INSIDE THIS ISSUE: - Kimisitu Sacco

INSIDE THIS ISSUE: - Kimisitu Sacco

INSIDE THIS ISSUE: - Kimisitu Sacco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

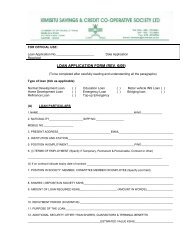

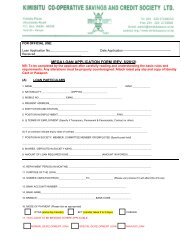

4 KIMISITUNEWS | JANUARY - APRIL, 2010New Appointments at <strong>Kimisitu</strong>Eve MaguBringing marketing experience and energy on boardEvelyne Njeri Magu has joined <strong>Kimisitu</strong> <strong>Sacco</strong> Society Ltd as the Marketing Officer. She joins us from BataShoe Company where she was a category merchandiser for one and a half years. Evelyne has also workedat Oakland Media Services as the Public Relations/Marketing Executive, the Nairobi Hospital as CustomerCare Executive and at the Kenya Association of Hotel Keepers and Caterers as the Administrative Assistantand Personal Assistant to the Chief Executive Officer. She has a degree in Business Administration fromStrathmore University and a post graduate diploma in marketing from the Chartered Institute of Marketing.During her free time Evelyne enjoys swimming and traveling as well as engaging in business forumswhere she can meet new people.Joshua KamwereAn extra eye in risk managementJoshua Kamwere Wanjiku has joined <strong>Kimisitu</strong> <strong>Sacco</strong> Society Ltd as the Assistant Internal Auditor. He holdsa Bachelor of Commerce degree from Catholic University and is a CPA (K). Previously he was the Financeand Operations Manager at Industrial Development Bank <strong>Sacco</strong> for three years and later worked for MakeniMutua and Associates as an Associate Manager. Joshua loves sports and in his free time he can enjoy around of golf, playing table tennis, badminton and loves community service as well.Departmental BriefsLoans Department:The Loans Department is the engine of <strong>Kimisitu</strong>’s core activities of savingsand credit. The department, which started of with one member ofstaff in1985 has grown to three; headed by Catherine Odhiambo theloans officer who supervises two assistants-Nancy Mugo and CatherineMbugua. Through teamwork and excellent customer care, the departmenthas managed to disburse 646 loans amounting to Kshs 202, 965,155 by 31st March 2010. All the functions of the department are guidedby the Society’s Loan Policy and the desire to ensure that members savemore and borrow wisely.Apart from loan processing, the department also ensures the quality ofthe loans portfolio, updates members statements and has been collectingmembers needs and developing new products to satisfy them.Finance Department:Alex Marige and Charity Muthoni .the <strong>Sacco</strong>’s Accountant and AssistantAccountant respectively have the responsibility of managing the <strong>Sacco</strong>’sfinances and ensuring that the financial records are up to date. Theyalso burn the midnight oil to ensure that financial reports are ready intime for the monthly Management Committee meetings. The Financedepartment also handles refunds to members.Admin Department:The Administration Department serves as customer care center as wellas providing logistical support to the board and other staff, in additionto records maintenance. Lilian Mochama, the Administrative Assistantand Jotham Opiyo, the Office Assistant multitask to ensure thatmembers receive fast and efficient service and all departments are welltaken care of.Executive Committee:The Executive Committee tirelessly works closely with the office to ensuresmooth running of operations. Under the leadership of KennedyAuka, the Chair, this indefatigable team consisting of Pamela Mokayathe Vice Chair, James Wagura, the Treasurer and Elizabeth Kariuki, Hon.Secretary ensures that members receive their payments without delay,manage prudently the society’s resources and spearhead the implementationof the AGM and board resolutions.Credit Committee:The dedicated team of Janerose Mwangi, Flo Waiyaki and Steven Nyambukaare always at the service of members every week to ensure thatloans are promptly approved strictly according to the loans policy. TheCredit Committee also has the responsibility of developing new productsthat meet the needs of members.Transforming lives through savings and credit

6 KIMISITUNEWS | JANUARY - APRIL, 2010<strong>Kimisitu</strong> TeamKennedy AukaHon. ChairmanPamela MokayaaHon. Vice ChairmanJames WaguraHon. TreasurerElizabeth KariukiHon. SecretaryLaban MusundiEducation CommitteeFlorence WaiyakiSecretaryCredit CommitteeCollins C BonyoChairmanSupervisory CommitteeFlorence OileSecretaryEducation CommitteeEdith KaranjaSecretarySupervisory CommitteeSteve NyambukaCommitte MemberJanerose MwangiChairmanCredit CommitteePaul N. MonyiSupervisory CommitteeJotham OpiyoOffice AssistantCharity M. MungaiAssistant AccountantAngela Nyanjong’ManagerCatherine MbuguaLoans AssistantCatherine OdhiambobLoans OfficerLilian MochamaAdmin AssistantHellen N. NderuiTemp ClerkTransforming lives through savings and credit

JANUARY - APRIL, 2010Holiday SavingsIn this era of objectives and targets finding a balance betweenwork and life is becoming increasingly difficult, yet the balanceis necessary. If you suffer from the feeling of completeexhaustion by the time you get home, merely trying to getthrough a day in the office or having the feeling that you arefalling behind and never catching up in the game of life thenyou are suffering from some of the typical signs that yourwork/life balance has gone amuck:It’s important to create the right mixture for your life becausewithout the balance, any career goals or aspirations you haveset for yourself will eventually fall flat due to your own mindor body’s inability to keep up. Finding your career niche involvesmore than gathering and applying copious amountsof industry and job information. Learning to create work/lifebalance can help by clearing the mind and body, which in turnhelps you identify which goals are the most important to youand define success using those objectives.Work/life balance can involve many things, from simply gettingenough sleep at night to taking a vacation away from theusual surroundings.When it comes to vacations the difficulty for most people isfinding the funds for that needed getaway. The <strong>Kimisitu</strong> HolidaySavings account provides an excellent avenue for you tosave for that needed break. The account requires a minimummonthly saving requirement of Kshs. 1000, with savings withdrawable after six months. This account comes with additionalbenefits of an attractive interest rate of 3% paid uponwithdrawal with no additional or hidden charges. Quarterlystatements are provided monthly in order to assist you tokeep track of your savings.Finding work-life balance in today’s frenetically paced worldis no simple task however the cost of success will be too highif you chose not to lead a balanced life. Going on holiday notonly provides the opportunity for you to relax but also createsan avenue for the person to spend quality time with familyand friends.Try it out and take a rest as you save for your rest.CONTACT US:KIMISITU CO-OPERATIVE SAVINGS AND CREDIT SOCIETY LTD.Woodlands Road, Kilimani, opposite IFRC, next to NARC KenyaP.O BOX 10454 – 00100 Nairobi ● Telephone: 254-020-273 3601/3Mobile: 0724 310 626 ● Fax: 254-020-2733598Email: manager@kimisitusacco.or.ke, admin@kimisitusacco.or.ke, loans@kimisitusacco.or.keWebsite: www.kimisitusacco.or.keTransforming lives through savings and credit