Concise tax guide for Turkey 2009

Concise tax guide for Turkey 2009

Concise tax guide for Turkey 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

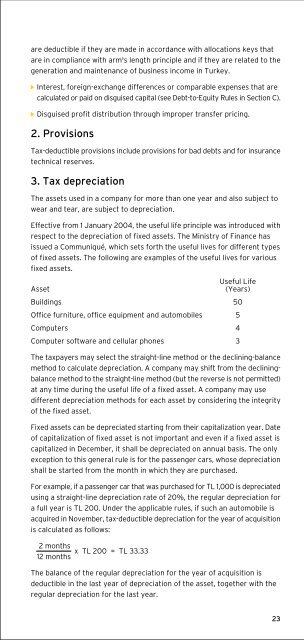

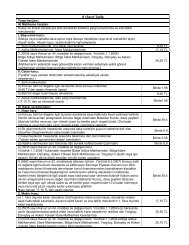

are deductible if they are made in accordance with allocations keys thatare in compliance with arm's length principle and if they are related to thegeneration and maintenance of business income in <strong>Turkey</strong>.Interest, <strong>for</strong>eign-exchange differences or comparable expenses that arecalculated or paid on disguised capital (see Debt-to-Equity Rules in Section C).Disguised profit distribution through improper transfer pricing.2. ProvisionsTax-deductible provisions include provisions <strong>for</strong> bad debts and <strong>for</strong> insurancetechnical reserves.3. Tax depreciationThe assets used in a company <strong>for</strong> more than one year and also subject towear and tear, are subject to depreciation.Effective from 1 January 2004, the useful life principle was introduced withrespect to the depreciation of fixed assets. The Ministry of Finance hasissued a Communiqué, which sets <strong>for</strong>th the useful lives <strong>for</strong> different typesof fixed assets. The following are examples of the useful lives <strong>for</strong> variousfixed assets.AssetUseful Life(Years)Buildings 50Office furniture, office equipment and automobiles 5Computers 4Computer software and cellular phones 3The <strong>tax</strong>payers may select the straight-line method or the declining-balancemethod to calculate depreciation. A company may shift from the decliningbalancemethod to the straight-line method (but the reverse is not permitted)at any time during the useful life of a fixed asset. A company may usedifferent depreciation methods <strong>for</strong> each asset by considering the integrityof the fixed asset.Fixed assets can be depreciated starting from their capitalization year. Dateof capitalization of fixed asset is not important and even if a fixed asset iscapitalized in December, it shall be depreciated on annual basis. The onlyexception to this general rule is <strong>for</strong> the passenger cars, whose depreciationshall be started from the month in which they are purchased.For example, if a passenger car that was purchased <strong>for</strong> TL 1,000 is depreciatedusing a straight-line depreciation rate of 20%, the regular depreciation <strong>for</strong>a full year is TL 200. Under the applicable rules, if such an automobile isacquired in November, <strong>tax</strong>-deductible depreciation <strong>for</strong> the year of acquisitionis calculated as follows:2 months x TL 200 = TL 33.3312 monthsThe balance of the regular depreciation <strong>for</strong> the year of acquisition isdeductible in the last year of depreciation of the asset, together with theregular depreciation <strong>for</strong> the last year.23