Download PDF - Vox

Download PDF - Vox

Download PDF - Vox

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

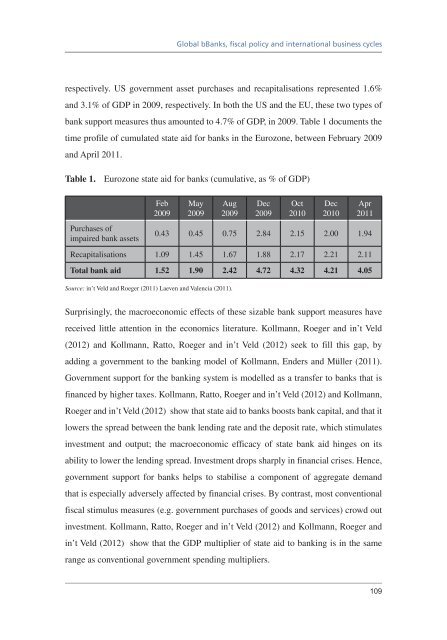

Global bBanks, fiscal policy and international business cyclesrespectively. US government asset purchases and recapitalisations represented 1.6%and 3.1% of GDP in 2009, respectively. In both the US and the EU, these two types ofbank support measures thus amounted to 4.7% of GDP, in 2009. Table 1 documents thetime profile of cumulated state aid for banks in the Eurozone, between February 2009and April 2011.Table 1. Eurozone state aid for banks (cumulative, as % of GDP)Purchases ofimpaired bank assetsFeb2009May2009Aug2009Dec2009Oct2010Dec2010Apr20110.43 0.45 0.75 2.84 2.15 2.00 1.94Recapitalisations 1.09 1.45 1.67 1.88 2.17 2.21 2.11Total bank aid 1.52 1.90 2.42 4.72 4.32 4.21 4.05Source: in’t Veld and Roeger (2011) Laeven and Valencia (2011).Surprisingly, the macroeconomic effects of these sizable bank support measures havereceived little attention in the economics literature. Kollmann, Roeger and in’t Veld(2012) and Kollmann, Ratto, Roeger and in’t Veld (2012) seek to fill this gap, byadding a government to the banking model of Kollmann, Enders and Müller (2011).Government support for the banking system is modelled as a transfer to banks that isfinanced by higher taxes. Kollmann, Ratto, Roeger and in’t Veld (2012) and Kollmann,Roeger and in’t Veld (2012) show that state aid to banks boosts bank capital, and that itlowers the spread between the bank lending rate and the deposit rate, which stimulatesinvestment and output; the macroeconomic efficacy of state bank aid hinges on itsability to lower the lending spread. Investment drops sharply in financial crises. Hence,government support for banks helps to stabilise a component of aggregate demandthat is especially adversely affected by financial crises. By contrast, most conventionalfiscal stimulus measures (e.g. government purchases of goods and services) crowd outinvestment. Kollmann, Ratto, Roeger and in’t Veld (2012) and Kollmann, Roeger andin’t Veld (2012) show that the GDP multiplier of state aid to banking is in the samerange as conventional government spending multipliers.109