Concise tax guide for Turkey 2009

Concise tax guide for Turkey 2009

Concise tax guide for Turkey 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

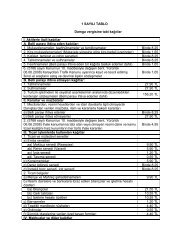

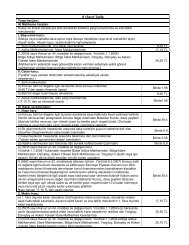

(t) The 10% rate applies to interest on loans granted by banks. The 15% rateapplies to other interest payments.(u) The 10% applies to royalties paid <strong>for</strong> the use of, or the right to use, copyrightsof literary, artistic or scientific works, including cinematographic films andrecordings <strong>for</strong> radio and television. The 15% rate applies to royalties paid<strong>for</strong> patents, trademarks, designs or models, plans, secret <strong>for</strong>mulas orprocesses, or <strong>for</strong> in<strong>for</strong>mation concerning industrial, commercial or scientificexperience.(v) The 10% rate applies to interest on loans granted by banks, financialinstitutions and insurance companies. The 15% rate applies to other interestpayments.(w) The 12% rate applies if the recipient owns more than 25% of the payer ofthe dividends. The 15% rate applies to other dividends.(x) The 5% rate applies if the recipient of the dividends is the government, apublic institution wholly owned by the government or a political subdivisionor local authority of the other contracting state. The 10% rate applies if therecipient owns more than 25% of the payer of the dividends. The 12% rateapplies to other dividends.(y) The 10% rate applies to interest derived from loans granted by financialinstitutions, such as banks, savings institutions or insurance companies. The15% rate applies to other interest payments.(z) The 5% rate applies if the recipient owns more than 25% of the payer ofthe dividends <strong>for</strong> an uninterrupted period of at least 2 years. 15% rate appliesto other dividends.(aa) See Section A.44