Notes to the Financial Statements

Notes to the Financial Statements

Notes to the Financial Statements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

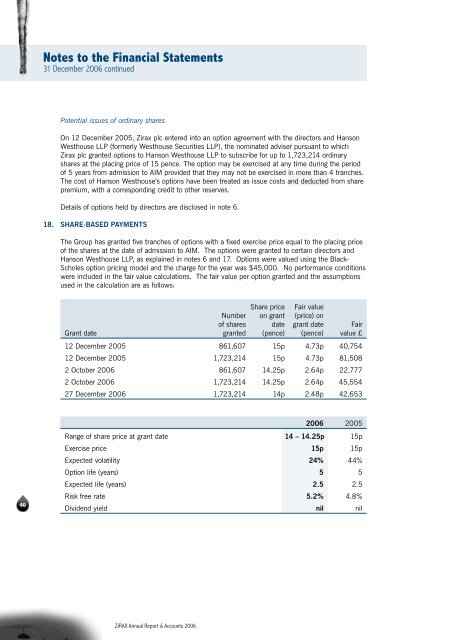

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong>31 December 2006 continuedPotential issues of ordinary sharesOn 12 December 2005, Zirax plc entered in<strong>to</strong> an option agreement with <strong>the</strong> direc<strong>to</strong>rs and HansonWesthouse LLP (formerly Westhouse Securities LLP), <strong>the</strong> nominated adviser pursuant <strong>to</strong> whichZirax plc granted options <strong>to</strong> Hanson Westhouse LLP <strong>to</strong> subscribe for up <strong>to</strong> 1,723,214 ordinaryshares at <strong>the</strong> placing price of 15 pence. The option may be exercised at any time during <strong>the</strong> periodof 5 years from admission <strong>to</strong> AIM provided that <strong>the</strong>y may not be exercised in more than 4 tranches.The cost of Hanson Westhouse’s options have been treated as issue costs and deducted from sharepremium, with a corresponding credit <strong>to</strong> o<strong>the</strong>r reserves.Details of options held by direc<strong>to</strong>rs are disclosed in note 6.18. Share-based paymentsThe Group has granted five tranches of options with a fixed exercise price equal <strong>to</strong> <strong>the</strong> placing priceof <strong>the</strong> shares at <strong>the</strong> date of admission <strong>to</strong> AIM. The options were granted <strong>to</strong> certain direc<strong>to</strong>rs andHanson Westhouse LLP, as explained in notes 6 and 17. Options were valued using <strong>the</strong> Black-Scholes option pricing model and <strong>the</strong> charge for <strong>the</strong> year was $45,000. No performance conditionswere included in <strong>the</strong> fair value calculations. The fair value per option granted and <strong>the</strong> assumptionsused in <strong>the</strong> calculation are as follows:Share price Fair valueNumber on grant (price) onof shares date grant date FairGrant date granted (pence) (pence) value £12 December 2005 861,607 15p 4.73p 40,75412 December 2005 1,723,214 15p 4.73p 81,5082 Oc<strong>to</strong>ber 2006 861,607 14.25p 2.64p 22,7772 Oc<strong>to</strong>ber 2006 1,723,214 14.25p 2.64p 45,55427 December 2006 1,723,214 14p 2.48p 42,653402006 2005Range of share price at grant date 14 – 14.25p 15pExercise price 15p 15pExpected volatility 24% 44%Option life (years) 5 5Expected life (years) 2.5 2.5Risk free rate 5.2% 4.8%Dividend yield nil nilZiRAX Annual Report & Accounts 2006