Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

38 Consolidated Financial Statements<br />

All amounts are in 000 CHF if not otherwise noted<br />

ing in the relevant foreign currencies.<br />

(a) Market Risk<br />

(i) Foreign Exchange Risk<br />

The Group operates internationally and is exposed to foreign<br />

exchange risk, primarily with respect to the euro. Foreign<br />

exchange risk arises from future commercial transaction,<br />

recognized assets and liabilities, and net investments<br />

in foreign operations.<br />

The Group has certain investments in foreign operations,<br />

whose net assets are exposed to foreign-currency translation<br />

risk. Currency exposure arising from the net assets of<br />

the Group’s foreign operations is managed primarily<br />

through borrowings denominated in the relevant foreign<br />

currencies.<br />

At December 31, <strong>2010</strong>, if the currency had weakened/<br />

strengthened by 5% against the euro with all other variables<br />

held constant, post-tax profit for the year would have<br />

been CHF 36 higher/lower, mainly as a result of foreign exchange<br />

gains/losses on translation of euro-denominated<br />

trade receivables, financial assets and borrowings.<br />

(ii) Cash Flow and Fair Value Interest Rate Risk<br />

The Group’s interest rate risk arises from long-term borrowings.<br />

Borrowings issued at variable rates expose the<br />

Group to cash flow interest rate risk. Borrowings issued at<br />

fixed rates expose the Group to fair value interest rate risk.<br />

Group policy is to maintain approximately 90% of its borrowings<br />

in fixed rate instruments. For information regarding<br />

fair values of fixed rate instruments refer to note 14.<br />

(b) Credit Risk<br />

Credit risk arises primarily from exposures to local electricity<br />

companies, which are owned by the government or<br />

federal state (canton, province). Such governments or<br />

federal states have a Standard & Poors rating of AA or<br />

higher. For further information regarding receivables refer<br />

to note 9.<br />

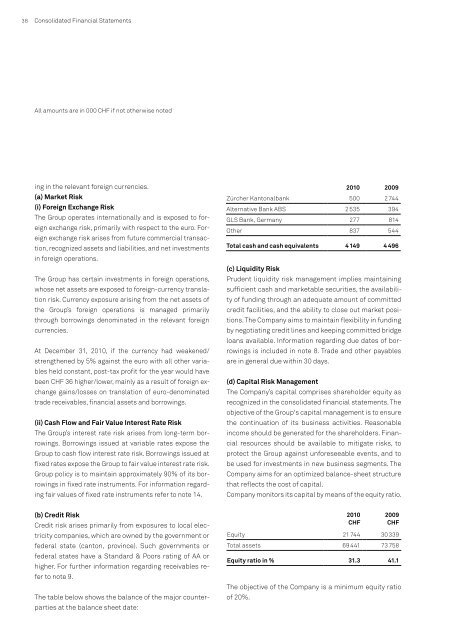

The table below shows the balance of the major counterparties<br />

at the balance sheet date:<br />

<strong>2010</strong> 2009<br />

Zürcher Kantonalbank 500 2 744<br />

Alternative Bank ABS 2 535 394<br />

GLS Bank, Germany 277 814<br />

Other 837 544<br />

Total cash and cash equivalents 4 149 4 496<br />

(c) Liquidity Risk<br />

Prudent liquidity risk management implies maintaining<br />

sufficient cash and marketable securities, the availability<br />

of funding through an adequate amount of committed<br />

credit facilities, and the ability to close out market positions.<br />

The Company aims to maintain flexibility in funding<br />

by negotiating credit lines and keeping committed bridge<br />

loans available. Information regarding due dates of borrowings<br />

is included in note 8. Trade and other payables<br />

are in general due within 30 days.<br />

(d) Capital Risk Management<br />

The Company’s capital comprises shareholder equity as<br />

recognized in the consolidated financial statements. The<br />

objective of the Group's capital management is to ensure<br />

the continuation of its business activities. Reasonable<br />

income should be generated for the shareholders. Financial<br />

resources should be available to mitigate risks, to<br />

protect the Group against unforeseeable events, and to<br />

be used for investments in new business segments. The<br />

Company aims for an optimized balance-sheet structure<br />

that reflects the cost of capital.<br />

Company monitors its capital by means of the equity ratio.<br />

<strong>2010</strong><br />

CHF<br />

2009<br />

CHF<br />

Equity 21 744 30 339<br />

Total assets 69 441 73 758<br />

Equity ratio in % 31.3 41.1<br />

The objective of the Company is a minimum equity ratio<br />

of 20%.