Title front - Sindh Board Of Investment, Government Of Sindh

Title front - Sindh Board Of Investment, Government Of Sindh

Title front - Sindh Board Of Investment, Government Of Sindh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

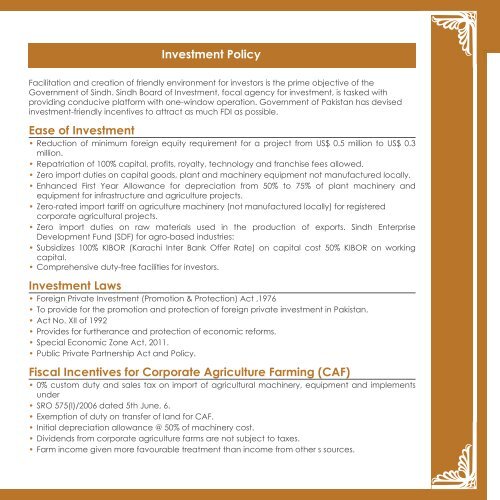

<strong>Investment</strong> PolicyFacilitation and creation of friendly environment for investors is the prime objective of the<strong>Government</strong> of <strong>Sindh</strong>. <strong>Sindh</strong> <strong>Board</strong> of <strong>Investment</strong>, focal agency for investment, is tasked withproviding conducive platform with one-window operation. <strong>Government</strong> of Pakistan has devisedinvestment-friendly incentives to attract as much FDI as possible.Ease of <strong>Investment</strong>• Reduction of minimum foreign equity requirement for a project from US$ 0.5 million to US$ 0.3million.• Repatriation of 100% capital, profits, royalty, technology and franchise fees allowed.• Zero import duties on capital goods, plant and machinery equipment not manufactured locally.• Enhanced First Year Allowance for depreciation from 50% to 75% of plant machinery andequipment for infrastructure and agriculture projects.• Zero-rated import tariff on agriculture machinery (not manufactured locally) for registeredcorporate agricultural projects.• Zero import duties on raw materials used in the production of exports. <strong>Sindh</strong> EnterpriseDevelopment Fund (SDF) for agro-based industries:• Subsidizes 100% KIBOR (Karachi Inter Bank <strong>Of</strong>fer Rate) on capital cost 50% KIBOR on workingcapital.• Comprehensive duty-free facilities for investors.<strong>Investment</strong> Laws• Foreign Private <strong>Investment</strong> (Promotion & Protection) Act ,1976• To provide for the promotion and protection of foreign private investment in Pakistan.• Act No. XII of 1992• Provides for furtherance and protection of economic reforms.• Special Economic Zone Act, 2011.• Public Private Partnership Act and Policy.Fiscal Incentives for Corporate Agriculture Farming (CAF)• 0% custom duty and sales tax on import of agricultural machinery, equipment and implementsunder• SRO 575(l)/2006 dated 5th June, 6.• Exemption of duty on transfer of land for CAF.• Initial depreciation allowance @ 50% of machinery cost.• Dividends from corporate agriculture farms are not subject to taxes.• Farm income given more favourable treatment than income from other s sources.