Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

Edisun Power Europe Ltd. Corporate Governance Report 2010 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

All amounts are in 000 CHF if not otherwise noted<br />

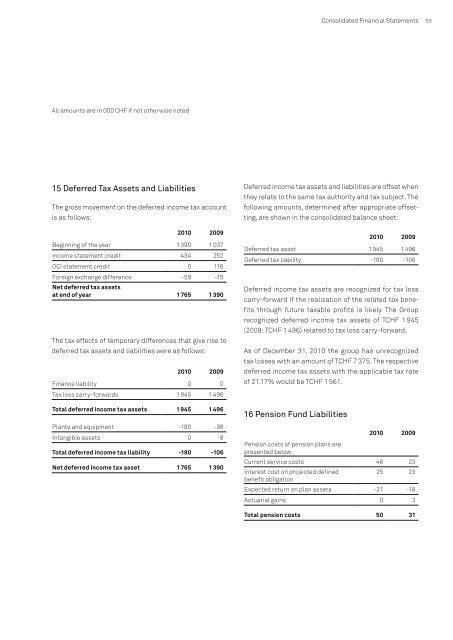

15 Deferred Tax Assets and Liabilities<br />

The gross movement on the deferred income tax account<br />

is as follows:<br />

<strong>2010</strong> 2009<br />

Beginning of the year 1 390 1 037<br />

Income statement credit 434 252<br />

OCI statement credit 0 116<br />

Foreign exchange difference<br />

Net deferred tax assets<br />

-59 -15<br />

at end of year 1 765 1 390<br />

The tax effects of temporary differences that give rise to<br />

deferred tax assets and liabilities were as follows:<br />

<strong>2010</strong> 2009<br />

Finance liability 0 0<br />

Tax loss carry-forwards 1 945 1 496<br />

Total deferred income tax assets 1 945 1 496<br />

Plants and equipment -180 -98<br />

Intangible assets 0 -8<br />

Total deferred income tax liability -180 -106<br />

Net deferred income tax asset 1 765 1 390<br />

Consolidated Financial Statements<br />

Deferred income tax assets and liabilities are offset when<br />

they relate to the same tax authority and tax subject. The<br />

following amounts, determined after appropriate offsetting,<br />

are shown in the consolidated balance sheet:<br />

Deferred income tax assets are recognized for tax loss<br />

carry-forward if the realization of the related tax benefits<br />

through future taxable profits is likely. The Group<br />

recognized deferred income tax assets of TCHF 1 945<br />

(2009: TCHF 1 496) related to tax loss carry-forward.<br />

As of December 31, <strong>2010</strong> the group has unrecognized<br />

tax losses with an amount of TCHF 7 375. The respective<br />

deferred income tax assets with the applicable tax rate<br />

of 21.17% would be TCHF 1 561.<br />

16 Pension Fund Liabilities<br />

<strong>2010</strong> 2009<br />

Deferred tax asset 1 945 1 496<br />

Deferred tax liability -180 -106<br />

<strong>2010</strong> 2009<br />

Pension costs of pension plans are<br />

presented below:<br />

Current service costs 46 23<br />

Interest cost on projected defined<br />

benefit obligation<br />

25 23<br />

Expected return on plan assets -21 -18<br />

Actuarial gains 0 3<br />

Total pension costs 50 31<br />

53