Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

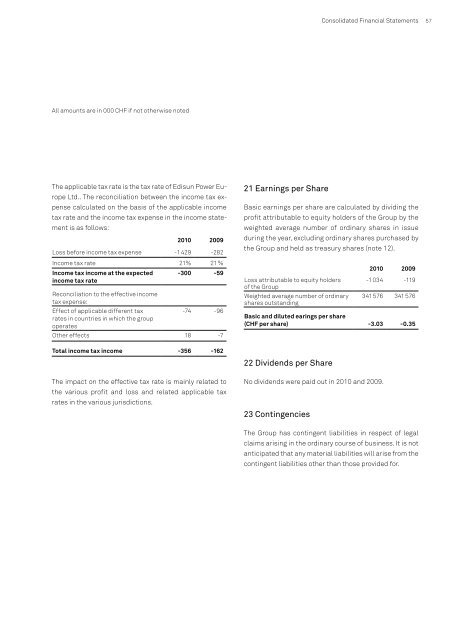

All amounts are in 000 CHF if not otherwise noted<br />

The applicable tax rate is the tax rate of <strong>Edisun</strong> <strong>Power</strong> <strong>Europe</strong><br />

<strong>Ltd</strong>.. The reconciliation between the income tax expense<br />

calculated on the basis of the applicable income<br />

tax rate and the income tax expense in the income statement<br />

is as follows:<br />

<strong>2010</strong> 2009<br />

Loss before income tax expense -1 429 -282<br />

Income tax rate 21% 21 %<br />

Income tax income at the expected<br />

income tax rate<br />

-300 -59<br />

Reconciliation to the effective income<br />

tax expense:<br />

Effect of applicable different tax<br />

rates in countries in which the group<br />

operates<br />

-74 -96<br />

Other effects 18 -7<br />

Total income tax income -356 -162<br />

The impact on the effective tax rate is mainly related to<br />

the various profit and loss and related applicable tax<br />

rates in the various jurisdictions.<br />

21 Earnings per Share<br />

Consolidated Financial Statements<br />

Basic earnings per share are calculated by dividing the<br />

profit attributable to equity holders of the Group by the<br />

weighted average number of ordinary shares in issue<br />

during the year, excluding ordinary shares purchased by<br />

the Group and held as treasury shares (note 12).<br />

Loss attributable to equity holders<br />

of the Group<br />

Weighted average number of ordinary<br />

shares outstanding<br />

22 Dividends per Share<br />

No dividends were paid out in <strong>2010</strong> and 2009.<br />

23 Contingencies<br />

<strong>2010</strong> 2009<br />

-1 034 -119<br />

341 576 341 576<br />

Basic and diluted earings per share<br />

(CHF per share) -3.03 -0.35<br />

The Group has contingent liabilities in respect of legal<br />

claims arising in the ordinary course of business. It is not<br />

anticipated that any material liabilities will arise from the<br />

contingent liabilities other than those provided for.<br />

57