Annual Report 2006-2007 - Forensicare

Annual Report 2006-2007 - Forensicare

Annual Report 2006-2007 - Forensicare

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

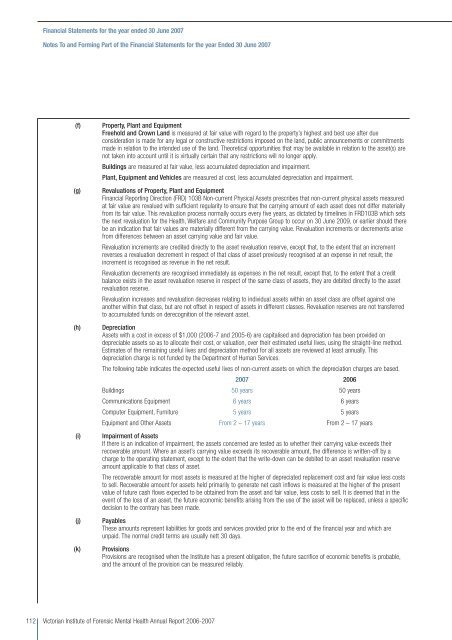

Financial Statements for the year ended 30 June <strong>2007</strong>Notes To and Forming Part of the Financial Statements for the year Ended 30 June <strong>2007</strong>(f)(g)(h)(i)(j)(k)Property, Plant and EquipmentFreehold and Crown Land is measured at fair value with regard to the property’s highest and best use after dueconsideration is made for any legal or constructive restrictions imposed on the land, public announcements or commitmentsmade in relation to the intended use of the land. Theoretical opportunities that may be available in relation to the asset(s) arenot taken into account until it is virtually certain that any restrictions will no longer apply.Buildings are measured at fair value, less accumulated depreciation and impairment.Plant, Equipment and Vehicles are measured at cost, less accumulated depreciation and impairment.Revaluations of Property, Plant and EquipmentFinancial <strong>Report</strong>ing Direction (FRD) 103B Non-current Physical Assets prescribes that non-current physical assets measuredat fair value are revalued with sufficient regularity to ensure that the carrying amount of each asset does not differ materiallyfrom its fair value. This revaluation process normally occurs every five years, as dictated by timelines in FRD103B which setsthe next revaluation for the Health, Welfare and Community Purpose Group to occur on 30 June 2009, or earlier should therebe an indication that fair values are materially different from the carrying value. Revaluation increments or decrements arisefrom differences between an asset carrying value and fair value.Revaluation increments are credited directly to the asset revaluation reserve, except that, to the extent that an incrementreverses a revaluation decrement in respect of that class of asset previously recognised at an expense in net result, theincrement is recognised as revenue in the net result.Revaluation decrements are recognised immediately as expenses in the net result, except that, to the extent that a creditbalance exists in the asset revaluation reserve in respect of the same class of assets, they are debited directly to the assetrevaluation reserve.Revaluation increases and revaluation decreases relating to individual assets within an asset class are offset against oneanother within that class, but are not offset in respect of assets in different classes. Revaluation reserves are not transferredto accumulated funds on derecognition of the relevant asset.DepreciationAssets with a cost in excess of $1,000 (<strong>2006</strong>-7 and 2005-6) are capitalised and depreciation has been provided ondepreciable assets so as to allocate their cost, or valuation, over their estimated useful lives, using the straight-line method.Estimates of the remaining useful lives and depreciation method for all assets are reviewed at least annually. Thisdepreciation charge is not funded by the Department of Human Services.The following table indicates the expected useful lives of non-current assets on which the depreciation charges are based.<strong>2007</strong> <strong>2006</strong>Buildings 50 years 50 yearsCommunications Equipment 6 years 6 yearsComputer Equipment, Furniture 5 years 5 yearsEquipment and Other Assets From 2 – 17 years From 2 – 17 yearsImpairment of AssetsIf there is an indication of impairment, the assets concerned are tested as to whether their carrying value exceeds theirrecoverable amount. Where an asset’s carrying value exceeds its recoverable amount, the difference is written-off by acharge to the operating statement, except to the extent that the write-down can be debited to an asset revaluation reserveamount applicable to that class of asset.The recoverable amount for most assets is measured at the higher of depreciated replacement cost and fair value less coststo sell. Recoverable amount for assets held primarily to generate net cash inflows is measured at the higher of the presentvalue of future cash flows expected to be obtained from the asset and fair value, less costs to sell. It is deemed that in theevent of the loss of an asset, the future economic benefits arising from the use of the asset will be replaced, unless a specificdecision to the contrary has been made.PayablesThese amounts represent liabilities for goods and services provided prior to the end of the financial year and which areunpaid. The normal credit terms are usually nett 30 days.ProvisionsProvisions are recognised when the Institute has a present obligation, the future sacrifice of economic benefits is probable,and the amount of the provision can be measured reliably.112Victorian Institute of Forensic Mental Health <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong>-<strong>2007</strong>