Jo<strong>in</strong>t action onf<strong>in</strong>ancial marketreform will leadto superior policyoutcomes. It’ssuccess h<strong>in</strong>ges on<strong>the</strong> U.S. <strong>and</strong> <strong>the</strong>EU solv<strong>in</strong>g <strong>the</strong>irbilateral issues<strong>and</strong> forg<strong>in</strong>g aheadwith <strong>in</strong>ternationalcooperation.forum of policy coord<strong>in</strong>ation from <strong>the</strong> traditionaladvanced nations of <strong>the</strong> G7 to <strong>the</strong> 20 mostimportant economies promised a more effectiveh<strong>and</strong>l<strong>in</strong>g of <strong>the</strong> 2008 f<strong>in</strong>ancial crisis <strong>and</strong> a moresusta<strong>in</strong>able policy framework for navigat<strong>in</strong>g <strong>the</strong>post-crisis environment. It did this by <strong>in</strong>vit<strong>in</strong>g fastdevelop<strong>in</strong>gnations such as Ch<strong>in</strong>a, India, <strong>and</strong> Brazil,which enjoy a grow<strong>in</strong>g share <strong>in</strong> global trade <strong>and</strong>output <strong>and</strong> <strong>in</strong>creas<strong>in</strong>g stakes <strong>in</strong> global production<strong>and</strong> asset ownership, as well as formidable f<strong>in</strong>ancialreserves. Includ<strong>in</strong>g key emerg<strong>in</strong>g economies <strong>in</strong>global economic policy coord<strong>in</strong>ation has beenpraised widely as a major leap forward for globalgovernance.The potential benefits of closer cooperation amonga larger number of key players are substantial.In f<strong>in</strong>ancial market policy, a jo<strong>in</strong>t approach toregulation <strong>and</strong> supervision promises a more levelplay<strong>in</strong>g field <strong>in</strong> terms of regulation <strong>and</strong> a lowerrisk of regulatory arbitrage by market participants.By establish<strong>in</strong>g high-quality rules across <strong>the</strong> G20,<strong>the</strong> overall level of f<strong>in</strong>ancial market oversightcould be raised substantially. Closer cooperationamong supervisory authorities may contribute toa more effective h<strong>and</strong>l<strong>in</strong>g of cross-border risksfor <strong>in</strong>ternational capital flows <strong>and</strong> transnationaloperations of f<strong>in</strong>ancial firms. In o<strong>the</strong>r words, jo<strong>in</strong>taction may result <strong>in</strong> superior policy outcomes,as <strong>the</strong> logic of what <strong>the</strong>orists refer to as collectiveaction also applies to f<strong>in</strong>ancial market diplomacy. 3But so do <strong>the</strong> problems associated with collectiveaction. Thus, <strong>the</strong> likelihood of reach<strong>in</strong>g agreementamong <strong>the</strong> participants <strong>in</strong> <strong>the</strong> policy processdecl<strong>in</strong>es with <strong>the</strong>ir number <strong>and</strong> with a ris<strong>in</strong>gheterogeneity of <strong>the</strong>ir <strong>in</strong>terests. The transitionfrom G7 to <strong>the</strong> G20 has added to both. In addition,<strong>the</strong> chances of f<strong>in</strong>d<strong>in</strong>g jo<strong>in</strong>t solutions rise with3Masson (2009) provides a comprehensive <strong>the</strong>oretical analysisof <strong>the</strong> dynamics beh<strong>in</strong>d <strong>in</strong>ternational cooperation <strong>in</strong> f<strong>in</strong>ancialmarket regulation.<strong>the</strong> expected costs of failure to do so, 4 <strong>and</strong> <strong>the</strong>unexpectedly quick economic recovery after<strong>the</strong> crisis <strong>in</strong> many parts of <strong>the</strong> world has clearlydim<strong>in</strong>ished <strong>the</strong> sense of urgency perceived <strong>in</strong> <strong>the</strong>context of f<strong>in</strong>ancial market reform. Cooperationmay get fur<strong>the</strong>r aggravated by <strong>the</strong> multitude ofnegotiat<strong>in</strong>g bodies <strong>in</strong>volved, especially if <strong>the</strong>irmembership varies as is <strong>the</strong> case between <strong>the</strong> G20,<strong>the</strong> IMF, <strong>the</strong> FSB, IOSCO or <strong>the</strong> Basel Committee. 5F<strong>in</strong>ally, <strong>the</strong> question of <strong>the</strong> right scope of <strong>the</strong>G20 rema<strong>in</strong>s a latent issue. Depend<strong>in</strong>g on <strong>the</strong>perspective <strong>the</strong>y have, critics have claimed that <strong>the</strong>Group may be ei<strong>the</strong>r too large or too small, <strong>and</strong>that <strong>the</strong> range of political issues on <strong>the</strong> G20 agendawas too extensive or too limited. 6Theory, however, tells us ano<strong>the</strong>r important storyabout <strong>in</strong>ternational negotiations: Their successcritically h<strong>in</strong>ges on group dynamics – atomistic,self-<strong>in</strong>terested countries are less likely to reachagreement than a limited number of oligopolisticplayers, <strong>and</strong> <strong>the</strong> likelihood of jo<strong>in</strong>t solutions vitallydepends on one or more large countries forg<strong>in</strong>gahead with <strong>in</strong>ternational cooperation. 7This br<strong>in</strong>gs us to <strong>the</strong> United States <strong>and</strong> <strong>the</strong> EU. If<strong>the</strong>ory — let alone historical experience — is rightabout <strong>the</strong> central importance of a small number ofkey drivers <strong>in</strong> <strong>in</strong>tergovernmental processes, <strong>the</strong>n<strong>the</strong> United States <strong>and</strong> <strong>the</strong> EU <strong>in</strong>tuitively qualifyas important promoters of jo<strong>in</strong>t G20 solutions.Judg<strong>in</strong>g by <strong>the</strong>ir economic <strong>and</strong> f<strong>in</strong>ancial weight,<strong>the</strong>y should <strong>in</strong>deed be <strong>the</strong> driv<strong>in</strong>g force beh<strong>in</strong>dglobal policy coord<strong>in</strong>ation, especially <strong>in</strong> <strong>the</strong> area off<strong>in</strong>ancial market regulation.4Masson (2009), pp. 18-19.5Weber (2007), p. 103 <strong>and</strong> Bradlow (2010).6Bradlow (2010), p. 12.7Masson (2009), p. 17.4Transatlantic Academy

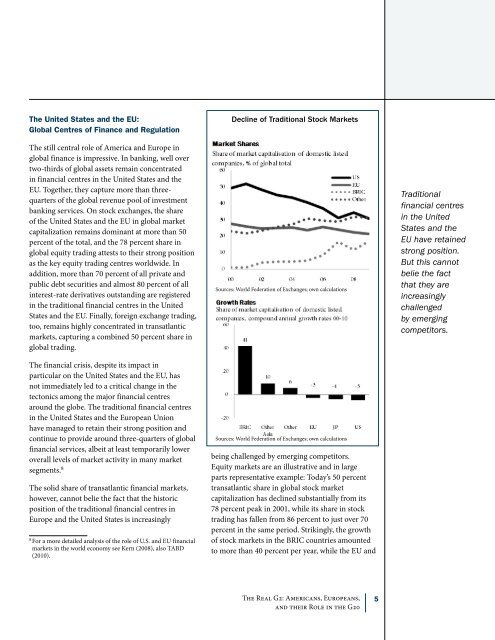

The United States <strong>and</strong> <strong>the</strong> EU:Global Centres of F<strong>in</strong>ance <strong>and</strong> RegulationThe still central <strong>role</strong> of America <strong>and</strong> Europe <strong>in</strong>global f<strong>in</strong>ance is impressive. In bank<strong>in</strong>g, well overtwo-thirds of global assets rema<strong>in</strong> concentrated<strong>in</strong> f<strong>in</strong>ancial centres <strong>in</strong> <strong>the</strong> United States <strong>and</strong> <strong>the</strong>EU. Toge<strong>the</strong>r, <strong>the</strong>y capture more than threequartersof <strong>the</strong> global revenue pool of <strong>in</strong>vestmentbank<strong>in</strong>g services. On stock exchanges, <strong>the</strong> shareof <strong>the</strong> United States <strong>and</strong> <strong>the</strong> EU <strong>in</strong> global marketcapitalization rema<strong>in</strong>s dom<strong>in</strong>ant at more than 50percent of <strong>the</strong> total, <strong>and</strong> <strong>the</strong> 78 percent share <strong>in</strong>global equity trad<strong>in</strong>g attests to <strong>the</strong>ir strong positionas <strong>the</strong> key equity trad<strong>in</strong>g centres worldwide. Inaddition, more than 70 percent of all private <strong>and</strong>public debt securities <strong>and</strong> almost 80 percent of all<strong>in</strong>terest-rate derivatives outst<strong>and</strong><strong>in</strong>g are registered<strong>in</strong> <strong>the</strong> traditional f<strong>in</strong>ancial centres <strong>in</strong> <strong>the</strong> UnitedStates <strong>and</strong> <strong>the</strong> EU. F<strong>in</strong>ally, foreign exchange trad<strong>in</strong>g,too, rema<strong>in</strong>s highly concentrated <strong>in</strong> transatlanticmarkets, captur<strong>in</strong>g a comb<strong>in</strong>ed 50 percent share <strong>in</strong>global trad<strong>in</strong>g.The f<strong>in</strong>ancial crisis, despite its impact <strong>in</strong>particular on <strong>the</strong> United States <strong>and</strong> <strong>the</strong> EU, hasnot immediately led to a critical change <strong>in</strong> <strong>the</strong>tectonics among <strong>the</strong> major f<strong>in</strong>ancial centresaround <strong>the</strong> globe. The traditional f<strong>in</strong>ancial centres<strong>in</strong> <strong>the</strong> United States <strong>and</strong> <strong>the</strong> European Unionhave managed to reta<strong>in</strong> <strong>the</strong>ir strong position <strong>and</strong>cont<strong>in</strong>ue to provide around three-quarters of globalf<strong>in</strong>ancial services, albeit at least temporarily loweroverall levels of market activity <strong>in</strong> many marketsegments. 8The solid share of transatlantic f<strong>in</strong>ancial markets,however, cannot belie <strong>the</strong> fact that <strong>the</strong> historicposition of <strong>the</strong> traditional f<strong>in</strong>ancial centres <strong>in</strong>Europe <strong>and</strong> <strong>the</strong> United States is <strong>in</strong>creas<strong>in</strong>gly8For a more detailed analysis of <strong>the</strong> <strong>role</strong> of U.S. <strong>and</strong> EU f<strong>in</strong>ancialmarkets <strong>in</strong> <strong>the</strong> world economy see Kern (2008), also TABD(2010).Decl<strong>in</strong>e of Traditional Stock MarketsSources: World Federation of Exchanges; own calculationsSources: World Federation of Exchanges; own calculationsbe<strong>in</strong>g challenged by emerg<strong>in</strong>g competitors.Equity markets are an illustrative <strong>and</strong> <strong>in</strong> largeparts representative example: Today’s 50 percenttransatlantic share <strong>in</strong> global stock marketcapitalization has decl<strong>in</strong>ed substantially from its78 percent peak <strong>in</strong> 2001, while its share <strong>in</strong> stocktrad<strong>in</strong>g has fallen from 86 percent to just over 70percent <strong>in</strong> <strong>the</strong> same period. Strik<strong>in</strong>gly, <strong>the</strong> growthof stock markets <strong>in</strong> <strong>the</strong> BRIC countries amountedto more than 40 percent per year, while <strong>the</strong> EU <strong>and</strong>Traditionalf<strong>in</strong>ancial centres<strong>in</strong> <strong>the</strong> UnitedStates <strong>and</strong> <strong>the</strong>EU have reta<strong>in</strong>edstrong position.But this cannotbelie <strong>the</strong> factthat <strong>the</strong>y are<strong>in</strong>creas<strong>in</strong>glychallengedby emerg<strong>in</strong>gcompetitors.The Real G2: Americans, Europeans,<strong>and</strong> <strong>the</strong>ir Role <strong>in</strong> <strong>the</strong> G205