Annual Report 2008 – Financial Section - Quilvest

Annual Report 2008 – Financial Section - Quilvest

Annual Report 2008 – Financial Section - Quilvest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated <strong>Financial</strong> Statements (continued)<br />

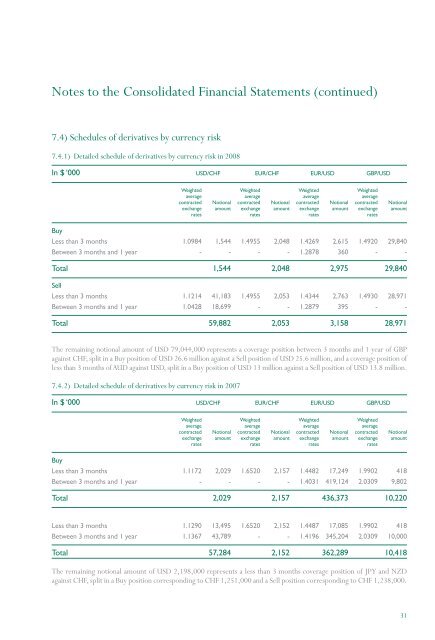

7.4) Schedules of derivatives by currency risk<br />

7.4.1) Detailed schedule of derivatives by currency risk in <strong>2008</strong><br />

In $ ‘000 USD/CHF EUR/CHF EUR/USD GBP/USD<br />

Weighted Weighted Weighted Weighted<br />

average average average average<br />

contracted Notional contracted Notional contracted Notional contracted Notional<br />

exchange amount exchange amount exchange amount exchange amount<br />

rates rates rates rates<br />

Buy<br />

Less than 3 months 1.0984 1,544 1.4955 2,048 1.4269 2,615 1.4920 29,840<br />

Between 3 months and 1 year - - - - 1.2878 360 - -<br />

Total 1,544 2,048 2,975 29,840<br />

Sell<br />

Less than 3 months 1.1214 41,183 1.4955 2,053 1.4344 2,763 1.4930 28,971<br />

Between 3 months and 1 year 1.0428 18,699 - - 1.2879 395 - -<br />

Total 59,882 2,053 3,158 28,971<br />

The remaining notional amount of USD 79,044,000 represents a coverage position between 3 months and 1 year of GBP<br />

against CHF, split in a Buy position of USD 26.6 million against a Sell position of USD 25.6 million, and a coverage position of<br />

less than 3 months ofAUD against USD, split in a Buy position of USD 13 million against a Sell position of USD 13.8 million.<br />

7.4.2) Detailed schedule of derivatives by currency risk in 2007<br />

In $ ‘000 USD/CHF EUR/CHF EUR/USD GBP/USD<br />

Weighted Weighted Weighted Weighted<br />

average average average average<br />

contracted Notional contracted Notional contracted Notional contracted Notional<br />

exchange amount exchange amount exchange amount exchange amount<br />

rates rates rates rates<br />

Buy<br />

Less than 3 months 1.1172 2,029 1.6520 2,157 1.4482 17,249 1.9902 418<br />

Between 3 months and 1 year - - - - 1.4031 419,124 2.0309 9,802<br />

Total 2,029 2,157 436,373 10,220<br />

Less than 3 months 1.1290 13,495 1.6520 2,152 1.4487 17,085 1.9902 418<br />

Between 3 months and 1 year 1.1367 43,789 - - 1.4196 345,204 2.0309 10,000<br />

Total 57,284 2,152 362,289 10,418<br />

The remaining notional amount of USD 2,198,000 represents a less than 3 months coverage position of JPY and NZD<br />

against CHF, split in a Buy position corresponding to CHF 1,251,000 and a Sell position corresponding to CHF 1,238,000.<br />

31