AnnuAl REpORt - Bisnode

AnnuAl REpORt - Bisnode

AnnuAl REpORt - Bisnode

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

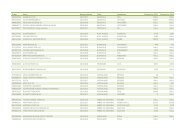

26Directors’reportThe Board of Directors and the Chief ExecutiveOfficer of <strong>Bisnode</strong> Business Information Group AB,556681-5725, hereby submit their report for 2009.The Group’s operations<strong>Bisnode</strong> is a leading provider of digital businessinformation in Europe, with a complete offering ofonline solutions for market, credit and businessinformation. <strong>Bisnode</strong>s business information serviceshelp companies to maximise sales, minimise businessrisks and make better business decisions.<strong>Bisnode</strong> conducts operations in 18 Europeancountries and has approximately 3,100 employees.Consolidated revenue in 2009 amounted to slightlyover SEK 4.7 billion.Significant events during the financial yearIn the beginning of 2009 <strong>Bisnode</strong> introduced a neworganisation based on four geographical regions(Nordic, DACH, BeNeFra and Central Europe), allcovering the product offerings Market Solutions,Credit Solutions and Business Information Solutions.In addition, two separate business areas, ProductInformation and Software and Applications, andcentral support functions were created.The motive for the organisational change is thatthe market for digital business information is local innature, and that data collection, enhancement, packagingand sales take place primarily at the nationallevel. With a regional organisation, combined withcentral support functions, the Group has greater opportunitiesto realise both revenue and cost synergies.Acquisitions and divestituresTwo major acquisitions were carried out during theyear. In October <strong>Bisnode</strong> acquired the Finnish companyKauppalehti 121 Oy (name changed to 121Media Oy). The company is a leading provider ofdirect marketing services in Finland with 55 employeesand annual revenue of EUR 8 million in 2009.In December <strong>Bisnode</strong> acquired 80.1 per cent ofthe shares in the previously partly-owned companyTA Teleadress Information AB. After the acquisition,<strong>Bisnode</strong>’s holding is 100%. TA Teleadress Informationhas a leading position in the Swedish market forsales of contact data for direct marketing and informationpurposes. The company has 35 employeesand annual revenue of approximately SEK 60 million.Aside from the above acquisitions, the Grouphas acquired the remaining 9.9 per cent of theshares in One Holding AS and taken over operationsin the German company RAAD Researchthrough the acquisition of net assets.Five units were divested during the year. In May<strong>Bisnode</strong> divested the net assets of the Norwegiancompany Inter Dialog AS and in July divested NomiGroup, which is active in the Nordic market forpharmaceutical intelligence.In August <strong>Bisnode</strong> completed the divestiture ofICC in the UK and Ireland and a couple of smallerBritish operations. The divestitures included allbusiness operations Region UK and Ireland, whichhas thus been discontinued.In December <strong>Bisnode</strong> divested Finfo AB and theGroup’s companies active in information and marketingservices for the construction industry, SverigeBygger AB och Norge Bygges AS.In accordance with IFRS 5 Non-current AssetsHeld for Sale and Discontinued Operations, allincome and expenses in the discontinued operations,including capital gains, are reported in profitfrom discontinued operations on a separate line inthe consolidated income statement. The consolidatedcash flow statement is also presented with a separationbetween continuing and discontinued operations.The figures for the comparison period havebeen restated accordingly.Earnings and financial positionRevenue and profitRevenue improved by 10 per cent to SEK 4,741million (4,325). Organic growth amounted to 4 percent. Adjusted for foreign exchange effects, organicgrowth was -1 per cent.Operating profit, EBITA, was SEK 593 million(533), equal to an operating margin of 12.3 per cent(12.0). Adjusted for capital gains on the sale of subsidiaries,operating profit, EBITA, was SEK 563 million(492) and operating margin was 11.9 per cent (11.4).Operating profit, EBIT, fell to SEK 428 million(446) as a result of goodwill impairment andincreased amortisation of intangible assets attributableto business combinations. The year’s goodwillimpairment losses amounted to a total of SEK 41million. The increased amortisation of intangibleassets attributable to business combinations refersto the acquisition of Wer Liefert Was that was completedat the end of 2008.Net financial items totalled SEK -189 million(-416). A stronger Swedish krona rate led to unrealisedforeign exchange gains of SEK 75 million (-131)attributable to the Group’s long-term borrowing. Inaddition, net financial items were positively affectedby lower market interest rates and a reduced loandebt.Income tax for the year totalled SEK -69 million(-14), equal to an average tax rate of 29 per cent(47). The high tax rate for the comparison period isexplained by tax adjustments attributable to priorperiods.Profit from continuing operations was SEK 170million (16), equal to earnings per share of SEK 1.3(0.0).Profit from discontinued operations for the fullyear was SEK -108 million (-4). This figure includesall profit and loss items from Region UK and Ireland,including the capital gain on the sale of ICC andimpairment of goodwill attributable to the region.Profit for the year was SEK 62 million (13) andearnings per share, basic and diluted, were SEK0.4 (0.0).Cash flow and investmentsThe year’s cash flow from operating activities wasSEK 471 million (426). The stronger cash flow ismainly explained by an improved profit beforedepreciation/amortisation and impairment. <strong>Bisnode</strong>is taking active measures to reduce working capitaland is seeing the positive effects of these efforts.Financial positionConsolidated net debt fell from SEK 3,148 million toSEK 2,684 during the year. The large decrease isexplained by strong cash flow from operating activitiestogether with lower expenditure and a net gainof SEK 81 million on the acquisition and divestitureof subsidiaries.Cash and cash equivalents amounted to SEK368 million, compared to SEK 324 million at 31December 2008. In addition, the Group has totalgranted but unutilised bank overdraft facilities ofSEK 400 million.