio pursuesits objective by investing primarily in common stocks of large, high-quality domesticcompanies that the Investment Advisor believes have superior growth potential. TheInvestment Advisor looks for companies whose growth potential is generally unrecognized ormisperceived by the market. The Portfolio may invest, under normal market conditions, at least80% of total assets in securities with market capitalizations of $3 billion or more, and up to20% of total assets in securities of foreign companies..WFVT Equity Value: seeks long-term capital appreciation and above-average dividendincome. The Portfolio pursues its objective by investing primarily in equity securities of U.S.companies with strong return potential based on current market valuations. Under normalcircumstances, the Portfolio invests at least 80% of its assets in equity securities with the samecharacteristics as common stocks, and in preferred stocks, warrants, and securities of foreigncompanies through ADRs and similar investments.WFVT Equity Income: seeks long-term capital appreciation and above-average dividendincome. The Portfolio pursues its objective primarily by investing in the common stocks oflarge, domestic companies with above-average return potential based on current marketvaluations and above-average dividend income. Under normal market conditions, the Portfolioinvests at least 80% of its total assets in income producing equity securities and in issues ofcompanies with market capitalizations of $3 billion or more.PORTFOLIOADVISOR/SUB-ADVISORWells Fargo FundsManagement, LLCWells Fargo FundsManagement, LLCWells Fargo FundsManagement, LLCWells Fargo FundsManagement, LLCWells Fargo FundsManagement, LLCWells Fargo FundsManagement, LLCContract described herein is no longer available for sale.WFVT Asset Allocation: seeks long-term total return, consistent with reasonable risk. ThePortfolio pursues its objective by allocating and reallocating its assets among common stocksand U.S. Treasury Bonds. The Investment Advisor manages the allocation of investments inthe Portfolio assuming a "neutral" target allocation of 60% stocks and 40% bonds. The stockportion of the Portfolio is invested to replicate the weightings of each company comprising theS&P 500 Index. The bond portion of the Portfolio is invested to replicate the Lehman Brothers20+ Year Treasury Index.Wells CapitalManagementIncorporated11