Annual Report 2010/11

Annual Report 2010/11

Annual Report 2010/11

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

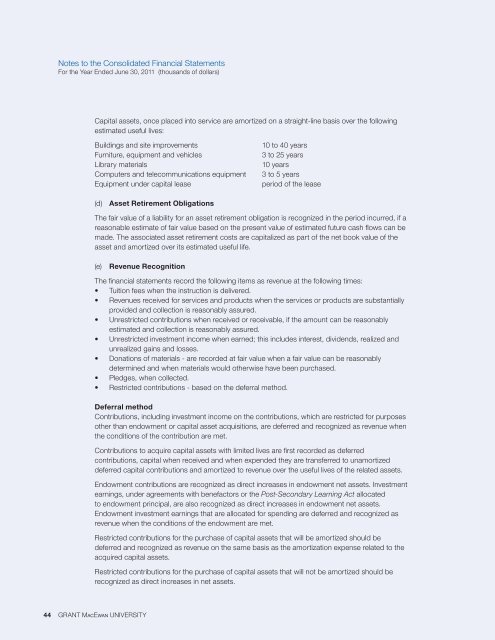

Notes to the Consolidated Financial StatementsFor the Year Ended June 30, 20<strong>11</strong> (thousands of dollars)Capital assets, once placed into service are amortized on a straight-line basis over the followingestimated useful lives:Buildings and site improvementsFurniture, equipment and vehiclesLibrary materialsComputers and telecommunications equipmentEquipment under capital lease10 to 40 years3 to 25 years10 years3 to 5 yearsperiod of the lease(d) Asset Retirement ObligationsThe fair value of a liability for an asset retirement obligation is recognized in the period incurred, if areasonable estimate of fair value based on the present value of estimated future cash flows can bemade. The associated asset retirement costs are capitalized as part of the net book value of theasset and amortized over its estimated useful life.(e) Revenue RecognitionThe financial statements record the following items as revenue at the following times:• Tuition fees when the instruction is delivered.• Revenues received for services and products when the services or products are substantiallyprovided and collection is reasonably assured.• Unrestricted contributions when received or receivable, if the amount can be reasonablyestimated and collection is reasonably assured.• Unrestricted investment income when earned; this includes interest, dividends, realized andunrealized gains and losses.• Donations of materials - are recorded at fair value when a fair value can be reasonablydetermined and when materials would otherwise have been purchased.• Pledges, when collected.• Restricted contributions - based on the deferral method.Deferral methodContributions, including investment income on the contributions, which are restricted for purposesother than endowment or capital asset acquisitions, are deferred and recognized as revenue whenthe conditions of the contribution are met.Contributions to acquire capital assets with limited lives are first recorded as deferredcontributions, capital when received and when expended they are transferred to unamortizeddeferred capital contributions and amortized to revenue over the useful lives of the related assets.Endowment contributions are recognized as direct increases in endowment net assets. Investmentearnings, under agreements with benefactors or the Post-Secondary Learning Act allocatedto endowment principal, are also recognized as direct increases in endowment net assets.Endowment investment earnings that are allocated for spending are deferred and recognized asrevenue when the conditions of the endowment are met.Restricted contributions for the purchase of capital assets that will be amortized should bedeferred and recognized as revenue on the same basis as the amortization expense related to theacquired capital assets.Restricted contributions for the purchase of capital assets that will not be amortized should berecognized as direct increases in net assets.44 grant Macewan university