Notes to the Financial Statements

Notes to the Financial Statements

Notes to the Financial Statements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

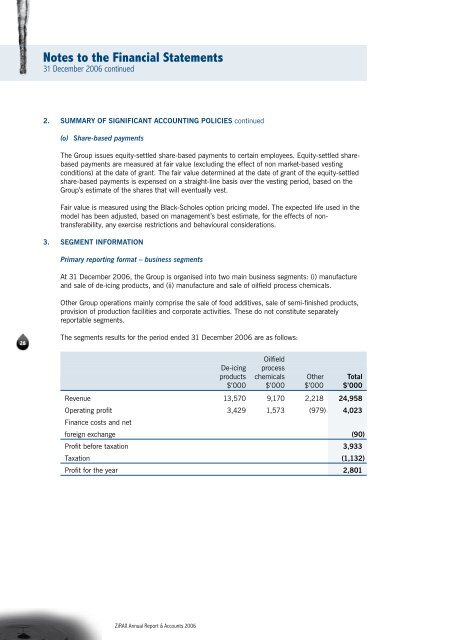

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong>31 December 2006 continued2. Summary of significant accounting policies continued(o) Share-based paymentsThe Group issues equity-settled share-based payments <strong>to</strong> certain employees. Equity-settled sharebasedpayments are measured at fair value (excluding <strong>the</strong> effect of non market-based vestingconditions) at <strong>the</strong> date of grant. The fair value determined at <strong>the</strong> date of grant of <strong>the</strong> equity-settledshare-based payments is expensed on a straight-line basis over <strong>the</strong> vesting period, based on <strong>the</strong>Group’s estimate of <strong>the</strong> shares that will eventually vest.Fair value is measured using <strong>the</strong> Black-Scholes option pricing model. The expected life used in <strong>the</strong>model has been adjusted, based on management’s best estimate, for <strong>the</strong> effects of nontransferability,any exercise restrictions and behavioural considerations.3. Segment informationPrimary reporting format – business segmentsAt 31 December 2006, <strong>the</strong> Group is organised in<strong>to</strong> two main business segments: (i) manufactureand sale of de-icing products, and (ii) manufacture and sale of oilfield process chemicals.O<strong>the</strong>r Group operations mainly comprise <strong>the</strong> sale of food additives, sale of semi-finished products,provision of production facilities and corporate activities. These do not constitute separatelyreportable segments.28The segments results for <strong>the</strong> period ended 31 December 2006 are as follows:OilfieldDe-icing processproducts chemicals O<strong>the</strong>r Total$’000 $’000 $’000 $’000Revenue 13,570 9,170 2,218 24,958Operating profit 3,429 1,573 (979) 4,023Finance costs and netforeign exchange (90)Profit before taxation 3,933Taxation (1,132)Profit for <strong>the</strong> year 2,801ZiRAX Annual Report & Accounts 2006