Concise tax guide for Turkey 2009

Concise tax guide for Turkey 2009

Concise tax guide for Turkey 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

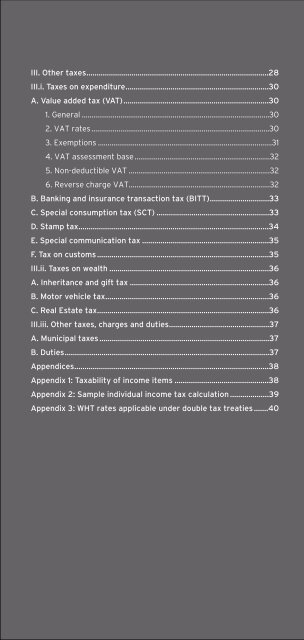

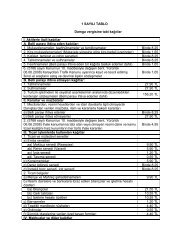

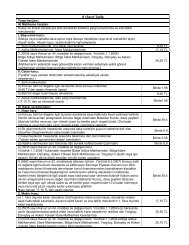

III. Other <strong>tax</strong>es.........................................................................................28III.i. Taxes on expenditure......................................................................30A. Value added <strong>tax</strong> (VAT).......................................................................301. General .................................................................................................302. VAT rates ............................................................................................303. Exemptions ..........................................................................................314. VAT assessment base......................................................................325. Non-deductible VAT .........................................................................326. Reverse charge VAT.........................................................................32B. Banking and insurance transaction <strong>tax</strong> (BITT).............................33C. Special consumption <strong>tax</strong> (SCT) .......................................................33D. Stamp <strong>tax</strong>.............................................................................................34E. Special communication <strong>tax</strong> ..............................................................35F. Tax on customs....................................................................................35III.ii. Taxes on wealth ..............................................................................36A. Inheritance and gift <strong>tax</strong> ....................................................................36B. Motor vehicle <strong>tax</strong>................................................................................36C. Real Estate <strong>tax</strong>....................................................................................36III.iii. Other <strong>tax</strong>es, charges and duties.................................................37A. Municipal <strong>tax</strong>es ...................................................................................37B. Duties....................................................................................................37Appendices...............................................................................................38Appendix 1: Taxability of income items ..............................................38Appendix 2: Sample individual income <strong>tax</strong> calculation ...................39Appendix 3: WHT rates applicable under double <strong>tax</strong> treaties .......40