2006 Annual Report - Timberlane Regional School District

2006 Annual Report - Timberlane Regional School District

2006 Annual Report - Timberlane Regional School District

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

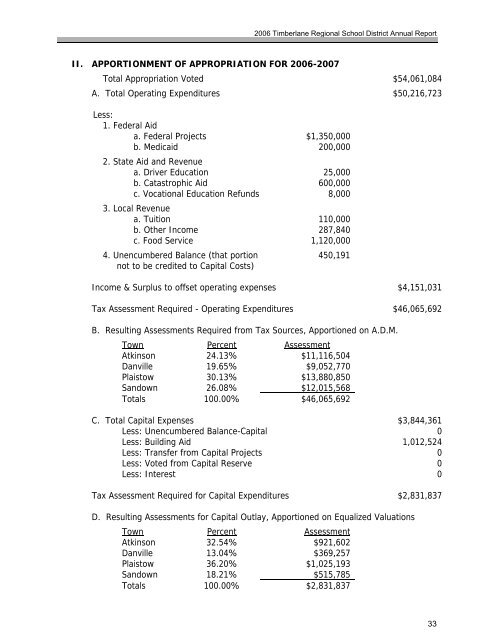

<strong>2006</strong> <strong>Timberlane</strong> <strong>Regional</strong> <strong>School</strong> <strong>District</strong> <strong>Annual</strong> <strong>Report</strong>II. APPORTIONMENT OF APPROPRIATION FOR <strong>2006</strong>-2007Total Appropriation Voted $54,061,084A. Total Operating Expenditures $50,216,723Less:1. Federal Aida. Federal Projects $1,350,000b. Medicaid 200,0002. State Aid and Revenuea. Driver Education 25,000b. Catastrophic Aid 600,000c. Vocational Education Refunds 8,0003. Local Revenuea. Tuition 110,000b. Other Income 287,840c. Food Service 1,120,0004. Unencumbered Balance (that portion 450,191not to be credited to Capital Costs)Income & Surplus to offset operating expenses $4,151,031Tax Assessment Required - Operating Expenditures $46,065,692B. Resulting Assessments Required from Tax Sources, Apportioned on A.D.M.Town Percent AssessmentAtkinson 24.13% $11,116,504Danville 19.65% $9,052,770Plaistow 30.13% $13,880,850Sandown 26.08% $12,015,568Totals 100.00% $46,065,692C. Total Capital Expenses $3,844,361Less: Unencumbered Balance-Capital 0Less: Building Aid 1,012,524Less: Transfer from Capital Projects 0Less: Voted from Capital Reserve 0Less: Interest 0Tax Assessment Required for Capital Expenditures $2,831,837D. Resulting Assessments for Capital Outlay, Apportioned on Equalized ValuationsTown Percent AssessmentAtkinson 32.54% $921,602Danville 13.04% $369,257Plaistow 36.20% $1,025,193Sandown 18.21% $515,785Totals 100.00% $2,831,83733