You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

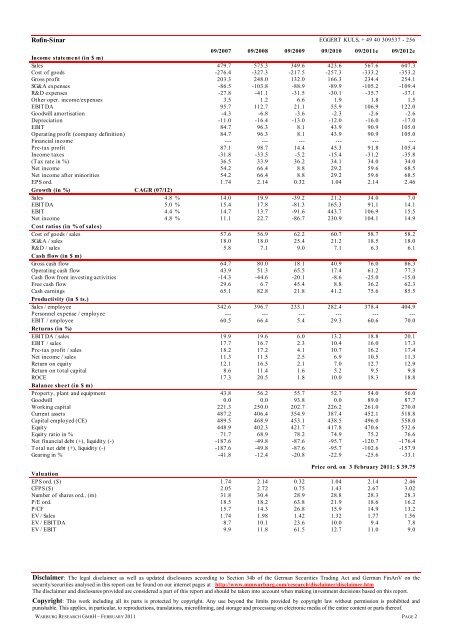

<strong>Rofin</strong>-<strong>Sinar</strong> EGGERT KULS, + 49 40 309537 - 256<br />

09/2007 09/2008 09/2009 09/2010 09/2011e 09/2012e<br />

Income statement (in $ m)<br />

Sales 479.7 575.3 349.6 423.6 567.6 607.3<br />

Cost of goods -276.4 -327.3 -217.5 -257.3 -333.2 -353.2<br />

Gross profit 203.3 248.0 132.0 166.3 234.4 254.1<br />

SG&A expenses -86.5 -103.8 -88.9 -89.9 -105.2 -109.4<br />

R&D expenses -27.8 -41.1 -31.5 -30.1 -35.7 -37.1<br />

Other oper. income/expenses 3.5 1.2 6.6 1.9 1.8 1.5<br />

EBITDA 95.7 112.7 21.1 55.9 106.9 122.0<br />

Goodwill amortisation -4.3 -6.8 -3.6 -2.3 -2.6 -2.6<br />

Depreciation -11.0 -16.4 -13.0 -12.0 -16.0 -17.0<br />

EBIT 84.7 96.3 8.1 43.9 90.9 105.0<br />

Operating profit (company definition) 84.7 96.3 8.1 43.9 90.9 105.0<br />

Financial income --- --- --- --- --- ---<br />

Pre-tax profit 87.1 98.7 14.4 45.3 91.8 105.4<br />

Income taxes -31.8 -33.5 -5.2 -15.4 -31.2 -35.8<br />

(Tax rate in %) 36.5 33.9 36.2 34.1 34.0 34.0<br />

Net income 54.2 66.4 8.8 29.2 59.6 68.5<br />

Net income after minorities 54.2 66.4 8.8 29.2 59.6 68.5<br />

EPS ord. 1.74 2.14 0.32 1.04 2.14 2.46<br />

Growth (in %) CAGR (07/12)<br />

Sales 4.8 % 14.0 19.9 -39.2 21.2 34.0 7.0<br />

EBITDA 5.0 % 15.4 17.8 -81.3 165.3 91.1 14.1<br />

EBIT 4.4 % 14.7 13.7 -91.6 443.7 106.9 15.5<br />

Net income<br />

Cost ratios (in % of sales)<br />

4.8 % 11.1 22.7 -86.7 230.9 104.1 14.9<br />

Cost of goods / sales 57.6 56.9 62.2 60.7 58.7 58.2<br />

SG&A / sales 18.0 18.0 25.4 21.2 18.5 18.0<br />

R&D / sales<br />

Cash flow (in $ m)<br />

5.8 7.1 9.0 7.1 6.3 6.1<br />

Gross cash flow 64.7 80.0 18.1 40.9 76.0 86.3<br />

Operating cash flow 43.9 51.3 65.5 17.4 61.2 77.3<br />

Cash flow from investing activities -14.3 -44.6 -20.1 -8.6 -25.0 -15.0<br />

Free cash flow 29.6 6.7 45.4 8.8 36.2 62.3<br />

Cash earnings<br />

Productivity (in $ ts.)<br />

65.1 82.8 21.8 41.2 75.6 85.5<br />

Sales / employee 342.6 396.7 233.1 282.4 378.4 404.9<br />

Personnel expense / employee --- --- --- --- --- ---<br />

EBIT / employee<br />

Returns (in %)<br />

60.5 66.4 5.4 29.3 60.6 70.0<br />

EBITDA / sales 19.9 19.6 6.0 13.2 18.8 20.1<br />

EBIT / sales 17.7 16.7 2.3 10.4 16.0 17.3<br />

Pre-tax profit / sales 18.2 17.2 4.1 10.7 16.2 17.4<br />

Net income / sales 11.3 11.5 2.5 6.9 10.5 11.3<br />

Return on equity 12.1 16.5 2.1 7.0 12.7 12.9<br />

Return on total capital 8.6 11.4 1.6 5.2 9.5 9.8<br />

ROCE<br />

Balance sheet (in $ m)<br />

17.3 20.5 1.8 10.0 18.3 18.8<br />

Property, plant and equipment 43.8 56.2 55.7 52.7 54.0 56.0<br />

Goodwill 0.0 0.0 93.8 0.0 89.0 87.7<br />

Working capital 221.3 250.0 202.7 226.2 261.0 270.0<br />

Current assets 487.2 406.4 354.9 387.4 452.1 518.8<br />

Capital employed (CE) 489.5 468.9 453.1 438.5 496.0 558.0<br />

Equity 448.9 402.3 421.7 417.8 470.6 532.6<br />

Equity ratio in % 71.7 68.9 78.2 74.9 75.2 76.6<br />

Net financial debt (+), liquidity (-) -187.6 -49.8 -87.6 -95.7 -120.7 -176.4<br />

Total net debt (+), liquidity (-) -187.6 -49.8 -87.6 -95.7 -102.6 -157.9<br />

Gearing in % -41.8 -12.4 -20.8 -22.9 -25.6 -33.1<br />

Price ord. on 3 February 2011: $ 39.75<br />

Valuation<br />

EPS ord. ($) 1.74 2.14 0.32 1.04 2.14 2.46<br />

CFPS ($) 2.05 2.72 0.75 1.43 2.67 3.02<br />

Number of shares ord., (m) 31.8 30.4 28.9 28.8 28.3 28.3<br />

P/E ord. 18.5 18.2 63.8 21.9 18.6 16.2<br />

P/CF 15.7 14.3 26.8 15.9 14.9 13.2<br />

EV / Sales 1.74 1.98 1.42 1.32 1.77 1.56<br />

EV / EBITDA 8.7 10.1 23.6 10.0 9.4 7.8<br />

EV / EBIT 9.9 11.8 61.5 12.7 11.0 9.0<br />

Disclaimer: The legal disclaimer as well as updated disclosures according to Section 34b of the German Securities Trading Act and German FinAnV on the<br />

security/securities analysed in this report can be found on our internet pages at : http://www.mmwarburg.com/research/disclaimer/disclaimer.htm<br />

The disclaimer and disclosures provided are considered a part of this report and should be taken into account when making investment decisions based on this report.<br />

Copyright: This work including all its parts is protected by copyright. Any use beyond the limits provided by copyright law without permission is prohibited and<br />

punishable. This applies, in particular, to reproductions, translations, microfilming, and storage and processing on electronic media of the entire content or parts thereof.<br />

WARBURG RESEARCH GMBH – FEBRUARY 2011 PAGE 2