8 - Kuwait Oil Company

8 - Kuwait Oil Company

8 - Kuwait Oil Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

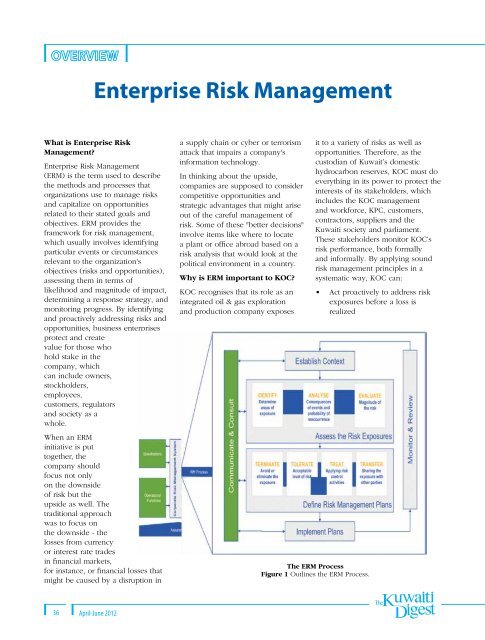

Enterprise Risk ManagementWhat is Enterprise RiskManagement?Enterprise Risk Management(ERM) is the term used to describethe methods and processes thatorganizations use to manage risksand capitalize on opportunitiesrelated to their stated goals andobjectives. ERM provides theframework for risk management,which usually involves identifyingparticular events or circumstancesrelevant to the organization'sobjectives (risks and opportunities),assessing them in terms oflikelihood and magnitude of impact,determining a response strategy, andmonitoring progress. By identifyingand proactively addressing risks andopportunities, business enterprisesprotect and createvalue for those whohold stake in thecompany, whichcan include owners,stockholders,employees,customers, regulatorsand society as awhole.When an ERMinitiative is puttogether, thecompany shouldfocus not onlyon the downsideof risk but theupside as well. Thetraditional approachwas to focus onthe downside - thelosses from currencyor interest rate tradesin financial markets,for instance, or financial losses thatmight be caused by a disruption ina supply chain or cyber or terrorismattack that impairs a company'sinformation technology.In thinking about the upside,companies are supposed to considercompetitive opportunities andstrategic advantages that might ariseout of the careful management ofrisk. Some of these "better decisions"involve items like where to locatea plant or office abroad based on arisk analysis that would look at thepolitical environment in a country.Why is ERM important to KOC?KOC recognises that its role as anintegrated oil & gas explorationand production company exposesit to a variety of risks as well asopportunities. Therefore, as thecustodian of <strong>Kuwait</strong>’s domestichydrocarbon reserves, KOC must doeverything in its power to protect theinterests of its stakeholders, whichincludes the KOC managementand workforce, KPC, customers,contractors, suppliers and the<strong>Kuwait</strong>i society and parliament.These stakeholders monitor KOC’srisk performance, both formallyand informally. By applying soundrisk management principles in asystematic way, KOC can:• Act proactively to address riskexposures before a loss isrealizedThe ERM ProcessFigure 1 Outlines the ERM Process.36 April-June 2012