Full of Energy - Energie AG Oberösterreich

Full of Energy - Energie AG Oberösterreich

Full of Energy - Energie AG Oberösterreich

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

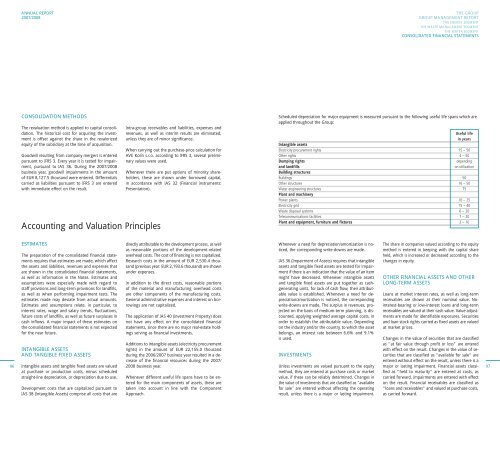

ANNUAL REPORT2007/2008THE GROUPGROUP MAN<strong>AG</strong>EMENT REPORTTHE ENERGY SEGMENTTHE WASTE MAN<strong>AG</strong>EMENT SEGMENTTHE WATER SEGMENTCONSOLIDATED FINANCIAL STATEMENTSCONSOLIDATION METHODSThe revaluation method is applied to capital consolidation.The historical cost for acquiring the investmentis <strong>of</strong>fset against the share in the revalorizedequity <strong>of</strong> the subsidiary at the time <strong>of</strong> acquisition.Goodwill resulting from company mergers is enteredpursuant to IFRS 3. Every year it is tested for impairment,pursuant to IAS 36. During the 2007/2008business year, goodwill impairments in the amount<strong>of</strong> EUR 8,127.5 thousand were entered. Differentialscarried as liabilities pursuant to IFRS 3 are enteredwith immediate effect on the result.Accounting and Valuation PrinciplesIntra-group receivables and liabilities, expenses andrevenues, as well as interim results are eliminated,unless they are <strong>of</strong> minor significance.When carrying out the purchase-price calculation forAVE Kolín s.r.o. according to IFRS 3, several preliminaryvalues were used.Whenever there are put options <strong>of</strong> minority shareholders,these are shown under borrowed capital,in accordance with IAS 32 (Financial Instruments:Presentation).Scheduled depreciation for major equipment is measured pursuant to the following useful life spans which areapplied throughout the Group:Useful lifein yearsIntangible assetsElectricity procurement rights 15 – 50Other rights 4 – 50Dumping rightsdependingand landfillson utilizationBuilding structuresBuildings 50Other structures 10 – 50Water engineering structures 75Plant and machineryPower plants 10 – 25Electricity grid 15 – 40Waste disposal systems 6 – 20Telecommunications facilities 7 – 20Plant and equipment, furniture and fixtures 3 – 1096ESTIMATESThe preparation <strong>of</strong> the consolidated financial statementsrequires that estimates are made, which affectthe assets and liabilities, revenues and expenses thatare shown in the consolidated financial statements,as well as information in the Notes. Estimates andassumptions were especially made with regard tostaff provisions and long-term provisions for landfills,as well as when performing impairment tests. Theestimates made may deviate from actual amounts.Estimates and assumptions relate, in particular, tointerest rates, wage and salary trends, fluctuations,future costs <strong>of</strong> landfills, as well as future surpluses incash inflows. A major impact <strong>of</strong> these estimates onthe consolidated financial statements is not expectedfor the near future.INTANGIBLE ASSETSAND TANGIBLE FIXED ASSETSIntangible assets and tangible fixed assets are valuedat purchase or production costs, minus scheduledstraight-line depreciation, or depreciation due to use.Development costs that are capitalized pursuant toIAS 38 (Intangible Assets) comprise all costs that aredirectly attributable to the development process, as wellas reasonable portions <strong>of</strong> the development-re latedoverhead costs. The cost <strong>of</strong> financing is not capitalized.Research costs in the amount <strong>of</strong> EUR 2,530.4 thousand(previous year: EUR 2,193.6 thousand) are shownunder expenses.In addition to the direct costs, reasonable portions<strong>of</strong> the material and manufacturing overhead costsare other components <strong>of</strong> the manufacturing costs.General administrative expenses and interest on borrowingsare not capitalized.The application <strong>of</strong> IAS 40 (Investment Property) doesnot have any effect on the consolidated financialstatements, since there are no major real-estate holdingsserving as financial investments.Additions to intangible assets (electricity procurementrights) in the amount <strong>of</strong> EUR 22,155.0 thousandduring the 2006/2007 business year resulted in a de -crease <strong>of</strong> the financial resources during the 2007/2008 business year.Whenever different useful life spans have to be en -tered for the main components <strong>of</strong> assets, these aretaken into account in line with the ComponentApproach.Whenever a need for depreciation/amortization is no -ticed, the corresponding write-downs are made.IAS 36 (Impairment <strong>of</strong> Assets) requires that intangibleassets and tangible fixed assets are tested for impairmentif there is an indication that the value <strong>of</strong> an itemmight have decreased. Whenever intangible assetsand tangible fixed assets are put together as cashgeneratingunits, for lack <strong>of</strong> cash flow, their attribut -able value is established. Whenever a need for de -pre ciation/amortization is noticed, the correspondingwrite-downs are made. The surplus in revenues, projectedon the basis <strong>of</strong> medium-term planning, is discounted,applying weighted average capital costs, inorder to establish the attributable value. Dependingon the in dustry and/or the country, to which the assetbe longs, an interest rate between 6.6% and 9.1%is used.INVESTMENTSUnless investments are valued pursuant to the equitymethod, they are entered at purchase costs or marketvalue, if these can be reliably determined. Changes inthe value <strong>of</strong> investments that are classified as "avail ablefor sale" are entered without affecting the operatingresult, unless there is a major or lasting impairment.The share in companies valued according to the equitymethod is entered in keeping with the capital shareheld, which is increased or decreased according to thechanges in equity.OTHER FINANCIAL ASSETS AND OTHERLONG-TERM ASSETSLoans at market interest rates, as well as long-termreceivables are shown at their nominal value. Nointerest-bearingor low-interest loans and long-termreceivables are valued at their cash value. Value ad justmentsare made for identifiable exposures. Securitiesand loan stock rights carried as fixed assets are valuedat market prices.Changes in the value <strong>of</strong> securities that are classifiedas "at fair value through pr<strong>of</strong>it or loss" are enteredwith effect on the result. Changes in the value <strong>of</strong> se -curities that are classified as "available for sale" areentered without effect on the result, unless there is amajor or lasting impairment. Financial assets classifiedas "held to maturity" are entered at costs, ascarried for ward. Im pairments are entered with effecton the re sult. Financial receivables are classified as"loans and re ceiv ables" and valued at purchase costs,as carried forward.97